With Enterprises’ Anticipated Transition to AI, the Network Vendor Landscape is Shifting

Amidst the expansive setting of Shanghai’s Expo 2010 site, Huawei wowed over 20,000 attendees at Huawei Connect 2024 for three days this September. The conference had the dazzling feel of a Mobile World Congress for enterprises – but with Huawei as the main attraction.

Complete with humanoid robots playing soccer and fast EV charging stations, slick demos displayed the breadth of Huawei’s portfolio. Areas of the showroom floor targeted different industry verticals, with the majority of the expositions orchestrated and staffed directly by Huawei. Around the periphery of the floor, partner companies showcased the way that applications for specific verticals such as banking or transportation were being supported by Huawei’s technology.

The scale of Huawei’s Enterprise Connect showed the aggressive bet that the company is taking on IT infrastructure, despite the soft market currently hampering vendors.

Huawei Continues to Invest in R&D

At a time when many technology companies are cutting staff or freezing hiring, Huawei is recruiting the brightest graduates in China and has climbed to a workforce of over 200,000 employees. The company is weeks away from opening its largest research complex, the Huawei Lianqiu Lake R&D Center, in which it has invested 10 B Yuan (USD 1.4 B). The 2400-acre site is in Jinze, outside Shanghai, and consists of office buildings, laboratories, conference halls, and canteens connected by a system of trains that wind their way through a lakeside landscape. The new facilities are expected to accommodate 35,000 employees.

At Huawei Connect in Shanghai, staff from the vendor’s solution teams were on hand, explaining their mandate of pulling from the wide array of Huawei equipment to build customized multi-technology solutions for enterprise customers. Wireless LAN (WLAN) and Campus Switching often make up the foundation of such solutions, and Huawei has made concerted investments in its portfolio.

The company took an aggressive bet on Wi-Fi 7 in 2023 and is now the vendor with the largest family of Wi-Fi 7 Access Points (APs), with a dozen different models available. Huawei’s R&D department has focused on driving costs down on the lower-end Wi-Fi 7 APs, stimulating the market outside North America to move over to the new technology. With each of the new AP models supporting interfaces of 2.5 Gbps or higher, Huawei expects that the wave of next-generation Wi-Fi will generate revenue in multi-gigabit switch ports as well. In North America, where Huawei is prevented from competing by government restrictions, there is a smaller selection of Wi-Fi 7 APs available to enterprises, and there has been a higher penetration of Wi-Fi 6E.

A Glut of Shipments Has Slowed the Market

For most WLAN and Campus Switch vendors, 2024 will be a year of significant revenue decline. Following the order backlogs built up during a period of supply constraints, a high volume of campus network equipment was delivered in late 2022 and early 2023, flooding the market with excess inventory. Since then, enterprises have delayed purchases, distributors have lowered inventory levels, and prices have become more competitive. Even though Huawei did not face the same supply shortages as their North American competitors, they have felt the impacts of the shipment glut.

In China, enterprise activity has slowed as the economy has softened and competition in the Campus LAN market (made up of Campus Switch and WLAN sales) has remained intense. H3C, Ruijie, and Sundray are all aiming to chip away at Huawei’s dominant market share.

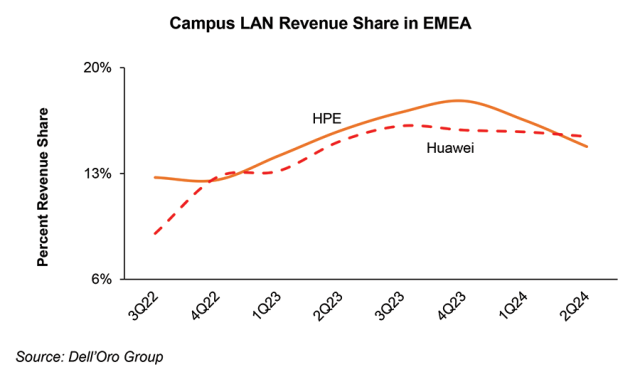

Huawei has continued to look elsewhere for growth, taking on networking competitors Cisco and HPE in Europe, Middle East and Africa (EMEA), Asia Pacific excluding China, as well as in Latin America. Over the past two years, Huawei has fairly consistently landed the majority of the company’s Campus LAN revenues from markets outside China, benefiting from a ramp up of technology spending in the Middle East in addition to winning major projects in Europe, Africa, and Southeast Asia. In EMEA, the macroeconomic region with the highest Campus LAN revenues after North America, Huawei’s aggressive expansion has threatened HPE’s second place rank in terms of revenue share.

AI Sows Uncertainty

In 2Q 2024, the Campus LAN market showed a glimmer of recovery, with worldwide revenue growing quarter-over-quarter for the first time in a year. However, enterprises are facing a seismic transition, with generative AI poised to revolutionize businesses in ways that are not well understood, by either the enterprises or their suppliers.

Most industry participants agree that whatever form enterprise AI takes, companies will be making considerable AI investments in the upcoming years. This has caused uncertainty in the size and rate of the expected recovery in campus network equipment sales, leaving vendors to wonder whether IT budgets will be diverted.

Cisco and HPE have taken actions to position themselves to benefit from the AI revolution, with both companies announcing partnerships with Nvidia, and Huawei has its own portfolio for enterprises embracing AI. Meanwhile, if the AI revolution causes either of the two leading vendors to lose focus on their network equipment markets outside North America, Huawei is poised to pounce.

The Vendor Network Equipment Landscape is Shifting

The Campus LAN market is characterized by one dominant company (Cisco) and over a dozen smaller competitors, and recent divestiture and acquisition activity is changing market dynamics. HPE’s August sale of a large portion of its stake in H3C leaves the Chinese vendor a greater latitude to compete outside China, which adds another challenger to battle for coveted network revenue in EMEA and Asia Pacific excluding China. HPE’s acquisition of Juniper, expected to complete late in 2024 or early 2025, will subsequently reduce the number of players in the field.

While an acquisition of this scale could distract both HPE and Juniper from capitalizing on opportunities in the short term, a combination of HPE’s global market presence and Juniper’s popular Mist solution may eventually make HPE a more formidable competitor to Huawei.

Meanwhile, Arista executives have declared their intention to break out of the data center, targeting $750 M of campus network revenues by 2025. By beginning with its existing data center customers, Arista has managed to grow its Campus LAN revenue, even in these last four quarters of market contraction.

Huawei has bet aggressively that the next generation of LAN technology will propel the company’s market share outside China. Meanwhile, HPE is making bold moves of its own, promising to challenge Cisco’s dominance in networking with its acquisition of Juniper. With the smaller manufacturers adapting their strategies and jostling for position, the landscape of enterprise network vendors is ripe for a shakeup.