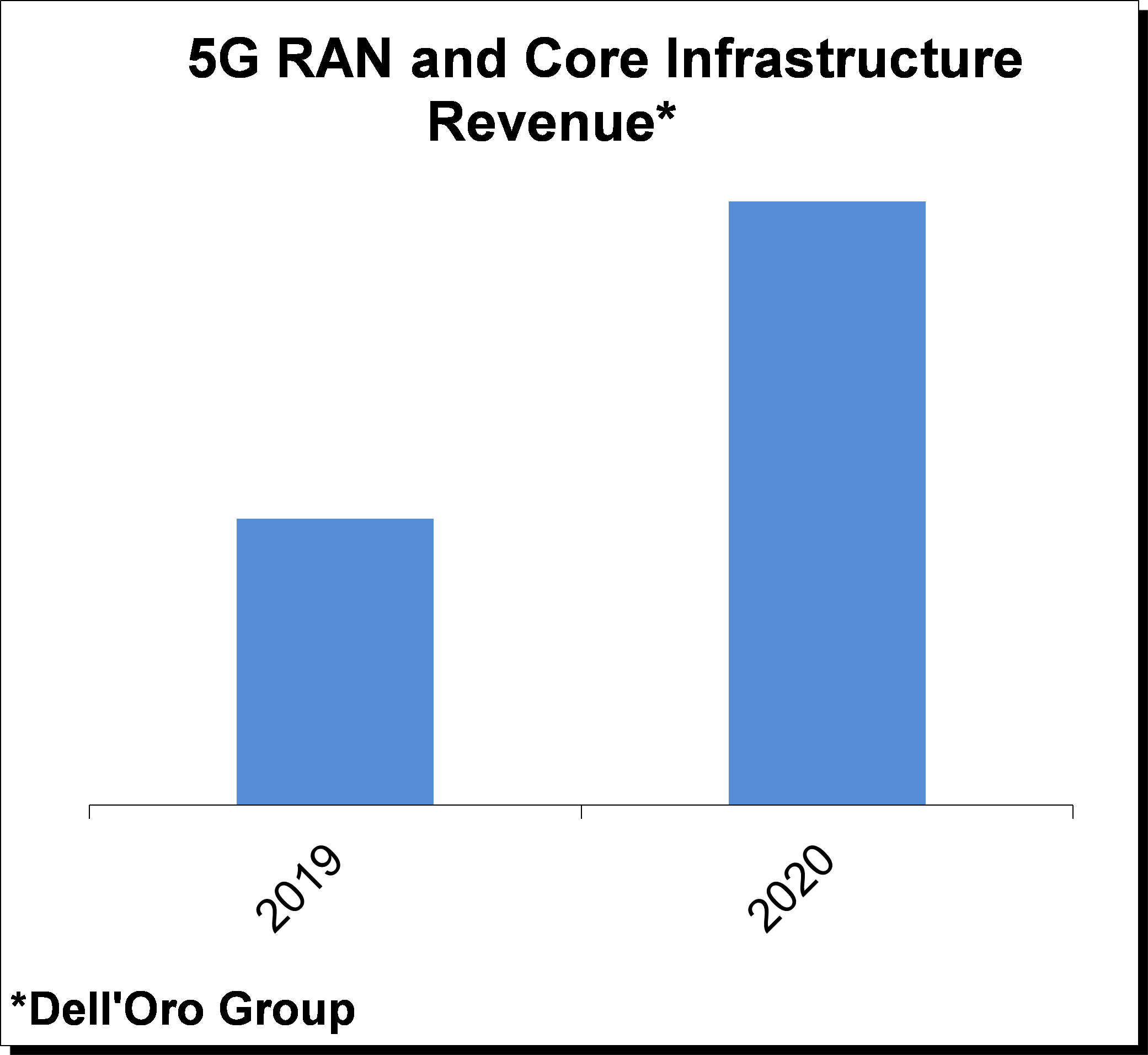

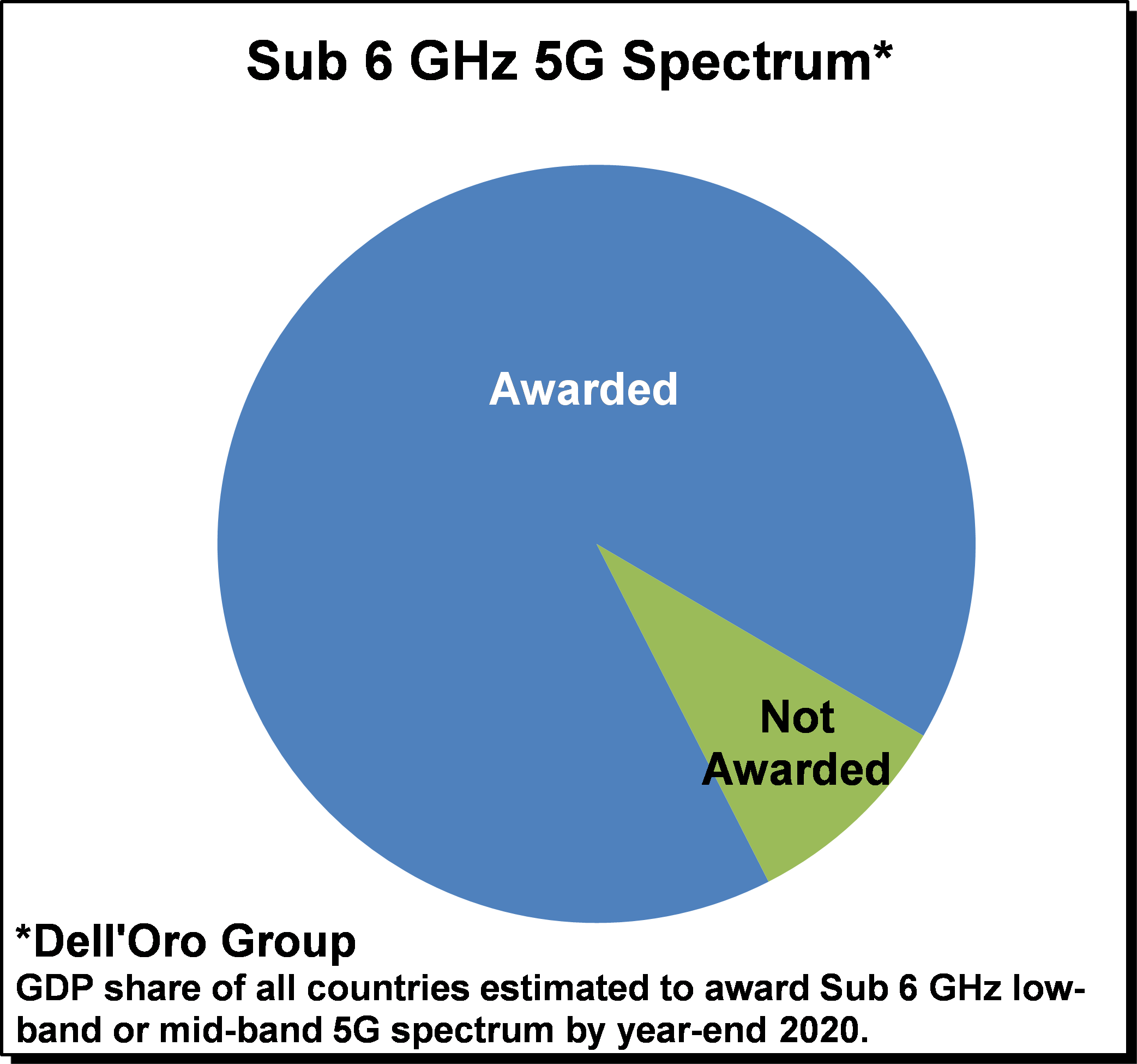

With 5G deployments now accelerating at a torrid pace and 5G NR investments projected to comprise 30% to 50% of global RAN investments in 2020 (Dell’Oro Group), operators are reassessing how to optimize their spectrum resources to capitalize on the potential business and technology benefits with 5G NR. Many countries are realizing the strategic importance of timely 5G deployments spurring governments and regulators to actively release/award 5G spectrum. Even with some minor spectrum auction delays as a result of Covid-19, countries that have auctioned or plans to award sub 6 GHz spectrum by year-end 2020 together comprise nearly 90% of worldwide GDP. At the same time, the amount of spectrum and the type of spectrum that is available varies widely across the globe, prompting operators to effectively capitalize on their respective spectrum assets to build 5G networks with optimal experience.

With 5G deployments now accelerating at a torrid pace and 5G NR investments projected to comprise 30% to 50% of global RAN investments in 2020 (Dell’Oro Group), operators are reassessing how to optimize their spectrum resources to capitalize on the potential business and technology benefits with 5G NR. Many countries are realizing the strategic importance of timely 5G deployments spurring governments and regulators to actively release/award 5G spectrum. Even with some minor spectrum auction delays as a result of Covid-19, countries that have auctioned or plans to award sub 6 GHz spectrum by year-end 2020 together comprise nearly 90% of worldwide GDP. At the same time, the amount of spectrum and the type of spectrum that is available varies widely across the globe, prompting operators to effectively capitalize on their respective spectrum assets to build 5G networks with optimal experience.

One of the more compelling features with 5G in addition to the increased spectrum bandwidth that comes with the upper mid-band and the mmW spectrum is the fact that 5G NR offers spectral efficiency improvements on a like for like basis relative to LTE, implying that operators and eventually enterprises can take advantage of these efficiency benefits regardless of their current spectrum portfolio. And in contrast to previous mobile technology transitions, new technologies such as dynamic spectrum sharing, dual connectivity and carrier aggregation across multiple technologies will provide the necessary tools to simplify and accelerate the migration from LTE to 5G NR. This improved flexibility taken together with the efficiency and performance upside with 5G NR plays an important role in the improved market sentiment that has characterized the RAN market in this initial 5G mobile broadband (MBB) deployment phase. While having the right mix of spectrum remains extremely important, the relatively seamless transition enables operators to put parts of the spectrum to use today. It does not matter if the spectrum is optimized for coverage or better suited for capacity or if an operator has a non-ideal portfolio mix of low-band, mid-band, or high-band spectrum. With 5G, operators now have the tools to capitalize on the benefits with the respective bands and put together a roadmap that migrates the portfolio in various phases from legacy 2G-4G to 5G NR.

One of the more compelling features with 5G in addition to the increased spectrum bandwidth that comes with the upper mid-band and the mmW spectrum is the fact that 5G NR offers spectral efficiency improvements on a like for like basis relative to LTE, implying that operators and eventually enterprises can take advantage of these efficiency benefits regardless of their current spectrum portfolio. And in contrast to previous mobile technology transitions, new technologies such as dynamic spectrum sharing, dual connectivity and carrier aggregation across multiple technologies will provide the necessary tools to simplify and accelerate the migration from LTE to 5G NR. This improved flexibility taken together with the efficiency and performance upside with 5G NR plays an important role in the improved market sentiment that has characterized the RAN market in this initial 5G mobile broadband (MBB) deployment phase. While having the right mix of spectrum remains extremely important, the relatively seamless transition enables operators to put parts of the spectrum to use today. It does not matter if the spectrum is optimized for coverage or better suited for capacity or if an operator has a non-ideal portfolio mix of low-band, mid-band, or high-band spectrum. With 5G, operators now have the tools to capitalize on the benefits with the respective bands and put together a roadmap that migrates the portfolio in various phases from legacy 2G-4G to 5G NR.

Massive MIMO configured TDD based systems accounted for the lion share of the 2019 5G NR market (Dell’Oro Group), underpinning projections that the current outdoor macro grid in combination with Massive MIMO delivers favorable RAN economics for operators with the appropriate spectrum.

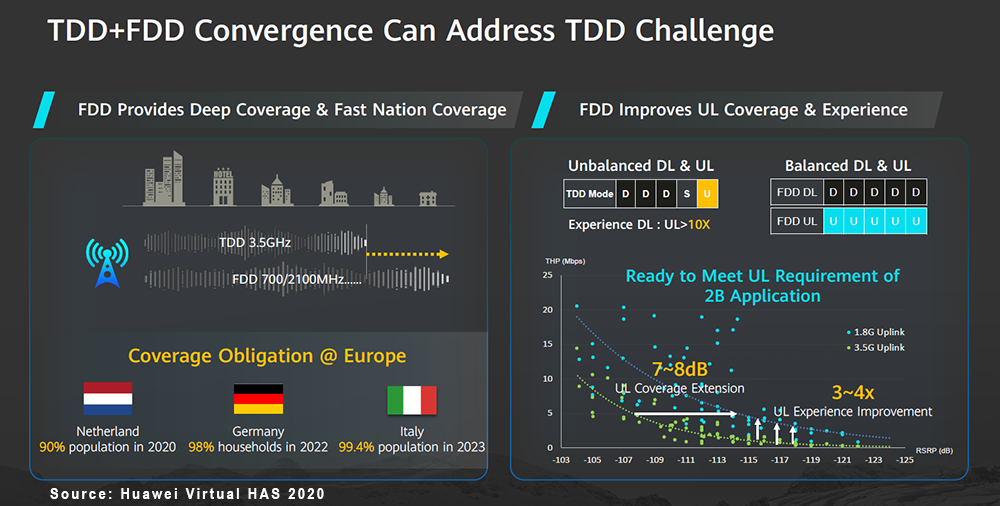

Meanwhile, multiple indicators suggest that that the interest for FDD based 5G NR deployments are on the rise, reflecting not only surging demand from operators with insufficient upper mid-band spectrum but also a shift in the overall attitude towards FDD based 5G NR deployments. Operators are starting to realize that the FDD spectrum will play an increasingly important role to help the operators achieve nationwide footprints rapidly and benefit not only from the marketing upside inherent with nationwide 5G but also the spectral efficiency and overall performance gains in both the UL and DL. During Huawei’s virtual 2020 HAS event, Huawei share data suggesting FDD based UL signal to spectrum in combination with C-band TDD spectrum for the DL would result in a 7 to 8 dB UL coverage extension and improve the overall UL user experience three-fold to four-fold, addressing shortcoming with relying completely on TDD. And more importantly, for operators that are seeking to use 5G to propel the use cases beyond MBB, this FDD coverage layer will play an important role simplifying and accelerating the transition toward 5G SA and potentially open up a wide range of new opportunities with non-traditional use cases. Per Dell’Oro Groups 5-Year RAN Forecast, FDD based 5G NR investments are projected to advance 5x to 10x over the next five years.

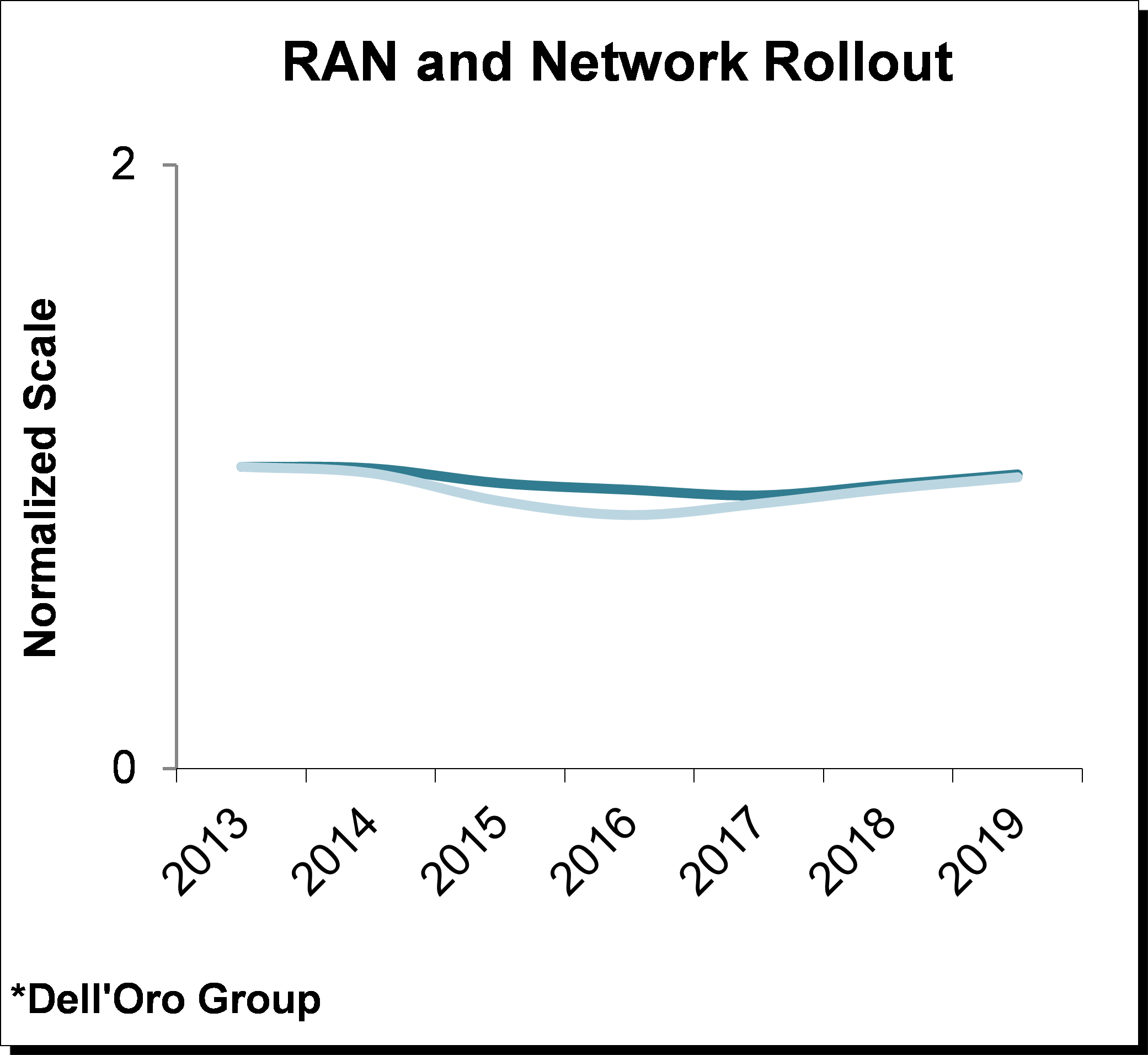

One of the reasons this shift from 4G to 5G has accelerated at a much faster pace than initially expected is the fact that operators can for the most part leverage their existing macro grid, which has been a major benefit both from a time-to-market and TCO perspective as it reduces the need to add more outdoor sites to realize 5G NR coverage that is equivalent to the outdoor sub 3 GHz LTE coverage. This model of adding new technologies to the existing sites at a faster pace than legacy technologies are sunset will naturally complicate the situation as the sites are becoming increasingly crowded. Although suppliers have invested heavily to address some of the short comings at the site with more power efficient systems and smaller form factors to manage the challenges with adding both Massive MIMO and non-Massive MIMO configured systems, there is more work to be done. For this approach to succeed at scale, the suppliers need to continue innovating and focus on the underlying site challenges with simplified site solutions that reduces and consolidates the amount of equipment at the cell site, reduces the size and weight of the equipment where possible, and minimizes the overall power consumption.

Given that there is a strong correlation between network services requirements and mobile broadband investments for the more simplified site deployments, this on-going shift towards multi technology sites including both legacy technologies and more complicated 5G solutions that could involve dynamic spectrum sharing and beamforming addressing a wider scope of use cases spanning across potentially multiple industries in combination with the increased site complexity and the need to focus on energy optimization will accelerate the shift towards more intelligent planning/design, operations and predictive analysis.

Given that there is a strong correlation between network services requirements and mobile broadband investments for the more simplified site deployments, this on-going shift towards multi technology sites including both legacy technologies and more complicated 5G solutions that could involve dynamic spectrum sharing and beamforming addressing a wider scope of use cases spanning across potentially multiple industries in combination with the increased site complexity and the need to focus on energy optimization will accelerate the shift towards more intelligent planning/design, operations and predictive analysis.

In other words, everyone wants more spectrum. But until then, efficient spectrum management, simplified site solutions, and more intelligence to navigate the increased site complexity will go a long way for operators seeking to maximize the efficiency of current spectrum assets while at the same time laying the basic foundation for taking 5G to the next level.