Sameh Boujelbene

Vice President

As data centers scale to meet the growing demands of cloud computing, AI, and enterprise workloads, high-speed Ethernet switching plays a critical role in ensuring seamless connectivity. The Ethernet Switch—Data Center report provides a comprehensive analysis of the front-end network infrastructure, which connects general-purpose and accelerated servers to the broader data center network.

This report helps industry leaders understand how front-end networks are evolving to support increasing bandwidth demands, higher-speed migrations, and new network architectures. It focuses on who is driving market growth, what technologies are shaping the future, and how different customer segments—including hyperscalers, telcos, and enterprises—are adopting Ethernet switching solutions.

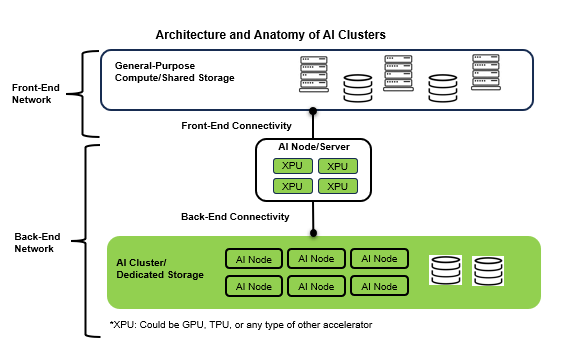

While this report covers front-end networks, which handle traffic between compute, storage, and external environments, it does not cover back-end network connectivity used for high-performance AI workloads. For that, we offer a separate “AI Networks for AI Workloads” report.

The chart below explains the definition of front-end networks and back-end networks.

This Ethernet Switch- Data Center report addresses the following questions:

- What are the growth drivers in front-end networks?

- How are the Top 4 U.S. Cloud Service Providers performing vs. the Top 3 Chinese Cloud Service Providers vs. the Telco Service Providers vs. Enterprises?

- How is the speed migration to 25, 50, 100, 200, 400 Gbps, 800 Gbps and ≥1600 Gbps different across various customer segments?

- What is the network topology, chip generation and speed implementation roadmap at the various hyperscalers?

- Which SerDes technology is driving the different Ethernet switch speeds in the market?

- At what rate are the top Cloud providers adopting white box switches?

- At what rate the disaggregation beyond the hyperscalers being adopted and what role is SONiC playing in accelerating this trend?

- If and when Co-packaged Optics may replace pluggable optics?

To answer these and other important questions, Dell’Oro Group currently delivers both quarterly reports and 5-year forecasts on the Ethernet Switch—Data Center market.

Ethernet Switch — Data Center Quarterly Reports

Dell’Oro Group’s Ethernet Switch—Data Center quarterly reports contain in-depth market-level and vendor-level information on manufacturers’ revenue, ports shipped and average selling prices for the physical switches as listed below. Separately, we also report topline revenue attributed to the Software segment. The report address software-based Ethernet Switch functionality that is not included in the physical switch.

Types of products within the Software segment are:

- Custom end-user-based software that is designed and built by the end user for its own purposes and not for resale (for example, a controller built by Google for Google).

- Vendor-based software that is built by a vendor for resale to multiple companies (for example, a Cumulus Operating system or Cisco’s APIC controller).

The research focuses on Ethernet switches for:

- Server access and aggregation

- Storage systems aggregation

- Data Center core

We report on:

- Form factors: Modular, Fixed Managed, and Fixed Unmanaged by Port Speed (combined and separately).

- Port speeds: 1/10/25/40/50/100/200/400/800/≥1600 Gbps

- Customer segments: Top 4 U.S Cloud, Top 3 China Cloud, Rest of Cloud, Large Enterprises, Rest of Enterprises.

- Regions: Mfg. Revenue only, including North America, EMEA (Europe, Middle East, and Africa), APAC (Asia Pacific), APAC excluding China, China, and CALA (Caribbean and Latin America)

For a comprehensive view of the entire data center, we offer a package of data center equipment research including AI Networks for AI Workloads, Data Center IT Capex, Ethernet Adapter & Smart NIC, and Ethernet Switches—Data Center.

Ethernet Switch — Data Center 5-Year Forecasts

Dell’Oro Group publishes Ethernet Switch — Data Center 5-year forecast reports offering a complete overview of the market with historical data from 2010 to the present. Our forecasts include analysis and data on sales by customer type including separate reporting on:

- Top 4 U.S. Cloud Service Providers

- Top 3 Chinese Cloud Service Providers

- Telecom Service Providers

- Rest of Cloud

- Large Enterprises or Private Cloud

- Rest of Enterprises

The forecasts provide a comprehensive overview of market trends and include tables covering manufacturers’ revenue, port shipments, and average selling price forecasts for various technologies:

- Form factors: Modular, Fixed Managed, and Fixed Unmanaged by Port Speed (combined and separately).

- Port speeds: 1/10/25/40/50/100/200/400/800/≥1600 Gbps

- Customer segments: Top 4 U.S Cloud, Top 3 China Cloud, Rest of Cloud, Large Enterprises, Rest of Enterprises.

- Regions: Mfg. Revenue only, including North America, EMEA (Europe, Middle East, and Africa), APAC (Asia Pacific), APAC excluding China, China, and CALA (Caribbean and Latin America)

- Forecast of port speed by SerDes Speed

- SONiC Forecast by Customer segment

- Co-packaged Optics Forecast by Port Speeds

Click here to contact us for more information about the Ethernet Switch – Data Center research program or about purchasing option.