We just came back from a couple of intense days in Barcelona. Below we will share some initial RAN related thoughts about discussions around industry challenges, AI, 6G, Open RAN, and the 2024 RAN market.

Industry challenges – focus on revenues or cost?

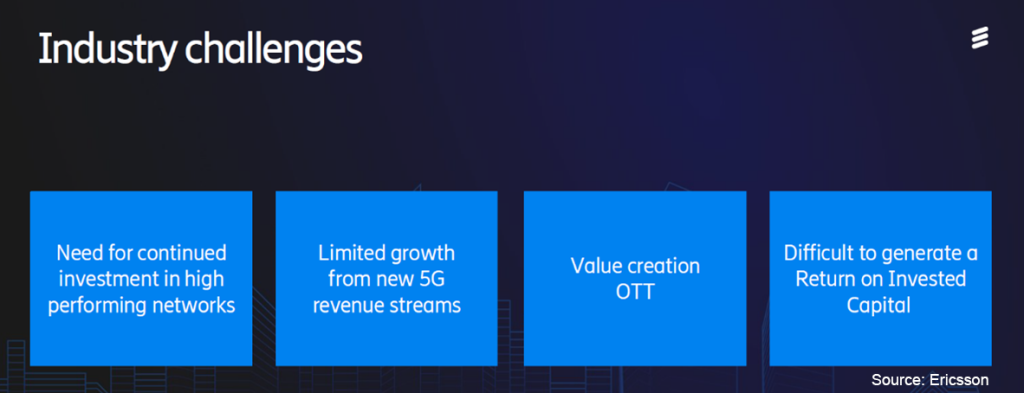

While AI may have been the buzzword at the show, the predominant theme revolved around the broader challenges confronting the industry. Primarily, there’s a pressing need for increased investments to fully leverage the potential with ubiquitous connectivity, yet operators are hesitant to boost investments due to stagnant revenues.

For those familiar with the industry and our RAN research, these challenges are nothing new. The dilemma of balancing costs and revenues has been a recurring topic at MWC for decades. Even if the probability that 5G was going to change the carrier revenue trajectory in the first five years was always small and most analysts base case projections were predicated on the assumption that wireless carrier revenues would remain flat, perhaps what was different this time around was the realization that this hope seems to have diminished for the time being.

Consequently, this year’s focus appears to lean more towards cost reduction rather than revenue growth. Whether discussing 5G-Advanced, AI, automation, “softwarization,” energy efficiency, Open RAN, or future-proofing investments, optimizing TCO through capital and operational savings to enhance the chances of success in a world with constrained revenue growth emerges as a key theme.

Despite the temptation to invest only the bare minimum required to address known challenges, there are still rewards for those who continue to invest in their networks wisely over time. Operators are well aware of the risks associated with underinvestment, hence equipping them with the best tools to foster innovation and lay the groundwork for future monetization opportunities were still important aspects at this year’s event, even if TCO was likely in the driver seat.

How can the RAN industry jump on the AI train?

With Nvidia’s market cap quadrupling in just over a year, the message that AI is important resonated strongly in Barcelona. However, the fundamental question remains: How will AI impact the RAN market? From our perspective, most of the areas discussed in a previously posted AI RAN blog remain unchanged, with the exception of the RAN chip dynamics (the AI blog will be updated soon). To summarize, we are now considering six key areas where AI can directly or indirectly impact the RAN market:

- Mobile data traffic

- Operator revenue growth

- Performance/experience

- TCO

- RAN algorithms

- RAN semi dynamics

Our high-level position has not changed. We believe it is unlikely that AI alone will significantly change the trajectory of mobile data traffic or operator revenue growth. However, it is probable that AI will contribute to enhancing performance and reducing TCO through automation, power consumption optimization, resource utilization, and efficiency improvements. Similarly, it is evident that AI will increasingly influence the entire RAN stack, particularly in the second half of the 5G era and beyond with 6G.

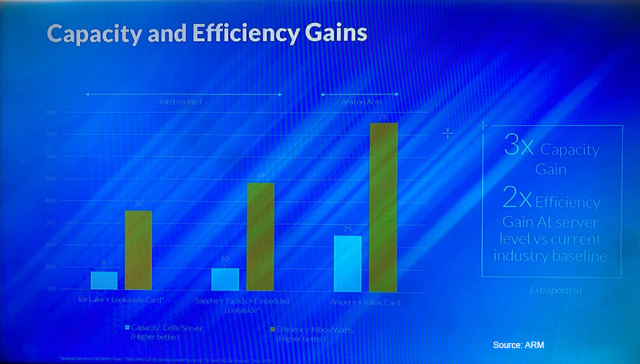

While we do not publish vendor share data for L1 vRAN semis, one notable observation from the show was the heightened activity in this space, especially as vRAN adoption accelerates and AI becomes more integrated. This, combined with operators’ openness to exploring alternative solutions, underlies the surge in PR-related announcements. According to third-party sources, Intel currently dominates the L1 vRAN market. Notably, ARM management believes that market dynamics could shift in the future. During the event, ARM showcased the reach, capacity, and efficiency benefits of Arm-based processors in its booth. Santiago Tenorio, Vodafone’s RAN director, has also emphasized that the “efficiency of the Arm-based architecture will expand the chip and software ecosystem.” Meanwhile, Intel announced several enhancements to its vRAN portfolio, including the vRAN AI development kit and Granite Rapids-D with integrated vRAN boost/AI acceleration.

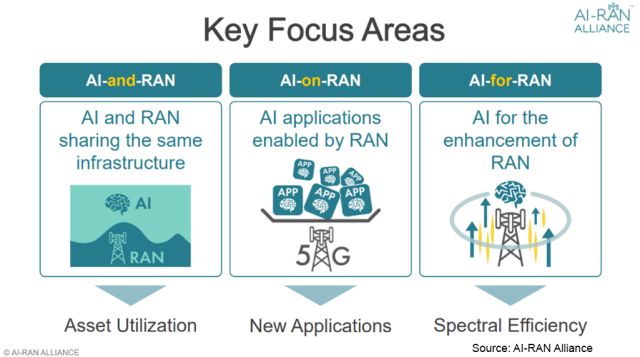

Riding on its success in the data center, NVIDIA appears now more serious about usings its chips in the RAN. Together with other founding members, NVIDIA recently launched a new AI-RAN Alliance initiative (also announced a new collaboration with Nokia).

The primary objective is to enhance the AI-RAN ecosystem and accelerate AI adoption in the RAN, thereby capitalizing on new revenue opportunities. The alliance is currently focusing on three key areas: asset utilization, new applications, and spectral efficiency, which intersect with the TCO, performance, and operator revenue growth aspects outlined earlier.

RAN infrastructure is typically dimensioned to handle peak usage, resulting in underutilization due to uneven distribution of daily traffic. The concept of C-RAN, introduced in 2010, aimed to address this inefficiency by centralizing resources. While C-RAN architecture is in use today, its widespread adoption has been limited due to economic constraints and reliance on fiber-rich operators.

What distinguishes the current vision is that the RAN evolves into a software workload, benefiting from existing hardware deployed to support non-RAN AI. However, the market is still constrained by stringent performance requirements for real-time sensitive functions. Although AI optimization may extend the range beyond the typical 20 km FH requirement, some challenges from the original C-RAN model are likely to persist.

The Alliance expresses more optimism than us regarding AI’s potential to alter carriers’ revenue trajectories and offset RAN infrastructure investments. Ronnie Vashista, NVIDIA’s SVP for telecom, envisions that networks capable of delivering necessary SLAs for advanced 5G will facilitate more AI applications and spur revenue growth.

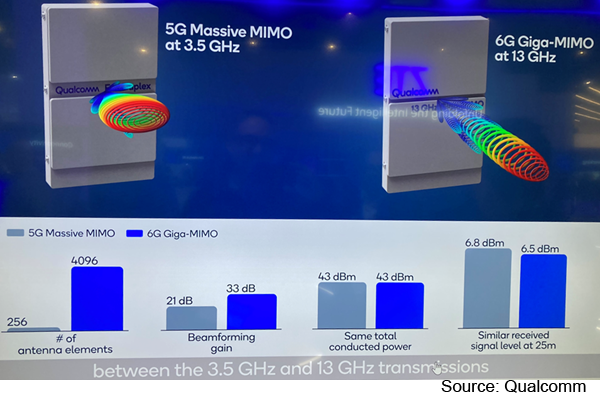

6G is all about the RF

Although 6G was not a primary focus at the show, it’s worth mentioning that the few demonstrations we observed aligned with the message we’ve conveyed in both the RAN2030 report and the recently published 6G article. Specifically, the emphasis is on utilizing the 6/7 to 15 GHz spectrum bands as anchor bands. The objective is to maximize the utilization of the existing macro grid, indicating that there is significant RF work required to support wider bandwidths and compensate for the additional path loss compared to the C-band.

Qualcomm estimates that the combination of beamforming gains at 13 GHz and a greater number of antenna elements (4096 vs. 256) will go a long way to address the outdoor link budget gap.

Open RAN is moving forward

The fundamental message we’ve consistently conveyed over the past couple of years, highlighting the resilience of the Open RAN movement despite ongoing challenges with multi-vendor RAN, remained unchanged during MWC. If anything, the event largely reaffirmed the notion that Open RAN is happening and most operators will over time incorporate more openness, virtualization, intelligence, and automation into their RAN roadmaps. The event not only provided improved clarity but also reinforced our assumptions regarding single-vendor versus multi-vendor O-RAN scenarios, while offering some optimism for smaller suppliers.

Several operators announced new commitments to Open RAN during or around the event. As a reminder, our internal tracker indicates approximately 30+ deployments by the end of 2023 (refer to the table in the January Open RAN report). Over the past month, the following operators have announced new deployment commitments: DT Germany, Kyivstar, Mobily, Ooredoo, STC Group, Telefónica, Telus, Vodafone Idea, and Vodafone Romania.

Vodafone reiterated its commitment to its forthcoming 170 K RFQ to address contracts expiring in 2025. The operator has invited 26 suppliers to participate in the RFQ process. Importantly, Vodafone believes that the best MM and non-MM radios currently available on the market, based on performance and energy consumption, are now O-RAN compliant.

Unsurprisingly, the definition of Open RAN varies. For Vodafone, Open RAN encompasses COTS server, open FH, open interfaces to SMO and RIC, integration of third-party radios including MM, support for 2G/4G/5G in Europe (3G in Africa), and FDD/TDD support. Vodafone also clarified that 30% of its European installed base will be multi-vendor RAN, while 100% of the 170 K sites will require O-RAN FH. This further validates the Open RAN movement and presents significant opportunities for both industry leaders and challengers.

Considering that the base case expectation is that RAN concentration will remain high, the event provided some hope for “non-traditional” RAN suppliers. Both Mavenir and Rakuten announced new wins over the past month. If Vodafone Idea secures 5G funding and Mavenir becomes one of the key suppliers (Vodafone Idea mentioned in its earnings call that they could roll out 5G in six to seven months once funding is secured), this could provide a much needed boost for Mavenir’s RAN business.

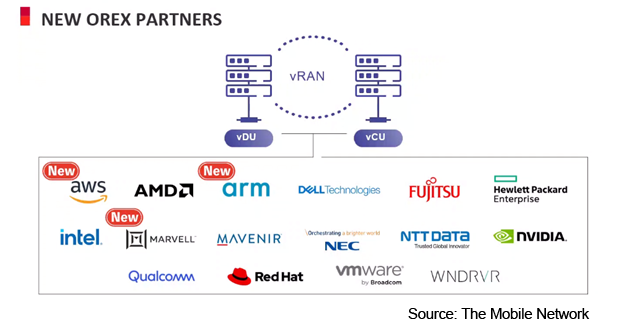

Additionally, NTT DoCoMo and NEC expanded on their previously announced OREX solutions by forming a joint venture with the primary objective of commercializing Open RAN packages beyond Japan. While it’s still early days with just three live field trials (Ooredoo, StarHub, Smart), the partner list is expanding.

While our Open RAN definitions have consistently included single-vendor Open RAN since we began tracking the segment in 2019, it’s important to note that not everyone has shared the same perspective on single-vendor versus multi-vendor definitions. One notable takeaway from the event and the past few months is the growing consensus that single-vendor Open RAN will indeed play a significant role in this movement. Ultimately, the overarching objective of Open RAN is to enhance supplier diversity and give more power to the operators. At the same time, the state of the North American RAN market in 2023 serves as a reminder that there are two sides to this equation.

RAN is still projected to shrink in 2024

Following a challenging 2023, the state of RAN in 2024 was a major focus in most of our meetings. The assumptions and projections outlined in the latest RAN report still hold. RAN conditions are expected to remain difficult with global RAN declining at a mid-single-digit rate this year. Most of the key players we’ve spoken with are for the most part in agreement, though risks remain significant in especially India, North America, and Europe.

In short, it was yet another exciting event. As we always emphasize, the RAN market may not be the fastest growing, but beneath that relatively flat top line, there’s a wealth of activity and opportunities to stand out. This summary doesn’t delve much into 5G-Advanced, FWA, private wireless, and NTN, but we may include more blogs on these topics in the future. If you have any further questions, please don’t hesitate to reach out. We’re planning to release updates to the Telecom Capex and Private Wireless reports in the second half of March.