400 Gbps Market Demand

A significant shift towards 400 Gpbs-capable routers is underway, driven by the global need to upgrade IP backbones. In the first half of 2022, 400 Gbps router port shipments grew over 140% Y/Y, and we expect that momentum to continue through 2026, with revenues increasing from 15-20% of total router port revenue in 2022 to 30-35% by 2026.

We estimate the market opportunity for 400 Gbps-capable routers at roughly $17 B for the five-year period from 2022 to 2026. The combined market opportunity for the 400 and 100 Gbps-capable routers is estimated to exceed $36 B for the same period, as network operators continue to deploy 400 Gbps ports to deliver 4×100 Gbps connections using breakout modules and adapters, as well as software activation keys.

Internet backbone/IP backbone network upgrades represent the highest demand for 400 Gbps routers because the Internet backbone includes both Cloud and Telco service provider (SP) networks and transports traffic from Mobile and Broadband service networks and Cloud infrastructure. We expect that most 400 Gbps router ports will be deployed in IP backbone networks over the next five years and that 400 Gbps technology will lead the next phase of internet backbone expansion.

Largest Buyers

We believe that Cloud SPs were the first to adopt 400 Gbps routers, beginning with large-scale backbone network deployments in 2021. As they aggressively enrich their service offerings and expand their customer bases, we believe that Cloud SPs are expanding their network infrastructure faster than Telco SPs. However, the market opportunity generated by Cloud SPs is relatively small compared to that of Telco SPs. Over the next five years, we estimate that Cloud SPs will account for about a third of the Core Router Market.

Telecom SPs are adopting 400 Gbps technology on a large scale by deploying 400 Gbps routers in diverse network topologies and in a range of configurations to accommodate a variety of service offerings. Telco SP networks and service offerings are more mature than those of Cloud SPs. Because of the different network topologies and purposes, the demand drivers for Telcos deploying 400 Gbps routers in their networks are unique, as well. Telco SPs typically do not rip and replace network equipment but rather gradually upgrade outdated devices and expand capacity when needed.

Driving Forces Behind the 400Gbps Router Adoption

Network operators are now adding 400 Gbps ports in their backbone networks for two primary reasons: economic efficiency and increased traffic levels. By using the newest generation of high-capacity ASICs, 400 Gbps routers offer the benefits of higher speeds per port with decreased energy consumption, thus reducing the total number of ports required and, in turn, the size of the chassis, saving valuable rack space. The higher speed per port also lowers the cost per bit per port, because the cost of one 400 Gbps port is typically lower than the cost of four 100 Gbps ports. Combined with the reduced energy consumption and the smaller, space-saving format of the router, transitioning to 400 Gbps ports enables SPs to make more economically efficient investments and lower operating costs.

Before 2021, Telco SPs did not make substantial investments in core networks to accommodate the significant traffic growth that occurred during the Covid-19 pandemic. Contrary to general expectation, traffic volumes in SP networks have not fallen to pre-pandemic levels as the pandemic has eased. We believe that many SPs are investing to reset capacity and align their networks to satisfy traffic growth expectations. We predict a rapid growth in demand for 400 Gbps routers that will transform network capacity over the next five years.

Capacity Demand on the Rise

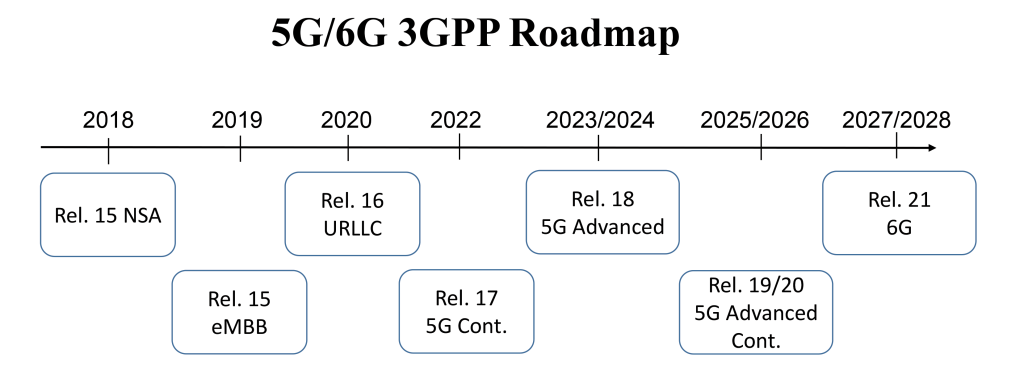

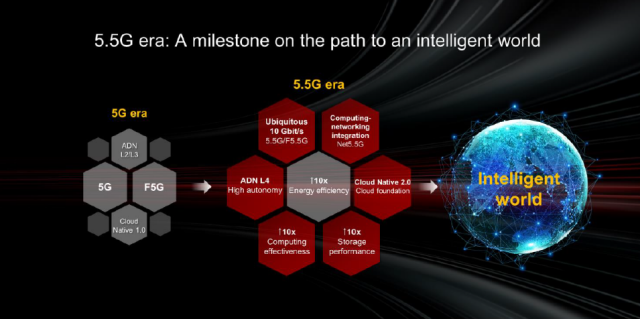

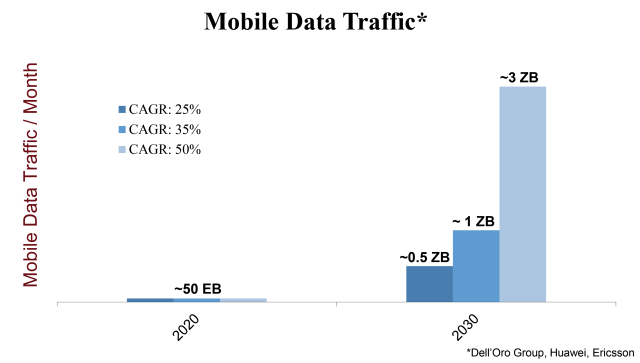

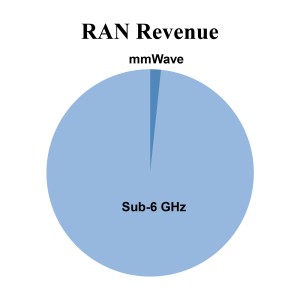

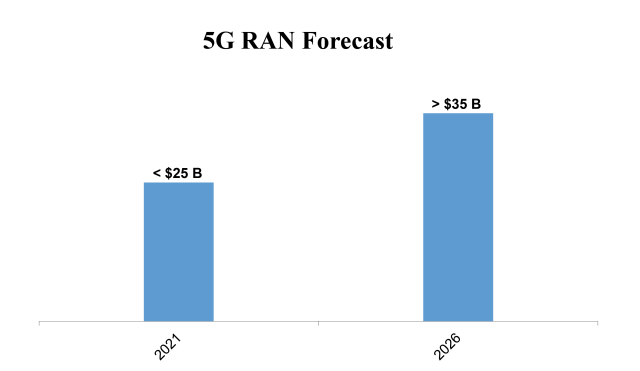

5G RAN deployments are leading to a rapid expansion of mobile networks, with a two-fold effect. First, mobile SPs need to expand their mobile transport networks and are deploying 400 Gbps routers to do so. Second, 5G technology enables higher mobile internet connection speeds, which encourage mobile network customers to consume data-heavy media content and thus drive up traffic volumes in SP networks.

Major broadband SPs around the world are expanding their fiber infrastructure buildouts by taking advantage of government subsidies along with substantial private investments. According to Jeff Heynen, VP analyst for Broadband Access & Home Networking, fiber homes passed goals for many operators are easily double or triple their homes passed currently. The net result will be a massive shift to fiber broadband over the next decade, with baseline speeds of symmetric 1-5 Gbps per household.

Work-from-home and hybrid work models, along with online learning models established during the pandemic, are sustaining and continuing to drive increasing numbers of broadband subscriptions, which also result in higher network traffic levels. Fixed broadband subscriptions in homes and businesses have now been cemented as an essential service. Although it was expected that broadband subscriptions would decline as workers returned to their offices and students returned to school, subscriber additions accelerated throughout 2021 and into 1H22.

Media content services offered by Cloud SPs are also driving the growth of Telco SP network traffic. Cloud-based video, music streaming, and gaming platforms—such as Netflix, Google TV, YouTube, Amazon Prime, and Spotify—require high-speed (high-bandwidth) internet connections and typically create a high volume of internet traffic across Telco SP networks.

Given the expected traffic growth across backbone networks around the world, we believe the increasing adoption of 400 Gbps-capable routers by Cloud and Telco SPs aiming to improve economic efficiency and optimize network capacity will transform the SP Router market and lead the next phase of internet backbone expansion.