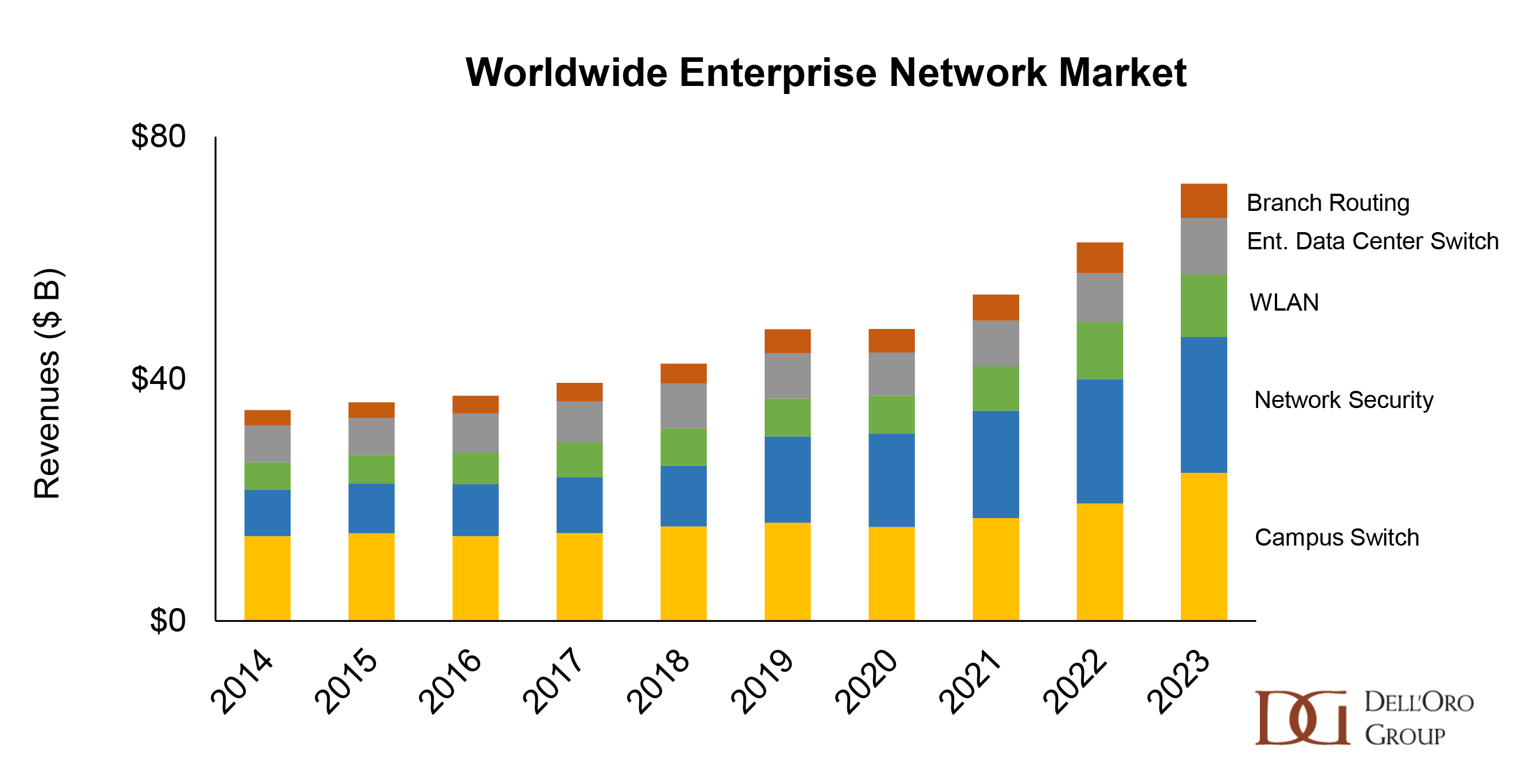

Turbulent is the best word to describe the worldwide Enterprise Network equipment market over the past few years. Enterprise Network manufacturer revenues hit a high of $72 B in 2023. However, by the end of 2023, signs of an impending market shift appeared.

To predict what will happen next, we look back over the past ten years to identify the overarching trends that are influencing this market, which is made up of manufacturer revenues from hardware and software purchased by enterprises for network connectivity and security purposes, divided into the five sub-markets shown in the figure below.

Over the five-year period from 2014 and 2019, the worldwide Enterprise Network market experienced a Compound Annual Growth Rate (CAGR) of 7%. Manufacturers such as Cisco, Huawei, HPE, Arista, Palo Alto Networks and Fortinet have managed to grow revenues–even as challengers, such as Juniper and Zscaler, gained market share.

Tracking of Secure Service Edge (SSE) and Web Application Firewalls (WAF) markets began in 2019, contributing to the significant growth of the Network Security market. While annual growth of Switch and WLAN slowed in 2019, the fundamentals of the Network Security (firewall, SSE, SWG, WAF, and ADC) and Branch Routing markets (SD-WAN and access routing) remained robust, pushing overall network equipment spending up to $48 B.

The Market Trajectory is Altered

Then, in 2020, the pandemic hit. Workers vacated their offices and network projects ground to a halt. The following year, with IT leaders besieged with demands for networking to support remote work, companies tried to get digital transformation initiatives back on track – just as vendors began to experience supply shortages. Equipment hardware lead times became long – but worst of all, unpredictable. They could be close to normal, or they could be twenty times longer than normal, depending on the type of equipment and the day that the orders were placed. Manufacturers began to accumulate large backlogs of orders. Equipment prices began to rise, keeping industry revenues growing despite the longer wait times for enterprises.

Near the end of 2022 and into early 2023, the tide began to change. As supply began to flow to the equipment vendors, they began to ship more networking equipment. Then, backlogs spiraled downward, and the market was flooded. Manufacturer revenues ballooned.

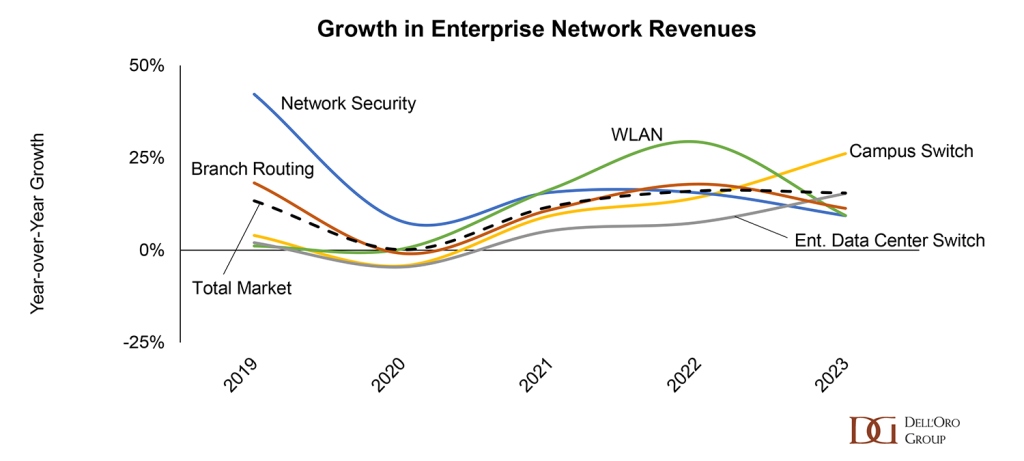

Since the end of 2022, Dell’Oro Group has been predicting a digestion period, or a pause in spending on some segments of the Enterprise Network market. This slowdown first appeared in Wireless LAN revenues in 3Q23, as the market contracted Y/Y for the first time since 2Q20. This was followed by Y/Y contractions in Branch Routing and Campus Switching in 4Q23. These contractions are expected to continue throughout most of 2024. During the period of supply constraints, many enterprises adjusted their ordering behavior, placing orders in 2022 for equipment they required in 2024. In addition, in times of scarcity, distribution companies ordered more equipment than they needed. Now that the deliveries have been made, working through the excess inventory will take time.

An Uneven Revenue Recovery

Supply constraints and rapid backorder fulfillment have created the roller coaster trajectory of the worldwide Enterprise Networking market. However, if we look more closely, we see that the peaks and troughs of each sub-market are not aligned.

Growth of Enterprise Data Center switching revenue, in particular, did not reach the same heights in 2023 as the other enterprise networking markets. However, revenue growth remained positive throughout the year, driven by large enterprises. The supply constraints for switches were resolved later than those for WLAN, and manufacturer backlogs have remained elevated for longer, leading to a continued stretch of Y/Y growth in revenues. Dell’Oro group is also projecting a digestion period for enterprise switching – although it is expected to be offset from that of WLAN and Branch Routing.

Growth of Enterprise Data Center switching revenue, in particular, did not reach the same heights in 2023 as the other enterprise networking markets. However, revenue growth remained positive throughout the year, driven by large enterprises. The supply constraints for switches were resolved later than those for WLAN, and manufacturer backlogs have remained elevated for longer, leading to a continued stretch of Y/Y growth in revenues. Dell’Oro group is also projecting a digestion period for enterprise switching – although it is expected to be offset from that of WLAN and Branch Routing.

In contrast, the Network Security market stands out as the only market that has grown at least 5% every year for the last ten years. This consistent growth reflects the critical role of network security in enterprise strategies to mitigate cyber threats. Although the Y/Y expansion has been slowed somewhat by the enterprise digestion phenomenon, market expansion is anticipated again in 2024, whereas Dell’Oro Group expects all other segments to contract.

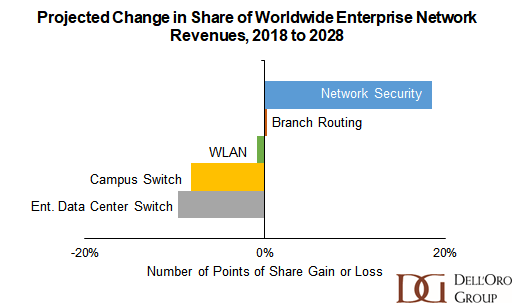

A Shift in IT Priorities

The continued importance of IT security to enterprises will cause a share shift in Enterprise Network revenues over the longer term. In 2023, spending on Network Security more than doubled from just five years ago. By 2028 Dell’Oro Group expects Network Security to account for an even larger portion of equipment sales. On the other hand, the switch market is more mature. Following the increasing penetration of Work From Home and Hybrid Work models, Enterprises’ adoption of Wi-Fi First strategies has grown, dampening the expansion of Campus Switch revenues in favor of WLAN. In addition, enterprises’ shift to cloud computing has slowed the growth of Enterprise Data Center Switch spending.

Looking forward to the anticipated CAGR of the worldwide Enterprise Network market, Dell’Oro Group has a word of warning for industry observers. Using the elevated 2023 revenues as a baseline is sure to make future CAGR calculations look anemic. Taking an average over 2021 to 2023, smoothing out the supply release tsunami, allows us to predict that cumulative growth rates should return to pre-pandemic levels over the next five years.