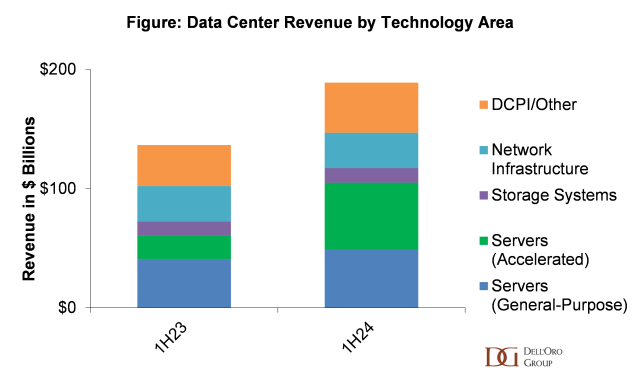

In 1H24, worldwide data center capital expenditure (capex) surged by 38 percent year-over-year (Y/Y). This rapid increase was primarily driven by the rise of accelerated servers, which are critical for generative AI applications. This marks the fourth consecutive quarter of triple-digit Y/Y revenue growth in accelerated server shipments. Notably, servers powered by NVIDIA Hopper GPUs and custom accelerators, such as Google’s TPU and Amazon’s Trainium, gained traction among hyperscale cloud service providers. Enterprises and Tier 2 cloud providers also contributed to this strong demand, highlighting the broadening adoption of AI technologies across industries.

Following a correction phase in 2023, the general-purpose server market is steadily recovering, with two consecutive quarters of Y/Y revenue growth. Higher commodity prices played a role in this rebound, but the market also saw positive momentum in unit sales. Server upgrades, particularly to 4th and 5th generation CPU platforms, have been long overdue, and despite ongoing global economic uncertainties, demand for these systems is expected to rise.

Data center switch sales, which account for a significant portion of the overall data center network infrastructure revenues, remained flat Y/Y in 1H24, despite a nice recovery in 2Q24. Heightened AI-related investments, particularly among cloud service providers for networks based on 200, 400, and 800 Gbps port speeds were not able to offset the contraction from the rest of the market, which is still undergoing a digestion cycle.

The data center physical infrastructure (DCPI) market outperformed expectations in 1H24. After a brief digestion in 1Q24, revenue increased by double-digits in 2Q24. Growth was largely attributed to new data center construction with AI-related design modifications to support increasing rack power densities. North America led the way with the fastest growth rate, while revenues in the Asia-Pacific region, excluding China, also saw double-digit growth.

Record-High Server and Storage System Component Revenues

Server and storage system component revenues reached record highs in the first two quarters of the year. The rapid growth of accelerators, which include GPUs and custom accelerators, as well as memory and storage drives, was a key factor behind this revenue increase. Generative AI applications were the primary drivers of accelerated server demand, but higher commodity prices, particularly for memory and storage drives, also contributed to the revenue surge.

NVIDIA emerged as the leader in data center IT component revenues in the first half, accounting for nearly half of the reported revenue, as Hopper GPU supplies improved. Samsung also saw growth in its market share, driven by higher memory prices and increased contributions from high-bandwidth memory (HBM). Intel, on the other hand, experienced a decline in market share due to the slow recovery of the server CPU market and competition from AMD, and slower adoption of its accelerator products.

AI Servers and Infrastructure Fuel Future Growth

Looking ahead to full-year 2024, data center capex is projected to increase by 35 percent to over $400 B, with spending on AI servers and infrastructure leading the way. Hyperscale cloud service providers are racing to expand their AI offerings, creating strong demand for these specialized systems. The recovery of the general-purpose server market, will also contribute to growth, especially as server component prices continue to rise.

Component revenues are forecasted to double in 2024, fueled by the increased deployment of specialized processors such as accelerators and Smart NICs. Commodity component prices, such as memory and storage drives, are expected to rise substantially throughout the year, further boosting revenue growth. Additionally, unit growth for components is projected to improve steadily as demand for general-purpose servers recovers in the second half of 2024.

We project the recovery in the Ethernet switch market to be led by the hyperscale Cloud SPs, on both networks for general-purpose computing, and AI clusters. However, the broader market is still facing significant inventory correction that could persist for several more quarters.

DCPI revenue growth is forecast to maintain momentum in 2024, with growth rates accelerating in the second half of the year. Vendor’s backlog mix has shifted from infrastructure to support general-purpose computing to accelerated computing workloads, which have longer lead times for higher ampacity power distribution and thermal management requirements. However, order growth is expected to moderate in the second half of the year as the recent expansion cycle on infrastructure normalizes.