During a presentation at SCTE’s Cable-Tec Expo, Comcast’s VP Network Architecture Rob Howald provided details on the pace of Comcast’s Distributed Access Architecture (DAA) deployments, stating that the operator has already deployed over 120,000 Remote PHY nodes along with 1,000 PPODs, or physical vCMTS servers. The number of Remote PHY nodes deployed is up from 83,000 nodes Comcast’s Elad Nafshi reported around seven months ago, and 50,000 nodes reported just one year ago at the 2022 Cable-Tec Expo in Philadelphia.

With Comcast having a total node base of around 200,000, the operator is a little over halfway done with its overall DAA upgrade program for its existing node base. The 200,000 nodes do not include nodes that will be added as part of network expansions or continued efforts to push fiber deeper and replace amplifiers with additional node-based RPDs.

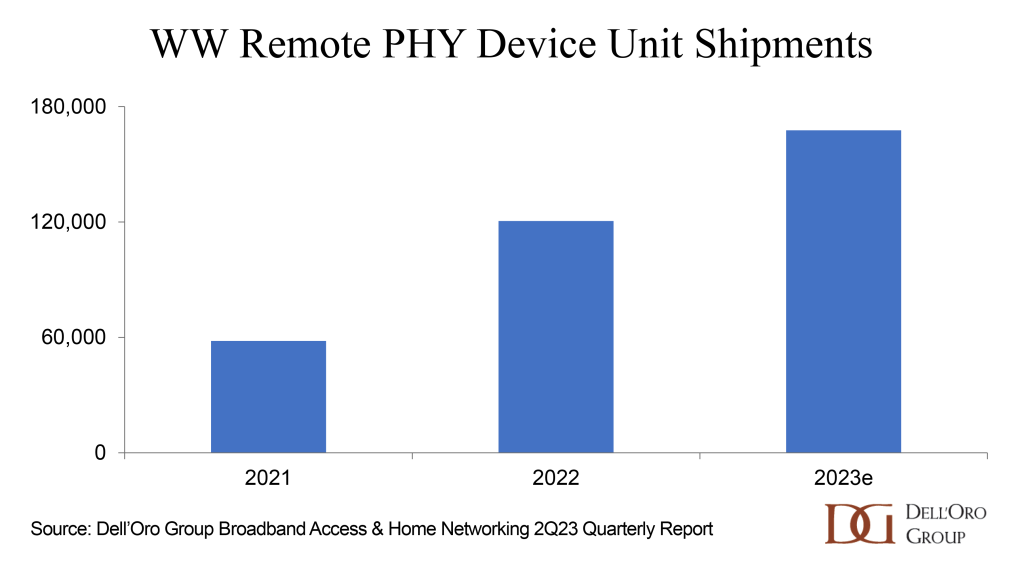

As of 2Q23, Dell’Oro Group estimates that total RPD shipments (either as nodes or modules in R-PHY shelves) on a global basis are in the neighborhood of 350,000 units. That means that Comcast alone accounts for almost one-third of all RPD shipments. Cox Communications is estimated to have upgraded “tens of thousands” of nodes over a five-year span to Remote PHY. We estimate those totals to be in the 12-15,000 node range, covering roughly 50% of the operator’s overall footprint. Together, Comcast and Cox alone account for roughly 38% of the total RPD market.

This is why we frequently have to reiterate that the DAA upgrade cycle is truly in its very early stages, with the vast majority of upgrades expected to happen beginning in 2024 and continuing through 2027. Certainly, Charter Communications is going to drive a significant amount of RPD purchases, with an installed base that exceeds 200,000, and will continue to increase by a few thousand annually through network expansions and continued fiber extensions. But beyond Charter, the combined Rogers and Shaw, Mediacom, Midcontinent, Astound, Videotron, Cable One, and others will all initiate or continue their DAA upgrades, largely through the deployment of RPDs.

These operators’ mid- and high-split DOCSIS 3.1 upgrades and subsequent evolutions to DOCSIS 4.0 will largely be based on the deployment of DAA, which provides immediate signal quality and reliability improvements that operators require today to remain competitive with fiber overbuilders.

Additionally, these operators will take advantage of improvements in RPD density and efficiency, as well as similar improvements in vCMTS density. Elad Nafshi, EVP and Chief Network Officer at Comcast said as much during this year’s Cable-Tec Expo, stating that the operator was now rolling out a third generation of its vCMTS platform that allows for one rack to cover about 100,000 households passed, which is an increase from the second-generation platform that supported about 60,000 homes passed per rack.

The original vision of taking advantage of improvements in the core processing capabilities of servers rather than waiting on a vendor’ release schedule for new line cards and processor cards is being fulfilled. This DAA upgrade cycle—the bulk of which remains ahead—will be interesting to watch as operators learn how to operationalize these new elements while reaping the benefits of improved signal quality, increased reliability, and reduced power consumption.