The latest Dell’Oro Group CBRS RAN 5-year forecast report suggests delays have not changed the underlying demand for CBRS. The overall CBRS market – LTE plus 5G NR – is expected to grow at a rapid pace between 2019 and 2024 with cumulative RAN investments projected to surpass $1.5 Billion.

Even if the regulatory process has taken significantly longer than expected (> 4 years since initial NPRM), the high level vision has not changed. We continue to believe that there is an opportunity to improve spectrum utilization while at the same time stimulating innovation for both public and private networks. The CBRS band with its unique spectrum sharing characteristics include many of the right ingredients to be a game changer over the long term, making us extremely optimistic about the opportunities within the CBRS band. At the same time, we also believe it is important to be realistic about the potential upside with new opportunities—we still envision that CBRS deployments targeting new business models and use case will need some time to cross the chasm.

Other highlights from the CBRS 5-Year Forecast Report:

- CBRS capex is not projected to have a significant impact on the WLAN capex.

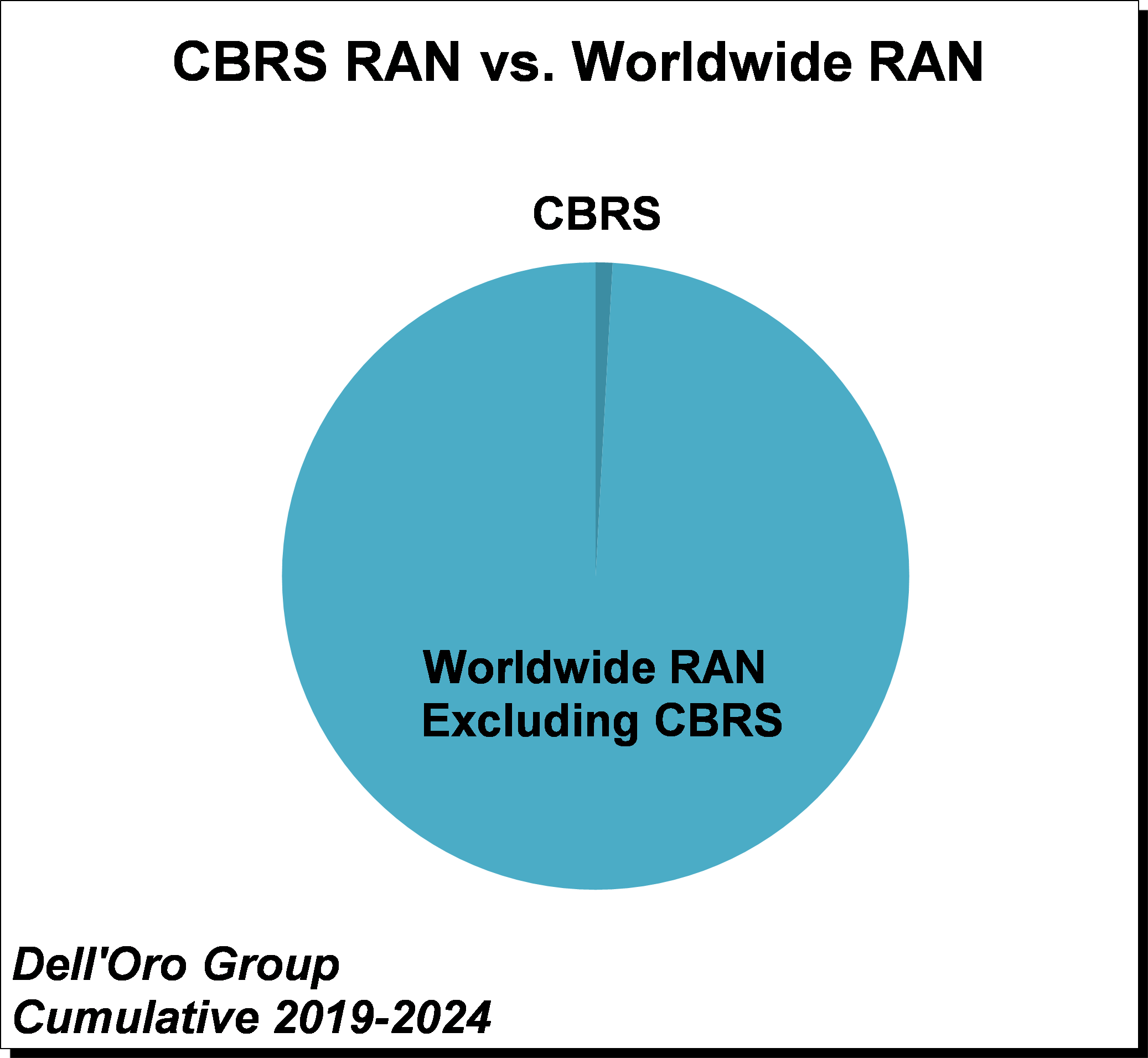

- CBRS investments are projected to account for a mid-single digit share of the overall North America RAN market.

- Activity is anticipated to accelerate rapidly during the forecast period. 5G NR is expected to drive the lion share of the service provider CBRS capex in the outer part of the forecast period while LTE will likely dominate the technology mix for FWA, IoT, and Enterprise deployments through the forecast period

Dell’Oro Group’s Advanced Research: Citizen Broadband Radio Service (CBRS) Report offers an overview of the CBRS LTE and 5G NR potential with a 5-year forecast for the CBRS RAN market by technology, location, and buyer along with an analysis about the vendor landscape. To purchase this report, please contact us by email at dgsales@delloro.com.