Significant Share Shifts Expected in 2025 as Ethernet Gains Momentum in AI Back-end Networks

The networking industry is experiencing a dramatic shift, driven by the rise of AI workloads and the need for new AI back-end networks to connect an ever-increasing number of accelerators in large AI clusters. While investments in AI back-end networks are reaching unprecedented levels, traditional front-end networks needed to connect general-purpose servers remain essential.

At Dell’Oro Group, we’ve just updated our five-year forecast reports for both the front-end as well as the back-end and we’re still bullish on both. Below are some key takeaways:

AI Back-End Network Spending Set to Surpass $100B through 2029 with Ethernet Gaining Momentum

Despite growing concerns about the sustainability of spending on accelerated infrastructure—especially in light of DeepSeek’s recent open-source model, which requires significantly fewer resources than its U.S. counterparts—we remain optimistic. Recent data center capex announcements by Google, Amazon, Microsoft, and Meta in their January/February earnings calls showed ongoing commitment to a sustained high level of AI infrastructure capex supports that view.

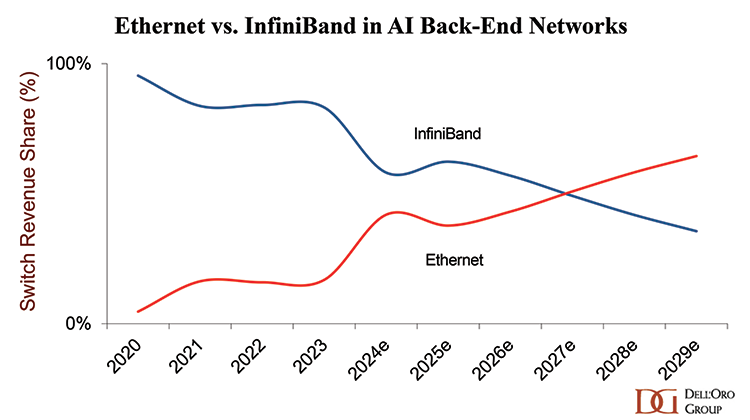

We have again raised our forecast for data center switch sales sold in AI Back-end networks with our January 2025 report. However, not all technologies are benefiting equally.

Ethernet is experiencing significant momentum, propelled by supply and demand factors. More large-scale AI clusters are now adopting Ethernet as their primary networking fabric. One of the most striking examples is xAI’s Colossus, a massive NVIDIA GPU-based cluster that has opted for Ethernet deployment.

We therefore revised our projections, moving up the anticipated crossover point where Ethernet surpasses InfiniBand to 2027.

Major share shifts anticipated for Ethernet AI Back-end Networks in 2025

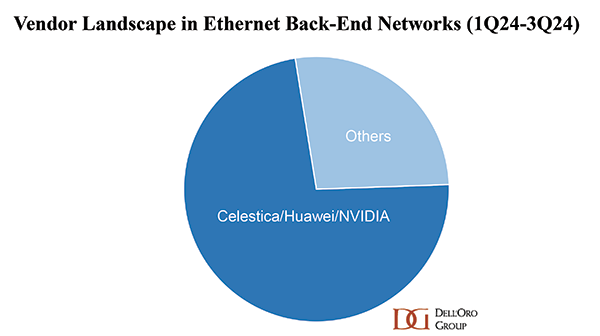

While Celestica, Huawei, and NVIDIA dominated the Ethernet segment in 2024, the competitive landscape is set to evolve in 2025, with Accton, Arista, Cisco, Juniper, Nokia, and other vendors expected to gain ground. We expect the vendor landscape in AI Back-end networks to remain very dynamic as Cloud SPs hedge their bets by diversifying their supply on both the compute side and the networking that goes with it.

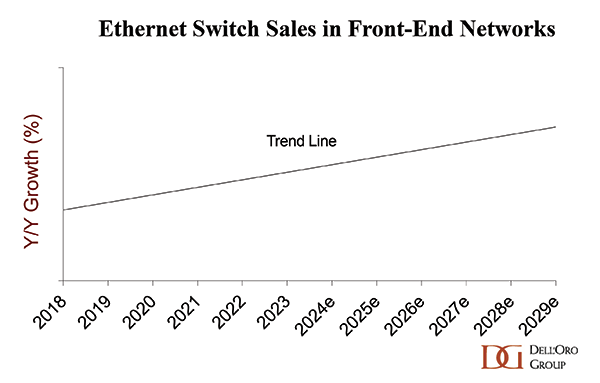

Strong Rebound in Front-end Networks Spending in 2025 and Beyond

Despite the challenges in 2024, we expect growth in the front-end market to resume in 2025 and beyond, driven by several factors. These include the need to build additional capacity in front-end networks to support back-end deployments, especially for greenfield projects. These additional front-end network connectivity deployments are expected to include high speeds (>100 Gbps), driving a price premium. Sales growth will be further stimulated by inferencing applications that may not require accelerated servers and will instead operate in front-end networks, whether at centralized locations or edge sites.

The Road Ahead

As AI workloads expand and diversify, the networking infrastructure that supports them—in both front-end and back-end must evolve accordingly. The transition to higher-speed Ethernet and the shifting competitive landscape among vendors suggest that 2025 could be a pivotal year for Ethernet data center switching market.

For more detailed views and insights on the Ethernet Switch—Data Center report or the AI Networks for AI Workloads report, please contact us at dgsales@delloro.com.