[wp_tech_share]

Introduction

2020 has been proclaimed as the year of 5G with 5G Standalone (5G SA) networks. By definition, this includes the 5G Core. To get an earlier start in 2019, the wireless communications industry pushed an architecture known as 5G Non-standalone (5G NSA) with full commercial launches. For some service providers (SPs), this launch may have had an impact on the 5G SA timeline, making 2020 the year of more trials before full commercial deployment in 2021. But for others, primarily in China and South Korea, countrywide 5G SA networks will launch in the second half of 2020.

In this blog we will explore:

The path to 5G SA

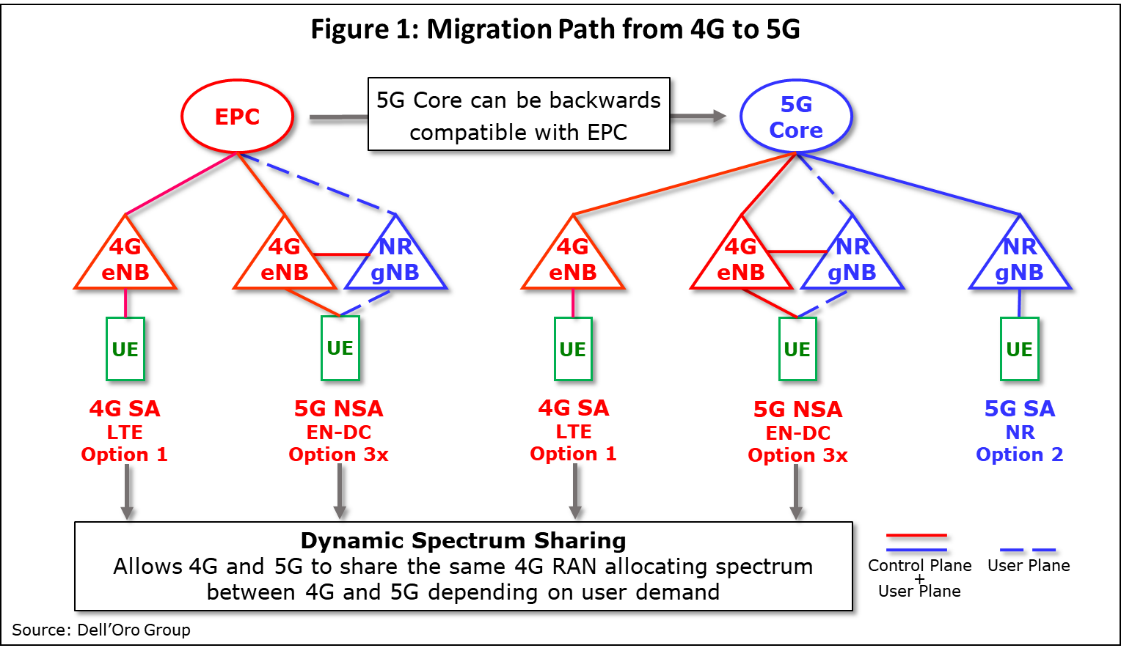

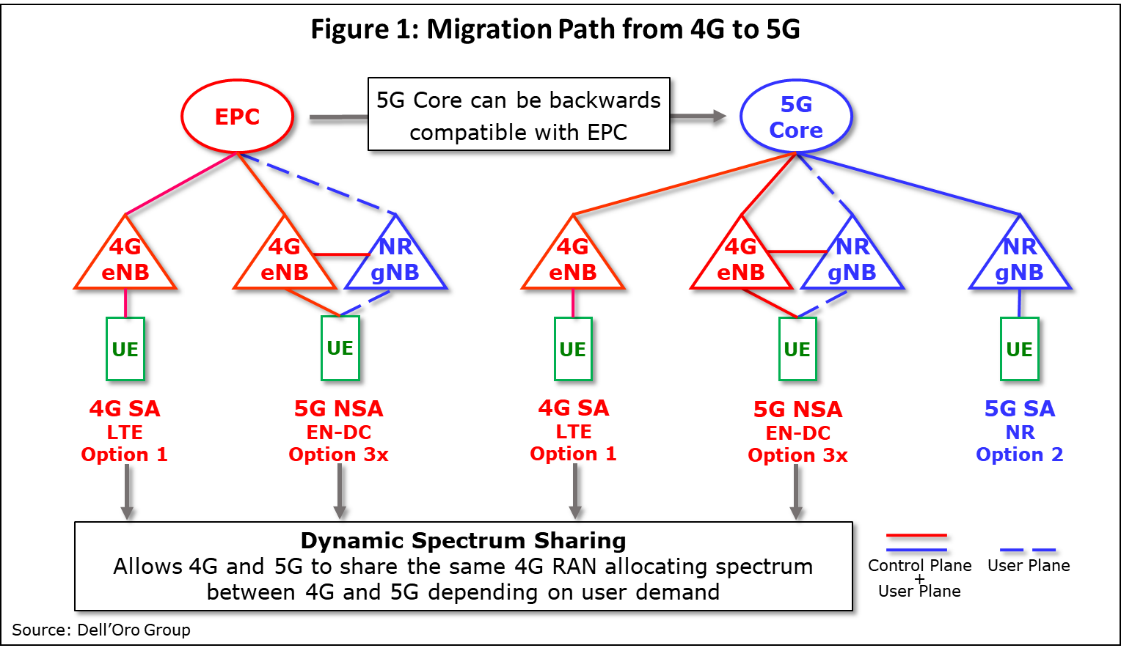

Looking at the 5G landscape from today’s vantage point, in 40 countries (per the GSA, including Japan), more than 70 5G networks are commercially deployed. These are known as 5G Non-standalone (5G NSA) networks. 5G NSA refers to the configuration of the network shown in Figure 1. To date, nearly all 5G commercial networks are 5G NSA. This means that the 5G NR gNodeB base station depends on a 4G eNodeB anchor base station providing dual connectivity (a.k.a. EN-DC or Option 3x) to the UE, combining the bandwidth of both base stations. In addition, the 4G LTE Evolved Packet Core (EPC) is utilized with a slight upgrade to be forward compatible for carrying 5G traffic. Some networks have upgraded their 4G EPC with Control Plane and User Plane Separation (CUPS) in preparation for a 5G Core.

Since October 2019, the Chinese media have reported that the three largest Chinese SPs are offering commercial 5G SA service on small-scale deployments. These networks are now providing service to their 5G subscribers. The first 5G SA and 5G NSA dual-mode smartphone was released in July 2019, making these small-scale 5G SA commercial networks viable for consumers. With the increasing popularity of these smartphones, the stage is now set for the large-scale commercialization of 5G SA networks. In addition, 5G SA trials for verticals have been ongoing in Smart Ports, Smart Manufacturing, and other vertical business applications.

Where are we going in 2020? Some markets now have limited 5G coverage. A technique called Dynamic Spectrum Sharing (DSS) has been developed to allow 5G users to share access with existing 4G LTE base stations. DSS is a RAN technique that can immediately expand 5G coverage to all 4G base stations and is shown in Figure 1 to provide a complete view of the migration options to 5G. DSS is expected to be deployed in some markets starting in mid-2020.

During 2020, the industry will progress toward 5G SA. Lab proof-of-concepts and field trials are well underway around the world. Vendors and SPs are working together to learn about the intricacies of implementing 5G SA, which primarily means implementing the 5G Core for 5G NR base stations (a.k.a. Option 2). Some SPs will operate multiple 5G Cores dedicated to consumers, enterprise, public safety, and Internet of Things (IoT). They believe that dedicated 5G Core networks will be able to deliver new agile business solutions at a quicker pace for their respective user bases and more efficient network management.

Completing our discussion of Figure 1, eventually 4G base stations (LTE Option 1) and 5G NSA base stations (EN-DC Option 3x) will come under the 5G Core, since the 5G Core will be backward compatible with the EPC. This will allow SPs to simplify their operations and offer 5G-like services on 4G eNodeB base stations. This migration will begin after the 5G Cores are up and running.

The 3GPP release schedule

Before moving on to the intricacies of the 5G Core, let’s look at progress on the 3GPP 5G release schedules. Release 15 (5G Stage 1) for 5G NSA was completed in the first half of 2018. 5G SA was completed in the second half of 2018 with the final freeze in mid-2019. (As a reminder, at this writing in 2Q 2020, no 5G SA networks have been commercially deployed with the exception of a few, at very small scale venues.

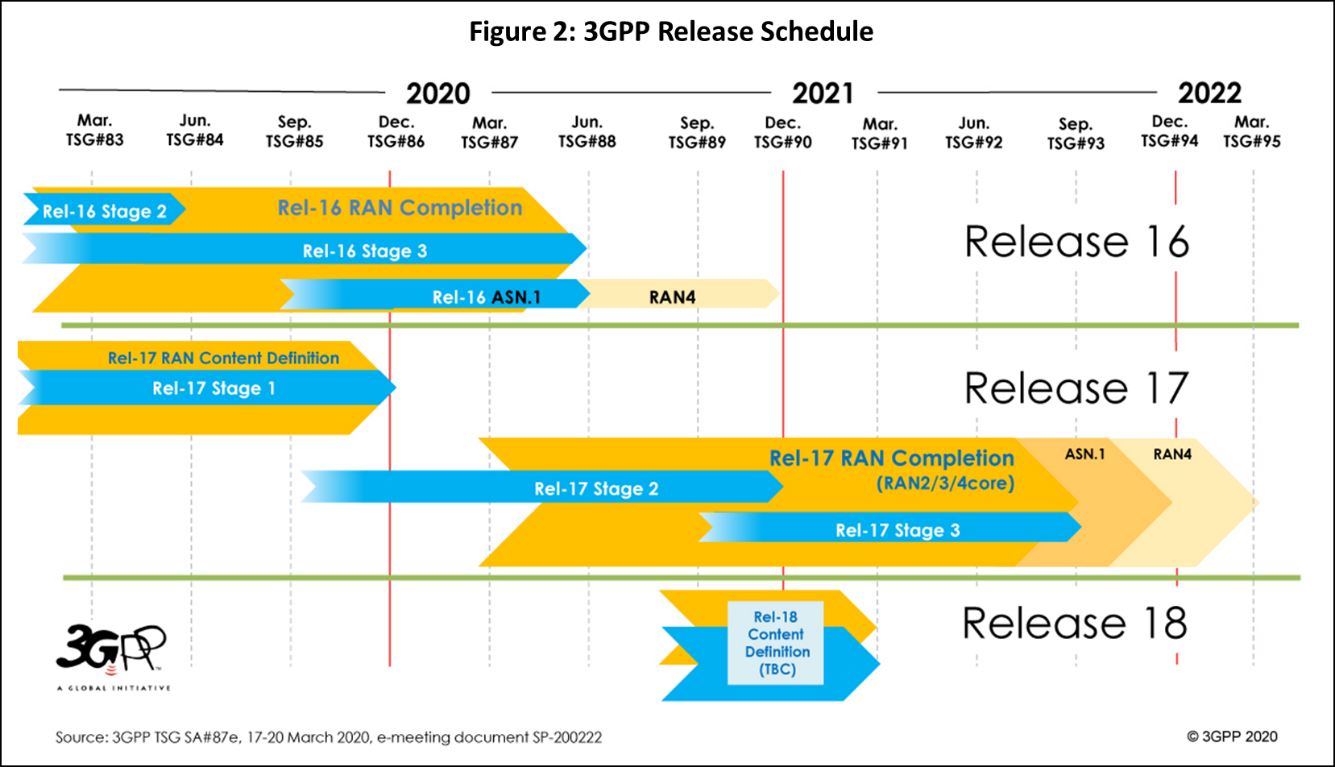

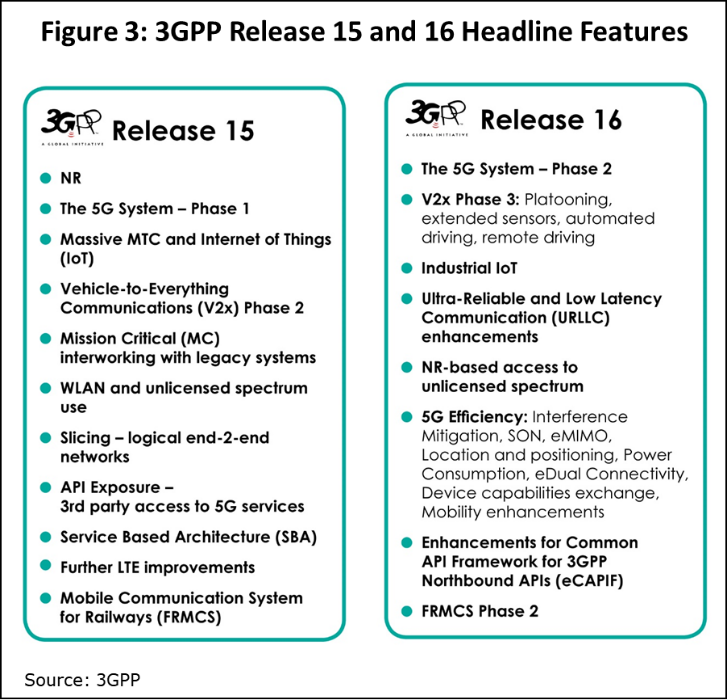

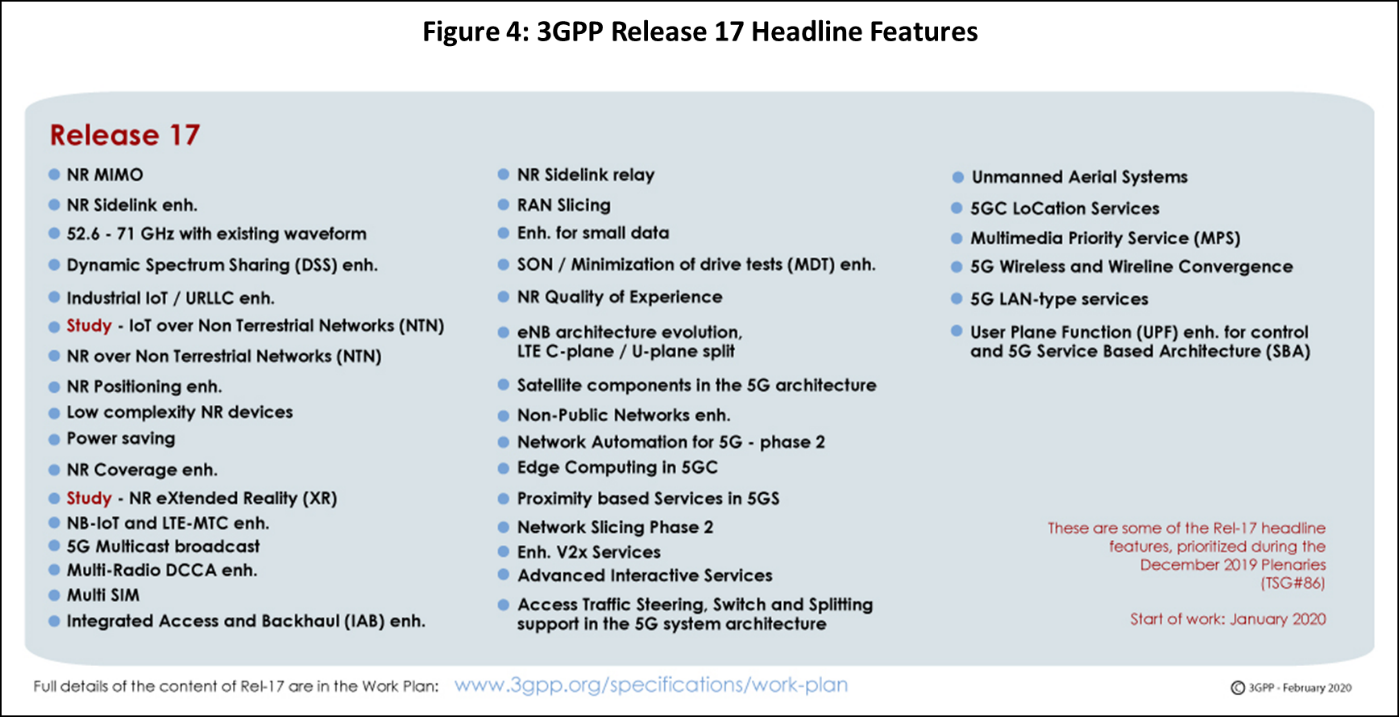

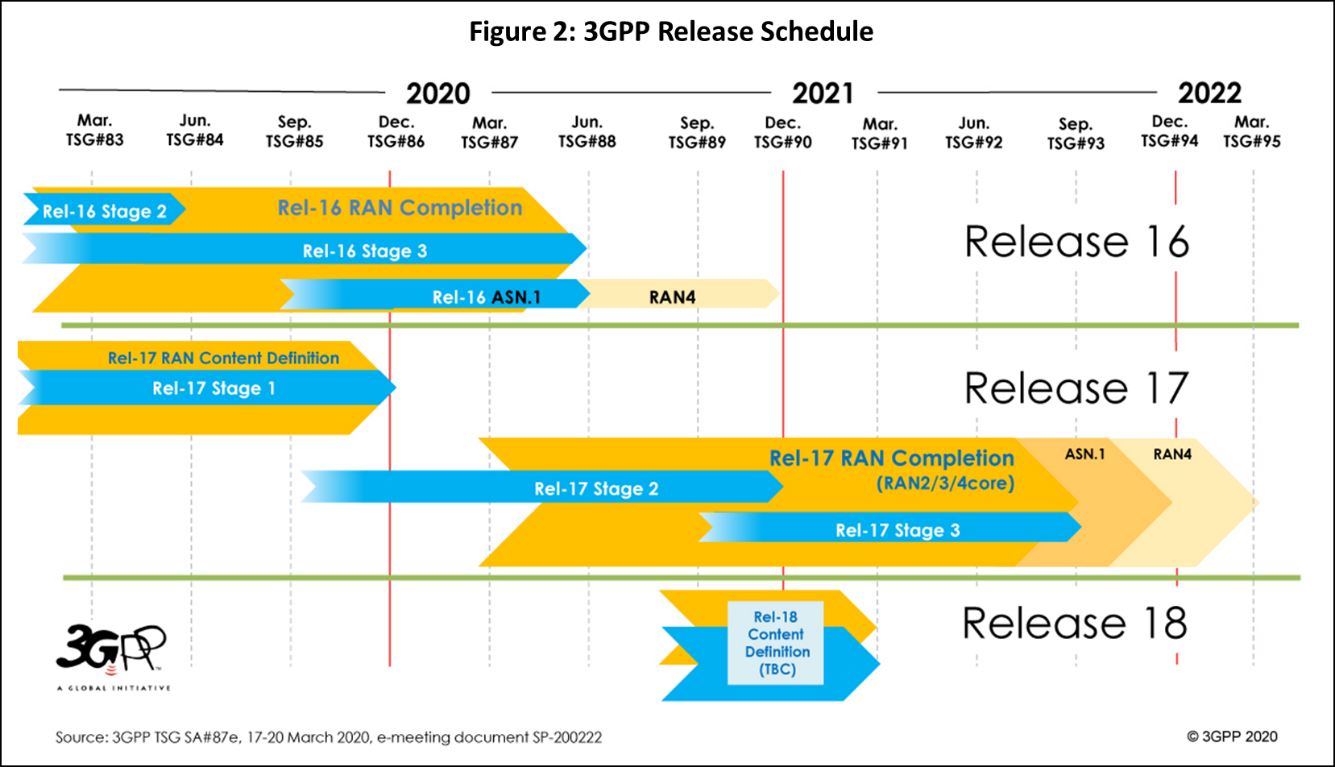

Regardless of where we are in commercial deployments, the 3GPP standards body has moved on with Releases 16 and 17 as shown in Figure 2. Release 16 is complete with formal approval scheduled for mid-2020. Release 17, Stage 1 was completed at the end of 2019. Release 17, Stage 2 is scheduled for completion at the end of 2020 and Stage 3 is scheduled for completion at the end of 3Q 2021 with formal approval by the end of 2021. Work items for Release 18 will be identified by the end of 2021.

The 3GPP release schedule is highlighted to emphasize that 5G, and especially the 5G Core standard (3GPP TS 23.501, the overarching specification), still has a long way to go before the full potential of 5G will be achieved. While the industry has been touting 5G for several years, it cannot be realized without the 5G Core.

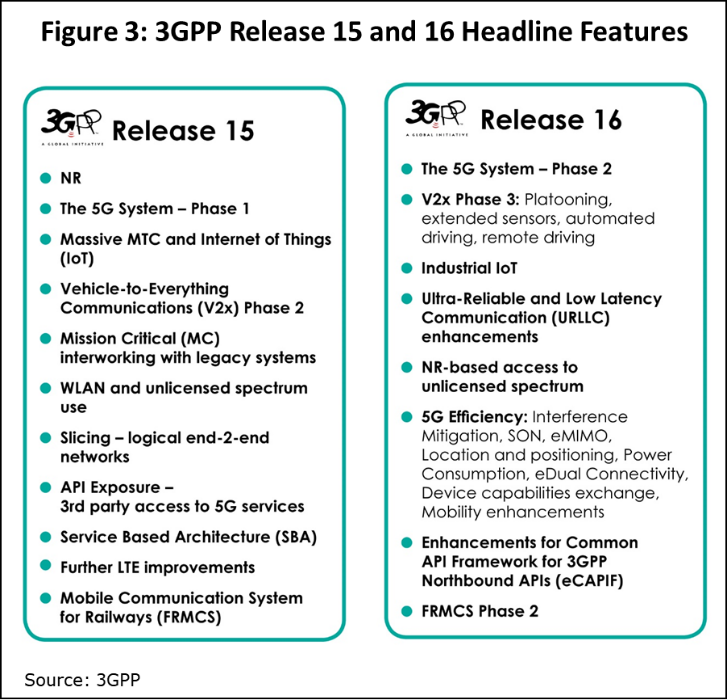

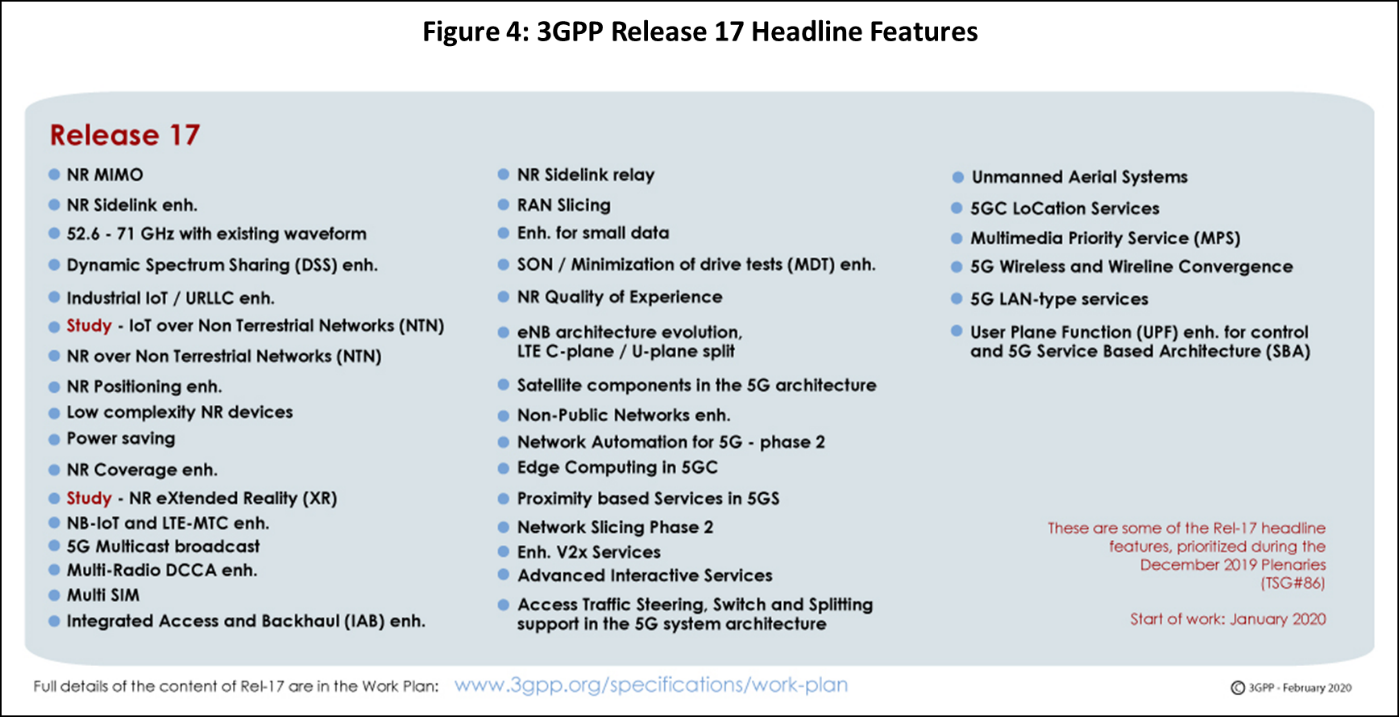

Figures 3 and 4 highlights of features for Release 15, 16, and 17 as published by the 3GPP. The intent is not to walk through each of these items, since some are RAN-associated while others are Core-related. Rather, the point is to illustrate the vast number of new features being introduced in the 5G Core. Some the most important of these will be discussed next.

The 5G Core?

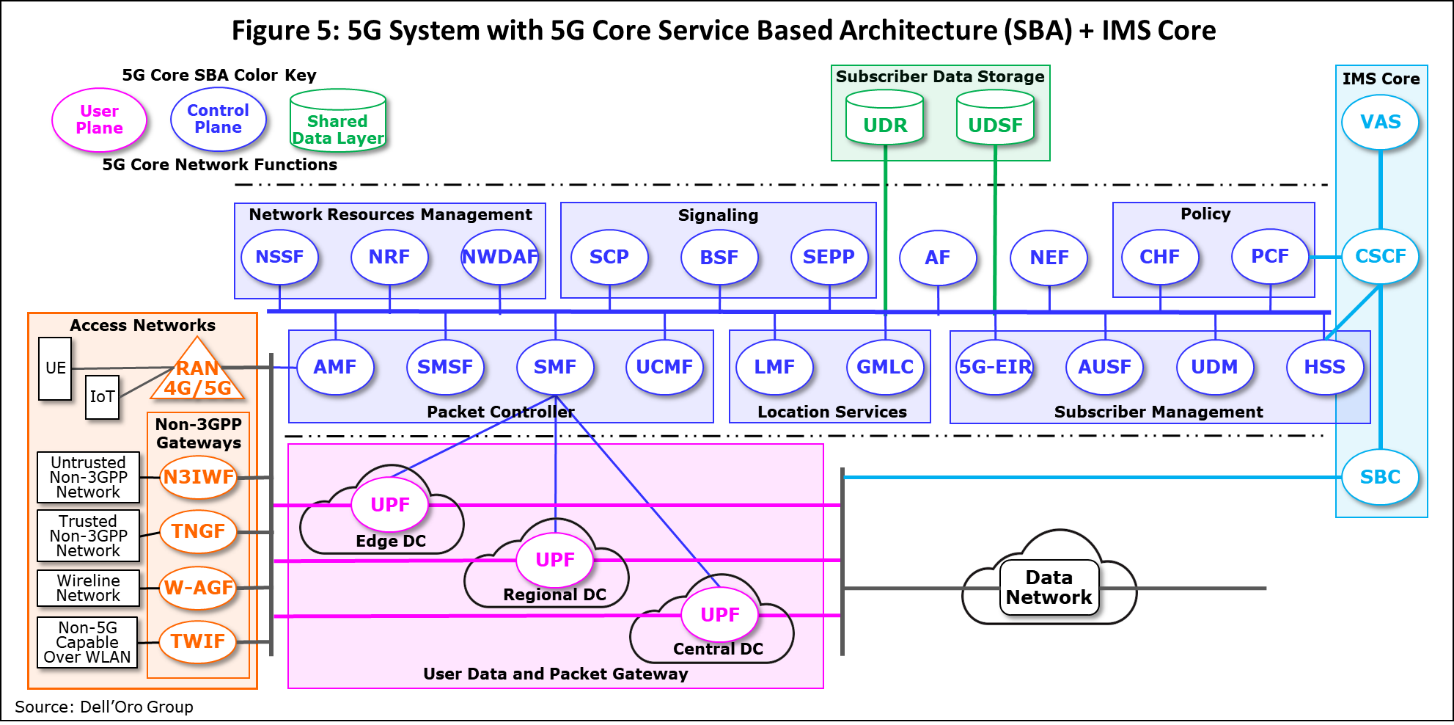

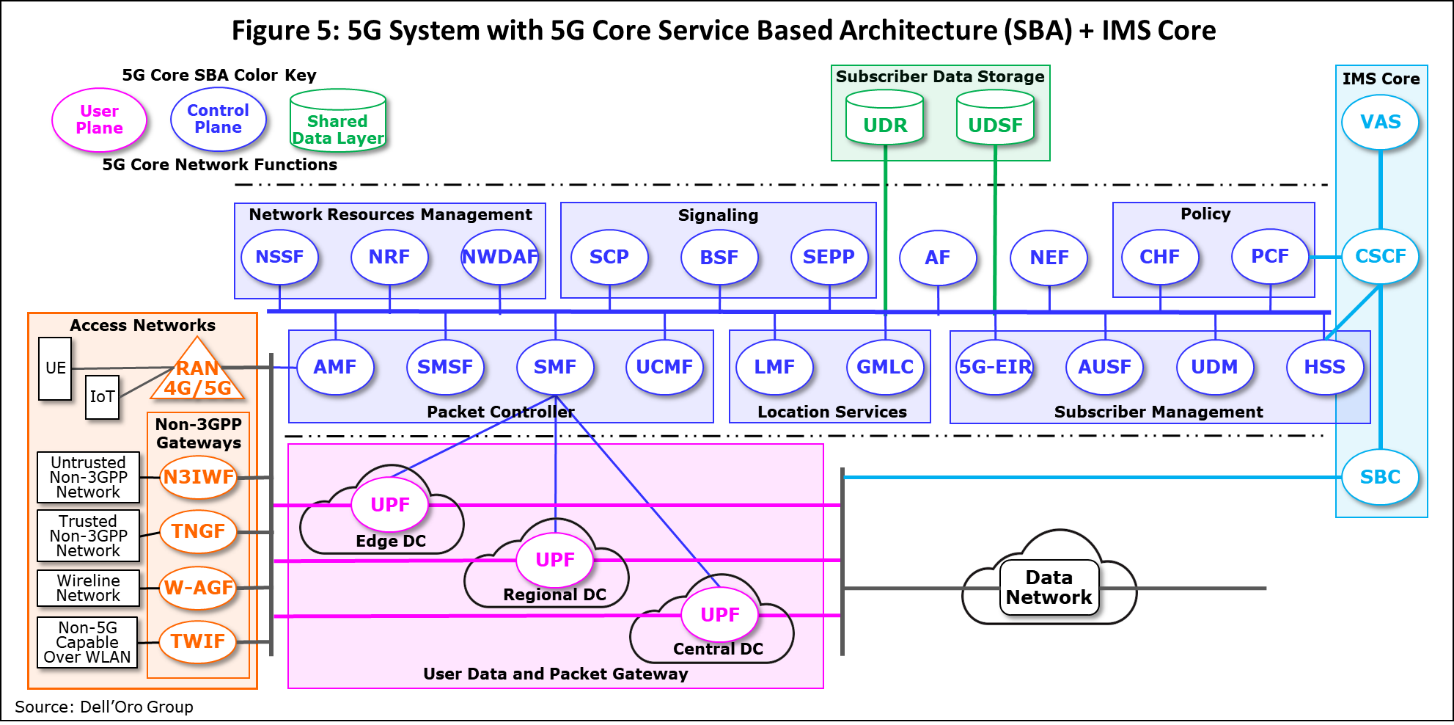

Figure 5 depicts the architecture of a 5G system. Starting at the lower left is 5G user equipment (UE), such as smartphones, tablets, and watches; and IoT devices, such as sensors and surveillance cameras. This does not seem too different than a 4G network. However, the 4G requirement for 4G IoT devices was 2,000 per square kilometer (sq. km.), whereas for 5G the requirement is 1,000,000 IoT devices per sq. km. Immediately, it becomes apparent that the 5G Core will have to handle more sessions long-term than what we saw with the EPC. As far as bandwidth is concerned, 5G can employ ten times the spectrum as compared with 4G or 1 GHz vs. 100 MHz, respectively. This suggests that a 5G network can have as much as ten times the capacity of a 4G EPC network.

UE and IoT devices can be connected to multiple Access Networks, which need not be either 4G or 5G Radio Access Networks (RANs). Non-3GPP Gateways are specified for multiple-access networks, such as Wi-Fi Networks. Wireline Networks (such as a Fixed Wireless Access) can be managed by the 5G Core. This adds another layer of complexity to 5G over 4G.

The 5G Core is known as a Service-Based Architecture (SBA). At a high level, it consists of the User Plane, the Control Plane, and the Shared Data Layer Network Functions. This enables a more resilient core network (CN). Hardware and software disaggregation creates what is known as stateless Virtual Network Functions (VNFs) that runs on COTS Network Function Virtualization Infrastructure (NFVi). If a hardware failure occurs, a new virtual machine (VM) or Container can spin up on a new server without loss of data because it resides in the Shared Data Layer.

As already suggested, this structure allows for Cloud computing with container-based Cloud-Native Network Functions (CNFs) that permit microservices tailor-made for smaller groups of subscribers. CNFs enable SPs to build a web-scale core with greater degrees of orchestration and automation to bring new services to the market in a few hours or days, as compared to months or years.

Third-party applications can also be integrated into the 5G Core via the Application Function (AF), such as edge computing and, eventually, the IMS Core. To date, the IMS Core, required for real-time voice and video calls, is separate from the 5G Core SBA. The third-party applications integrated into the 5G Core via the AF rely on the Network Exposure Function (NEF) to expose all of the other network functions, facilitating the third-party app.

Network Slicing and Automation

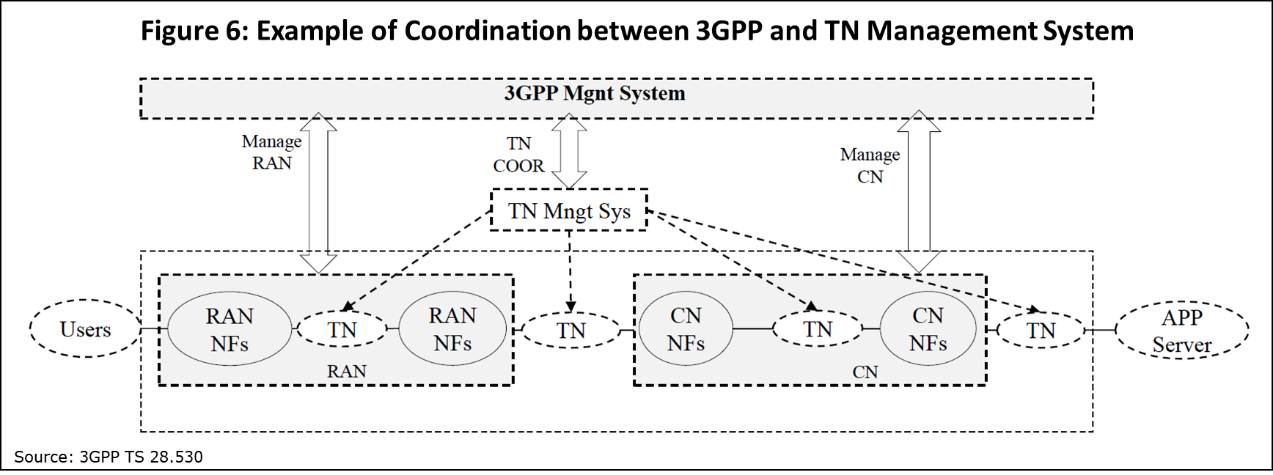

One of the most publicized and powerful new feature introduced in the 5G Core is the Network Slicing Selection Function (NSSF). This allows a SP to create a logical network with different characteristics customized to the need of the consumer market and the enterprise market. Service-level Agreements (SLAs) with different pricing can be made to order based on the SLA selected by a customer. Some of the parameters that can be selected for an SLA are desired latency, bandwidth/throughput, security, availability, jitter, and packet loss. Some of these parameters can be met just by slicing the Core, while other parameters require slicing the RAN and the Transport Network (TN).

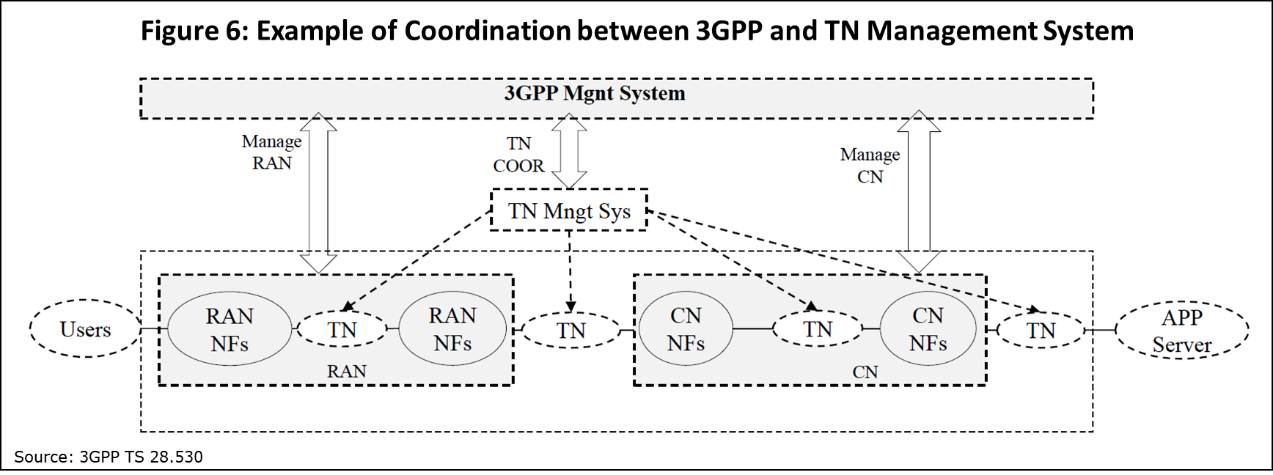

It is beyond the scope of this blog to provide a detailed explanation of how network slicing works. For our purposes, suffice it to say that 3GPP specifies Network Slicing for the RAN and the CN but not the slicing of the TN which is not part of 3GPP. FlexEthernet (FlexE), defined by the Optical Internetworking Forum (OIF), would be one way to slice the TN. Figure 6 shows an example of E2E slicing from the 3GPP perspective.

In order to do E2E Network Slicing (RAN-CN-TN), a new means of automation has been created by 3GPP. It is known as the Communication Service Management Function (CSMF) with Network Slice Management Function (NSMF) and a Network Slice Subnet Management Function (NSSMF).

Multi-Access Edge Computing

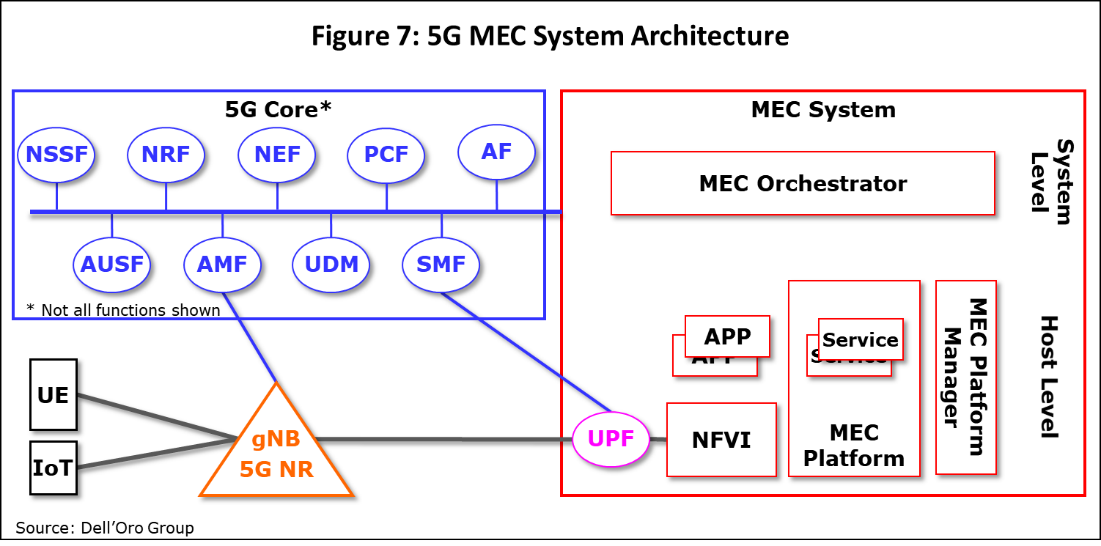

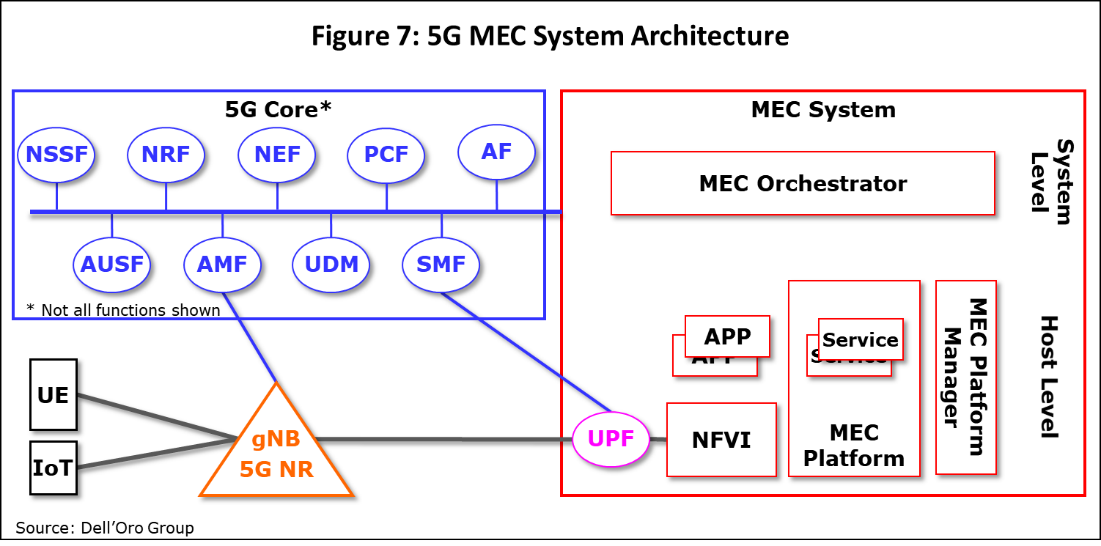

One way that a 5G Core can reduce latency is with multi-access edge computing (MEC) as shown in Figure 7. The closer the compute power is to the user, the shorter the latency. Latency reduction is done with a distributed User Plane Function (UPF) that can be distributed into multiple MEC Systems at desired distances to meet varying latency requirements with a tiered pricing model based on latency.

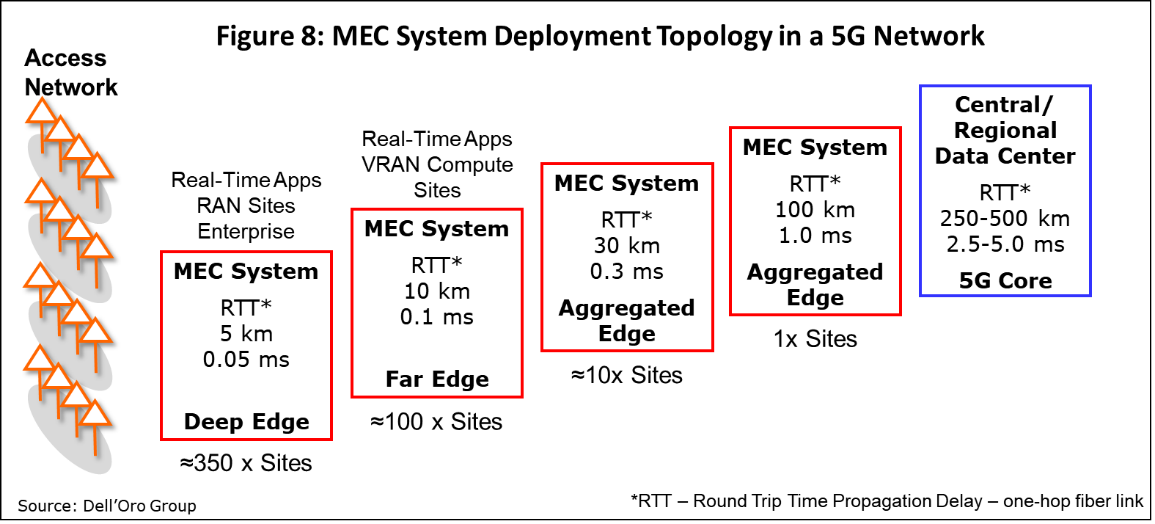

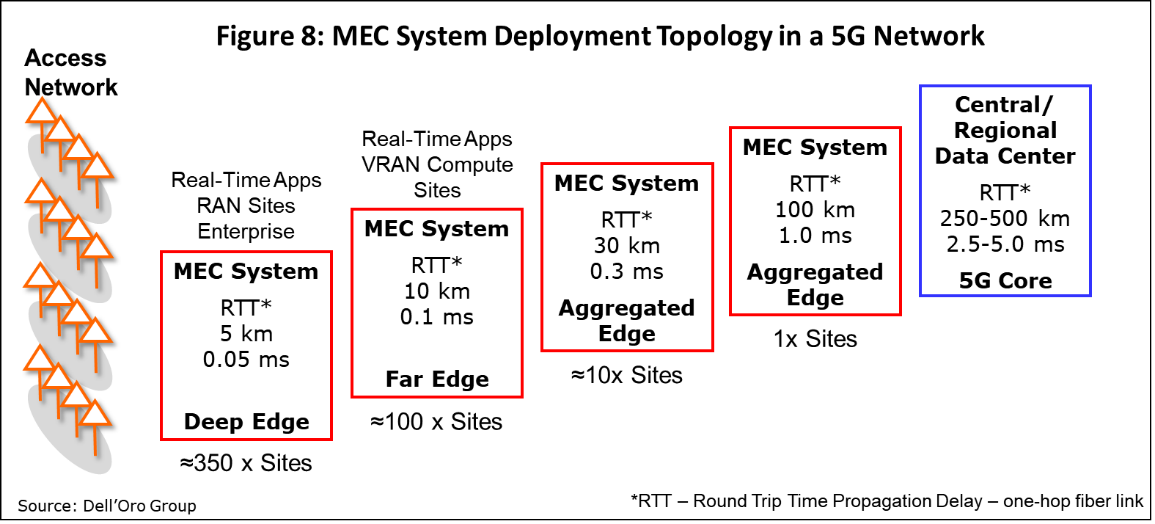

Figure 8 shows some sample distances and the Round-trip Time (RTT) of a one-hop fiber link for various MEC locations to illustrate a tiered pricing model. This does not include the RTT for compute and storage (processing delay, queuing delay, transmission delay, encoding delay, and computational time) that could add another 15 to 20 ms.

Time Sensitive Networking

For real-time applications, every saving that can be gained in reducing RTT is critical. One such application for extreme Ultra Reliable Low Latency (URLLC) is for factory automation. 5G networks designed for URLLC can replaces wireline real-time Ethernet for cyber-physical control applications. Automation is key to the control of processes, devices, or systems in vertical domains by automatic means. This is referred to as Time Sensitive Networking (TSN).

The main control functions of automated control systems include taking measurements, comparing results, computing any detected or anticipated errors, and correcting the process to avoid future errors. These functions are performed by sensors, transmitters, controllers, and actuators. 3GPP has defined the KPIs for periodic deterministic communications (communication with stringent requirements on the timeliness of the transmission). As expected, the most stringent E2E latency requirement of 0.5 ms to 2 ms is for motion controls, depending on availability of the network and message size requirements. In addition, the 5G System is required to have a clock synchronization of 1 microsecond or less.

The readiness of two 5G Core Vendors: Huawei and Ericsson

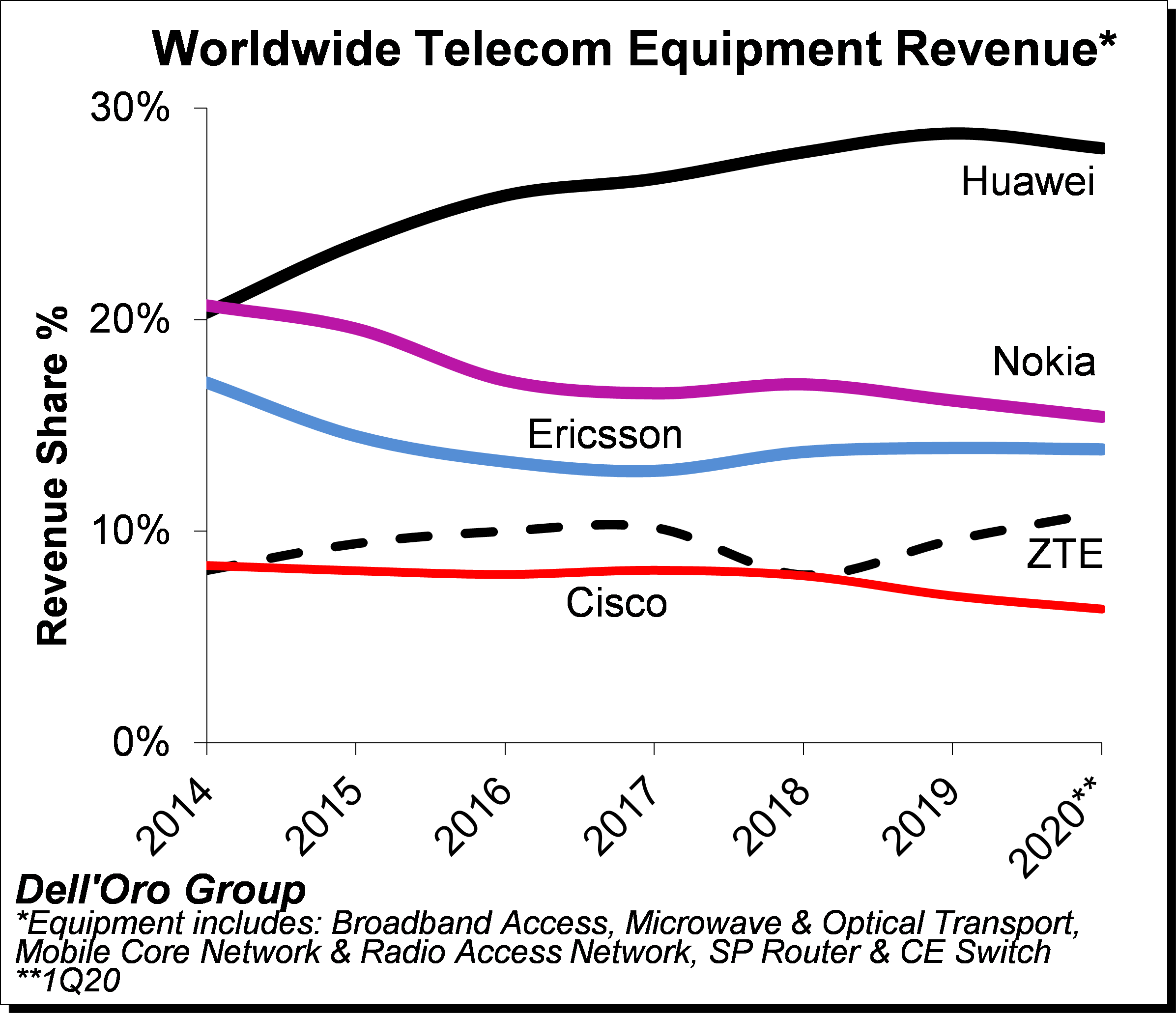

Huawei and Ericsson are the top two Wireless Packet Core suppliers. These top two vendors account for 60% of the wireless packet core market today. How have they positioned themselves for the 5G Core market and the future laid out by 3GPP?

Huawei

In May 2019, Huawei proposed the innovative concept of 5G Deterministic Networking (5GDN), which aimed at addressing the differentiated requirements and deterministic experiences of industries and promoted 5G business development—especially for industrial and enterprise applications.

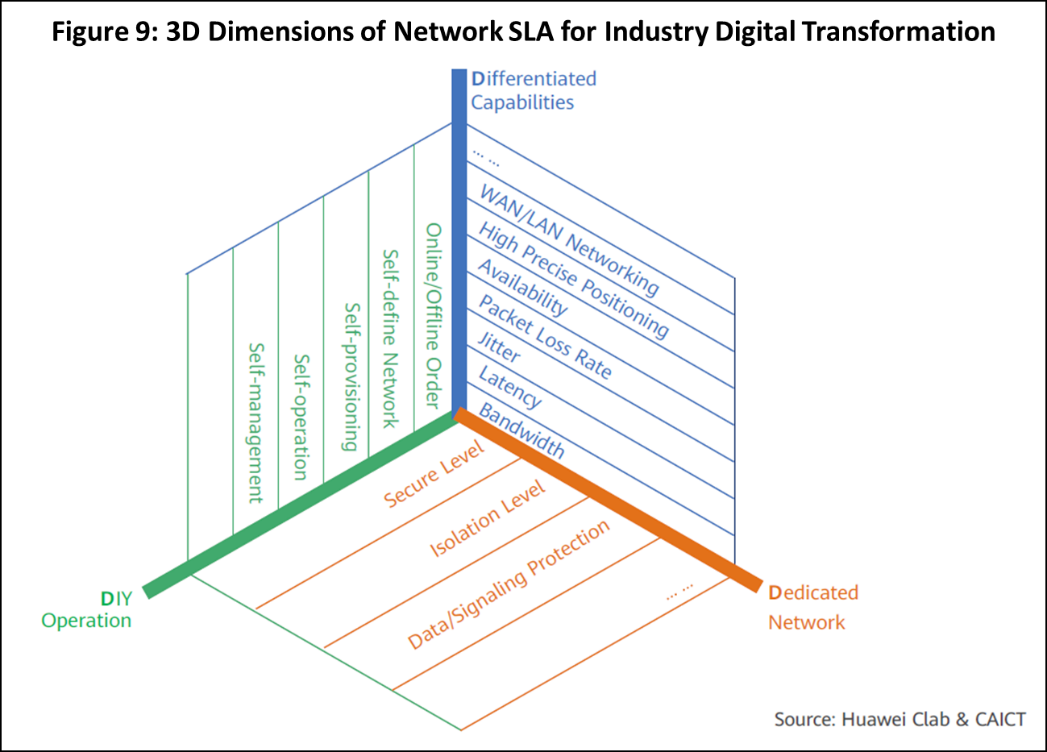

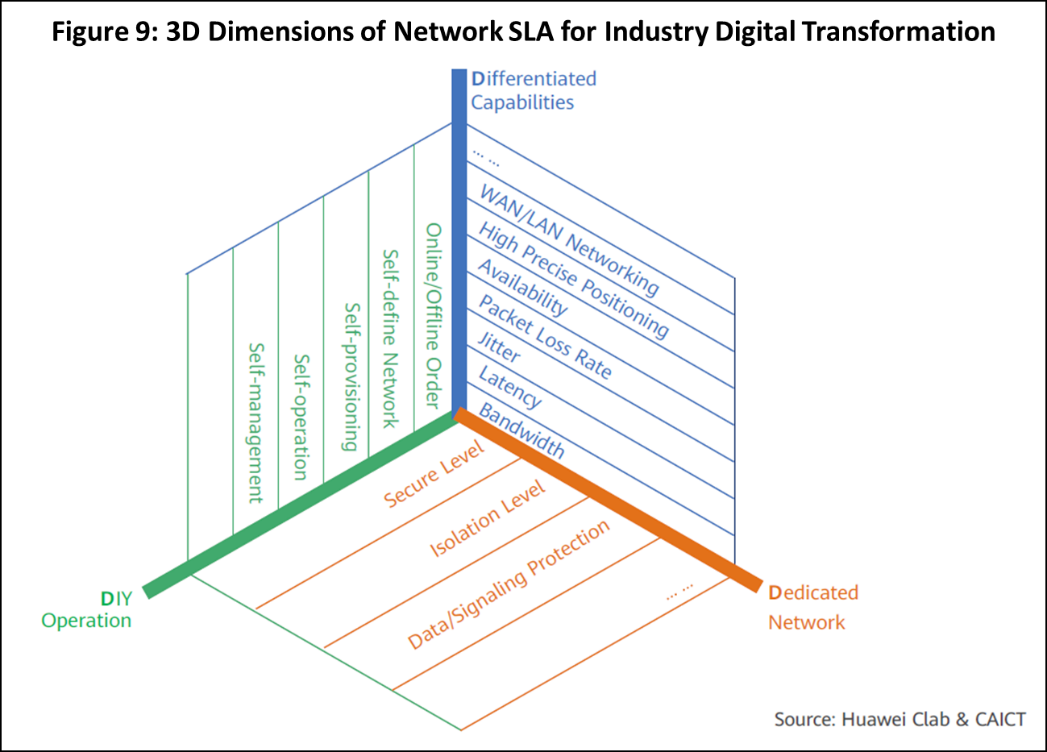

In February 2020, at Huawei’s London press conference, the company heralded the industry’s first 5G Core solution adapted to 5GDN. Huawei articulated the principles of industrial digital transformation using 5G networks along three dimensions: differentiated networks with orchestrated capabilities; dedicated networks with guaranteed data security; and self-service, do-it-yourself (DIY) networks with automated management (Figure 9).

In its press release, Huawei proposed four pillars of the 5G Core as the key to building 5GDN: Cloud Native, One Core, Real-time Operation, and Edge Computing. Thus, the company’s 5G Core solutions run on a Cloud-native platform and support microservices-based 2G/3G/4G/5G full convergence. Leveraging super-performance heterogeneous MEC, multi-dimensional dynamic intelligent slicing, and a core network automation engine, Huawei’s 5GDN can provide differentiated network capabilities and a deterministic networking experience.

In an analysis briefing in December 2019 on the 5GDN, Huawei recognized that the development of 5G business depends not only on solution technology breakthroughs but also on a thriving ecosystem. Therefore, based on the concept of 5GDN, Huawei and multiple organizations jointly established the 5G Deterministic Networking Alliance (5GDNA). The partnership is aimed at promoting consensus on industry development and ecosystem building.

A white paper published in February 2020 by Huawei and its 5GDN Alliance partners described current projects in four verticals:

Smart Ports

Yangshan Port and Ningbo Port were implemented with China Mobile in 2019 using verified remote control of RTG cranes with HD video backhaul. Enabled by a 5G SA network, including MEC, the project met the port’s requirements for data-processing security with latencies as low as 10 ms.

Smart Grids

A State Grid Corporation of China 5G SA network field test was implemented with China Telecom, which verified the technical feasibility of 5G network slicing in multiple, typical smart grid scenarios, such as high-frequency information collection in substations and smart distributed feeder automation.

China Southern Power Grid Shenzhen Power Supply Bureau, and China Mobile completed the industry’s first 5G differential protection test for power distribution as well as a slice isolation test for the 5G CN and TN network.

Smart Manufacturing

Haier Group’s COSMOPlat industrial Internet platform, the interconnected factory, has been upgraded to 5GDN. It was implemented with China Mobile in 2019 for machine vision, AR man-machine collaboration, smart devices, smart transportation, and smart energy.

AR/VR

China Mobile, CAS-Visual-Dimension, and Huawei carried out an AR interactive project at the Beijing Expo 2019 on a 6000+ square meter campus. Based on 5G MEC, the project received an average of more than 1,000 visitors per day and leveraged ultra-high bandwidth, ultra-low latency, and the mobility of 5GDN.

In December 2019, Huawei, China Mobile, and Blaz demonstrated the 5GDN+AR cultural tourism project at Shenzhen Airport. 5GDN’s low latency ensures the user experience of AR advertising applications. Precise positioning enables AR advertisement applications to be precisely launched based on subscriber locations.

In September 2019, at the 5G Core Summit in Madrid, Huawei unveiled its fully containerized-based CNF 5G Core solution, claiming an industry first.

In a November 2019 press release, Huawei proposed how to leverage the 5G Core for an Autonomous Driving Network (ADN). The company states that this provides the industry’s first, comprehensive proposal for the concept and the classification standards of the ADN. The latter are defined in terms of customer experience, labor saving, and network complexity.

Finally, in March 2020, with four other companies Huawei jointly released the “Categories and Service Levels of Network Slicing White Paper” to introduce the industry’s first classification of network slice levels on behalf of the 5G Slicing Association. The slicing categories and service levels were introduced for the Core Network and also the RAN and Transport Network.

Ericsson

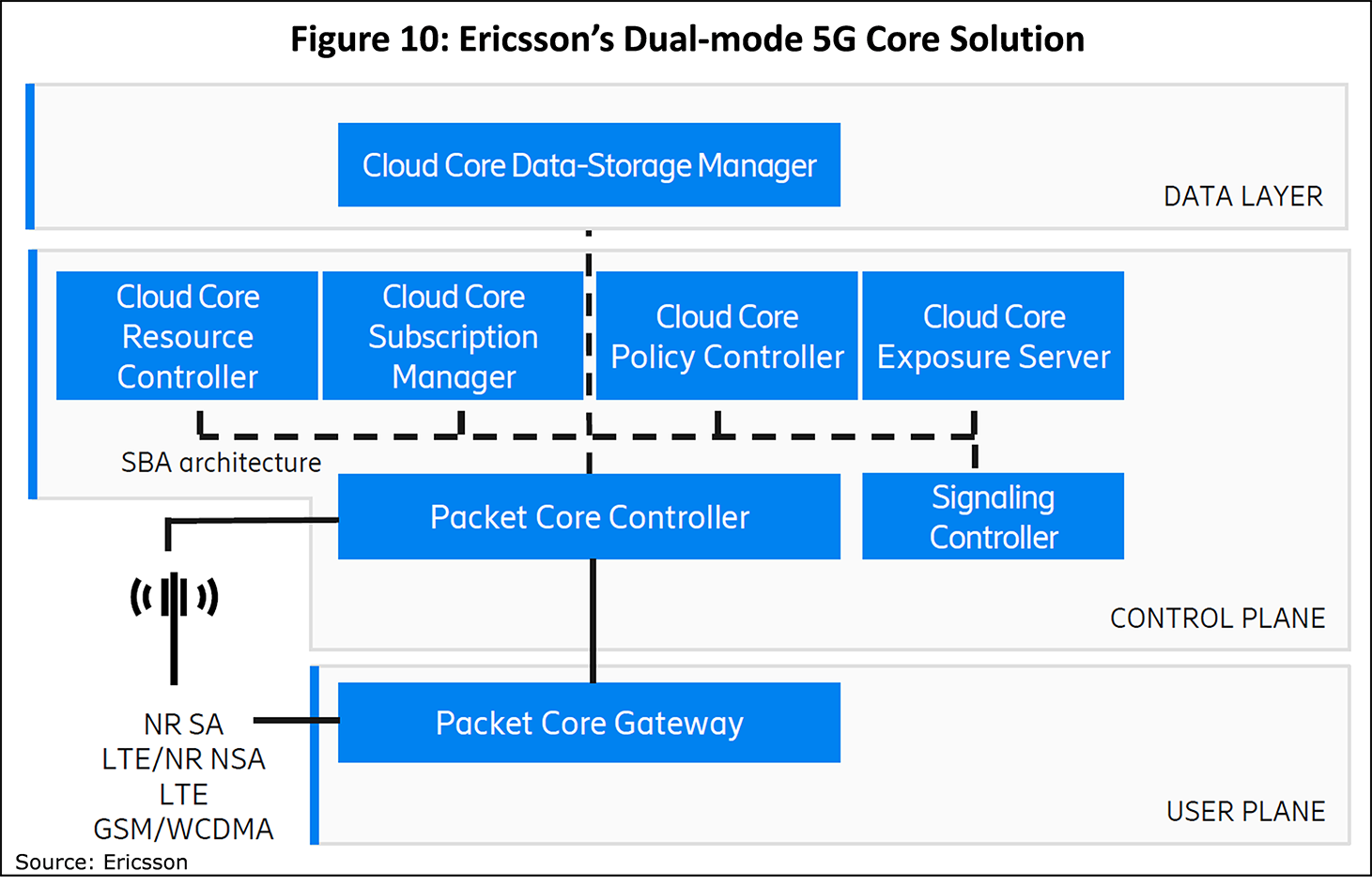

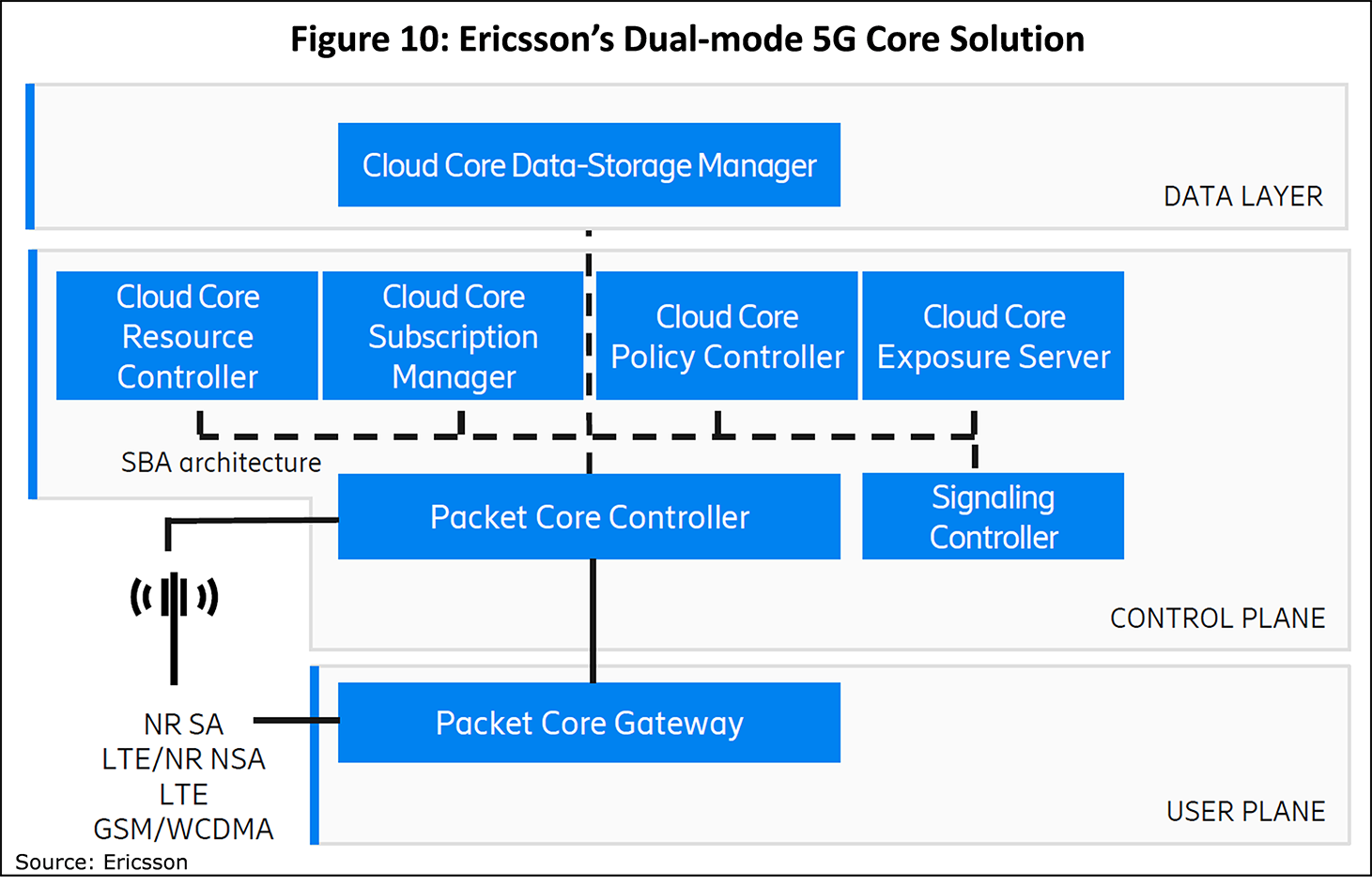

In February 2019, Ericsson introduced at MWC Barcelona a dual-mode, 5G Core that combines EPC and 5G Core network functions into a common Cloud-native platform for efficient total cost of ownership (TCO) and smooth migration to 5G. Optimized TCO is achieved with one core network for 5G as well as earlier generations. Revenue growth is achieved with open APIs for innovation on 5G capabilities, such as network slicing and edge computing. Smooth network evolution is achieved with the protection of earlier network investments with the co-existence of 5G and legacy networks (Figure 10).

In July 2019, Verizon announced a breakthrough proof-of-concept trial. In partnership with Ericsson, the company introduced container-based CNF technology on the core of its active network. The announcement was made in a live network environment in Verizon’s Hillsboro, Oregon market. The first ever container-based wireless EPC technology deployment in a live network, the trial introduced a significantly more efficient way to deliver operational applications that run the network. This solution will increase agility and enable deployment at scale for new services in 4G and 5G.

An August 2019 article in the Ericsson Technology Review explains how TSNs are an enabler of Industry 4.0. Together with 5G URLLC capabilities, the two key technologies can be combined and integrated to provide deterministic connectivity end to end. The article also discusses TSN standards and the value of the TSN toolbox for next-generation industrial automation networks.

In October 2019 at the MWC LA, Ericsson demonstrated end-to-end slicing on a live 5G SA network by slicing the RAN and 5G Core with Ericsson’s Dynamic Orchestrator. This provided the automation necessary to initiate and manage the network slices in real time.

Next, in a December 2019 press release, Ericsson announced that with Telstra, it had reached an industry-first milestone with the first commercial deployment of a container-based CNF Evolved Packet Core for the 4G and 5G NSA networks. This will enable a web-scale core network to deliver the full power of 5G to consumers and enterprise customers in the very near future.

In a February 2020 press release, Ericsson introduced containers on a bare-metal Cloud infrastructure solution to better support the deployment of Cloud-native applications, such as 5G Core. By eliminating the virtualization layer from the cloud infrastructure, complexity and TCO are reduced and SPs benefit from improved hardware efficiency and performance.

Finally, In another February 2020 press release, Ericsson and Audi announced they had successfully tested the 5G URLLC capabilities at Ericsson’s factory lab in Sweden. The next step will be to bring these capabilities to Audi P-Labs in Germany. Replacing wires in automated factories, 5G URLLC increases flexibility in the production and assembly process while also reducing personnel safety risks. At Audi’s P-Labs in Gaimersheim, Germany, Ericsson’s 5G system is already live in a real factory environment. Now, plans are underway to introduce 5G URLLC capabilities to the existing system for more advanced factory automation and personnel safety use cases.

Conclusions

This blog focused on the top-two market share vendors for 5G Core, Huawei and Ericsson. This is not to diminish the achievements of Cisco, Nokia, Samsung, and ZTE. All six manufacturers are poised to launch 5G Core networks with SPs in 2020 in China, South Korea, the U.S., Japan, Europe, and the Middle East. The most aggressive deployments will be in China and Korea.

China Mobile awarded 5G Core contracts in April 2020 totaling $1.3 B to three vendors: Huawei, ZTE, and Ericsson (in rank order). This will eventually be the largest 5G Core network in the world.

Are we ready for 5G Core? The answer is an enthusiastic yes. The journey started at least five years ago with proof of concepts and field trials. With Huawei showcasing early 5G SA commercial applications in 4Q19, the industry has demonstrated that it will start delivering on the promise of 5G, at scale, in the second half of 2020.

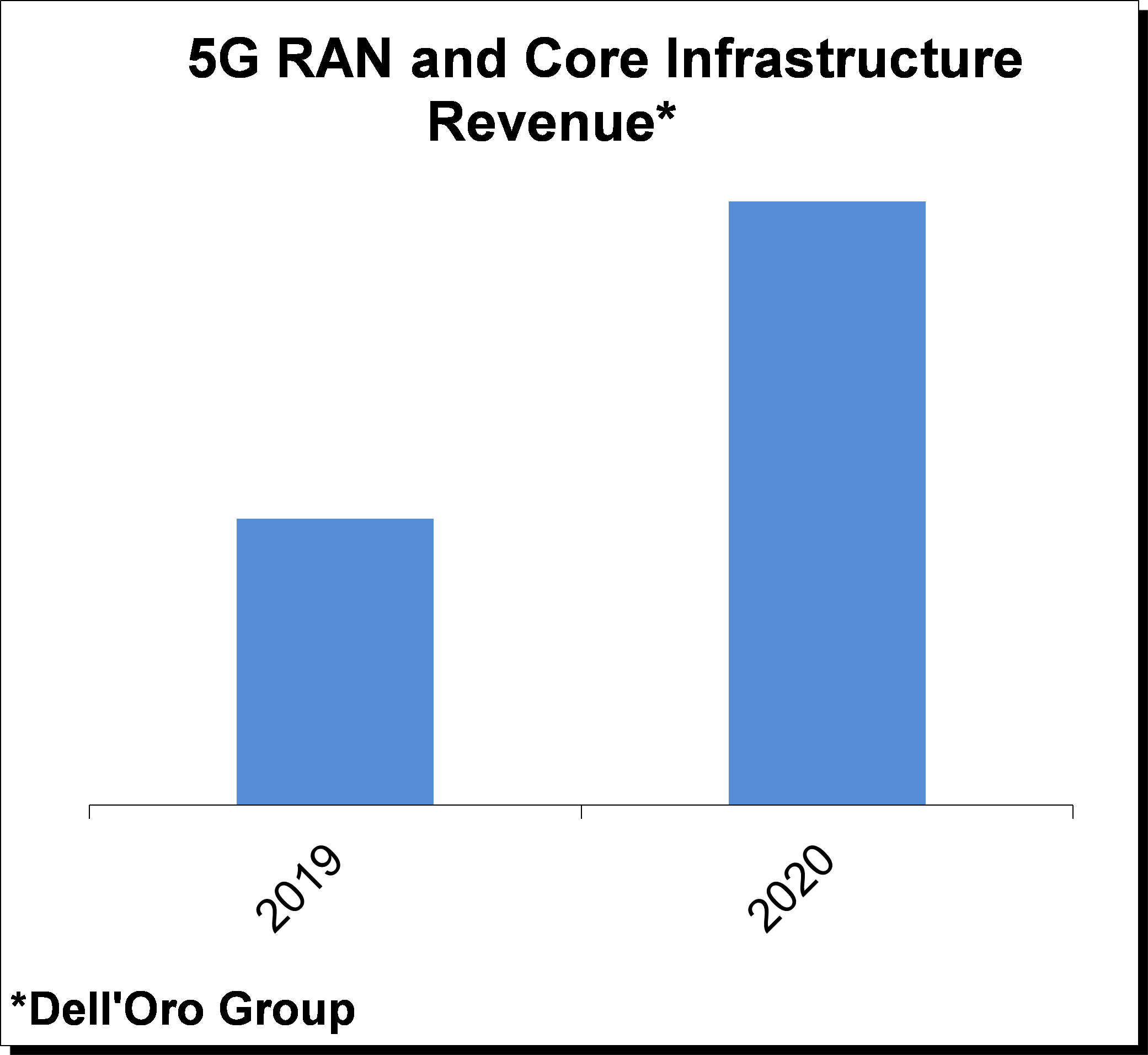

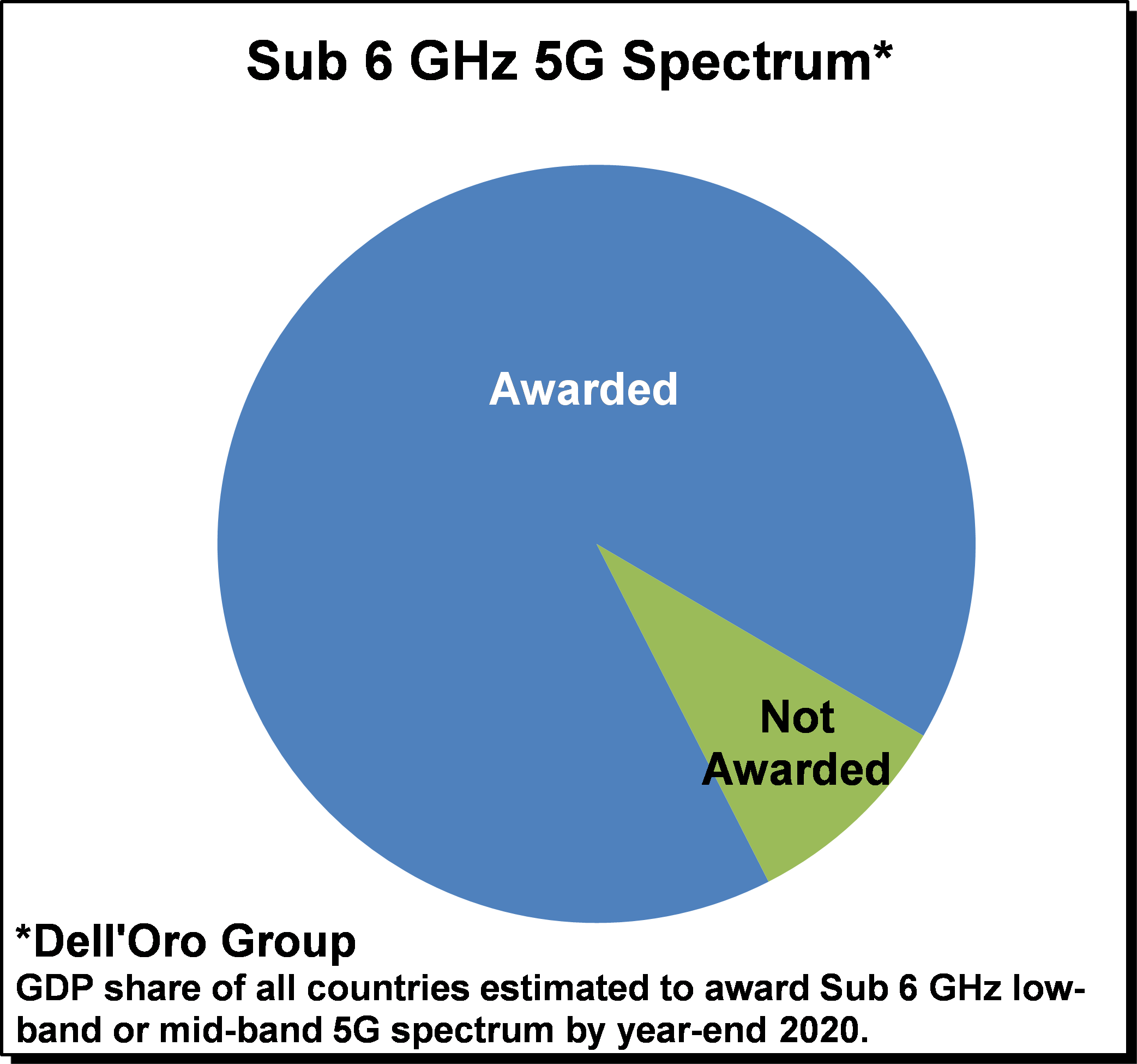

With 5G deployments now accelerating at a torrid pace and 5G NR investments projected to comprise 30% to 50% of global RAN investments in 2020 (Dell’Oro Group), operators are reassessing how to optimize their spectrum resources to capitalize on the potential business and technology benefits with 5G NR. Many countries are realizing the strategic importance of timely 5G deployments spurring governments and regulators to actively release/award 5G spectrum. Even with some minor spectrum auction delays as a result of Covid-19, countries that have auctioned or plans to award sub 6 GHz spectrum by year-end 2020 together comprise nearly 90% of worldwide GDP. At the same time, the amount of spectrum and the type of spectrum that is available varies widely across the globe, prompting operators to effectively capitalize on their respective spectrum assets to build 5G networks with optimal experience.

With 5G deployments now accelerating at a torrid pace and 5G NR investments projected to comprise 30% to 50% of global RAN investments in 2020 (Dell’Oro Group), operators are reassessing how to optimize their spectrum resources to capitalize on the potential business and technology benefits with 5G NR. Many countries are realizing the strategic importance of timely 5G deployments spurring governments and regulators to actively release/award 5G spectrum. Even with some minor spectrum auction delays as a result of Covid-19, countries that have auctioned or plans to award sub 6 GHz spectrum by year-end 2020 together comprise nearly 90% of worldwide GDP. At the same time, the amount of spectrum and the type of spectrum that is available varies widely across the globe, prompting operators to effectively capitalize on their respective spectrum assets to build 5G networks with optimal experience. One of the more compelling features with 5G in addition to the increased spectrum bandwidth that comes with the upper mid-band and the mmW spectrum is the fact that 5G NR offers spectral efficiency improvements on a like for like basis relative to LTE, implying that operators and eventually enterprises can take advantage of these efficiency benefits regardless of their current spectrum portfolio. And in contrast to previous mobile technology transitions, new technologies such as dynamic spectrum sharing, dual connectivity and carrier aggregation across multiple technologies will provide the necessary tools to simplify and accelerate the migration from LTE to 5G NR. This improved flexibility taken together with the efficiency and performance upside with 5G NR plays an important role in the improved market sentiment that has characterized the RAN market in this initial 5G mobile broadband (MBB) deployment phase. While having the right mix of spectrum remains extremely important, the relatively seamless transition enables operators to put parts of the spectrum to use today. It does not matter if the spectrum is optimized for coverage or better suited for capacity or if an operator has a non-ideal portfolio mix of low-band, mid-band, or high-band spectrum. With 5G, operators now have the tools to capitalize on the benefits with the respective bands and put together a roadmap that migrates the portfolio in various phases from legacy 2G-4G to 5G NR.

One of the more compelling features with 5G in addition to the increased spectrum bandwidth that comes with the upper mid-band and the mmW spectrum is the fact that 5G NR offers spectral efficiency improvements on a like for like basis relative to LTE, implying that operators and eventually enterprises can take advantage of these efficiency benefits regardless of their current spectrum portfolio. And in contrast to previous mobile technology transitions, new technologies such as dynamic spectrum sharing, dual connectivity and carrier aggregation across multiple technologies will provide the necessary tools to simplify and accelerate the migration from LTE to 5G NR. This improved flexibility taken together with the efficiency and performance upside with 5G NR plays an important role in the improved market sentiment that has characterized the RAN market in this initial 5G mobile broadband (MBB) deployment phase. While having the right mix of spectrum remains extremely important, the relatively seamless transition enables operators to put parts of the spectrum to use today. It does not matter if the spectrum is optimized for coverage or better suited for capacity or if an operator has a non-ideal portfolio mix of low-band, mid-band, or high-band spectrum. With 5G, operators now have the tools to capitalize on the benefits with the respective bands and put together a roadmap that migrates the portfolio in various phases from legacy 2G-4G to 5G NR.

Given that there is a strong correlation between network services requirements and mobile broadband investments for the more simplified site deployments, this on-going shift towards multi technology sites including both legacy technologies and more complicated 5G solutions that could involve dynamic spectrum sharing and beamforming addressing a wider scope of use cases spanning across potentially multiple industries in combination with the increased site complexity and the need to focus on energy optimization will accelerate the shift towards more intelligent planning/design, operations and predictive analysis.

Given that there is a strong correlation between network services requirements and mobile broadband investments for the more simplified site deployments, this on-going shift towards multi technology sites including both legacy technologies and more complicated 5G solutions that could involve dynamic spectrum sharing and beamforming addressing a wider scope of use cases spanning across potentially multiple industries in combination with the increased site complexity and the need to focus on energy optimization will accelerate the shift towards more intelligent planning/design, operations and predictive analysis.