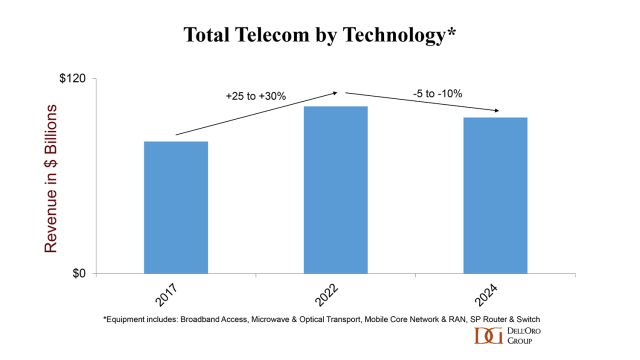

After five consecutive years of growth and stable trends in 1H23, the pendulum swung rapidly towards the negative in the second half of the year. Preliminary findings suggest that worldwide telecom equipment revenues across the six telecom programs tracked at the Dell’Oro Group – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected.

There are multiple forces at play. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and SP routers.

North America subsided faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

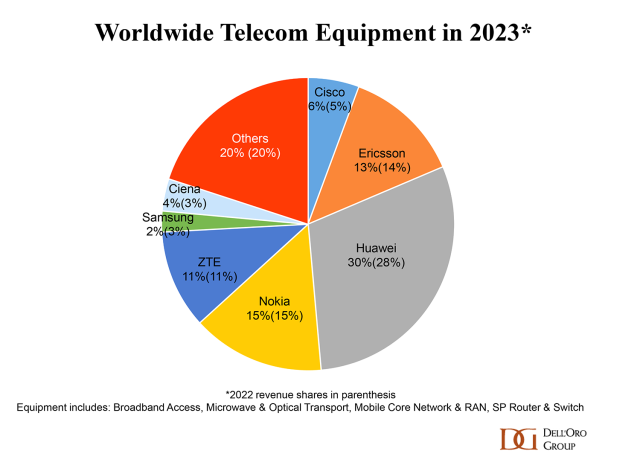

Supplier rankings were mostly unchanged; however, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top 7 suppliers accounted for around 80% of the overall market. One major theme across the various telecom programs is that despite ongoing efforts by the US government to limit Huawei’s addressable market and access to the latest silicon, Huawei still maintains its position as the global telecom equipment leader. In fact, our assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.