In the world of communications and networking, the year 2020 marked a turning point for communications service providers, as well as consumers and subscribers around the globe. 2020 was the year that fiber cemented itself as the preferred access technology of the future for a majority of operators. The catalyst for this strategic shift was the impact COVID-19 had on residential broadband network utilization rates, along with the dramatic increase in premium broadband subscribers around the world.

According to many operators around the world with cable, DSL, and fiber broadband networks, upstream peak traffic growth throughout 2020 increased over 50%, while downstream peak traffic growth increased 30%. In the early days of lockdown, operators reported staggering 125% increases in peak upstream and downstream growth, which ultimately leveled off as software adjustments were made to network platforms, and new capacity in the form of line cards and upgraded CPE was added.

Although the world is gradually returning to normal, with teleworkers moving slowly back into their offices, there is simply no turning back now for broadband subscribers who either upgraded or switched to FTTH services. The near-symmetric speeds pushing 1Gbps and beyond, the resulting elimination of buffering for streaming video, and the near-flawless performance of online and VR gaming, and video conference calls are more than enough to warrant holding on to their premium broadband.

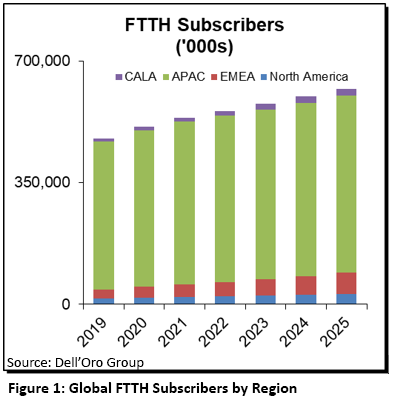

As a result, we expect global FTTH subscribers to continue to expand on a global basis, with the highest growth (by percentage) to come from Europe, North America, and CALA, where fiber penetration rates remain below 50% for most countries in each region (Figure 1).

Related blog: 5-Year Forecast—Broadband Spending to Remain Strong Through 2025

Fiber expansion will rely on a wide range of technologies

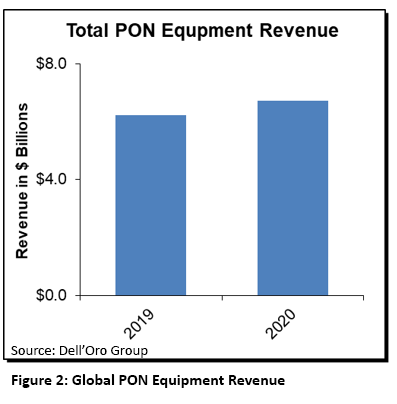

The fiber expansion in 2020, which saw total spending on PON equipment jump 8%, involved multiple technologies—from 1G EPON and 2.5G GPON to XG-PON and XGS-PON. While the clear trend among operators is to expand their fiber services using 10G technologies, there are still hundreds of operators who will continue to rely on 2.5G GPON as the workhorse for their fiber networks for years to come.

The diversity in PON technology choices specifically reflects the fact that fiber networks are no longer being considered for just residential applications. Instead, the same fiber networks that deliver residential services are now also being used for business and wholesale access. Additionally, the global expansion of 5G networks and continued small cell densification are opening up opportunities for 10G technologies to be used in both mid-haul and backhaul applications.

For operators considering a fiber deployment or network expansion, the key decision points used to be “how many homes can I pass?” and “what percentage of those homes will become subscribers?” While those remain critical metrics, the ROI equation for fiber networks has become increasingly easier given that the additional revenue potential from wholesale and business services, in addition to providing mid-haul and backhaul functions for a growing network of 5G small cells. The application and technology roadmap for PON networks and technologies has become much clearer, making it much easier for operators to justify the initial construction and buildout costs of their fiber networks.

Adding more incentive for operators to expand their PON networks has been the growing commercial availability of combo cards and optics, which can support 2.5G GPON, XG-PON, or XGS-PON from the same platform. These multi-technology options allow operators with existing PON deployments to begin the process of upgrading their networks to 10G on a gradual basis, without having to do a flash cut of entire service areas. Instead, operators can continue to deliver 2.5G GPON services to the bulk of their residential subscribers, while allocating XGS-PON wavelengths to business or high-end residential subscribers. Operators can then spread out the costs of more expensive 10G ONTs across a longer period of time.

More importantly, combo cards and optics don’t force operators to change any aspects of their existing ODN (Optical Distribution Network), allowing them to continue amortizing those initial construction and equipment costs over a longer period of time. From feeder and distribution cables to ducts, poles, and splitters, the co-existence of multiple PON technologies and re-use of the existing ODN is critical for operators around the world.

Ensuring the fiber experience in the home, not just to the home

With more operators spending the time and money to roll out or expand their fiber networks and with competitive threats from other broadband providers not slowing down, operators are increasingly pushing fiber inside homes, not just to the front door. In cases where it is not feasible to run fiber throughout the home, operators are moving quickly to provide residential gateways that support WiFi 6 speeds and services and complementing those with additional mesh satellites when homes have WiFi dead spots.

By extending service into homes, operators can now remotely monitor the performance of in-home WiFi networks while also offering subscribers additional services, such as parental controls, bandwidth-on-demand, as well as bandwidth boosts by device or by application. As more IoT devices and sensors are introduced in homes, the combination of gateway software platforms, such as OpenWRT, prpl, EasyMesh, and RDK-B plus WiFi 6 gives operators an advanced set of features and options to package for their subscribers so that they can better manage and monitor the performance of all these new IoT devices.

Specifically in the case of providing bandwidth-on-demand services, fiber networks provide the most flexibility for scaling upstream and downstream bandwidth based on individual subscriber requests. Cable networks are limited in how much upstream bandwidth can be allocated, unless they move to a full-duplex architecture, which is both costly and time-consuming.

In a growing number of cases, operators are eliminating any concerns they might have about in-home wiring and WiFi performance by offering to extend fiber directly to multiple locations within the home. China Telecom and China Mobile are expanding their in-home ONT projects to ensure near-gigabit speeds to all devices in the home. Though not all fiber providers around the world will follow these operators’ lead due to higher labor costs, there are more operators considering the move as it truly future-proofs their networks and services and further cements their relationship with subscribers.

Sharing best practices to move the industry forward

Over the last decade, operators have been benefitting from the lessons they’ve learned during their own fiber deployments and sharing those lessons with the industry. From securing right-of-way and building access to micro-trenching techniques to the optimal deployment of ODN infrastructure and components, the cost and complexity of deploying fiber networks have been significantly reduced. The sharing of best practices among operators has resulted in the identification of consistent problem areas that can add unnecessary costs or delays to a fiber network rollout. For example, a major portion of the time and cost of last-drop fiber deployments is around digging trenches and burying new ducts within those trenches. Over time, operators have learned to identify ducts or trenches that are already in place so they can re-use that existing infrastructure rather than starting from scratch. This situation is becoming more common as multiple operators roll out fiber to new small cell locations, business parks, or extend feeder fibers into neighborhoods for cable node splits.

Additionally, reducing labor costs and rollout delays by using pre-connectorized fiber is an industry best practice that has evolved over time. Using pre-connectorized fiber eliminates the need for on-site splicing and also expands the labor pool of technicians who can complete a subscriber connection.

As an increasing number of operators deploy fiber in different countries with various topography, regulatory restrictions, and labor pools, the industry as a whole will benefit, further providing operators with more knowledge and more incentive to take the plunge and deploy their own fiber networks.

Fiber Everywhere

The global trend toward the deployment and expansion of fiber networks has never been clearer. What began in a handful of countries just a decade ago has proliferated to hundreds of countries and thousands of network operators globally. Fueled by new applications, new subscriber requirements, and new competition, operators clearly see their networks of today and tomorrow relying on fiber. The road map for fiber technologies and use cases continues to expand, along with the knowledge and implementation of best practices. Those two trends alone will continue to provide operators with strong incentives to deploy fiber and future-proof their networks for decades to come.

Finally, network equipment vendors are expanding their product and service portfolios to become more comprehensive partners to fiber providers. From in-home networking equipment to ODN infrastructure and central office equipment, these suppliers are adding network design and consulting capabilities to help their service provider customers reduce the cost of deploying fiber networks and speed their time to market.

Related blog: Predictions 2021– Broadband Access and Home Networking Market