We just wrapped up our semi-annual Router Five Year Forecast report, refreshing our near-term and long-term market views. The following are some of the highlights of the January 2024 forecast report and key market trends for this year.

Near-Term Trends for 2024

- The level of market uncertainty remains higher than normal this year due to the following factors: 1) supply and demand imbalance among North American service providers; 2) wars in both Eastern Europe and the Middle East; 3) concern about or fear of an impending economic recession; and 4) higher borrowing costs created by governments raising interest rates.

- The component shortage that disrupted the industry is behind us. But, the residual effect of this long supply chain disruption is expected to have some adverse market effects in 2024, particularly in North America where service providers may be sitting on excess inventory.

- Although the full year 2023 results are not in yet (4Q23 reports to be completed in February 2024), Core Router revenue looks poised to grow 12% in 2023. That said, some market softness should be expected in 2024 following such a strong year.

Long-Term Trends beyond 2024

- The longer-term view of the routing market remains positive, especially for High End Routers since the need for routing capacity will trend higher for many more years to come. We forecast that the cumulative revenue of High End Routers for the next five years will be 15% higher than that of the previous five years at nearly $70 billion.

- Based on the annual shipment capacity we are projecting for the next five-years, we estimate that the cumulative network capacity from High End Routers will grow at an average annual rate of nearly 30% with the highest share contribution from 400 Gbps Ethernet and higher port speeds.

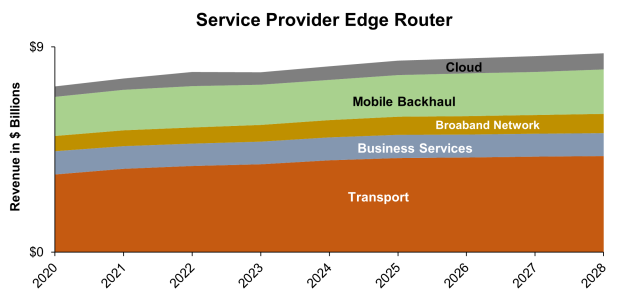

All major applications should contribute to Edge Router market growth over the next five years. While network capacity/transport will remain the largest contributor to the market revenue, Cloud DCI and fixed broadband should drive more of the growth in the next five years.