We recently updated the 2020 Telecom Capex Report. In this report, we analyze the relationships between wireless and wireline capex and revenue for more than 50 carriers, accounting for approximately 80% of worldwide capex and revenue. Given that the correlation between the equipment programs and telecom capital intensities remain significant, we believe there is value to study these trends. Some of the highlights from the report are shown below. For more info or if you need full access to the report, please contact dgsales@delloro.com.

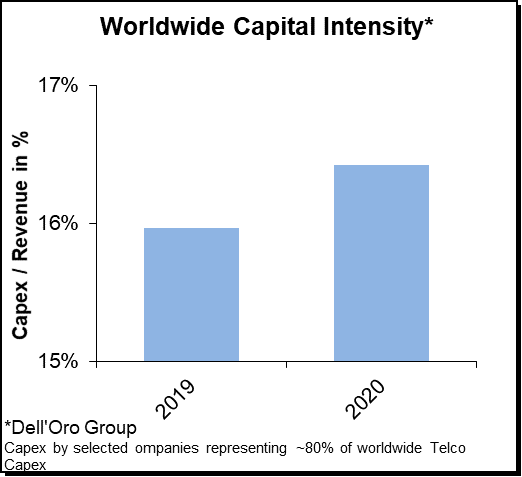

- Following three years of declining capex trends between 2015 and 2017 and flat trends in 2018, preliminary readings suggest that worldwide telecom capex—the sum of wireless and wireline telecom investments—increased 0% year-over-year (Y/Y) in nominal U.S Dollar (USD) and 2% in constant currency conditions.

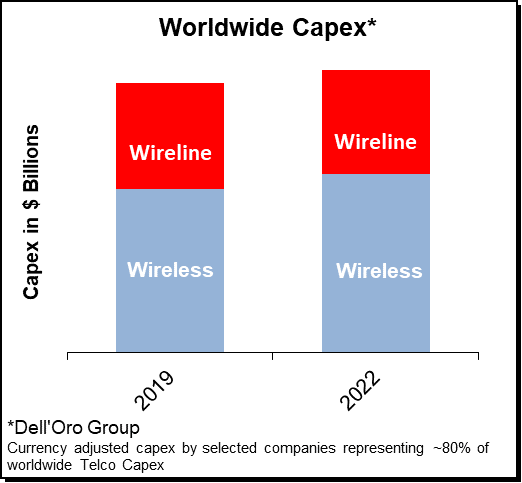

The growth in capex was driven by stable demand for wireline capex and surging investments in wireless related technologies to accommodate the on-going shift from 4G to 5G. Wireless capex increased 1% Y/Y in nominal USD terms while currency adjusted wireless capex advanced 4% Y/Y. Initial estimates indicate currency adjusted wireline capex was flat in 2019.

The growth in capex was driven by stable demand for wireline capex and surging investments in wireless related technologies to accommodate the on-going shift from 4G to 5G. Wireless capex increased 1% Y/Y in nominal USD terms while currency adjusted wireless capex advanced 4% Y/Y. Initial estimates indicate currency adjusted wireline capex was flat in 2019.- The bulk of the capex growth can be attributed to increasing investments in the Asia Pacific (APAC) region, driven primarily by improving trends in China and surging capex growth South Korea. The data for the operators we track indicate 2019 capex advanced at a low-single digit rate Y/Y in the APAC region. At the same time, capex in nominal USD terms declined at a low-single digit rate in both North America and Europe.

- Preliminary vendor report estimates suggest that the combined revenues of the carrier-related equipment programs tracked by the Dell’Oro Group (Broadband Access, Microwave Transport, Mobile Core Network, Mobile RAN, Optical Transport, and Routers & CE Switches) increased approximately 2% in 2019, suggesting that the relationship between carrier capex and supplier infrastructure equipment revenues remained strong.

- Even as we are issuing this forecast in the middle of a pandemic, we have not made any material downward revisions, partly because we believe this recession is a bit different than previous recessions. While there are clearly some downside risks over the short-term, we also believe there could be some long-term positives. Global capex growth for the 2019-2022 period is projected to improve at a CAGR of 1% in nominal USD terms. We continue to forecast robust wireless capex growth for 2020, reflecting positive demand in the Asia Pacific region with wireless capex in China expected to advance 15% to 20%.

Preliminary guidance suggests 5G will drive more than 80% of the mobile network related capex in 2020 in China, underpinning projections that the operators will continue to rollout 5G at a torrid pace with the collective 5G BTS macro installed base eclipsing half a million by 2020.

Preliminary guidance suggests 5G will drive more than 80% of the mobile network related capex in 2020 in China, underpinning projections that the operators will continue to rollout 5G at a torrid pace with the collective 5G BTS macro installed base eclipsing half a million by 2020.- Even with AT&T’s expected capex pull-back in 2020, we project capex levels in the U.S. to remain stable over the forecast period—total U.S. capex (excluding T-Mobile/Sprint integration capex) is projected to remain elevated over the forecast period. The projected capex envelope for the U.S. telecom market assumes investments in mid-band capex will remain elevated, millimeter wave investments will increase, and low-band related capex will remain flat or decline.

- Global risks are broadly balanced. On the one hand, the fundamentals remain healthy with the on-going shift from 4G to 5G, healthy end user fundamentals, and the increased realization that broadband is an essential utility. Even so, we are issuing this forecast in the middle of a pandemic, and it is still early days to fully grasp the human and economic impact from COVID-19. So at this juncture, we envision there could be some albeit limited short-term capex downside due to the COVID-19. At the same time, there are still some practical short-term challenges as countries shut down for a couple of months impacting the supply chain and the ability to perform network upgrades and deploy new equipment. Medium to long-term, we envision COVID-19 could have a positive impact on capex. We are not downplaying the tragedy that the Coronavirus represents with immeasurable humans losses and massive economic losses. But we do believe COVID-19 has and will continue to expose the digital divide accelerating the need for businesses and governments to review their broadband plans to not only prepare for the next pandemic, but also to accelerate their digital transformation plans.

Preliminary guidance suggests 5G will drive more than 80% of the mobile network related capex in 2020 in China, underpinning projections that the operators will continue to rollout 5G at a torrid pace with the collective 5G BTS macro installed base eclipsing half a million by 2020.

Preliminary guidance suggests 5G will drive more than 80% of the mobile network related capex in 2020 in China, underpinning projections that the operators will continue to rollout 5G at a torrid pace with the collective 5G BTS macro installed base eclipsing half a million by 2020.