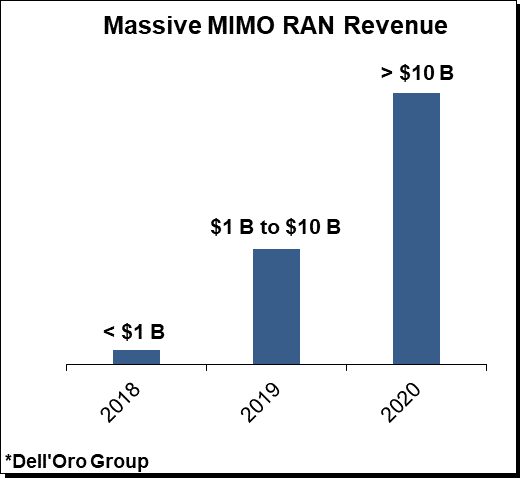

The Massive MIMO RAN market – which includes baseband and radio revenues for large-scale antenna systems featuring > 8T8R sub 6 GHz LTE and NR radio configurations – ended the year on a high note, with full-year Massive MIMO RAN revenues more than doubling in 2020 propelling global transceiver shipments to approach the 0.1 B to 0.2 B range.

Not surprisingly, Massive MIMO-based technologies are power the vast majority of the 100+ commercial 5G networks. And more than 75% of the 0.2 B+ 5G subscriptions by year-end 2020 utilized the upper mid-band.

Helping to explain this output acceleration is the exceptionally robust 5G Massive MIMO growth in the Asia Pacific (APAC) regions, driven by large-scale deployments in China, elevated investments in Korea, and improving trends in Japan. And even though narrow-band NR has been the main focus for the leading US operators, T-Mobile’s wide-band 5G NR network covered roughly a third of the population by the end of 2020.

Even with the elevated baseline, we believe market conditions remain favorable. Global Massive MIMO growth is expected to tick up at a double-digit pace in 2021, underpinned by continued investments in the leading 5G markets and improving Massive MIMO coverage with the early majority segment – the GSA has identified 220 operators in 63 countries/territories with the right spectrum assets to deploy LTE or NR based Massive MIMO systems.

And equally important, the vendors continue to innovate and come up with incremental advances, improving the form factor, weight, performance, cost, and price. Just this past week, Samsung announced enhancements that will improve the Massive MIMO throughput by up to 30%. And Ericsson’s latest AIR 6419 64T64R radio weighs just 20 kg (200 MHz BW, 320 W). It was just two years ago at MWC 2019 in Barcelona when the same product configurations were in the ~40 kg range. Huawei also announced a new Massive MIMO radio weighing only 19 kg, down from 25 kg just last year, though it is not entirely clear from the announcement if we are comparing apples-to-apples with the Ericsson solution. Regardless, the suppliers clearly understand the role that Massive MIMO is already playing and will continue to play to optimize the overall TCO per capacity.

In short, 2020 was a phenomenal year for Massive MIMO, and we remain excited about the short-term and near-term prospects and will continue to monitor the market and vendor dynamics. For more information about our Massive MIMO coverage, please see the quarterly RAN and 5-Year Forecast RAN reports.