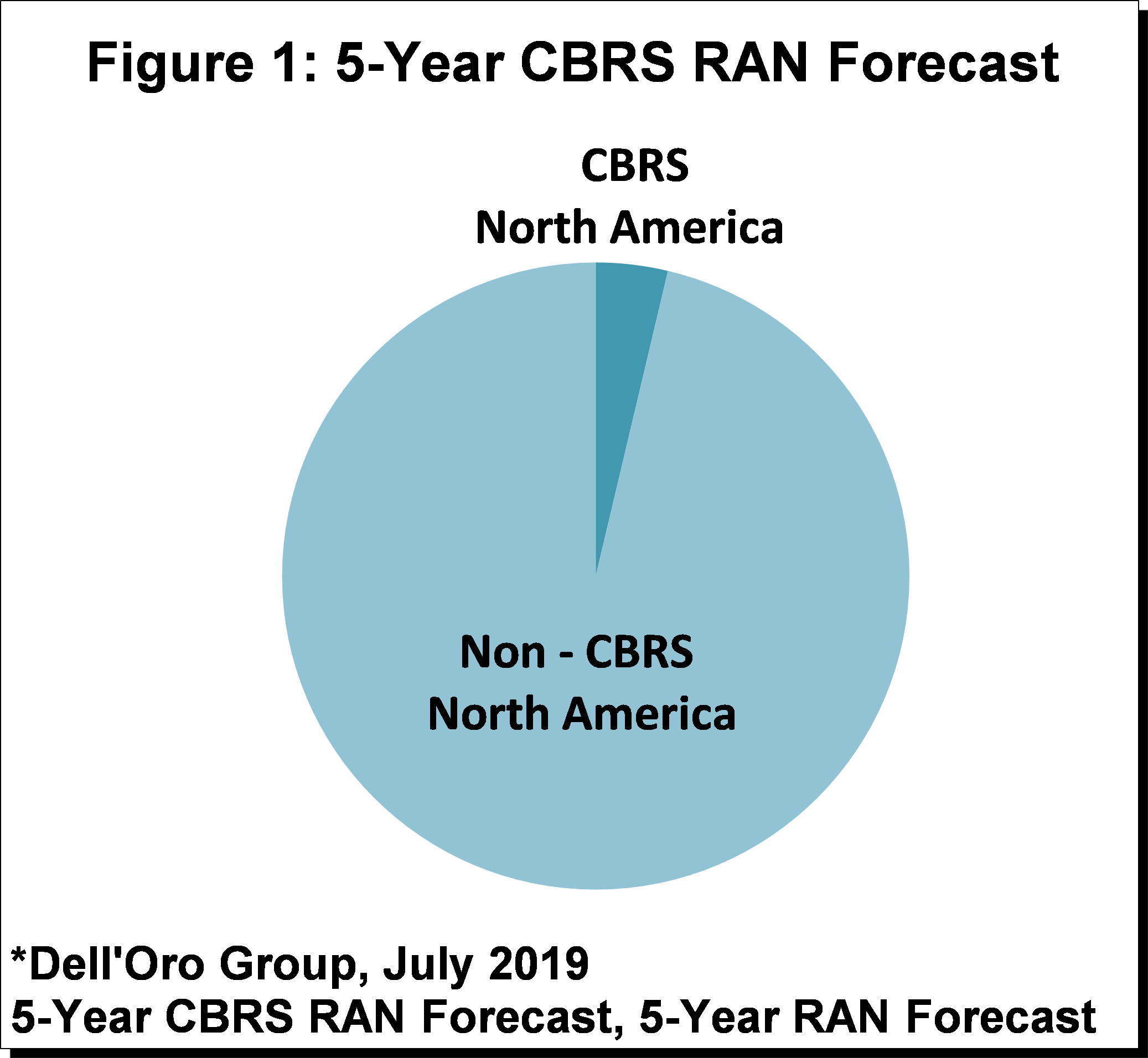

The latest Dell’Oro Group CBRS RAN 5-year forecast suggest short term delays and renewed concerns about the network economics for outdoor deployment will not  impact the long-term demand for LTE and 5G NR CBRS solutions – the overall CBRS RAN market outlook is relatively unchanged since the January 2019 update. The overall CBRS market is expected to grow at a rapid pace between 2019 and 2023 with cumulative RAN investments projected to comprise a tangible share of the overall North America RAN market (Figure 1).

impact the long-term demand for LTE and 5G NR CBRS solutions – the overall CBRS RAN market outlook is relatively unchanged since the January 2019 update. The overall CBRS market is expected to grow at a rapid pace between 2019 and 2023 with cumulative RAN investments projected to comprise a tangible share of the overall North America RAN market (Figure 1).

“There is a fine line between pleasing everyone and no one. And even with more questions raised about the outdoor CBRS TCO, our underlying position has not changed–we remain excited about the CBRS opportunity and continue to believe that the majority will benefit resulting in material CBRS investments over the next five years”, said Stefan Pongratz, Senior Research Director for RAN and Telecom Capex with the Dell’Oro Group.

Other highlights from the CBRS 5-Year Forecast Report:

- CBRS capex is not projected to have a significant impact on the WLAN capex.

- CBRS investments are projected to account for a mid-single-digit share of the overall North America RAN market.

- FWA is projected to drive the lion share of the CBRS capex over the near-term.

Dell’Oro Group’s Advanced Research: Citizen Broadband Radio Service (CBRS) Report offers an overview of the CBRS RAN potential with a 5-year forecast for indoor and outdoor LTE and 5G NR CBRS deployments along with a discussion on the participating suppliers. To purchase these reports, please contact us by email at dgsales@delloro.com.

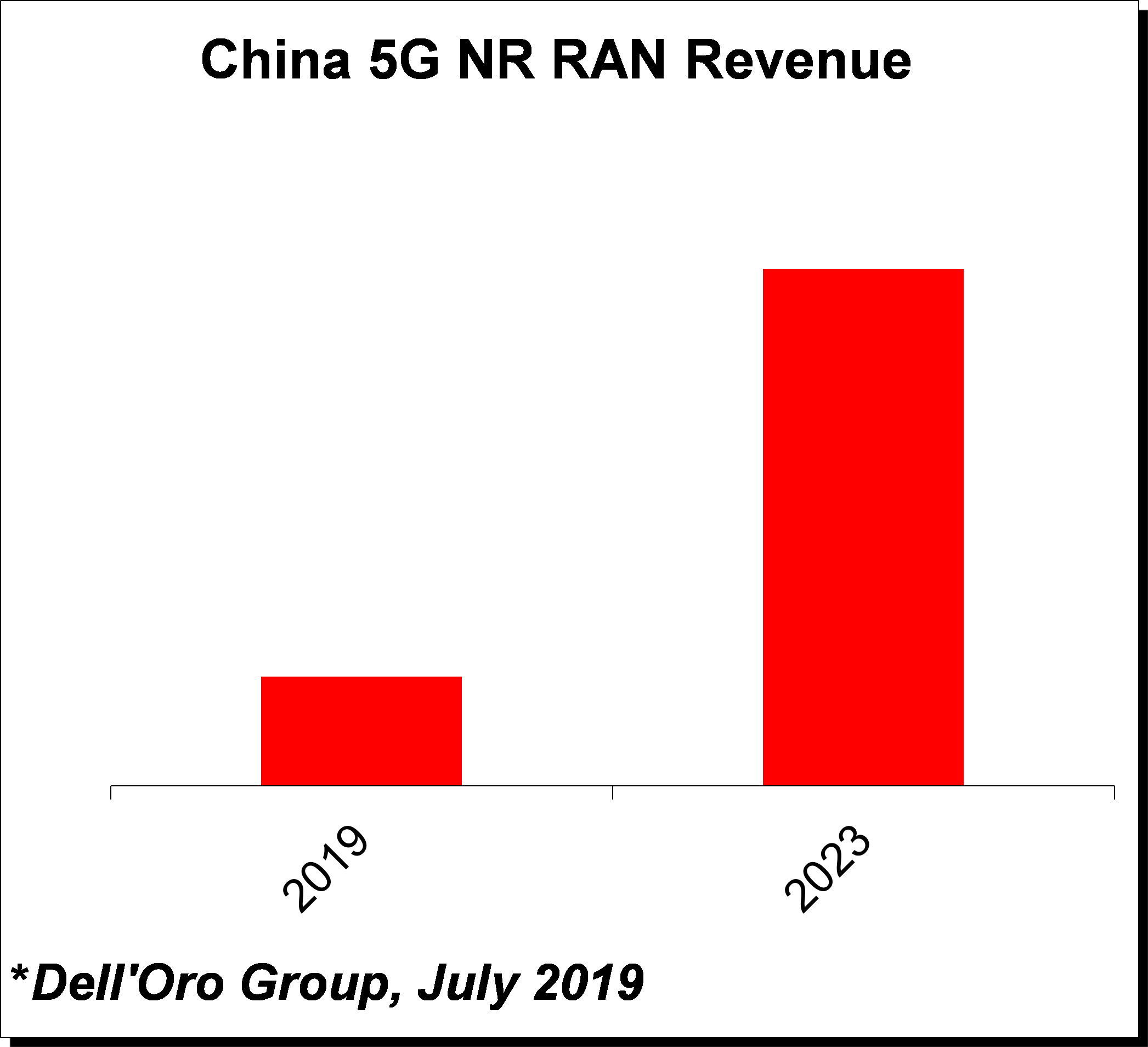

began in the second half of 2018 is expected to extend over the forecast period, propelling China’s 5G RAN market to advance nearly fivefold relative to an already-aggressive 2019 baseline.

began in the second half of 2018 is expected to extend over the forecast period, propelling China’s 5G RAN market to advance nearly fivefold relative to an already-aggressive 2019 baseline.

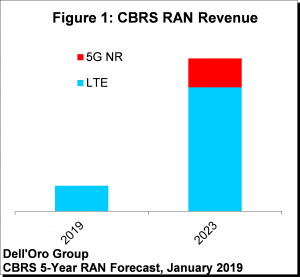

overall CBRS RAN market is expected to grow at a rapid pace between 2019 and 2023 with cumulative investments surpassing $1 B over the next five years.

overall CBRS RAN market is expected to grow at a rapid pace between 2019 and 2023 with cumulative investments surpassing $1 B over the next five years.