Each year, I like to take the pulse of the vendor landscape in Optical Transport, and each year I am always impressed by the number of companies that compete in this market. This year is no different.

The good news is that the Optical Transport market, by most measures, is very healthy. The market revenue is just north of $15 billion and has grown at an average annual rate of 5 percent since 2003 (a year when the Optical Transport market was at its worst and network capacity was more aligned with demand). If we focus on WDM systems, this market has grown at an average annual rate of 12 percent. The profit margins here are not the highest among industries but also not the lowest. That said, when considering the type of technology these optical system companies produce, many (myself included) would argue the profit margin should be higher. This leads me to my annual review of the vendor landscape and assessment of vendor competition. The result of my assessment is unchanged—vendor competition is very high in the Optical Transport industry. However, as we all know, the higher the competition, the slimmer the profit margins.

The following are key findings of the vendor landscape that I find the most interesting:

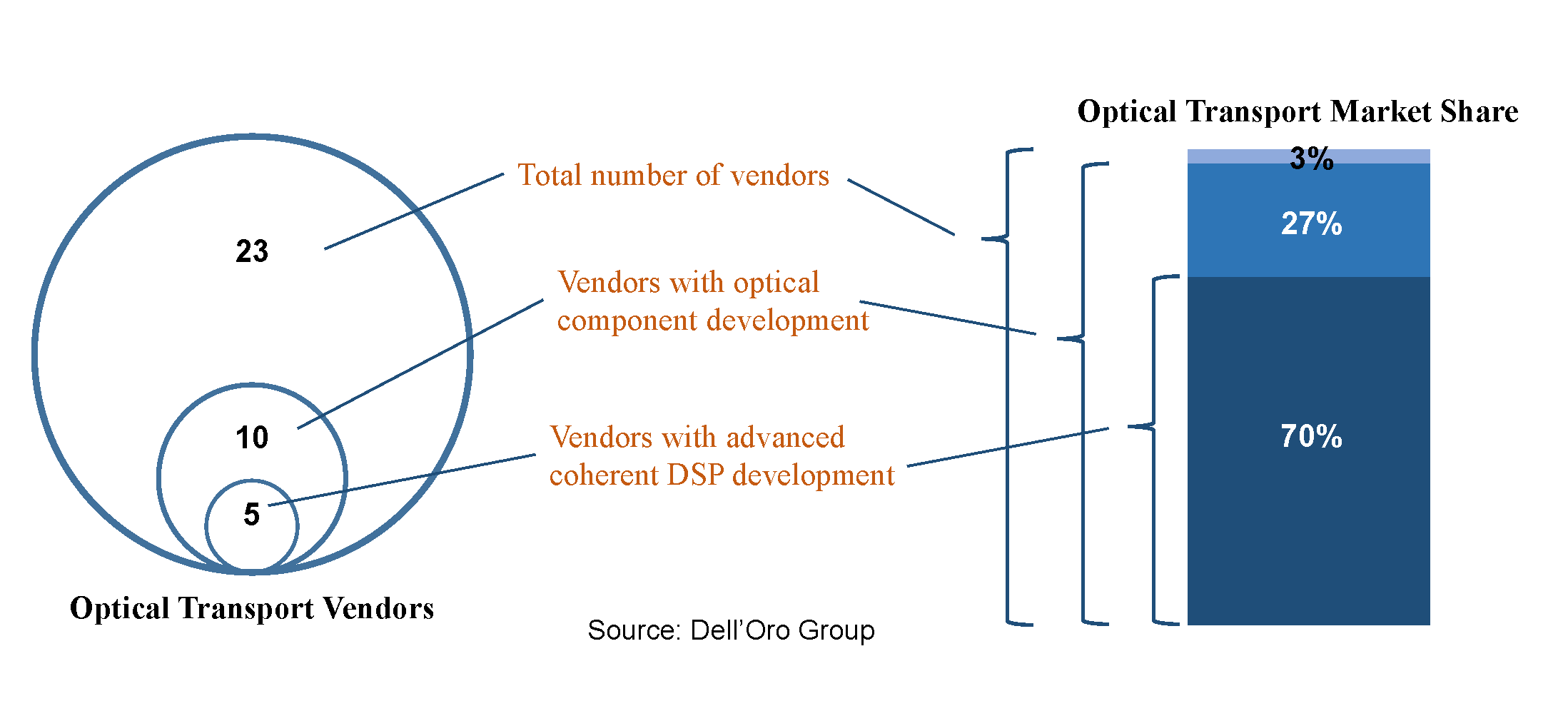

- There are 23 vendors actively selling optical systems. Nine have headquarters in North America, seven in Europe/Middle East, six in Asia Pacific, and one in Latin America.

- Of the 23 vendors, there are 10 that develop some optical components either in-house or through a sister company (subsidiary or part of a corporate group).

- The 10 vendors that have optical component development are also the top 10 vendors in the Optical Transport industry with a combined market share of 97 percent.

- Among the top 10 vendors, I find that 5 compete in technology. That is, 5 companies spend a larger amount on R&D to develop the latest coherent DSP and photonics to be first-to-market with the newest coherent wavelength technology.

- The 5 vendors that compete in technology amass a combined market share of 70 percent. More importantly, these 5 companies have 90 percent share of the faster growing 400+ Gbps wavelength shipments and 90 percent of the business with Internet Content Providers.

Hence, while there are 23 optical system vendors in the industry, they are located in different regions of the world, giving them some advantage when selling to local customers. Also, among these 23 vendors, 10 capture the vast majority of the market with half of them competing for technology leadership.

So, what about the 13 vendors competing for 3 percent of the market? First, I am pretty sure each of them will state that they are striving to go after the entire $15 billion. However, considering that 70 percent of the market is held by technology leaders, I argue that the 13 vendors have a SAM (serviceable available market) closer to $4 billion. Second, the remaining companies are not all the same. I believe some are poised to grow and grab some market share while others are just holding on or close to exiting. My assessment of the remaining 13 companies are:

- Four are growing

- Four are sustaining

- Five have stalled

This means that, in actuality, the total number of Optical Transport vendors competing each year is probably closer to 18.

As a point of reference, when I first did my assessment of the vendor landscape over a decade ago, I recall the number of vendors was closer to 30. It took over a decade to go from 30 vendors to 23. Perhaps, in another decade, the vendor count will be below 20.