We’ve just wrapped up the 1H21 reporting period for Dell’Oro Group’s enterprise network equipment programs, which include campus switches, enterprise data center switches, enterprise routers, network security, and Wireless LAN. Enterprises include businesses of all sizes as well as government, education, and research entities. The equipment tracked in these programs can be used for wired or wireless data communication in private and secure networks.

1H21 Market Performance

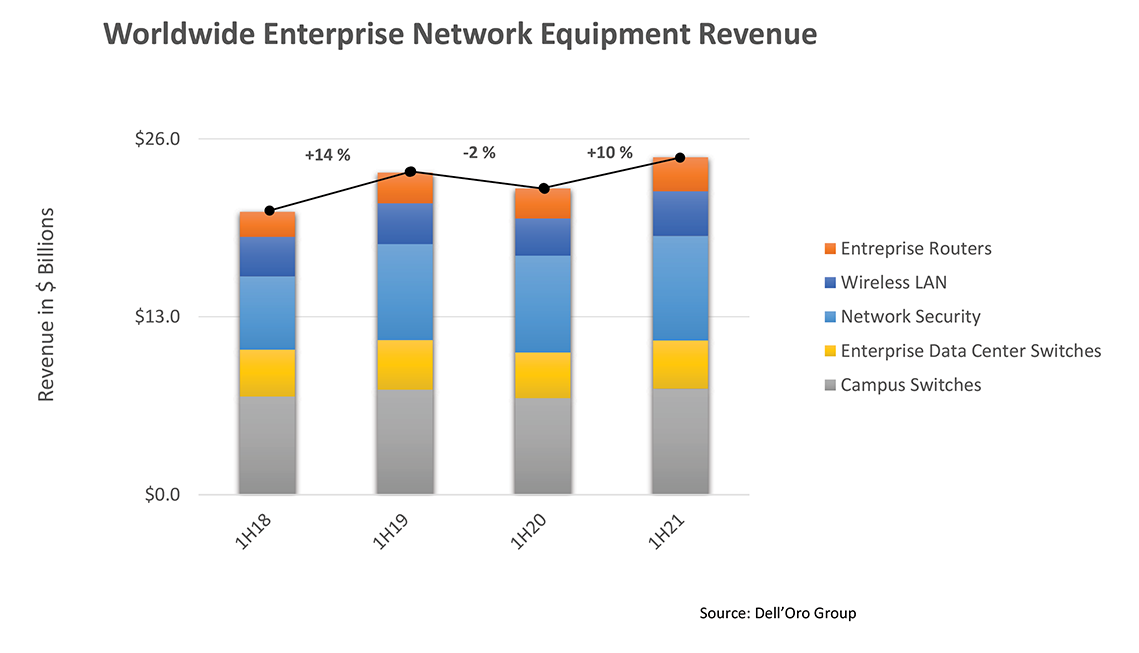

The overall Enterprise Network Equipment market was up 10% year-over-year (Y/Y) in 1H21. The growth was linear across the first and second quarters (up 10% and 11% Y/Y, respectively). Furthermore, the overall Enterprise Network Equipment market was able to exceed its 2019 pre-pandemic revenue level for the first half of the year.

The 1H21 growth was broad-based across all segments. Campus switching contributed about 30% of the increase in spending in the first half, followed by Network Security and WLAN at about 25%, each. Even the physical appliances segment of the Network Security market was able to turn the corner and go back to growth in 1H21. This broad-based recovery is encouraging given that last year was characterized by a significant decline in spending on hardware products, specifically campus switches, data center switches, access routers, physical firewalls, and Wireless Access Points (APs). In the meantime, 2020 spending on software and subscription-based products: SD-WAN and virtual and SaaS security, and the licenses portion of the WLAN segment, increased.

We attribute the 1H21 recovery to the following:

- Improving macro-economic conditions and business confidence

- Strong government stimulus around the world

- Pent-up demand from verticals that have been hit hard by the pandemic such as the hospitality and retail sectors

- Network upgrade activities in preparation for the back-to-work event planned for the second half of the year.

Despite the robust revenue growth recorded in the market in 1H21, major vendors reported that revenue would have been even stronger if they had not experienced supply constraints. In other words, demand outpaced supply. Although the gap between supply and demand impacted the different sectors within enterprise networking, it appears that the issues were more acute on the higher volume WLAN APs, where unit shipments declined Y/Y and Q/Q for some US-based manufacturers during a seasonally strong quarter.

1H21 Vendor Landscape

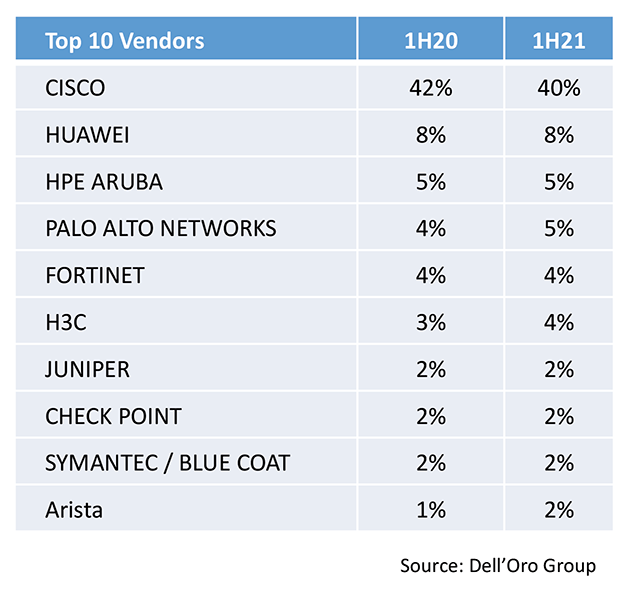

The analysis contained in these reports suggests the ranking and share of the top 10 vendors remain relatively stable, with the top two vendors, Cisco and Huawei, comprising nearly 50% of the Enterprise Network Equipment market in 1H21. We would like to note, however, that Cisco lost some shares between 1H20 and 1H21, while Palo Alto Networks, H3C and Arista, gained one point of revenue share, each.

2021 Market Outlook

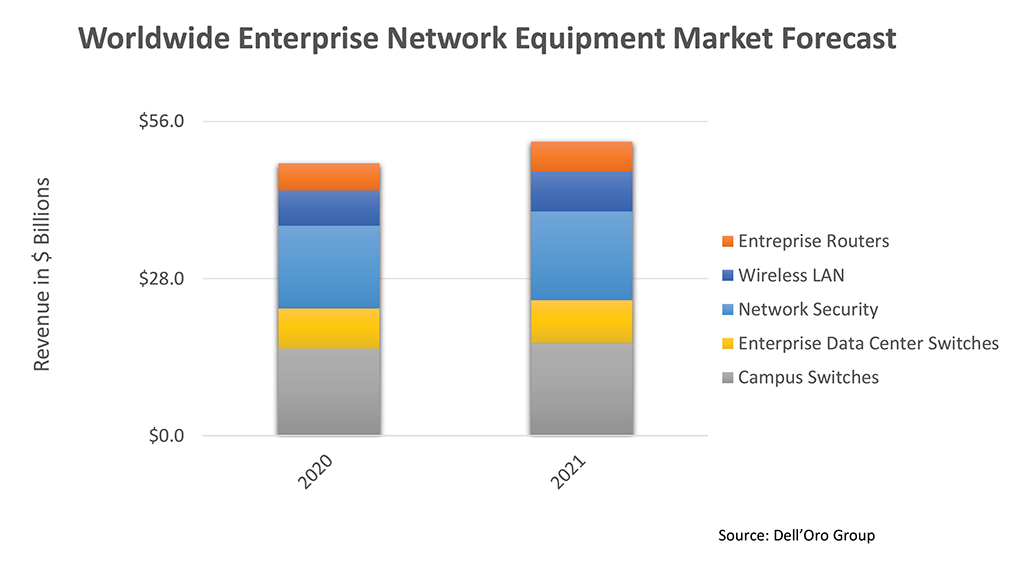

Even with the unusual uncertainty surrounding the economy, the supply chains, and the pandemic, the Dell’Oro analyst team remains optimistic about the second half – the overall enterprise network equipment market is projected to advance 5% to 10% for the full-year 2021. However, we are expecting a slowdown in the second half, compared to the first half as supply constraints seem to be worsening which may hinder market performance.

Dell’Oro Group Enterprise Network Equipment research programs consist of the following: Campus switches, Enterprise Data Center Switches, SD-WAN & Enterprise Routers, Network Security, and Wireless LAN.