Growing interest among operators to use PON technologies to offer enterprise customers an alternative to traditional Ethernet services is increasing 25GS-PON-capable OLT ports being deployed into service provider networks. Because of the increase in total 25GS-ready ports, as well as the consensus that a growing percentage of those ports will be used to deliver enterprise and leased line services, we have increased our forecasts for 25GS-PON equipment revenue (both OLT ports and ONTs).

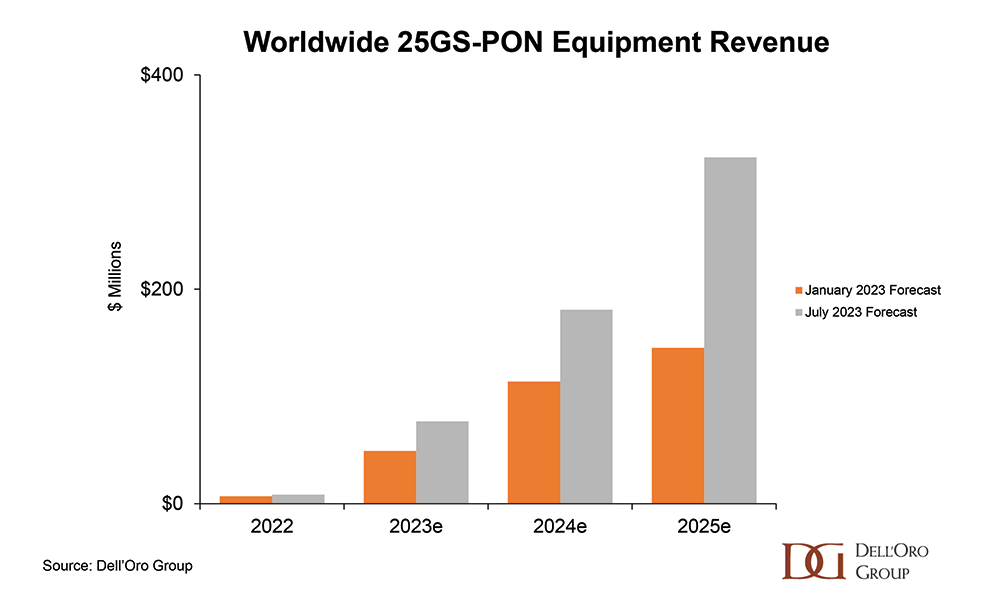

In our most recent forecast, published in July, we increased cumulative 25GS-PON equipment revenue between 2022 and 2025 from $315M to $588M worldwide, with the majority of revenue coming from the North American and Western European markets. While that increase is significant by itself, it’s important to bear in mind that cumulative XGS-PON equipment spent during that same period will easily push $7.7B. But XGS-PON will be the dominant technology across residential FTTH networks, whereas 25G-PON will be used strategically by operators for high-end residential services, enterprises, campus environments, access network aggregation, and wholesale connections.

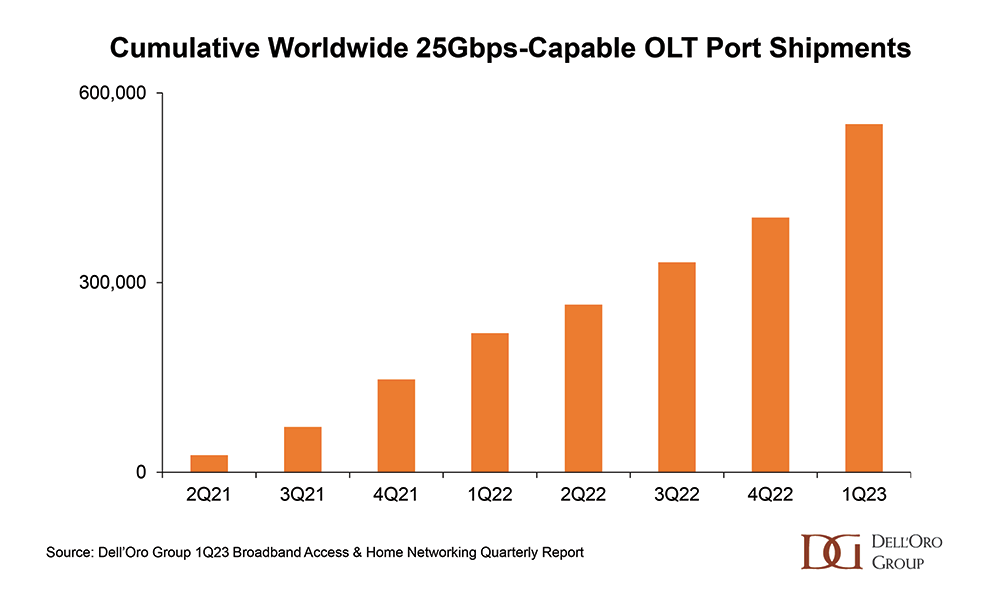

Through the end of 1Q23, a total of 550K 25Gbps-Capable OLT ports have been delivered to the market, largely via combo cards and optics that can support 2.5Gbps GPON, XGS-PON, and 25GS-PON from the same hardware and using the same ODN. If we assume that an average of 100-200K 25GS-capable OLT ports are purchased by service providers every quarter, by the end of 2023, there will be >1M 25GS-capable OLT ports. Continuing that incremental increase through 2025 yields over 2 million 25GS-capable OLT ports purchased by service providers. Further, let’s assume that a low single-digit percentage of those total ports are turned up to deliver enterprise services. The potential net result is anywhere from 500k-700k OLT ports in service delivering enterprise, wholesale, and mobile transport services.

That is the relatively modest strategy behind 25GS-PON: To finally expand the applicability of PON technologies beyond residential networks. Though it has been discussed by vendors and operators for years, we are finally seeing that many operators have earmarked PON as a network-flattening technology across their residential, enterprise, mobile transport, and wholesale networks. Though there certainly have been instances of operators using GPON for mobile backhaul and business-class Internet access, those use cases have been relatively limited. The combination of XGS-PON and 25GS-PON is really the first to give operators the flexibility they require to be able to address many customers and applications across the shared infrastructure. While some operators envision sharing an ODN across these use cases, others prefer to separate their ODNs because of concerns around security and significantly different SLAs. Nevertheless, PON technologies beyond XGS-PON are already central components of a larger discussion around simplifying access and edge network connectivity.

Though the ITU has determined that single channel 50G PON as defined in its G.hsp.50pmd specification is the next generation technology it will move forward with, the increasing use cases for PON combined with those use case requirements for additional speeds beyond what XGS-PON can provide have opened the door for 25GS PON as a potentially important tool in operators’ toolboxes. The current strength in fiber buildouts and the need to address new use cases today has resulted in a list of operators who simply can’t wait for 50G PON to be fully standardized, tested, and productized. As such, other industry standards group, including the Broadband Forum, are working with 25GS-PON and looking at developing testing and interoperability standards for the technology.

While standards bodies have traditionally defined which technologies get adopted and when there are certainly cases where operators have placed their thumbs on the scales in favor of a preferred option. These choices don’t generally go against what the standards bodies recommend or are working towards. Instead, they satisfy a more immediate internal requirement that doesn’t mesh with the proposed standardization, certification, and product availability timeline defined by the standards bodies and participating equipment suppliers.

Larger operators, including AT&T, BT Openreach, Comcast, and Deutsche Telekom, have also become far more comfortable over the last few years defining standards and pushing them through other industry organizations, such as ONF and the Broadband Forum. These operators know they have the scale, market potential, and, most importantly, internal technology and product development engineering teams to drive standards and thereby influence the product roadmaps of their incumbent equipment suppliers.

And that’s what appears to be happening with 25GS-PON. The growing list of service providers taking part in the 25GS-PON MSA has a general consensus around their PON technology choices: Use GPON and XGS-PON today for the bulk of your residential FTTH deployments, and then add in 25GS-PON using the same equipment and ODN where it makes strategic sense.

This strategy is no different from other access technology strategies and deployment models seen in the past. From ADSL to ADSL2+, VDSL to G.fast, and GPON to XGS-PON, broadband access networks are in a constant state of upgrade. It just so happens that they are now being extended to support other use cases and other end customers. The PON market, as well, has always been one offering different technology options to suit each operator’s unique use case requirements and competitive dynamics. That flexibility is proving to be particularly beneficial in today’s hypercompetitive broadband environment, in which each operator might have a different starting point when it comes to fiber deployments, but likely has similar goals when it comes to subscriber acquisition and revenue generation. In this environment, many operators have clearly said that they simply can’t wait on a promising technology when they need to establish their market presence today. And so, the vendor ecosystem has responded again with options that can steer them down a path to success.