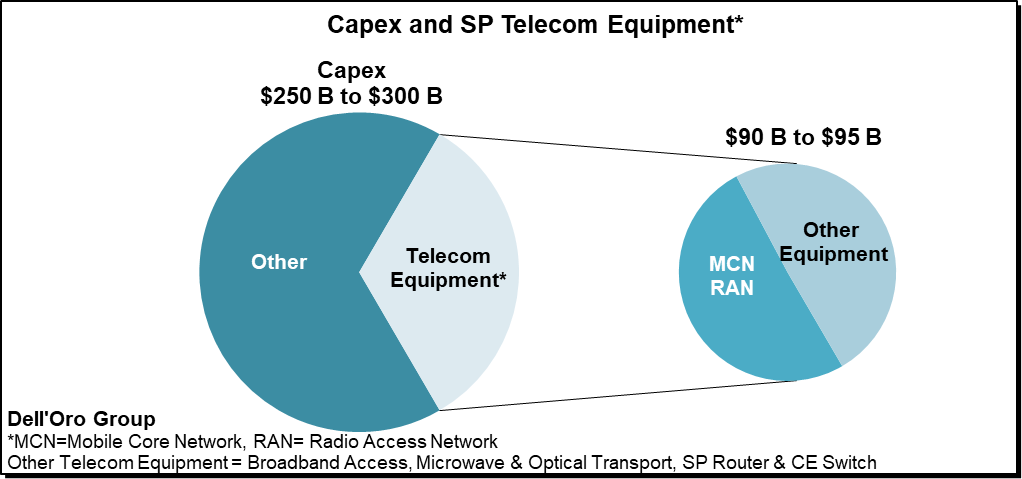

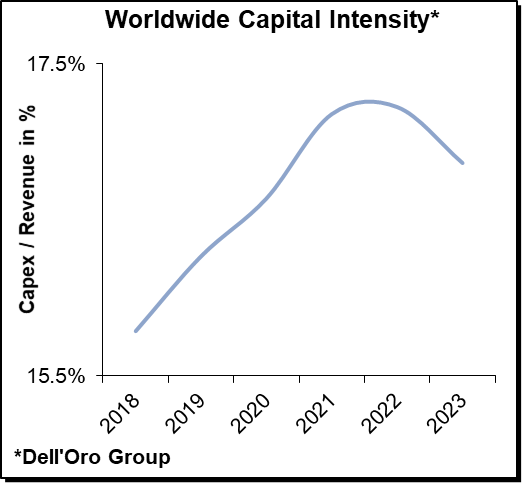

We recently updated the 2020 Telecom Capex Report. In contrast to the standard Dell’Oro equipment reports that track manufacturing revenue for telecommunications infrastructure, the capex report analyzes the investment plans for around ~50 operators, accounting for approximately 80% of worldwide capex and revenue. Now given that the sum of the SP telecom equipment programs we closely track – including Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Switch – accounts for about a third of the overall capex, it can be inferred that small changes in non-equipment related capex can impact the relationship between the overall capex and equipment rather materially. Having said that, the correlation between the equipment programs and telecom capital intensities remain significant over time. And even if the tracking is not always perfect and capex is just one piece of the forecasting puzzle, we believe there is value to analyzing these trends.

Some of the highlights from the 2020 Capex report are shown below. For more information or if you need full access to the report, please contact Daisy@delloro.com.

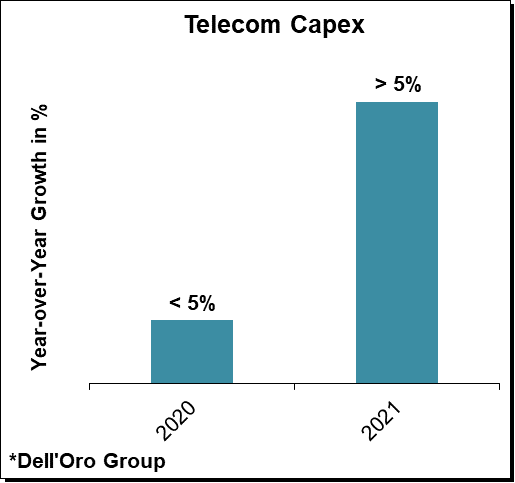

- Following three years of declining capex trends between 2015 and 2017 and flat trends in 2018, preliminary readings suggest that worldwide telecom capex—the sum of wireless and wireline telecom investments—advanced at a low single-digit rate in 2020, recording a second year of consecutive growth.

- Preliminary equipment vendor report estimates indicate that the combined revenues of the carrier-related equipment programs tracked by the Dell’Oro Group (Broadband Access, Microwave Transport, Mobile Core Network, Mobile RAN, Optical Transport, and SP Routers & Switches) increased approximately 7% Y/Y in 2020, suggesting that the relationship between carrier capex and supplier infrastructure equipment revenues decoupled somewhat, partly reflecting the site utilization reuse rate with 5G.

- Following the 3% Y/Y revenue contraction for the 1H20 period, preliminary readings indicate that worldwide telecom revenues bounced back in 2H20.

- We have revised our short-term and near-term capex outlook upward, reflecting a more favorable outlook in Europe, Japan, and the US. Total wirelines plus wireless telecom capex is now projected to advance more than 5% in 2021.

- Even as the 5G BTS installed base in China approached 0.8 M in 2020, preliminary guidance for the top 3 operators combined with initial estimates for CBN suggests the positive momentum that has characterized the Chinese market over the past two years, following steep declines between 2015 and 2018, will extend into 2021.

- With capex projected to outpace revenue growth over the near-term, the combined capital intensity is expected to increase in 2021 and 2022, before stabilizing and improving in the outer part of the forecast period

About the Report:

The Dell’Oro Group Telecom Capex Report provides in-depth coverage of more than 50 telecom operators highlighting carrier revenue, capital expenditure, and capital intensity trends. The report provides actual and 3-year forecast details by carrier, by region by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). To purchase this report, please contact by email at dgsales@delloro.com.