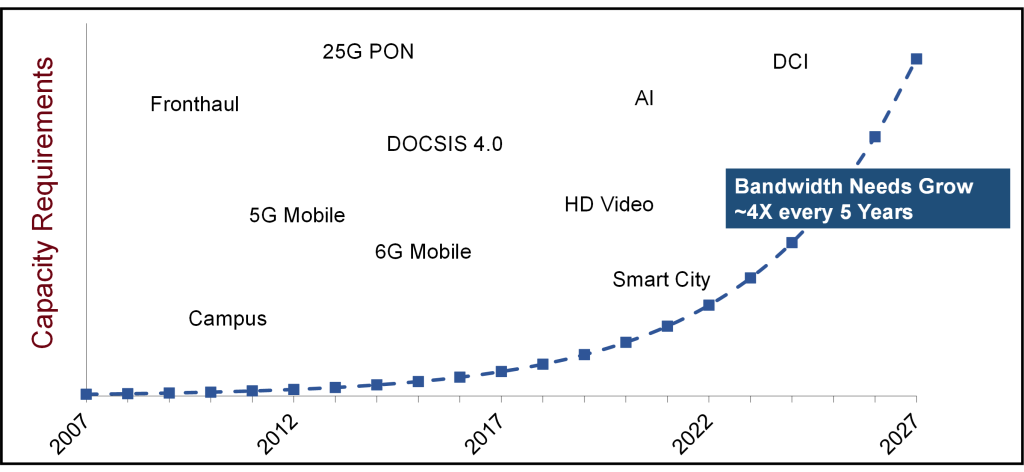

While visiting China and Taiwan, I still felt connected to the cable broadband industry in Denver via all the stream of announcements made during the show. I anticipated DOCSIS 4.0 advancements with a focus on new components, products, and partnerships to assist cable operators in transitioning from DOCSIS 3.1. In recent weeks, there have been inquiries about a single chipset supporting both DOCSIS 4.0 variants: Extended Spectrum (ESD) and Full Duplex (FDX).

As usual, where there is smoke, there is fire, as Comcast and Broadcom announced at the show silicon combines both flavors. The chips can be used in CPE, as well as in nodes, amplifiers, and Remote PHY Devices (RPDs). The new silicon is expected to be ready for trials in early 2024, with commercial deployments expected before the end of 2024.

Both Comcast and Broadcom emphasized that the unified silicon would provide operators “optionality,” allowing them to mix and match technologies based on the condition of their outside plant, the length of amplifier cascades, the overall cost to upgrade a particular system and, most importantly, the impact of competition. In theory, if an operator is facing competition from fiber overbuilders that have had success in stealing away subscribers based on the ability to deliver symmetric speeds, the cable operator could respond in targeted areas with FDX, while still pursuing a strategy of delivering ESD across the bulk of its footprint.

Unified FDX/ESD Chip Ideal for CPE, Though Questions Remain About Infrastructure

This type of optionality is a great fit for CPE, as it allows CPE vendors to reduce the number of individual products they have to develop and maintain, which is critical in the lower-margin business of consumer electronics. It also simplifies the inventory management process for operators, an important way for them to manage capex costs, particularly since CPE refresh cycles tend to occupy a significant portion of capital expenditures as they build up inventory.

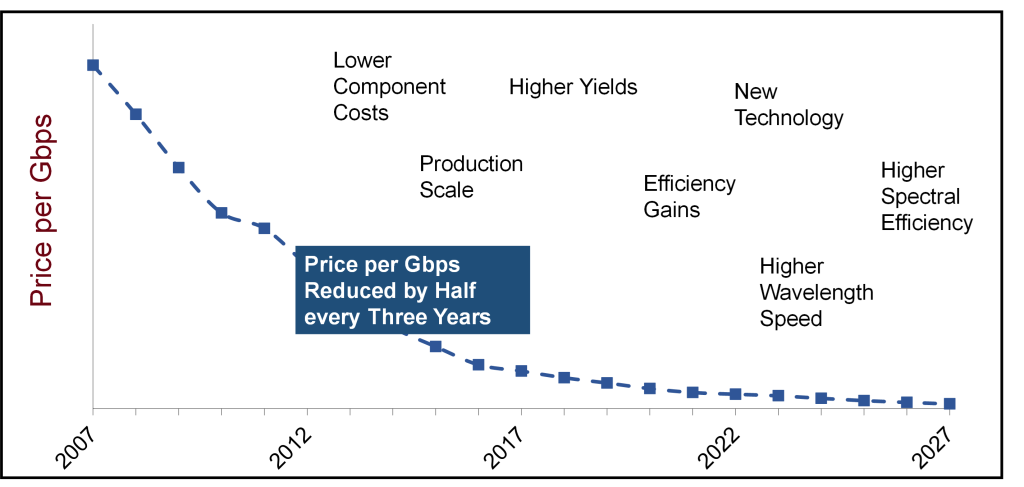

But outside of CPE, it is difficult to see how the additional costs associated with supporting both DOCSIS 4.0 variants make sense. We are already expecting North American cable operators to shell out $5.8B on 1.2GHz, 1.2GHz FDX, and 1.8GHz amplifiers from 2023-2030. Those totals include our estimates for FDX amplifiers, which we expect will carry a $150 price premium over 1.8GHz amplifiers, due to the integration of DSPs (Digital Signal Processors). It is hard to imagine an operator who has committed to one DOCSIS 4.0 technology being willing to spend additional money on optionality it likely will never use in significant volumes.

Comcast reiterated that it is moving forward with FDX exclusively, so the added costs of supporting ESD across amplifiers, nodes, and RPDs makes little sense for the company, especially when the cost of FDX amplifiers already carries a significant premium over 1.8GHz ESD amps.

Although Charter, Cox, Liberty Global, and Rogers Communications have all signed on to a JDA (Joint Development Agreement) with Broadcom that includes some volume commitments and a certain level of funding for the unified silicon, it is very hard to believe that these operators, who have publicly stated a preference for ESD, would want to bear the additional cost of including FDX support across all of their outside plant when it would likely only be a deployed on a limited, case-by-case basis.

Of course, these operators haven’t ruled out FDX explicitly, so it is more likely that they are making some commitment to Broadcom so that the semiconductor company will go ahead and proceed with development. This has very much become Broadcom’s standard operating procedure when it comes to the cable infrastructure market. Broadcom had a similar JDA in place with nearly the same group of operators to commit to volume purchases of Remote MACPHY equipment and a second-generation R-MACPHY chipset from Broadcom. However, once Charter changed its technology strategy from R-MACPHY to Remote PHY, the JDA essentially dissolved, with the other operators also opting for R-PHY.

Operational Improvements a Goal For Unified Chip

The only way it makes sense for the ESD-focused operators to absorb the costs associated with a unified chipset is if they believe that the addition of an SoC (System on a Chip) which combines a DSP for echo cancellation as well as the downstream and upstream equalizers, provides them with enhanced telemetry and performance metrics that might improve overall reliability and uptime, as well as reducing the amount of money they spend on truck rolls and handheld test and measurement equipment. The FDX SoC also includes an embedded cable modem (eCM) function which can communicate with a centralized controller in the headend or data center to help automate the setup and topology of the amplifiers within a cascade—again without having to roll a truck.

So, there is potential value in paying upfront for a device that will likely be an integral part of an operator’s network for 10 years, if not more. There is also the potential for significant savings in operational costs by reducing truck rolls and technician visits to determine which amplifier in a cascade might be incorrectly configured or underperforming.

But, with Comcast having developed so much FDX technology alongside its vendor partners, other operators have to be concerned about whether Comcast would prefer to license elements of the FDX ecosystem—from RPDs to vCMTS platforms to amplifiers. Speculation on Comcast’s ambitions regarding the licensing of its broadband technologies has existed ever since it announced its warrant agreement and subsequent enterprise licensing expansion with Harmonic in 2016 and 2019. Its X1 video platform has been licensed by Cox, Shaw, and others. So, Comcast certainly has experience in this regard. Broadband is a different story, however. Unlike linear TV, which is seeing continued subscriber losses, broadband subscriptions and revenue continue to grow. Because of this, operators have been more reluctant to hand over any level of control via a similar licensing arrangement.

So, it will be interesting to see whether any of the ESD-committed operators adopt the more expensive, unified chipset from Broadcom. The operators that are part of the JDA will get first dibs on the chips when they become available, leaving those operators that aren’t part of the JDA on the outside looking in. That includes a substantial number of tier 2 and tier 3 operators all trying to determine their path forward from DOCSIS 3.1

Unlike Broadcom, MaxLinear also introduced its own Puma 8 chipset supporting only ESD that will not require a JDA. The chip is expected to reach production in the second half of 2024. At the show, MaxLinear announced that Askey, CommScope, and Sercomm are the initial CPE partners for the Puma 8. These vendors have historically maintained DOCSIS CPE lines that incorporate both MaxLinear and Broadcom chips and are likely to eventually do so to support the DOCSIS 4.0 evolution. Vantiva, which is in the process of acquiring the CommScope Connected Home division, has historically been a Broadcom-only supplier. But it remains to be seen how the vendor will move forward given CommScope’s historic support of both Broadcom and MaxLinear.