In Dell’Oro Group’s January 2024 update to the Microwave Transmission & Mobile Backhaul Transport Five-Year Forecast report (2023-2028), a mixed outlook emerges. Here are some good news and bad news. Let’s delve into the highlights of these contrasting trends:

Good News

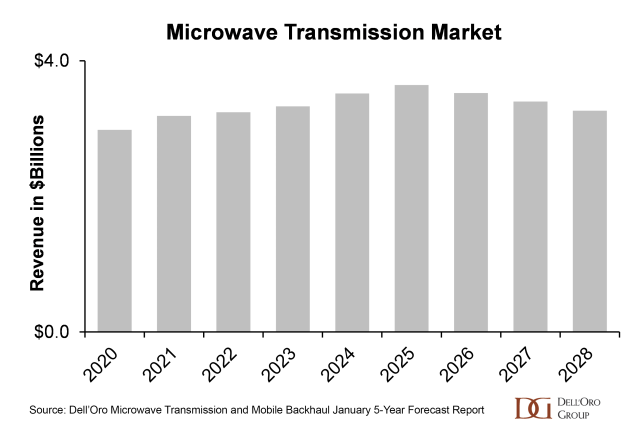

The good news is that the microwave transmission market entered a growth cycle due to the expansive 5G buildouts in 2021 and has enjoyed a steady pace of growth. Furthermore, we expect that there will be at least two more years added to this growth cycle, culminating in five years of market expansion. During this period, the microwave transmission market’s annual revenue will increase 22% and the cumulative revenue for that period will be nearly $17 billion. Other factors contributing to the near-term growth projections include:

- Overall demand for more bandwidth by customers is expected to continue for many more years, requiring higher link capacities. As a result, the adoption of E/V Band systems is expected to be much higher, and the number of carriers per cell site is also projected to increase.

- Revenue in Europe is expected to recover following a significant decline in 2022 and 2023 that was caused by the Russia/Ukraine war, unfavorable currency exchange rates, and macroeconomic uncertainty.

- India surprised us on the upside in 2023. We do have concerns that spending in 2024 will be lower after such a strong start to rolling out 5G, but based on our understanding, outside of one operator, the 5G roll out in the country has really just gotten started.

- Worldwide government initiatives to expand broadband coverage into rural areas should stimulate additional demand for microwave systems beyond mobile backhaul.

Bad News

Now for the bad news. The bad news is that the Microwave Transmission market, like many others, is cyclical. Therefore, following these five years of expansion, we are predicting the market to decline or contract for a few years. Specifically, we believe the Microwave Transmission market revenues will trend lower until the next growth cycle is initiated by 6G. Also, similar to past mobile generations, we anticipate that operators will focus on installing new 6G sites at locations with fiber before advancing to sites that use wireless systems for backhaul. So, the next growth cycle for microwave may not occur until 2030, meaning the market contraction period may also be five years in length.

There is one silver lining. Although the broader microwave market will be in a multi-year decline, we believe demand for E-band systems will continue to increase. We are forecasting E/V Band radio transceiver shipments to grow through 2028 at a 13 percent CAGR.