For many years now, the evolution of WiFi has been focused on improving two key technical attributes: speed and range. WiFi 6, however, is the first iteration to take a more holistic view of wireless technology that encompasses not only improvements in speed and range, but also network intelligence, analytics, and power efficiency. It is the first WiFi standard developed specifically for a world defined by the IoT and the consistent proliferation of connected devices.

WiFi 6 also comes at a critical time for global service providers looking to extend their broadband service portfolios into the home while facing increasing competition from other ISPs and consumer electronics providers also seeking to dominate that service space. WiFi 6 will undoubtedly boost the connected home service offerings of those service providers willing to embrace the technology, and make it available across their CPE and home networking equipment. It will quickly become a technology that subscribers will expect as a standard part of their in-home broadband experience. In fact, Dell’Oro Group expects that total WiFi 6 CPE shipments, including retail WiFi routers for residential and SOHO applications, will grow from just over 5 million units in 2019 to more than 23 million units in 2020, with further expansion expected through 2023.

WiFi 6 also has the capacity to dramatically improve how service providers will be able to provision, manage, troubleshoot, and analyze their in-home networking services. It provides options for the remote, zero-touch provisioning of devices and services, as well as the automatic adjustment of WiFi channels to ensure peak performance. As subscribers become savvier about broadband and WiFi, and as they become more reliant on broadband to enable multiple services in their home, they will demand uninterrupted service. With WiFi 6, service providers will finally have the power to deliver on those expectations.

New Features Deliver Speed Intelligently and Efficiently

Speed boosts are an essential feature of any new WiFi standard. Given its many key technical upgrades, WiFi 6 is quickly emerging as the first standard that is designed for the gigabit age and beyond, with a focus on providing a theoretical maximum of 10Gbps of throughput. The goal of this standard is to ensure that a customer’s WiFi network will not impede the delivery of high-bandwidth, latency-sensitive services such as cloud gaming, 8k video, and cloud VR services. These feature additions are especially critical for service providers that offer managed home networking services because subscribers have proven quite willing to use speed tests to verify the performance and value of their end-to-end broadband service.

But beyond increased speed and range, taken together, all of the features described above are designed to deliver stable, consistent performance not just to a handful of devices in the home, but potentially to hundreds of connected devices.

Perhaps the most important feature of WiFi 6 is OFDMA (Orthogonal Frequency Division Multiple Access). OFDMA allows WiFi routers and access points to divide multiple channels—on either the 2.4GHz or 5GHz frequency band—into smaller allocations called resource units (RUs). Each RU can then be divided into yet smaller channels, with that traffic earmarked simultaneously for multiple devices. Each of those devices can have dramatically different traffic profiles (e.g., a TV that is streaming an 8k movie and a connected thermostat communicating with a cloud-based analytics engine).

The net result is a reduction in latency for connected devices and an increase in the aggregate throughput across the wireless network. WiFi 6 adds both uplink and downlink OFDMA, meaning that routers and CPE can intelligently allocate different levels of transmit and receive power per connected device, depending on variables such as distance, noise, and other signal impediments.

OFDMA complements another feature that has been enhanced in WiFi 6: MU-MIMO (Multi-User, Multiple Input, Multiple Output). MU-MIMO was included as part of the WiFi 5 (802.11ac) standard, but it was limited to downlink signals from the router to end devices. WiFi 6 includes uplink signals from multiple devices, and it doubles the number of devices that can be supported from four to eight. While OFDMA divides channels into resource units to be allocated across multiple devices, MU-MIMO multiplexes transmit and receive traffic from multiple devices based on their proximity to the router and to each other. This streamlines traffic patterns and reduces latency by more intelligently allocating spectrum across multiple devices, as opposed to serving devices sequentially.

In addition, WiFi 6 adds the ability to support up to eight separate spatial streams using beamforming, which allows the router to allocate additional throughput to particular devices at a given range.

WiFi 6’s final major upgrade that improves overall speed and throughput is the increase in QAM (Quadrature Amplitude Modulation) from 256-QAM to 1024-QAM. This allows devices to send ten digits of binary code with each transmission to the router. According to the WiFi Alliance, this will increase throughput by 25-30% versus WiFi 5. This upgrade is critical for supporting today’s very high-bandwidth, latency-insensitive applications and services, as well as those anticipated in the next five years.

Smarter Management of Connected Devices

Of course, speed improvements are expected. Video streaming, online gaming, and other applications that continue to grow immensely in popularity and capability demand consistent speed and performance upgrades.

But home and connectivity requirements are changing. Just as the use of high-end applications is increasing, so is consumer reliance on myriad connected devices, including smart speakers, sensors, thermostats, and home security systems. Indeed, these devices are quickly becoming the ones we interact with most often on a daily basis. Though our interactions with such devices are short in duration, we expect that they will work perfectly every single time we interact with them.

Poor battery life is one of the main culprits that causes connected devices to underperform or flat out the malfunction. To ensure that these devices draw as little power as possible, thus improving battery life, WiFi 6 incorporates a feature called target wake time (TWT). TWT allows the router to set a schedule for connected devices to ping it to report their status; thus, devices do not have to fight for the channel spectrum to complete their communication. Each device can be guaranteed an optimal slot to ping the router, and it can remain in battery-saving sleep mode for a longer time.

How Service Providers can use WiFi 6 to their Advantage

According to Dell’Oro Group, as of the first half of 2019, approximately 85% of all broadband CPE (Cable, DSL, and PON) includes embedded WLAN capabilities. That is up from 63% in 2015. As these percentages have increased, so has the number of operators providing managed home WiFi services to their customers to increase broadband service revenue while also reducing churn by anticipating and reducing WiFi outages.

Within that same time frame, broadband and WiFi have become essential applications and experience enablers. From social networking to cloud gaming, telemedicine, and VR, broadband and WiFi are viewed as critical offerings. Because of its enhanced throughput, range, and overall performance, WiFi 6 will open up a whole new world of applications and services formerly unavailable at consistent levels. Obviously, true gigabit broadband services throughout the home will serve as the backbone service for network operators and consumers. From there, cloud gaming across multiple devices and with simultaneous usage become available, followed by true virtual and augmented reality services. WiFi 6 is a necessary precursor for these advanced services.

Service providers can start with the rollout of WiFi 6-enabled CPE to demonstrate their commitment to delivering the best wireless networking experience for their subscribers. Once WiFi 6-enabled devices are in the home, additional services that take advantage of the technology’s enhancements are sure to follow. Providers can bundle smart home devices alongside their upgraded CPE, marketing those devices as ‘optimized for WiFi 6.’

In addition, service providers can offer a range of CPE that is customized to the unique needs of their subscribers’ homes. For example, mesh routers can be used to enhance coverage in larger homes, homes with a significant number of dead spots, or homes with 4k and 8k TVs and displays in multiple rooms. The goal, of course, is to deliver sustained and consistent gigabit access to every device that requires it.

The industry is already seeing tremendous growth in mesh routers, both in retail outlets and directly from service providers. Operators are becoming smarter about identifying when mesh routers are required through delivering apps that allow new subscribers to describe their homes, the placement of their routers, and the types of devices throughout the home that might require closer proximity to a mesh base station or satellite.

By providing this type of indirect network consulting, a service provider ensures that it is a trusted partner for its subscribers, instead of simply being a company that turns on broadband service and then sends a bill.

Beyond improving connectivity and WiFi performance through the deployment of new networking terminals, service providers must also layer in remote provisioning, troubleshooting, and advanced analytics to enable the zero-touch installation and management of WiFi services. As service providers expand their presence in the home, they want to avoid having to respond to a phone call or roll a truck every time network performance is impacted by weather, the addition of a new device, or channel contention with a neighbor’s access point.

WiFi 6 eliminates a number of these issues and allows operators to constantly monitor the performance of their CPE, including mesh base stations and satellites, and to verify a customer’s service level remotely. New broadband subscribers can request service, be sent the appropriate devices, and have service turned on in their homes, all with a simple phone call to their service provider. The service provider can offer a range of additional managed WiFi services, depending on the needs of each subscriber.

Service providers continue to invest in upgrades to their access network infrastructure to support gigabit speeds and services, and WiFi 6 home networking technology is ideal for extending this investment in-home service capabilities with reliability. The network no longer stops just outside the subscriber’s door. Instead, the service provider’s network extends into the home, creating and defining the subscriber’s daily interactions with that network operator. Thus, operators must treat their gigabit WiFi offerings just as they would any other network service. If a service provider’s throughput, reliability, and overall performance are underwhelming, subscribers will quickly cancel the service in favor of a competitor’s.

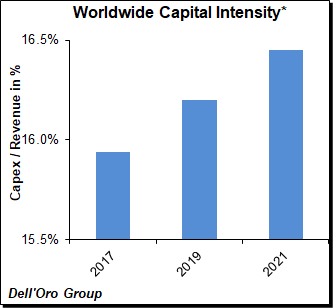

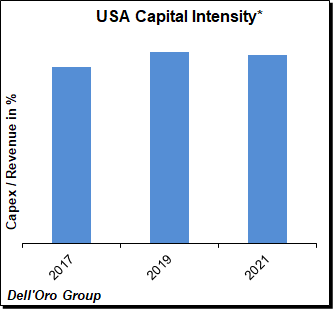

Constrained operator revenue growth is expected to be one of the primary inhibitors of further telco capex acceleration. With currency-adjusted carrier revenues projected to remain relatively stable over the forecast period, strong coupling between revenue and capex growth will ensure that capital intensities remain relatively flat over time. At the same time, the pickup in capex/revenue for the 1H19 period underpinned projections that operators are comfortable with some deviation in the short-term to accommodate the rollout of 5G.

Constrained operator revenue growth is expected to be one of the primary inhibitors of further telco capex acceleration. With currency-adjusted carrier revenues projected to remain relatively stable over the forecast period, strong coupling between revenue and capex growth will ensure that capital intensities remain relatively flat over time. At the same time, the pickup in capex/revenue for the 1H19 period underpinned projections that operators are comfortable with some deviation in the short-term to accommodate the rollout of 5G. active sharing arrangements, we are fielding more questions than typically for this topic, reflecting a renewed concern an uptick in partnership announcements could impact the RAN market negatively.

active sharing arrangements, we are fielding more questions than typically for this topic, reflecting a renewed concern an uptick in partnership announcements could impact the RAN market negatively.