Telecom holds steady in the first half. According to preliminary findings, worldwide telecom equipment revenues across the six telecom programs tracked at the Dell’Oro Group*, were flat year-over-year (Y/Y) in the quarter and advanced 2% in the first half of 2023.

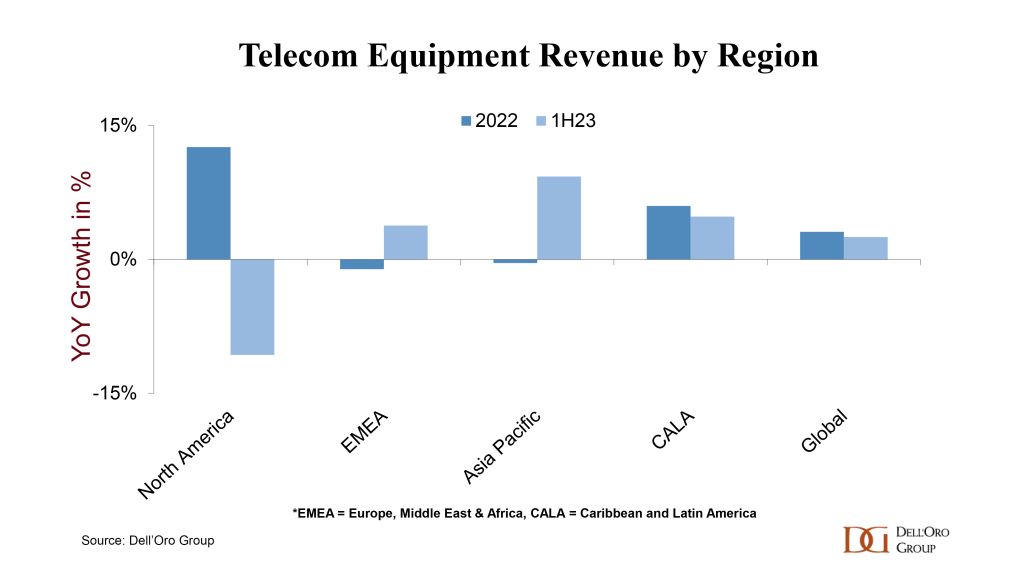

These results mostly align with expectations on an aggregate level, although performance by region and technology varied. After five years of expansion, during which the North America region advanced by around 50%, the pendulum swung toward the negative in the first half. The decline in North America was anticipated, but the pace of the contraction was slightly faster than expected. Alongside more challenging 5G comparisons and inventory corrections affecting some technology segments, North American Broadband Access equipment spending dropped to its lowest levels in nearly two years in the second quarter.

Stable performance in EMEA, CALA, and China, combined with robust growth in the Asia Pacific region outside of China, offset the weakness in the US market. Worldwide telecom equipment revenues, excluding North America, increased by 7% in the first half, supporting the thesis that the telecom equipment market remains robust outside of the US.

From a technology perspective, RAN declined, but the remaining five programs advanced in the first half. Notably, wireline outperformed wireless. Our analysis indicates that the collective results for the wireline-focused programs (SP Routers & Switches, Optical Transport, and Broadband Access) increased by around 7% in the first six months. This, coupled with the positive trends in Mobile Core Networks and Microwave Transmission, was more than enough to offset the more challenging conditions in RAN.

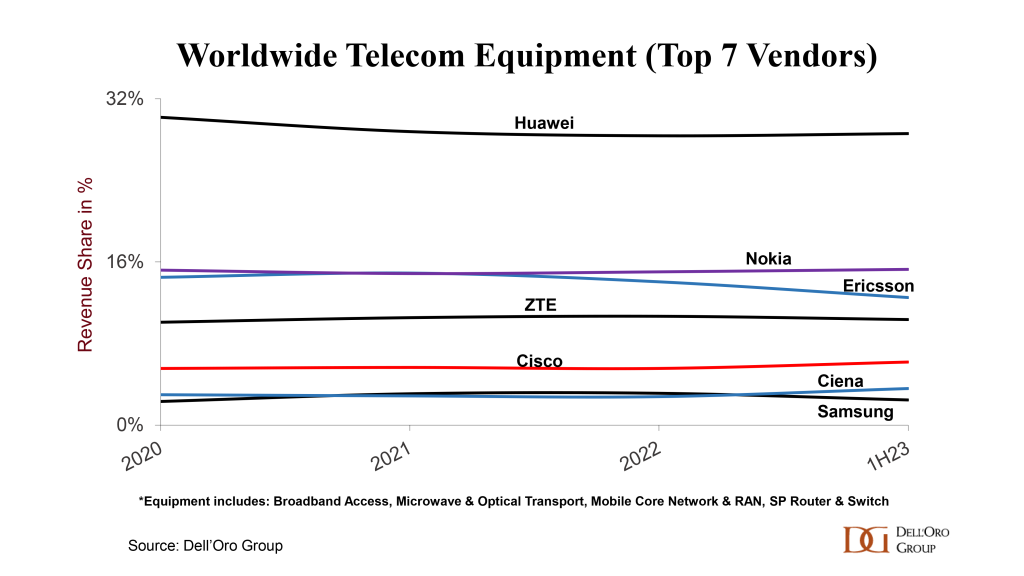

Vendor dynamics remained mostly stable between 2022 and 1H23, with a few exceptions. Ciena surpassed Samsung, and the gap between Nokia and Ericsson widened, reflecting, to some extent, the technology mix between wireless and wireline. Despite ongoing efforts by the US government to limit Huawei’s addressable market and access to the latest silicon, our analysis shows that Huawei still leads the global telecom equipment market. This is partly because Huawei remains the #1 supplier in five out of the six telecom segments we track, and the vendor continues to dominate the market outside of North America, accounting for 35% to 40% of 1H23 revenues.

The analyst team has not made any significant changes to the collective short-term outlook. Following five consecutive years of growth, worldwide telecom equipment revenues are projected to remain flat in 2023. As always, there are risks in both directions. In addition to currency fluctuations, economic uncertainty, and elevated interest rates, inventory adjustments, new technology rollouts, and the anticipated impact of national subsidization efforts can impact steady-state assumptions for the various regions.

*Telecommunications Infrastructure programs covered at Dell’Oro Group, include Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch.