After initially considering skipping MWC Vegas due to declining attendance, we are pleased with our decision to attend this event in person. We had a rather productive day, with about ten meetings and various demos, mostly focusing on non-traditional suppliers and opportunities. Although we may not be the best source to capture all the announcements timed with this event, we want to share some high-level takeaways related to Fixed Wireless Access (FWA), neutral host, Open RAN, and private wireless, which could potentially impact the RAN market.

Interest in mmWave FWA is on the rise

The narrative around millimeter-wave (mmWave) technology has evolved since its initial commercial deployments in 2018. Currently, mmWave accounts for approximately 2% of the RAN market. While we maintain optimism about its long-term growth potential, short-term prospects have been adjusted downward due to slower activity in the first half of 2023.

There are currently two main tracks aimed at advancing the mmWave business case for both MBB and FWA use cases. These tracks involve boosting the RF output power and improving economics through repeaters and Reconfigurable Intelligent Surfaces (RIS). At the MWC event, the focus was primarily on the FWA opportunity. Verizon and T-Mobile announced that the average FWA user consumes 300 GB and 450 GB of data per month, respectively. This raises the question of how many subscribers the operators can target while maximizing profitability and whether mmWave spectrum can be an economically viable option in areas where the upper mid-band is exhausted. Operators still have some time, but it’s the right moment to start planning for the next steps.

The problem statement remains the same, but discussions at both MWC Vegas and the 5GAmericas event suggest reasons for optimism regarding near-term FWA RAN growth prospects.

Neutral Host – This time is different!

Those who aren’t jumping out of their chairs with excitement after reading neutral host-related press releases can be forgiven. After all, discussions about the win-win scenario with neutral host deployments have been ongoing for as long as I’ve been an analyst (I joined Dell’Oro in 2010).

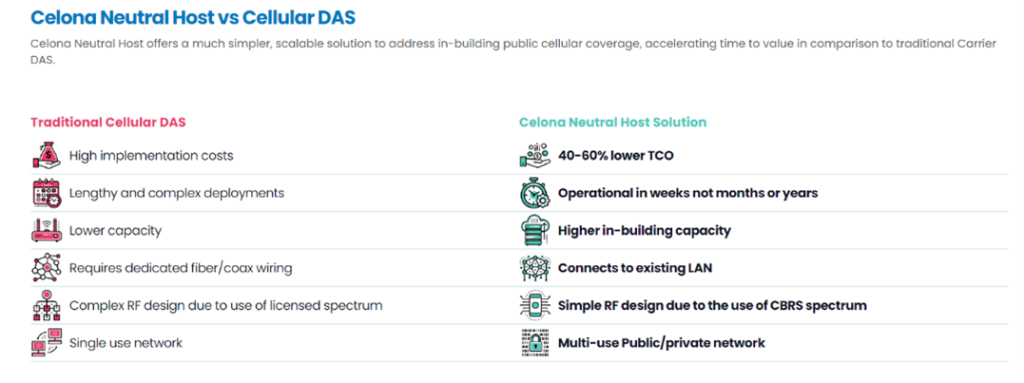

One of the key differences this time is the target market and the potential TAM expansion. It’s no longer just about larger public venues. The improved economics, simplicity, scalability, and deployment times associated with recently announced neutral host offerings are expected to open up opportunities beyond the traditional DAS footprint. For example, Celona recently announced a neutral host-based partnership with a major US retailer with 4 K stores. It will be interesting to follow the progress and learn more about the value derived from improved indoor coverage and performance.

With the right ownership and partnership models, the differing ROIs between operators and building owners could change the likelihood of 5G proliferating indoors. WiredScore, an expert in property digitalization, estimates that well-connected buildings, such as the ones Ericsson and Proptivity launched in Stockholm in collaboration with Fastpartner, have the potential to increase rent levels by about 3%. Proptivity also announced plans to invest 3 billion SEK in the coming years to improve 5G connectivity across Nordic properties.

InfiniG unveiled its Neutral Host as a Service offering at MWC. The company believes that its “collaboration with the mobile operators, enterprises, commercial real estate owners, and partners has birthed an innovative new model.” According to InfiniG, the market opportunity spans 40 B+ sq ft of untapped commercial space.

The incumbents are now committing to Open RAN

Open RAN has come a long way in just a few years but at the same time, brownfields beyond the early adopters are still more comfortable with traditional RAN architectures. In addition to cost, timing, and performance parity, operators are waiting for “approval” from the established suppliers.

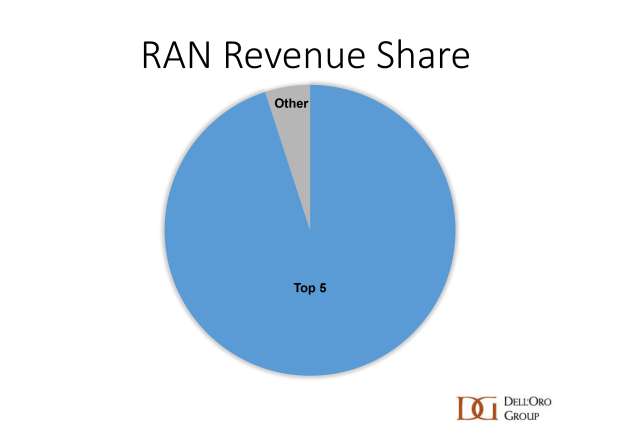

Although MWC Vegas had limited attendance from the top four RAN suppliers, Ericsson’s confirmation of its Cloud RAN/Open RAN fronthaul commitments was a major focus at the event. This was followed by Nokia’s recently announced paper clarifying its CloudRAN/Open RAN solution roadmap, validating the message we have communicated for some time, namely that Open RAN is here to stay and it is an architecture for both legacy and new suppliers. Importantly, with the top five suppliers still comprising around 95% of the RAN market, the incumbents are needed to accelerate O-RAN brownfield deployments.

Open RAN may not be as disruptive as some initially envisioned. But Ericsson and Nokia’s recent announcements taken together with Samsung’s Open RAN/vRAN portfolio readiness are significant validations of this movement and will help catalyze O-RAN-compatible brownfield deployments.

Private wireless goes smaller

As with most new opportunities, it always takes a while to figure out the right path. After initially trying to sell cellular connectivity as a Wi-Fi+ complement to enterprises with existing Wi-Fi, the focus over the past year shifted towards selling cellular connectivity to industrial sites where there is limited or no Wi-Fi/cellular connectivity. This pivot is accelerating the private wireless market, with preliminary findings suggesting that private RAN revenues increased around 60% YoY in the second quarter of 2023.

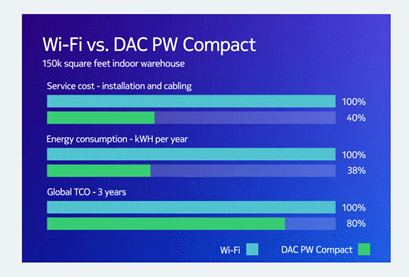

While the non-industrial market remains an essential part of the potential TAM, the focus is currently on low-hanging fruit. Nokia’s recently announced private wireless compact DAC, targeting “small” industrial sites, will likely expand the overlap with Wi-Fi. The focus remains on industrial sites such as warehouses, but it is also returning to selling Wi-Fi+ to places that may already have Wi-Fi.

Cost will be crucial for SMEs and Nokia estimates that its compact DAC PW can save enterprises 20% in TCO compared to Wi-Fi.

In summary, we are not adjusting any projections at this time based on these announcements/activities, but we see them as important validations of our RAN projections, especially for the upcoming growth engines. It will be key to monitor the progress with all of these potential revenue boosters, including neutral host, private wireless, and FWA (Open RAN is not a revenue booster).