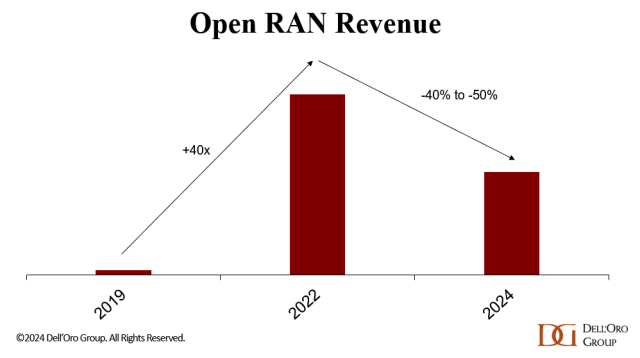

We just wrapped up the 3Q24 reporting period. And per our latest RAN findings, 2024 is so far not a great year from an Open RAN revenue perspective. As a reminder, Open RAN investments accelerated at a torrid pace between 2019 and 2022. This remarkable ascent was then followed by a ~$0.5 B decline in 2023 as activity in the US slowed. Market conditions remain challenging in 2024, and helping to explain the 30 % year-over-year (Y/Y) decline for the 1Q24-3Q24 period is the state of the 5G market in Japan and the US combined with the commercial readiness of next-generation O-RAN ULPI technologies.

In other words, the long-term trajectory is positive, but the short-term picture remains blurry. With large-scale greenfield deployments now mostly in the past, the broader market sentiment will remain uncertain until 5G activity in the US/Japan improves or modernization projects utilizing the latest O-RAN ULPI interfaces firm up.

Additional Open RAN highlights from the 3Q2024 RAN Report:

- Virtualized RAN is down 15 % Y/Y for the 1Q24-3Q24 period.

- The top 3 Open RAN suppliers for the 1Q24-3Q24 period based on worldwide revenues are Samsung, NEC, and Fujitsu.

- The top 3 vRAN suppliers for the 1Q24-3Q24 period based on worldwide revenues are Samsung, Fujitsu, and Ericsson.

- Short-term projections have been revised downward, while the long-term outlook remains unchanged. Open RAN is now projected to comprise a mid-single-digit share of the 2024 RAN market and 8 to 10 % of the combined proprietary plus Open RAN 2025 revenues.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments, including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at dgsales@delloro.com.