We just wrapped up the 1Q21 reporting period for all the Telecommunications Infrastructure programs covered at Dell’Oro Group. Preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Switch – started the year on a high note, advancing 15% year-over-year (Y/Y) in the first quarter, reflecting positive activity in multiple segments and regions, lighter comparisons, and a weaker US Dollar (USD).

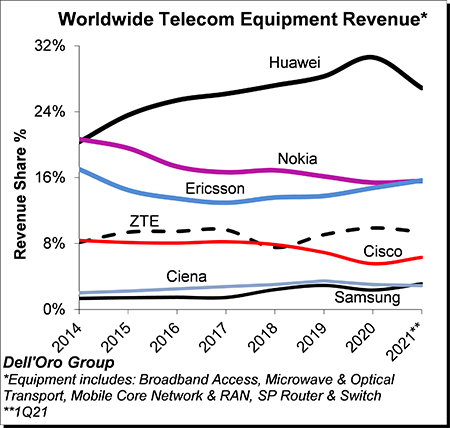

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1Q21, with the top seven vendors comprising around ~80% of the total market. Not surprisingly, Huawei maintained its leading position. However, the gap between Nokia and Ericsson, which was around 5 percentage points back in 2015, continued to shrink and was essentially eliminated in the quarter. In addition, Samsung passed Ciena in the quarter to become the #6 supplier.

Excluding North America, we estimate Huawei’s revenue share was about 36% in the quarter, nearly the same as the combined share of Nokia, Ericsson, and ZTE.

Additional key takeaways from the 1Q21 reporting period include:

- Following three consecutive years of growth between 2018 and 2020, preliminary readings suggest the positive momentum that characterized the overall telco market in much of 2020 extended into the first quarter, underpinned by double-digit growth on a Y/Y basis in both wireless and wireline technologies including Broadband Access, Microwave Transport, Mobile Core Network, RAN, and SP Router & Switch.

- In addition to easier comparisons due to poor market conditions in 1Q20 as a result of supply chain disruptions impacting some segments, positive developments in the North America and Asia Pacific regions, both of which recorded growth in excess of 15% Y/Y during the first quarter, helped to explain the output acceleration in the first quarter.

- Aggregate gains in the North America region was driven by double-digit expansion in Broadband Access, RAN, and SP Routers & Switch.

- The results in the quarter surprised on the upside by about 2%, underpinned by stronger than expected activity in multiple technology domains including Broadband Access, Microwave Transport, RAN, and SP Routers & Switch.

- The shift from 4G to 5G continued to accelerate at a torrid pace, impacting not just RAN investments but is also spurring operators to upgrade their core and transport networks.

- At a high level, the suppliers did not report any material impact from the ongoing supply chain shortages in the first quarter. At the same time, multiple vendors did indicate that the visibility going into the second half is more limited.

- Overall, the Dell’Oro analyst team is adjusting the aggregate forecast upward and now project the total telecom equipment market to advance 5% to 10% in 2021, up from 3% to 5% with the last forecast.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.