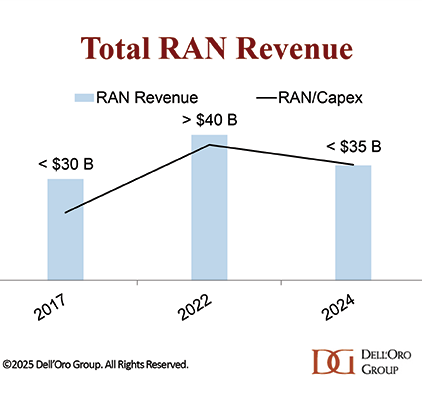

Mobile infrastructure investments slowed significantly in 2024. Preliminary findings indicate that the Radio Access Network (RAN) market contracted by 10 to 20% year-over-year (YoY) during the 1Q24 to 3Q24 period (final 4Q24 and full-year data expected around mid-February). Several factors contributed to this decline. First and foremost, the state of 5G coverage is impacting the market. According to Ericsson’s latest Mobility Report, 5G now covers approximately 55% of the global population. While the 5G macro-installed base is only halfway complete, macro shipment deployment growth is decelerating as year-over-year comparisons become increasingly challenging.

Also weighing on the capex is the disconnect between supply and demand. In the early days of 4G, mobile data traffic doubled annually, and limited bandwidths accelerated the transition to LTE-Advanced. In contrast, 5G deployments in the upper mid-band deliver a substantial capacity boost—sometimes more than doubling overall capacity. Combined with slower mobile data traffic growth, this has delayed the need for additional capacity-related investments.

In addition, the operators are struggling to monetize 5G beyond the known MBB use case scenarios. As a result, they are adopting a more cautious approach when balancing investments in maintaining existing services and exploring new applications.

These broader trends are not surprising. Heading into 2024, global RAN revenues were anticipated to decline at a mid-single-digit rate. However, with RAN on track to decline at a double-digit rate, it is evident that even though our predictions were correct directionally, we underestimated the scale of pullbacks in markets like Japan, India, and China. For instance, India and China were projected to decline by 30–50% and 5%, respectively, but initial results suggest the market is coming in below expectations.

Although market conditions showed signs of improvement in 3Q24, the overall state of the RAN market remains subdued. Looking ahead to 2025, the critical question is how this ongoing downturn will affect the broader RAN market and its sub-segments.

RAN conditions will improve in 2025

After two years of sharp declines, during which global RAN revenues fell by approximately 20% compared to 2022, we are cautiously optimistic about potential stabilization in 2025. Although the underlying drivers shaping the RAN market—slower 5G coverage expansion, postponed data traffic investments, and ongoing monetization challenges—are unlikely to change, regional variations are expected to be more favorable this year. Improved conditions in India, Japan, and North America may provide some relief, although reduced 5G activity in China will continue to exert downward pressure on the market. RAN revenues are projected to hold fairly steady globally and advance by 5% to 10%, excluding China.

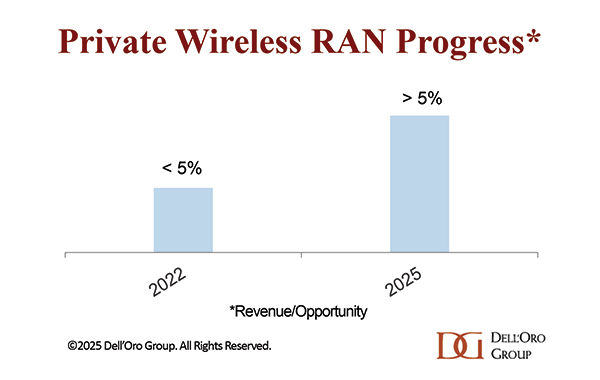

Private wireless will grow >20%

Preliminary estimates indicate that private wireless is expanding at a healthy rate, aligning closely with the projections outlined a year ago. Growth is expected to reach 20% to 30% in 2024, slightly lower than the ~40% growth recorded in 2023. Nevertheless, private 5G remains in its early stages within the broader enterprise landscape, and it will take time for private RAN to secure a more substantial share of the overall RAN market.

Looking ahead, we forecast private wireless RAN revenues to grow by over 20% in 2025, driven by robust industrial adoption. Manufacturing emerged as the largest vertical in 2024, and based on current visibility, it is likely to retain its leading position this year.

Contract activity will lag revenues. According to the GSA database, the total number of GSA private wireless customer references reached 1603 in 3Q24, up 8% Q/Q and 25% Y/Y. Although the market is slowing based on this metric, this is also not a major cause of concern. Both operators and suppliers agree that the quality of the contracts is improving as deals are progressing beyond the PoC phase and increasingly include larger, multi-site, and even multi-country agreements, reflecting the shift from local to global deployments. In addition to the improved reach, the overall deal value is advancing significantly as the equipment suppliers/operators move away from selling just private wireless and instead sell connectivity with bundles (edge, apps, services, etc).

Open RAN to account for 5% to 10% of RAN

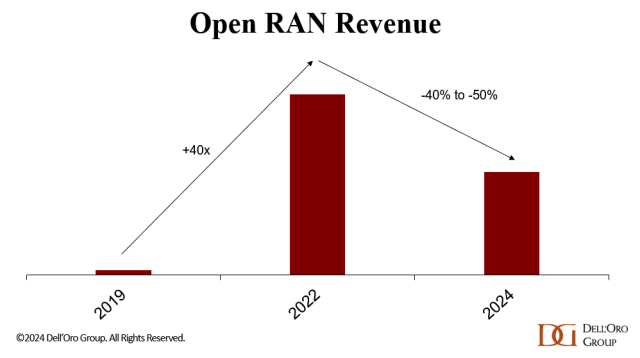

Open RAN revenues came in weaker than expected in 2024. Our latest report findings show worldwide Open RAN revenues are down 30% YoY over the first three quarters (vRAN revs are down 15% over the same period). While the leading RAN vendors outside of China are embracing most of the pillars shaping the Open RAN movement, the transition from a commercial perspective will be an evolution.

As a reminder, Open RAN investments accelerated rapidly in the initial phase between 2019 and 2022. Open RAN-based investments then declined in 2023 as activity in the US slowed. Market conditions remain challenging in 2024, and helping to explain the 30 % YoY decline for the 1Q24-3Q24 period is the state of the 5G market in Japan and the US combined with the commercial readiness of next-generation O-RAN ULPI interfaces.

Still, these speed bumps are not expected to derail the long-term trajectory. Short-term visibility is more uncertain, however. Even so, we are forecasting Open RAN revenues to grow in 2025, accounting for 5% to 10% of total RAN revenues (single-vendor Open RAN > multi-vendor Open RAN).

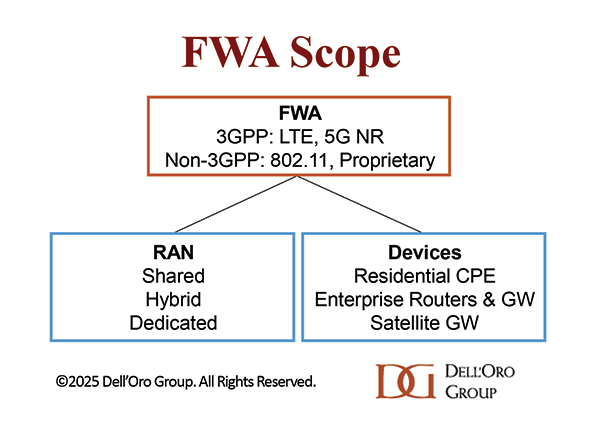

Dedicated FWA RAN < $1B

The market opportunity for DSL and fiber replacements or alternative solutions is vast. According to the ITU and Ericsson’s Mobility Report, approximately 35% of the world’s two billion households remain underserved, lacking broadband connectivity. Beyond these unconnected households, FWA technologies can also address the needs of secondary homes and small businesses. With nearly half of 5G operators supporting 5G FWA (GSA), fixed wireless is already a mature technology, boosting both the RAN and the broadband markets.

Despite these advancements, the fundamental economics driving FWA are not expected to shift significantly in 2025. While technological improvements are expanding the TAM, the business case remains constrained by the mobile network’s capacity and the ROI of dedicated FWA RAN deployments. Operators continue refining their targets, but the existing mobile network infrastructure offers the most favorable RAN economics.

Although operators are gradually increasing their investments in dedicated RAN solutions for high-traffic areas, mobile networks are expected to maintain dominance in the near term. According to our latest FWA report, which covers the broader FWA ecosystem—including 3GPP and non-3GPP RAN and devices—dedicated FWA RAN investments are projected to stay below $1 billion in 2025.

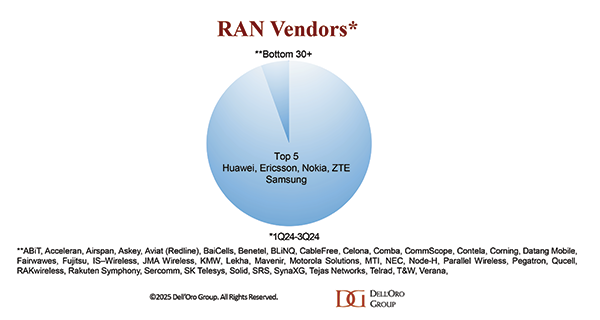

Market concentration to remain stable/increase

RAN remains a concentrated market, with the top 5 RAN suppliers accounting for 94% to 95% of the 1Q24-3Q24 RAN revenues. New technologies, architectures, and segments can, in some cases, present opportunities and attract vendors with smaller footprints.

Based on current visibility in the existing MBB market and expectations for new private 5G and dedicated FWA opportunities, which are likely to have a higher greenfield/brownfield ratio, we don’t expect any significant movement in the split between the top 5 and the Other suppliers.

In summary, conditions will improve in 2025, but it will still be another underwhelming year for the broader RAN ecosystem, characterized by challenging fundamentals. Nevertheless, certain sub-segments and regions are poised to perform well. As always, the competitive dynamics within the RAN market will remain intense. Please follow us and keep us honest as we monitor progress throughout 2025 (AI RAN and 6G will be discussed in separate updates).