At this year’s virtual Cable-Tec Expo, four prominent themes have emerged throughout the online panels and technical presentations:

-

- Cable broadband networks have performed incredibly well during the COVID-19 pandemic, with minimal outages and minimal complaints from customers.

- Despite the reliability, there is a clear and pressing need to dramatically improve upstream bandwidth.

- Cable operators’ future is one of business, infrastructure, and service convergence, with their DOCSIS networks serving as the platform for fixed-mobile convergence on a large scale.

- Convergence at all levels will be driven in part by the evolution of a common control and management plane across all networks and services.

I’ve dealt with the first two topics earlier this year in multiple blog posts and articles. Those two themes will certainly continue to evolve and have an impact on cable operator spending and strategic priorities for their access networks for the next year.

With this blog, I do want to spend some time considering the overall impact of convergence on cable operators’ long-term strategic plans, especially when it comes to their desire to become both fixed and mobile network operators.

The FCC’s auction of 3.5GHz CBRS licenses, which concluded in August, yielded few surprises when it came to the leading purchasers of the spectrum. Verizon and Dish Network led all bidders in terms of money spent, with Comcast, Charter, and Cox rounding out the top 5. Other major cable bidders included Mediacom, Midcontinent Communications, Shentel, and Cable One.

Comcast and Charter have been signaling for some time that they intend to build CBRS-based mobile networks in their existing cable footprints in an effort to reduce the amount of money they pay Verizon and other MVNO partners to use their networks. Their MVNO operations were always intended as a way to build a subscriber base and a brand in advance of owning their own wireless networks, even if that meant consistent EBITDA losses.

Cox, which had entered the wireless space a decade ago, only to exit after disappointing results, has signaled its intention to re-enter the wireless market through the purchase of a significant number of CBRS licenses across its cable footprint.

Finally, Cable One has taken an interesting approach, acquiring CBRS licenses but also making investments in two fixed wireless ISPs (WISPs) to provide coverage in rural and less dense areas surrounding its cable footprint.

Though they have no intention, at this point, of becoming national carriers, cable operators can certainly become competitive in their current markets, offering bundles of fixed and mobile services with the goal of reducing churn and stealing away some market share from their telco rivals.

Let’s not forget that the largest cable operators already have a very dense network of millions of Wi-Fi hotspots either through their own doing (Comcast’s Xfinity) or through their CableWiFi Alliance. Additionally, most cable operators have been deploying advanced Wi-Fi gateways in residential and small enterprise locations that typically reserve a single SSID for either open CableWiFi or Xfinity Wi-Fi subscriber access. These hotspots can very easily be turned into 5G small cells, expanding and amplifying mobile network access for their subscribers.

The dense network of hotspots and access points that the largest MSOs already have in place combined with the licensed CBRS spectrum that they have acquired should give them access to 150MHz of spectrum that they can reuse across a larger number of subscribers per individual access point.

But that type of spectrum reuse will only be possible with a vast and far-reaching deployment of CBRS small cells. In fact, according to a fascinating paper by Cisco’s John Chapman presented at Cable-Tec Expo, it “can take 200 CBRS small cells to cover an area equivalent to the area covered by one LTE macrocell.”[1]

Though the deployment of such a huge number of small cells seems daunting and costly at first, Chapman goes on in his paper to show that existing and future DOCSIS networks are completely up to the task. Firstly, a large percentage of small cells deployed by cable operators will be strand-mounted, drawing power from the existing HFC plant. Those strand-mount small cells will be deployed in conjunction with small cells located in residences to expand coverage and capacity, such that cable operators could expect to see a small cell count of anywhere from 1 to 80 per optical node, depending on the density of the area being covered, the average span length, and the number of mobile subscribers being served.

Cable operators are very accustomed to thinking about their networks as a shared resource among households and subscribers and then adding capacity when utilization rates remain consistently above 70% for any particular service group. As MSOs have been pushing fiber deeper into their networks, reducing the average number of amplifiers per node, and deploying DAA nodes in an effort to improve MER (Modulation Error Ratios,) they have prepared themselves for an access network that can handle the variable requirements of both fixed and mobile traffic.

Chapman points out in his paper, DAA nodes and CBRS small cells are essentially performing the same function: They are both RF gateways that convert RF traffic to IP over Ethernet. As cable operators continue to add capacity to their networks by pushing fiber deeper and reclaiming spectrum used for broadcast video (which they have been actively doing during the COVID-19 pandemic,) there is more than enough bandwidth to backhaul fixed and mobile broadband traffic over their existing DOCSIS infrastructure. Furthermore, with the introduction of low latency DOCSIS and the new LLX (Low Latency Xhaul) protocol, the overall DOCSIS network can deliver the 2ms of latency mandated by today’s 5g services.

Finally, today’s virtual CCAP platforms are already evolving to provide flexible data and control plane functions across cable operators’ converging fixed and mobile networks. Services like DOCSIS, 1588 and SyncE, BNG, as well as PON, can all be containerized and isolated either physically or logically, depending on the operator’s preference. The virtual CCAP becomes the centerpiece for the control and management of a diverse collection of media gateways located in the outside plant, including DAA nodes, CBRS small cells, PON OLTs, Wi-Fi access points, and cable modems.

Cable’s path to convergence is clearer now than it ever has been, from a business and service perspective to an infrastructure perspective. Chapman summarizes his paper with two (of a number) of points:

- Today’s cable operators are tomorrow’s mobile operators

- Behind every great wireless network is a great wireline network

I am in complete agreement with him and would add that the efforts being made by vendors to realize this at the control and management planes suggest that they agree, as well.

[1] John T. Chapman, “Small Cell Traffic Engineering: How Many Small Cells are Needed for Proper Coverage,” SCTE Cable-Tec Expo, October 2020.

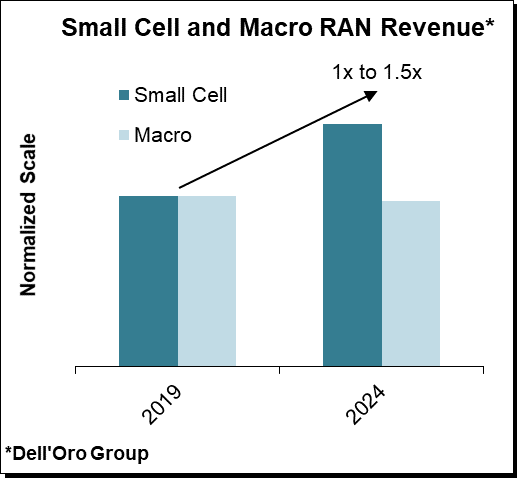

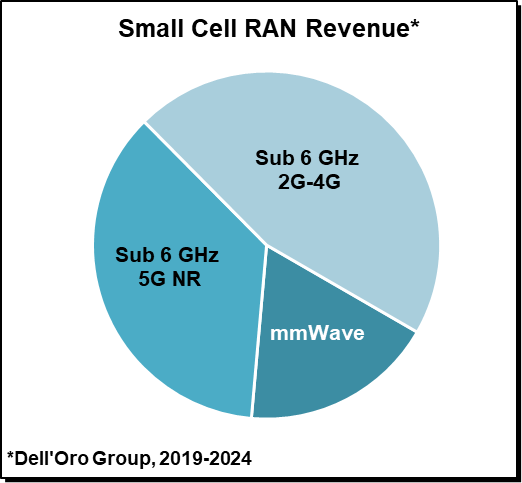

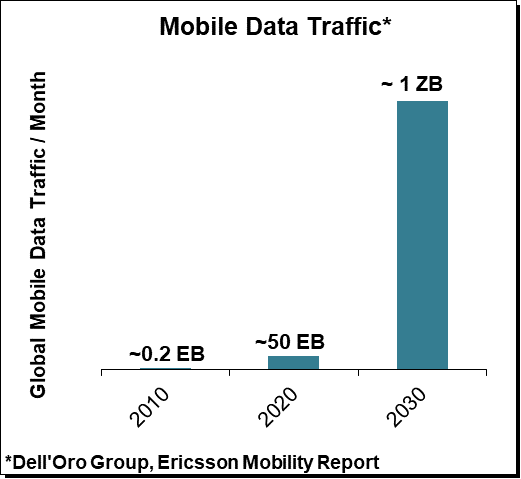

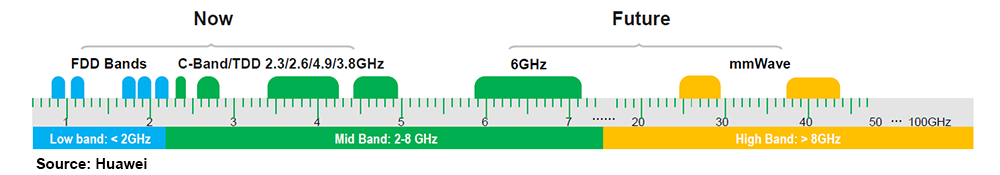

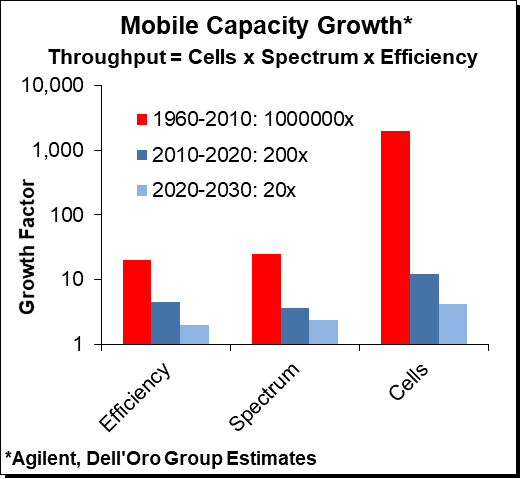

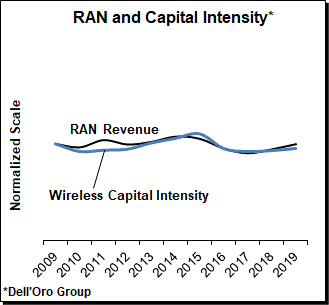

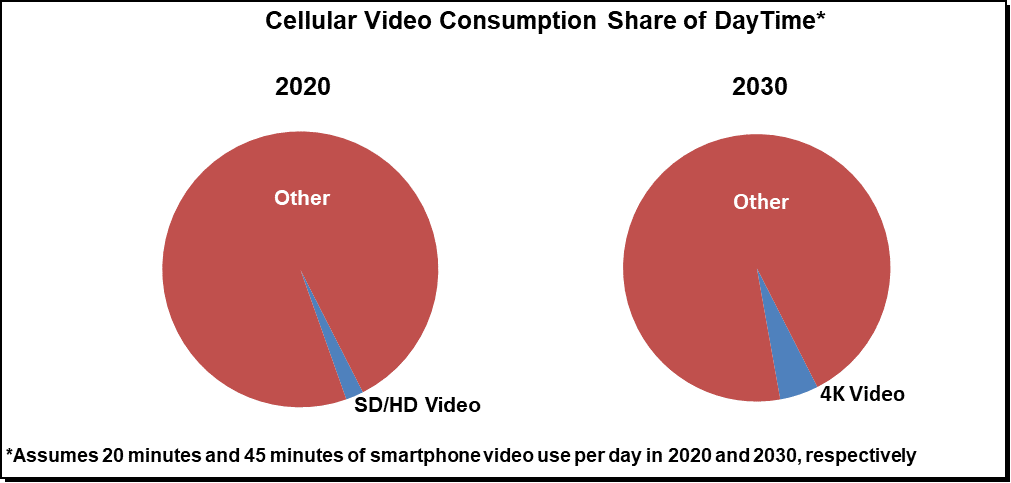

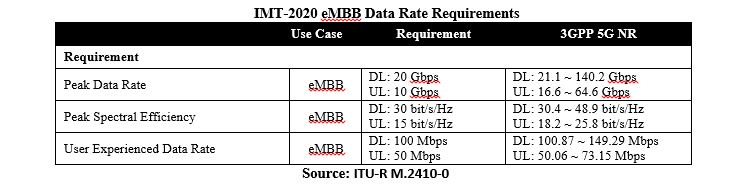

With 5G now being deployed at full speed in the sub 6 GHz spectrum utilizing both the low-band and the upper mid-band, the focus is shifting to the next spectrum frontier. Even if the upper mid-band in conjunction with Massive MIMO has been a tremendous success story both from an economic and technical perspective providing far more aggregate capacity and throughput upside at a much lower capex than initially envisioned, the baseline scenario suggests mobile data traffic is projected to advance another 15x to 25x over the next decade, surpassing 1 Zettabyte (ZB) per month by 2030. While Massive MIMO and the sub 6 GHz spectrum will go a long way delivering another 5x to potentially 15x of upside, it will likely not be enough to meet the capacity demands of the next decade given the economic constraints the operators are facing.

With 5G now being deployed at full speed in the sub 6 GHz spectrum utilizing both the low-band and the upper mid-band, the focus is shifting to the next spectrum frontier. Even if the upper mid-band in conjunction with Massive MIMO has been a tremendous success story both from an economic and technical perspective providing far more aggregate capacity and throughput upside at a much lower capex than initially envisioned, the baseline scenario suggests mobile data traffic is projected to advance another 15x to 25x over the next decade, surpassing 1 Zettabyte (ZB) per month by 2030. While Massive MIMO and the sub 6 GHz spectrum will go a long way delivering another 5x to potentially 15x of upside, it will likely not be enough to meet the capacity demands of the next decade given the economic constraints the operators are facing.

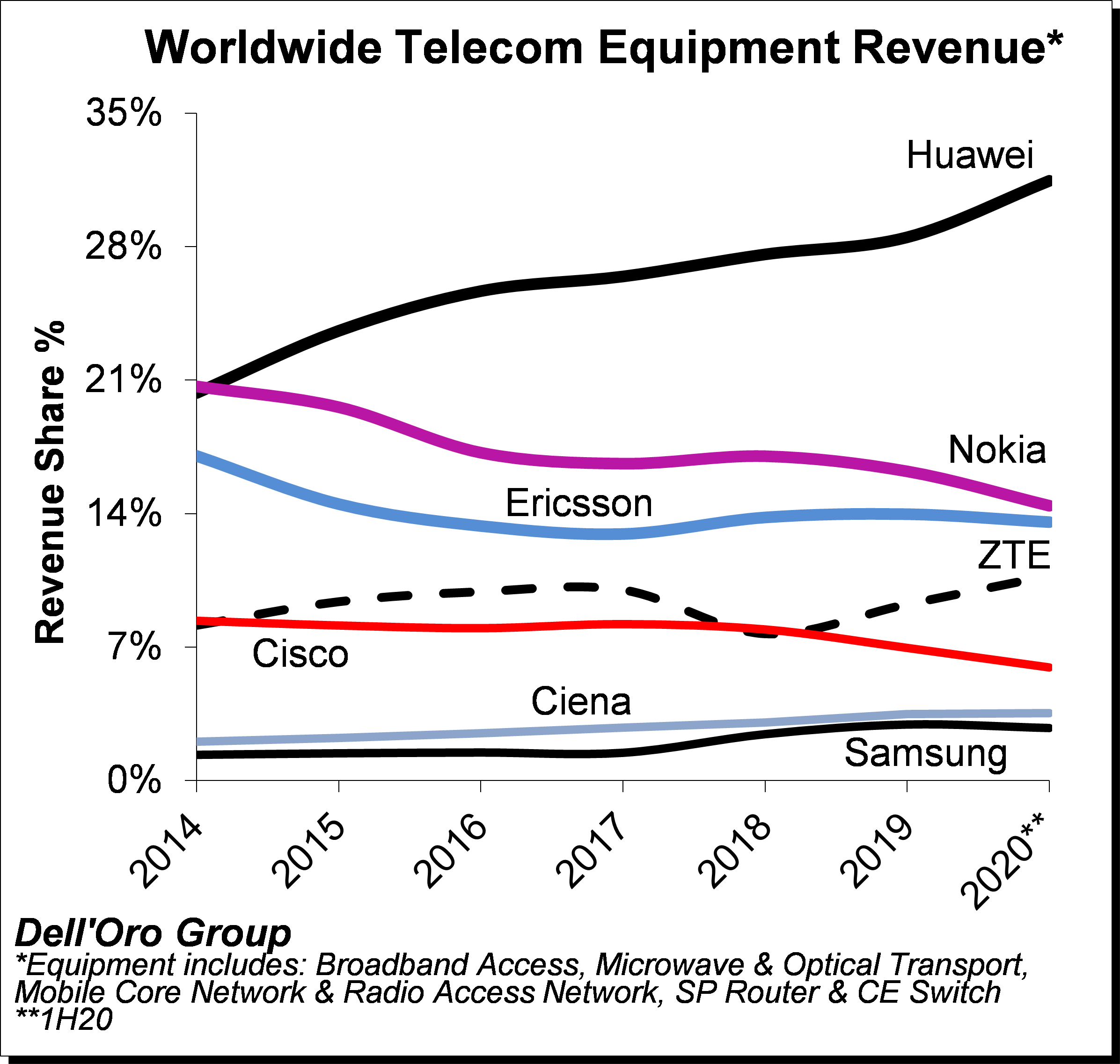

Preliminary readings suggest revenue rankings remained stable between 2019 and 1H20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers. At the same time, revenue shares changed slightly as the Chinese suppliers benefited from large scale 5G rollouts in China.

Preliminary readings suggest revenue rankings remained stable between 2019 and 1H20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers. At the same time, revenue shares changed slightly as the Chinese suppliers benefited from large scale 5G rollouts in China.