Open and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed. In this blog we will discuss three key takeaways for the 3Q20 quarter including:

1) The primary objective of Open RAN is to address market concentration and vendor lock-in;

2) Open RAN revenues are trending ahead of schedule;

3) Not all Open RAN is disruptive.

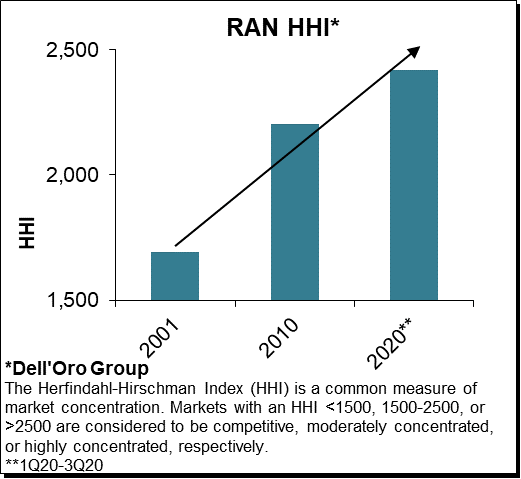

First, when it comes to the broader movement behind Open RAN, the leading drivers have not changed since we published the Open RAN Forecast this August. Addressing vendor lock-in and market concentration remain the leading drivers behind the Open RAN movement. Initial readings suggest that the overall RAN market concentration levels as measured by the Herfindahl-Hirschman Index (HHI) increased around 10% between 2010 and 1Q20-3Q20, underpinning projections that these trends will not reverse anytime soon with the current RAN model.

Preliminary estimates suggest Open RAN revenues – including radio, baseband, and software – are coming in at a slightly faster pace than initially expected, reflecting positive developments in the Asia Pacific region. We have adjusted the 2020 outlook upward from ~$0.2 B to ~$0.3 B.

Even though we are in the middle of updating the long-term projections, at this point we just want to clarify that the stronger than expected short-term acceleration does not necessarily translate to faster or slower brownfield adoption beyond 2020.

The results are mixed. While Dish is running into delays in the US market, Rakuten is moving forward at a rapid pace in Japan deploying a variety of both sub 6 GHz and mmWave RAN systems. In addition, some of the Japanese suppliers are reporting that the lion share of their radio shipments are already O-RAN compatible.

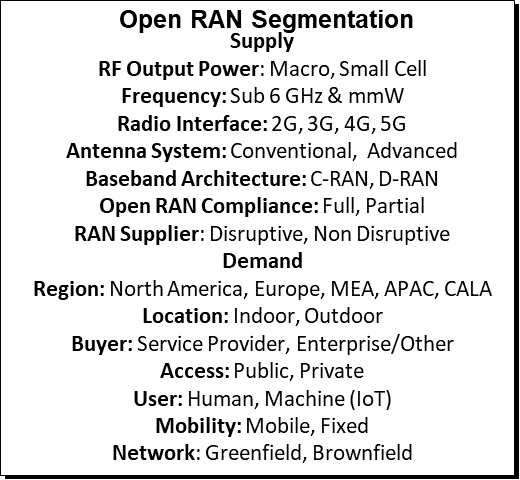

The last point we want to make is that not all Open RAN is the same. There is no shortage of ways to segment the Open RAN market – at a highly simplified level, we envision there at least 14 ways to think of the Open RAN opportunity. And while revenue remains a fundamental metric to determine the overall market adoption, it will be particularly interesting to pay attention to the RAN supplier segmentation. This will be important to assess if Open RAN is also disruptive. Because at the end of the day, Open RAN will likely not be considered a complete success story even if Open RAN comprises 100% of the total RAN market but the HHI is still hovering around 2500.

So on the one hand, we estimate total Open RAN revenues are tracking ahead of schedule. On the other hand, the lion share of any “security” related RAN swaps are still going to the traditional RAN players, suggesting the technology for basic radio systems remains on track but the smaller players also need to ramp up investments rapidly to get ready for prime time and secure larger brownfield wins.

For more information about the Open RAN and Virtualized RAN forecast and assumptions, please visit the Open RAN site or please email us at dgmedia@delloro.com or dgsales@delloro.com.