Open RAN and virtualized RAN technologies have many of the right ingredients to address both supply and demand related challenges that continue to characterize the mobile infrastructure market.

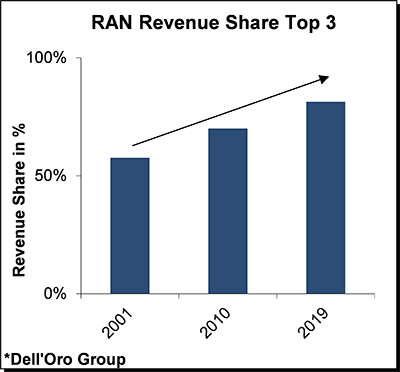

When it comes to the broader movement behind Open RAN, one of the leading drivers is the degree of competition in the RAN market and the fact that the share of the top 3 RAN suppliers continues to trend upward. With few signs that these revenue share trends are about to reverse anytime soon, Open RAN is increasingly seen as a possible solution to address the reliance on the top 3 and/or to simplify swaps in the event that further consolidation becomes a reality down the road.

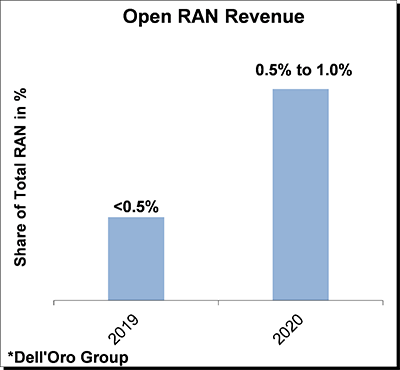

The momentum is picking up pace, resulting in an improved Open RAN outlook across the globe.

In this latest Open RAN forecast, we project that Open RAN baseband and radio investments—including hardware, software, and firmware excluding services—are projected to more than double in 2020 with cumulative investments on track to surpass $5 B over the forecast period.

We attribute the more favorable Open RAN outlook to a confluence of factors including:

-

Verification from live networks the technology is working in some settings;

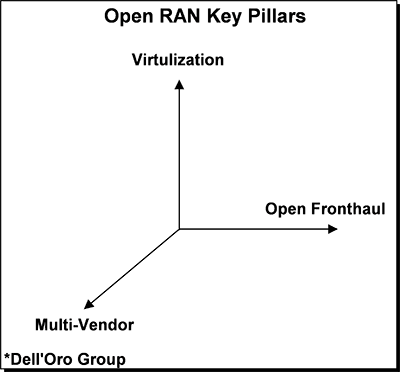

- Three of the five incumbent RAN suppliers are planning to support various forms of Open RAN – “Partial Open RAN” (open and virtual but not multi-vendor) are at this juncture captured in the Open RAN estimates meaning we require the first two pillars but we are excluding the third multi-vendor requirement as a necessity to reflect the Open RAN movement;

- The geopolitical uncertainty has escalated significantly in the past six months, with multiple operators reassessing and/or reviewing their reliance on Huawei’s RAN portfolio, resulting in an improved entry point for the Open RAN suppliers;

- Progress with full virtualization is firming up, with multiple suppliers announcing the commercial availability of V-RAN, consisting of both vCU and vDU;

- Operators are increasingly optimistic the technology will move beyond the rural settings for brownfield deployments;

- Policies to stimulate Open RAN are on the rise.

For more information about the recently published Open RAN and Virtualized RAN forecast, assumptions, and risks, please email us at dgmedia@delloro.com or dgsales@delloro.com.

Related Video to the Open RAN Market:

Sign up to Dell’Oro Analyst Talks channel at BrightTalk to watch the full video