This blog post is a summary of RAN-related key takeaways from MWC 2019 Barcelona. For access to the full version, please contact daisy@delloro.com

RAN Optimism

The MWC event supported the premise we have communicated for some time that there are convincing reasons to be optimistic about the RAN market. One of the show’s key findings was a strong consensus that 2019 will be another solid year for the RAN market driven by growth in China, Korea, and the U.S.

While we have already projected that 5G NR would accelerate rapidly in 2019, key findings at the show increase our confidence level that 5G NR shipments and revenues will be material in 2019. We discuss the mobile infrastructure market’s 2018 performance in this press release.

Massive MIMO

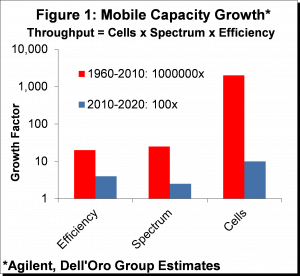

Another key takeaway from MWC2019 was the strong focus on Massive MIMO. This increased confidence in the upwardly adjusted Massive MIMO projections we outlined in conjunction with recently published Mobile RAN reports. Given that operators have multiple tools in their toolkit to manage capacity (Figure 1), why are we so optimistic about the Massive MIMO opportunity in the sub 6 GHz spectrum? Learn more about Massive MIMO at Barcelona in this article.

Millimeter Wave

The Millimeter Wave (mmW) narrative has morphed somewhat over the past couple of years with the industry sentiment fluctuating about the role mmW will play for mobile applications. Even though the opportunity cost for operators with significant mid-band assets will be more favorable for

some time leveraging the macro grid and Massive MIMO, our view has always been that mmW will be an important technology over the long-term (there is no fourth alternative in Figure 1).

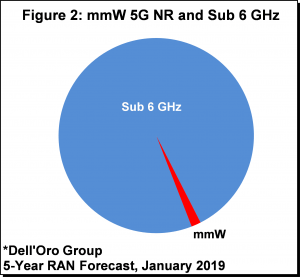

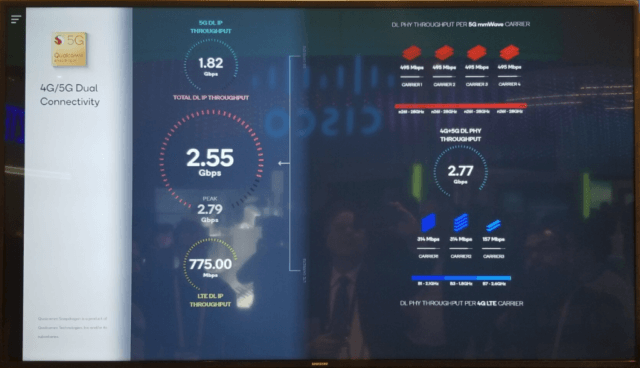

The most important takeaways from the event include: 1) mmW is now real, phones are coming to the market, and mmW shipments will be material in 2019, 2) The perception about Qualcomm’s mmW simulation is changing, 3) Findings validate our short-term and long-term forecast.

A summary of the latest Mobile RAN five-year forecast may be found here.

Open and Virtual RAN

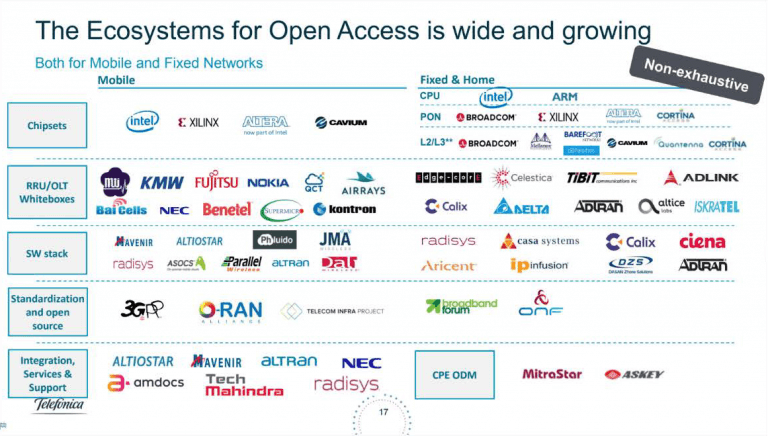

In general good momentum during the show behind the shift towards opening up the RAN and moving away from proprietary hardware with Rakuten communicating its C-RAN (Cloud Radio Access Network) progress in Japan, Ericsson recently joining the ORAN Alliance, and Telefonica sharing its roadmap and ecosystem partners for Open Access – which did not include the larger macro RAN vendors for the SW stack or the radios.

While there is no doubt that virtual RAN sceptics will be monitoring Rakuten’s performance when the company goes to live with its 5500 sites this fall, it remains to be seen how well true C-RAN systems will handle—for example, a site with 64T64R 100 MHz BW Massive MIMO systems, along with legacy 2G/4G systems.

To some degree, the event reminded both virtual and proprietary HW RAN proponents that both sides have something to bring to the table. Open RAN and Virtual RAN are making significant headway and there is excitement about this progress. However, the event did little to convince us of our long-standing thesis—that the shift toward RAN virtualization will eventually occur—but it will take time. Moreover, initially, it will be confined to non-traditional builds, e.g., new use cases, indoor deployments, greenfield deployments, and rural settings. Finally, after such deployments, it will need to be revised.

CBRS

The key takeaway from a CBRS perspective is the reduced risk that regulatory delays could eventually impact the ecosystem. With Pixel 3 and Galaxy S10 now supporting the CBRS band, the ecosystem will undoubtedly get a boost. In addition to Qualcomm’s Snapdragon X20/24, Sierra Wireless and Sequans Cassiopeia now also have production-grade modules.

Our CBRS forecast report, which suggests that will grow at a rapid pace between 2018 and 2022 with total RAN investments approaching $1 Billion and CBRS RAN shipments to eclipse half a million units. Learn more from my blog on the CBRS RAN market.

For access to the full version, please contact daisy@delloro.com

Rakuten

Rakuten