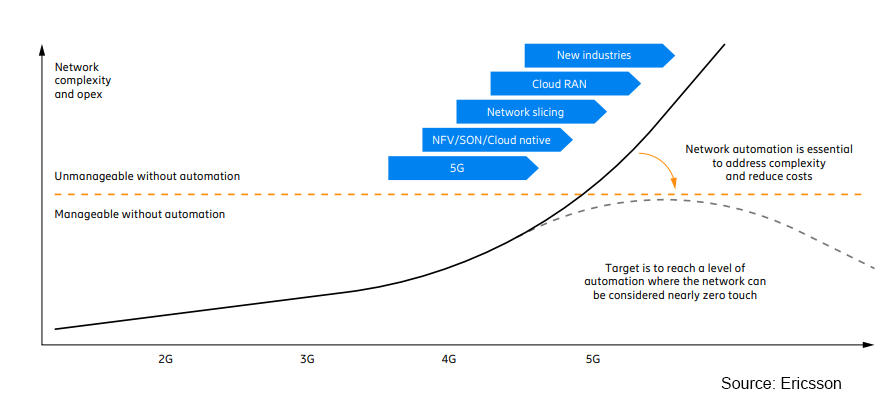

Mobile networks continue to advance to support changing supply and demand requirements. In order to manage the rise in mobile data traffic and the diversity of the use case requirements with new technologies, frequencies, and more agile networks without increasing the complexity and costs while still maintaining legacy technologies, mobile networks have to become more intelligent and automated, spurring the need for Intelligent RAN. In this blog, we will review Intelligent RAN drivers, current status, and the ecosystem.

Intelligent RAN Automation Background

RAN automation and intelligence are not new concepts. In fact, both existing and new 4G and 5G networks rely heavily on automation to replace manual tasks and manage the increased complexity without growing operational costs. But the use of intelligent machine-learning-based functionality embedded in the management system and RAN nodes for real time and non-real time processing is new. The combination of machine learning and automation will enable operators to evolve their 5G networks to the next level by autonomously optimizing resources resulting in improved cost and energy budgets.

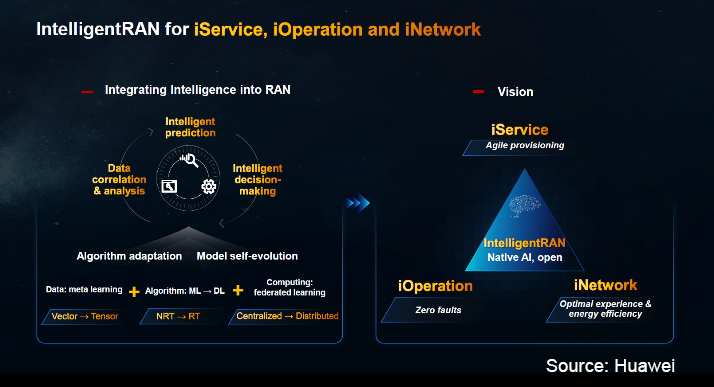

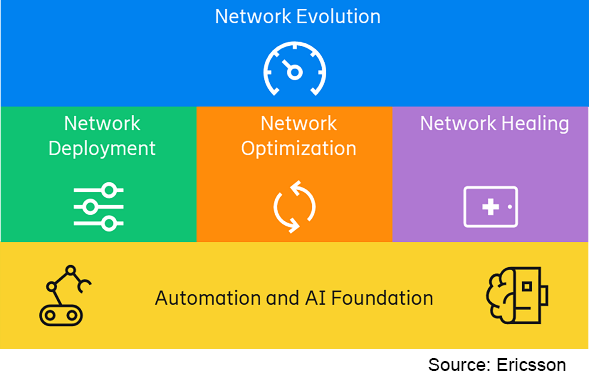

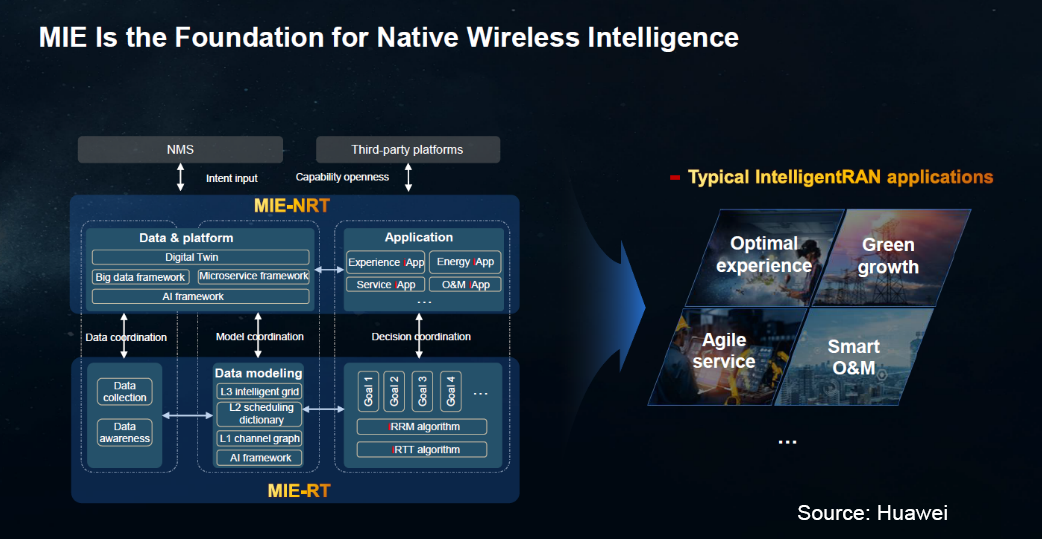

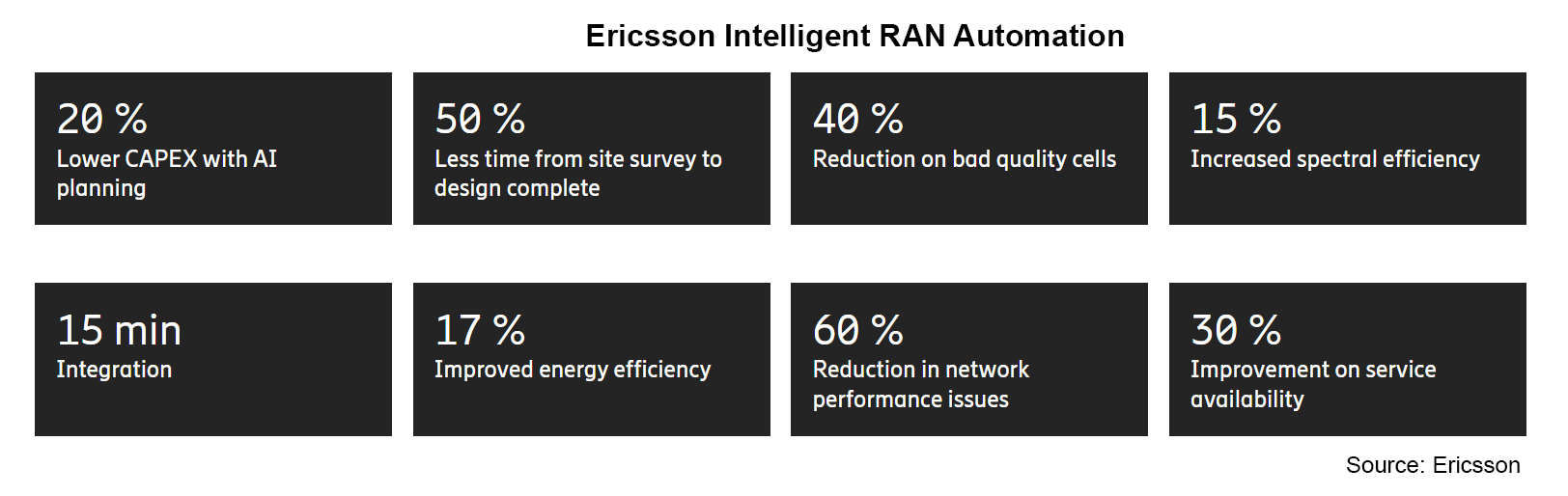

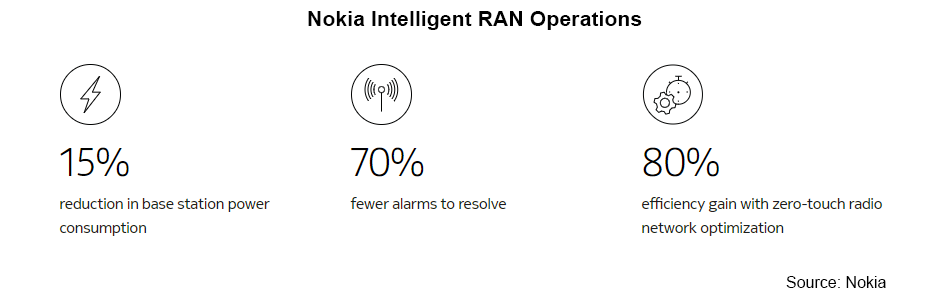

Intelligent RAN Automation is not confined to just the RAN infrastructure. Instead, these solutions will improve performance, reduce energy consumption, and lower costs across multiple infrastructure and services domains. Huawei envisions its IntelligentRAN portfolio will address three key areas, including networks, services, and operations. Similarly, Ericsson’s Intelligent RAN Automation solution is targeting four main areas: Network evolution, network deployment, network optimization, and network healing. And Nokia’s recently launched Intelligent RAN Operations is targeting operational efficiency gains and equipment power savings across multiple domains.

|

|

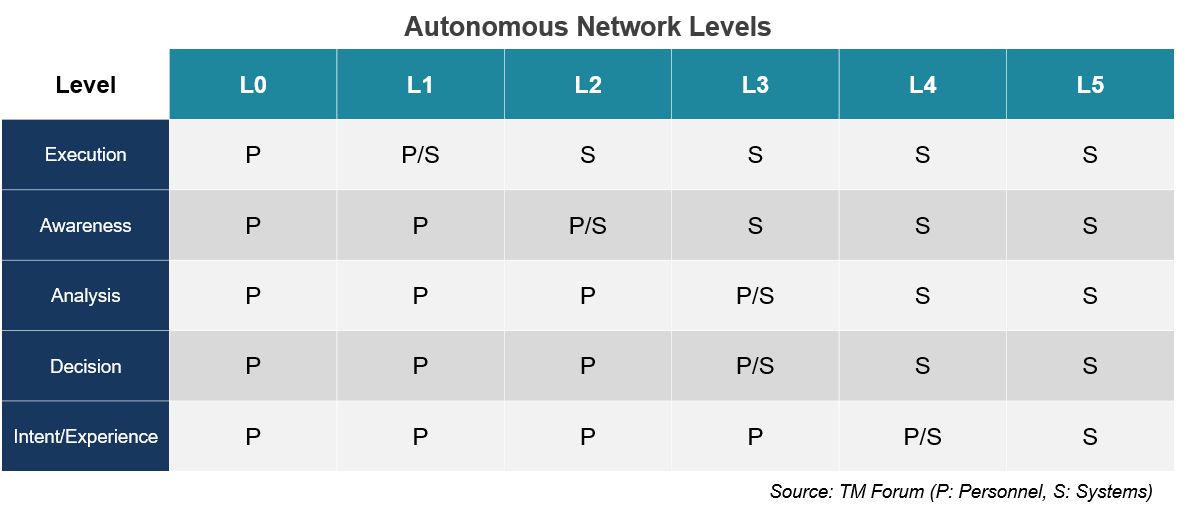

Not surprisingly, the level of automation varies significantly, with most operators in the very early phases in the RAN autonomy transition. For review, we are showing a table summarizing the current automation framework outlined in the TM Whitepaper:

Why More RAN Intelligence and Automation?

Mobile data traffic continues to grow at an unabated pace while carrier revenue growth remains flat, implying operators have limited wiggle room to expand capex and opex to manage the increased complexity typically inherent with the technological and architectural advancements required to deliver the appropriate network performance while supporting more demanding and diverse end-user requirements.

Leading RAN suppliers envision Intelligent RAN automation will deliver several key benefits:

- Maximize ROI on network investment

- Improve performance and experience

- Boost network quality

- Accelerate time to market

- Reduce complexity

- Reduce energy consumption

- Bring down CO2 emissions

The ongoing shift from proprietary RAN towards disaggregated Open RAN could accelerate innovation, however, costs and complexity of managing multi-vendor deployments could increase if the networks are not effectively managed. According to Ericsson, operator opex could double over the next five years without more automation across deployment and management & operations just to support the expected changes with MBB-driven use cases.

Performance gains underpinned by Intelligent RAN will vary depending on a confluence of factors. Ericsson estimates Intelligent RAN Automation solutions can improve the spectral efficiency by 15% while Huawei has been able to demonstrate that its IntelligentRAN multi-band/multi-site 3D coordination feature can improve the user experience by 50%, in some settings.

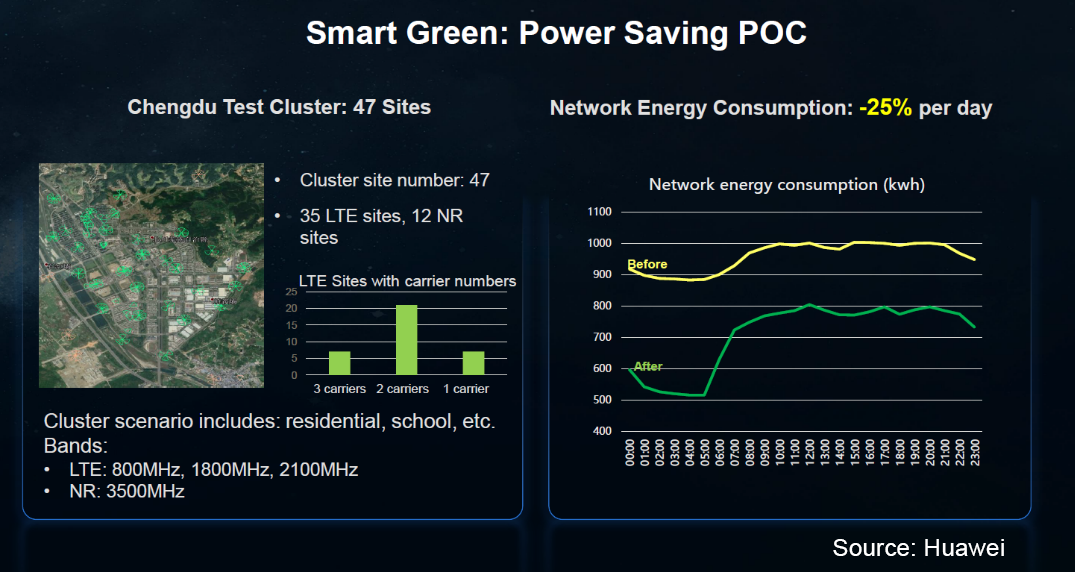

The intensification of climate change taken together with the current power site trajectory forms the basis for the increased focus on energy efficiency and CO2 reduction. Preliminary findings suggest Intelligent RAN can play a pivotal role in curbing emissions, cutting energy consumption by 15% to 25%.

It is still early days in the broader 5G transition, with 5G MBB and FWA in the early majority and early adopter phases, respectively. However, 5G IoT has barely started yet. As private 5G and IoT begin to ramp more meaningfully and diverse use cases comprise a greater share of the overall 5G capex, operators will need to evolve their networks to manage varying latency, throughput, UL, positioning, and reliability requirements. Ultimately it will be extremely challenging to deliver optimal network efficiency across the RAN spectrum with the current networks.

This is why RAN intelligence and automation are increasingly viewed as fundamental elements in the broader digital transformation and autonomy roadmaps. At a recent RAN intelligence roundtable, leading operators agreed AI and automation will be essential components in future networks.

Intelligence and Automation Status

RAN Intelligence & Automation is a relatively nascent but growing segment. Rakuten Mobile’s focus on vRAN and automation has enabled the operator to deploy more than 270 K macro and small cells while maintaining an operational headcount of about 250 people, which is a fraction of that of the typical operator. In the US, greenfield operator Dish is leveraging its cloud-native 5G network and IBM’s AI-powered automation and network orchestration software and services along with VMWare’s RAN Intelligent Controllers to manage costs and to improve performance and innovation for more diverse use cases.

Germany’s fourth operator, 1&1, is planning to build a fully virtualized and open RAN network utilizing specially developed orchestration software to automate operations.

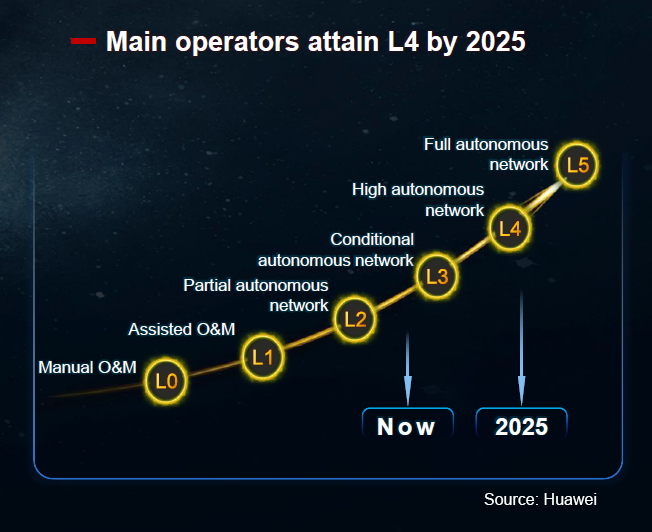

While most of the green field networks are clearly moving towards new architectures that are more automation conducive, change typically does not happen as fast with the brownfields – the average brownfield operator today falls somewhere in between L2 and L3 and still has some way to go before reaching high and full autonomy. Still, China Mobile remains on track for L4 automation by 2025. Vodafone is using RAN Intelligence to boost network quality and to implement Zero Touch Operations.

Also, Etisalat, Du, STC, and Zain recently announced at the SAMENA Telecom Summit that they are collaborating with Huawei to bring more AI into the RAN to improve the performance, enhance the customer experience, and provide the right foundation for more RAN autonomy.

Per Huawei’s HAS2022 analyst event, the vendor remains optimistic L4 High autonomous network will be more prevalent by the 2025 timeframe.

Vendor ecosystem

The top 3 RAN players are also heavily focused on improving their Intelligent RAN Automation portfolios. Huawei recently announced its IntelligentRAN solution, using the Mobile Intelligent Engine (MIE), will be more widely available for both the Site and Network layers by 2023.

Meanwhile, both Ericsson and Nokia have recently announced enhancements and additions to their Intelligent RAN solutions. Qualcomm recently announced its intent to acquire Cellwize, a RAN SMO and Non-RT RIC supplier.

In summary, it is still early days in the 5G journey. Today’s networks are already leveraging automation to manage the increased network complexity. The network of the future will gradually include more automation and AI to provide operators and enterprises with the right tools to proliferate 5G connectivity efficiently. The revenue upside will be limited over the short-term. However the long-term prospects remain healthy.