With the 5G mobile broadband ramp accelerating at a much faster pace than expected, and 5G NR comprising a double-digit share of the overall 1Q19 to 3Q19 RAN, the time is right to discuss some of the key 5G projections for 2020.

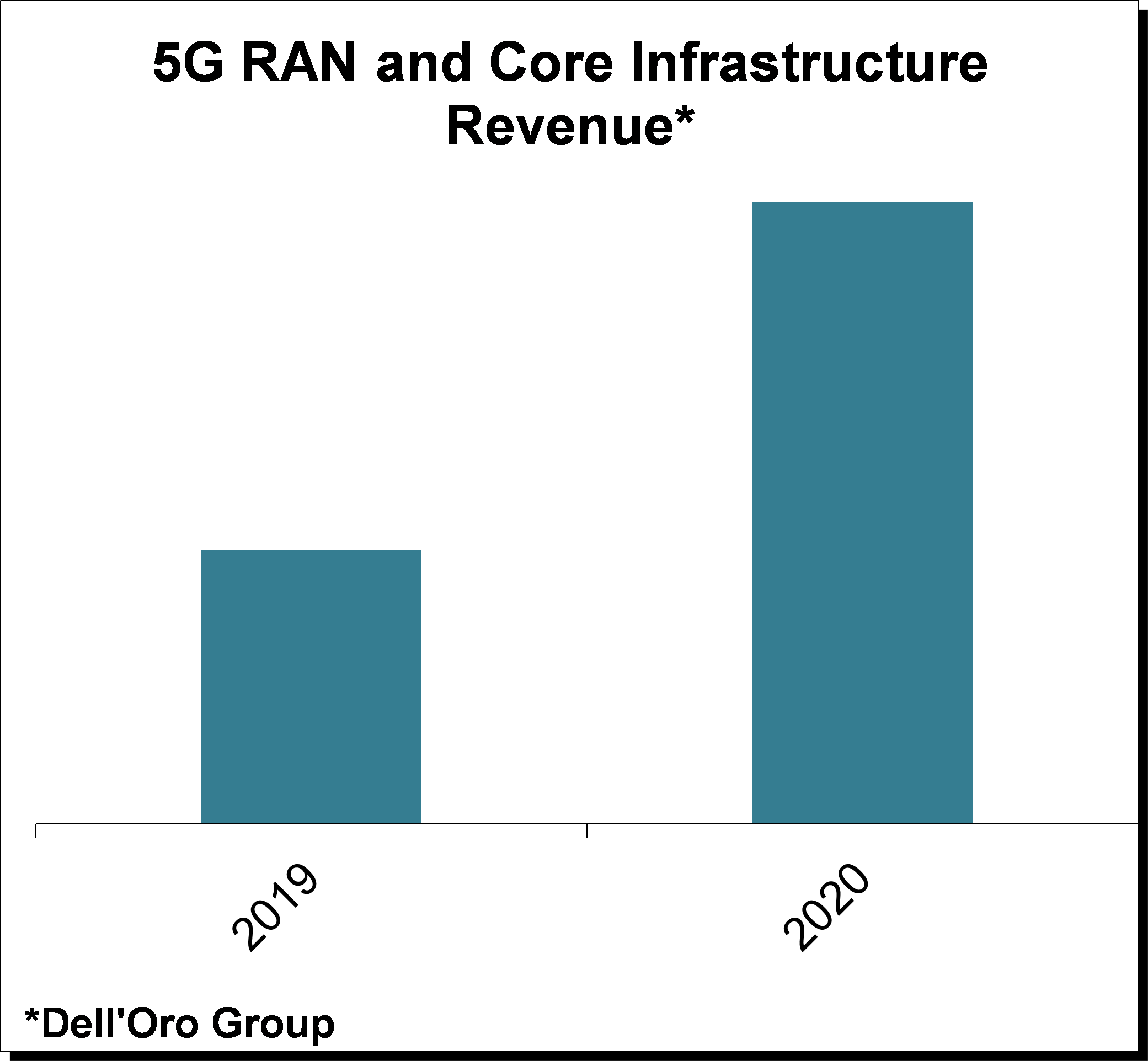

1) 5G RAN+Core Infrastructure Market to More than Double

5G NR continues to accelerate at an extraordinary pace, much faster than expected four or five years ago or even just six or three months ago, underpinned by large-scale deployments in China, Korea, and the US.

These trends are expected to extend into 2020. The upside in 5G NR will be more than enough to offset declining LTE investments, propelling the overall RAN (2G-5G) market for a third consecutive year of healthy growth.

2) Early Adopters to Embrace 5G SA

The path toward 5G has become more straight forward since the 2Q19 quarter with only two options now—Option 3 which is 5G NSA, utilizing the EPC, and Option 2 which is 5G SA utilizing the 5G Core.

As we move into 2020, we will see the emergence of the first 5G Standalone (5G SA) networks. We expect service providers in China, Korea, the Middle East, and the U.S. to launch 5G SA sometime in 2020.

3) More than 100 Million Transceivers

The Massive MIMO business case has changed rather significantly over the past two to three years with the technology now considered to be a foundational building block for mid-band NR deployments. We recently revised the 2020 Massive MIMO outlook upward, driven by surging year-to-date shipments and improved market sentiment for 2020. The overall 5G NR transceiver installed base – Massive MIMO plus Non-Massive MIMO for sub 6 GHz and Millimeter (mmW) macros and small cells – is projected to eclipse 0.1 B by 2020.

4) Dynamic Spectrum Sharing Takes Off

The attitude towards spectrum sharing is on the upswing, with both suppliers and operators discussing their spectrum sharing roadmaps. In addition to the spectral efficiency gains of 15% to 20%, operators are considering the benefits from a marketing perspective. Operators also see the extended 5G NR coverage with a lower band spectrum as a key enabler for 5G SA and network slicing. The technology is expected to play a pivotal role in upgrading existing low-band LTE sites to NR in the year 2020.

5) 5G NR Indoor Small Cell Market to Surpass LTE

With more data points suggesting the beamforming gains with Massive MIMO radios delivering comparable outdoor coverage in the C-band relative to 2 GHz LTE deployments, preliminary data from the field also suggests indoor performance will be a challenge and operators are already migrating the indoor capex from 4G to 5G. These trends are expected to intensify in 2020.

6) Millimeter Wave (mmW) to Approach 10% of 5G NR Small Cell Installed Base

Even though deploying 5G NR in the mid-band using the existing macro grid will deliver the best ROI for some time for operators seeking to optimize cost per GB and average speeds, 5G NR mmW shipments and revenues increased substantially in the third quarter of 2019, with the overall mmW NR market trending ahead of expectations.

We recently adjusted our near-term mmW outlook upward to take into consideration the state of the market and improved visibility about the underlying fundamentals in Japan, Korea, and the U.S.

7) 5G MBB to Account for More than 99% of the 5G NR Market

We remain optimistic about the IoT upside for Industrial IoT/Industry 4.0, reflecting a confluence of factors including 1) Suppliers are reporting healthy traction with the vertical segments; 2) More countries are exploring how to allocate spectrum for verticals; 3) Ecosystem of industrial devices is proliferating rapidly; 4) New use cases that require cellular QoS are starting to emerge.

At the same time, the LTE platform is expected to suffice for the majority of the near-term vertical requirements implying it is unlikely 5G NR IoT related capex will move above the noise in 2020.

8) Virtual RAN 5G NR Revenues to Exceed Open RAN 5G NR Revenues

There are multiple ongoing efforts driven both by operators and suppliers with the primary objective of realizing a more flexible architecture that will optimize TCO for both the known and unknown use cases while at the same time improving the ability for the service providers to differentiate their services.

Given the current state of these tracks with the incumbents investing more in virtual solutions and the readiness of Open RAN initiatives for existing 5G MBB deployments, we envision Non-Open RAN Virtual 5G NR revenues will be greater than Open RAN (virtual RAN with open interfaces) 5G NR revenues in 2020.

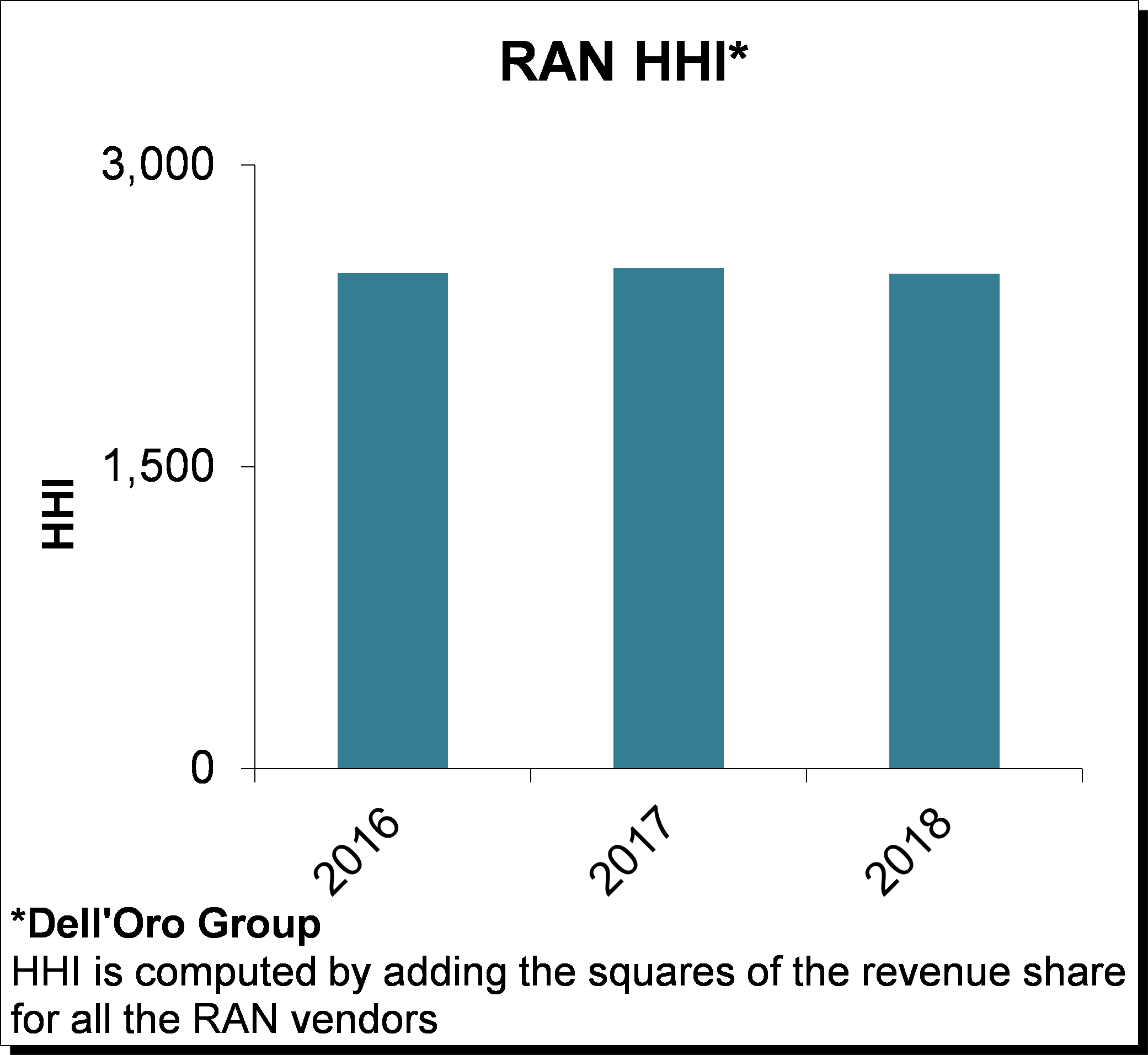

9) 5G NR RAN Revenue HHI to Increase > 100 Points

Total RAN HHI has been fairly stable over the past three years, reflecting a competitive dynamic that remains fierce, moderately concentrated, and relatively stable. Initial readings suggest the 5G NR HHI for the 4Q18 to 3Q19 period is trending below the 2018 overall RAN HHI; however, we expect the 5G NR HHI to increase in 2020.

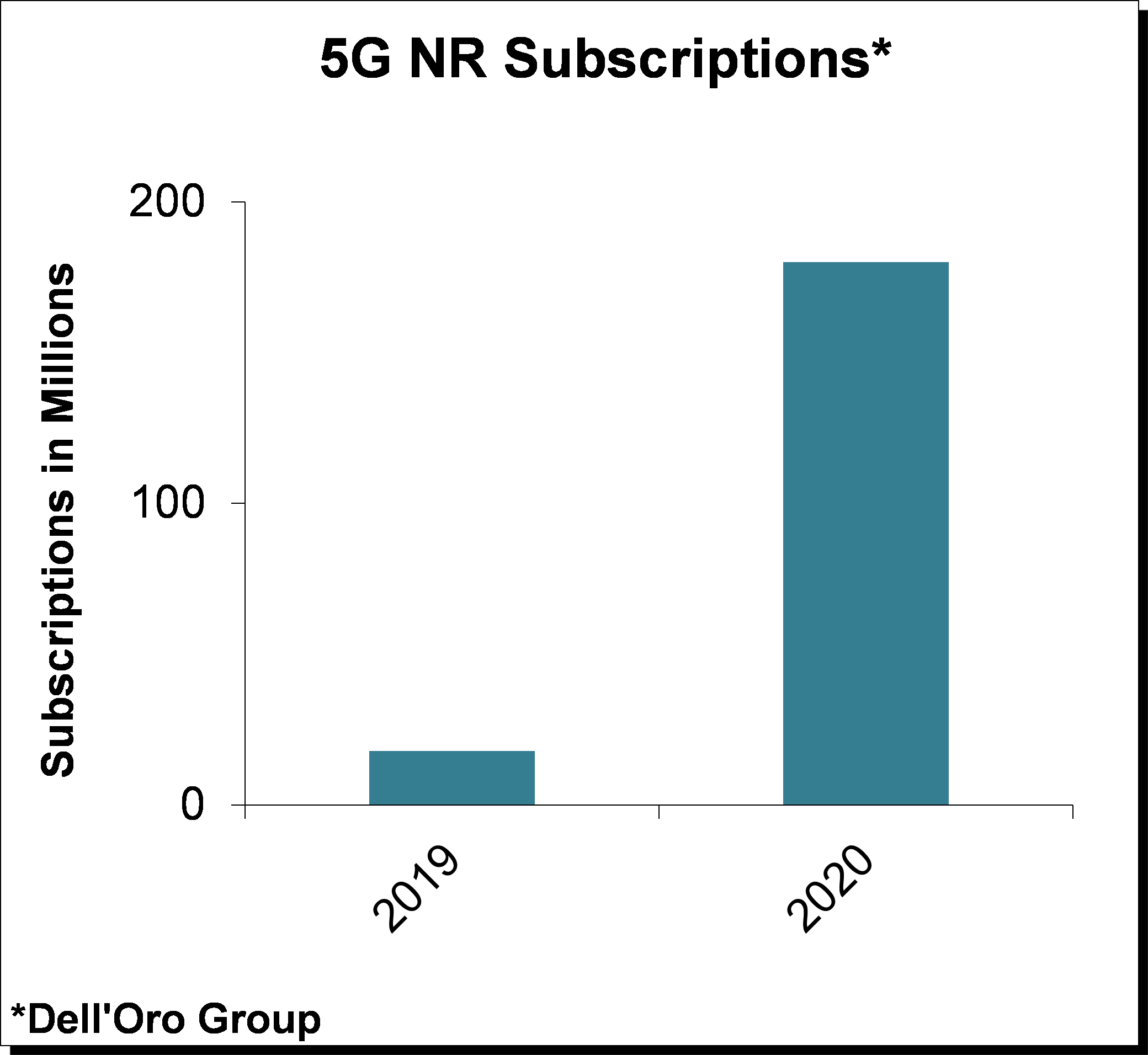

10) 5G NR Subscriptions to Approach 200 Million

Preliminary estimates suggest the shift from LTE to NR is roughly two to three years faster than the 3G to 4G migration from a RAN infrastructure and subscription adoption perspective.

The end-user ecosystem is developing at a rapid pace with multiple chipsets, devices, and phones supporting both NSA and SA for the low-, mid-, and mmW- spectrum now commercially available. While TDD has dominated mid-band and mmW deployments to date, FDD-based 5G NR phones became a reality in 2H19 and will proliferate in 2020.

The end-user ecosystem is developing at a rapid pace with multiple chipsets, devices, and phones supporting both NSA and SA for the low-, mid-, and mmW- spectrum now commercially available. While TDD has dominated mid-band and mmW deployments to date, FDD-based 5G NR phones became a reality in 2H19 and will proliferate in 2020.

End-user device adoption is projected to accelerate rapidly in 2020, with 5G NR approaching 0.2 B subscriptions, bolstered by healthy NR subscriber adoption in China, Korea, and the U.S.

For more information about our 5G, Mobile RAN, and Mobile Core Network programs, please visit our website or please contact dgsales@delloro.com.