2022 marked a record year for broadband spending around the world, as service providers forged ahead with major network upgrades and expansions. In many cases, the focus of these investments was to expand the reach of fiber for business and residential services with the ultimate aim of de-commissioning legacy copper and DSL networks.

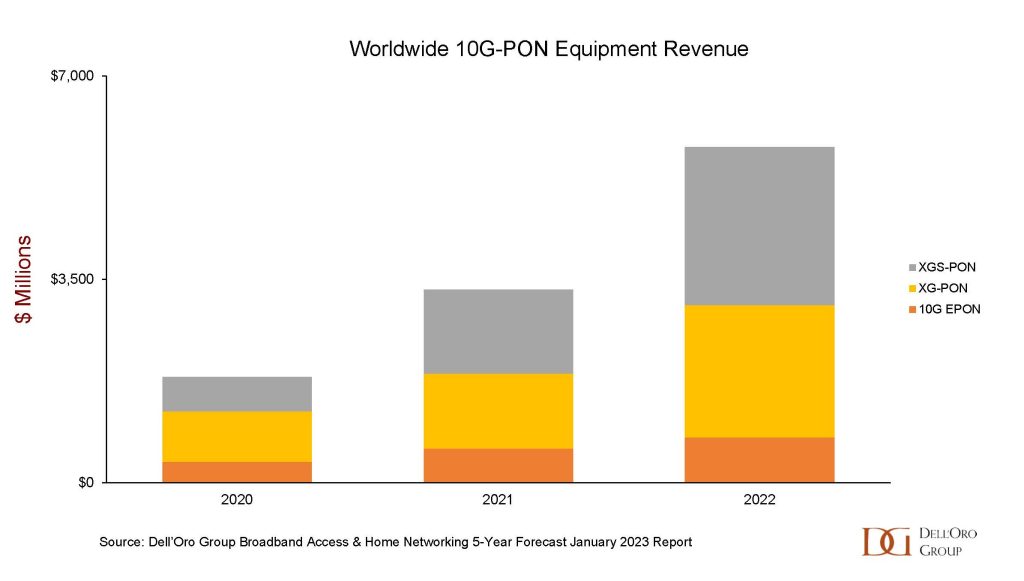

A major part of these network upgrades was the investment in PON technologies with the ability to deliver 10Gbps of bandwidth across a single OLT port, which is then shared by dozens of subscribers. The short-term goal is to be able to deliver symmetric 1-5Gbps of bandwidth consistently to each residential subscriber. The focus on delivering these speed tiers has resulted in a significant jump in the purchasing of 10Gbps-capable technologies, including 10G EPON, XG-PON, and XGS-PON. From 2020 to 2022, spending on OLT platforms and ONTs supporting 10Gbps technologies jumped 308% (Figure 1).

Figure 1: Worldwide 10Gbps-Capable PON Equipment Revenue

While these technologies will serve most operators well for the next 5 years operators in a growing number of markets want to ensure that the significant investments they are making today in expanding their fiber networks and ODN won’t be regrettable investments and that there is a technology roadmap in place that keeps them ahead of their competition in terms of speeds and latency, but also allows them to achieve a number of architectural goals, including delivering both residential and enterprise services using the same technology and ODN; collapsing access and aggregation networks to reduce the total number of network platforms; providing a simplified upgrade path through co-existence of multiple PON technologies, and; delivering wholesale mobile transport services.

Bandwidth demands show no signs of slowing, with the ITU having estimated that worldwide bandwidth consumption grew at a compound annual growth rate (CAGR) of 50% from 2015 to 2021, reaching a total of 932 Tbps, up from 719 Tbps in 2020. With governments and operators alike focused on expanding their networks to get more homes and businesses connected, as well as applications like virtual reality (VR) and online gaming set to expand, bandwidth consumption will almost certainly accelerate throughout the remainder of this decade.

For some operators in highly-competitive environments, 25G PON is the appropriate next step, as short-term demands for bandwidth beyond 10Gbps and for the need to address both residential and business customers from a single ODN push them to act within the next 1-2 years.

Meanwhile, the ITU-T’s 50G PON Standard and corresponding prototype platforms and components continue to evolve quickly, as operators and equipment vendors look to accelerate the availability of products so that they can undergo the rigorous testing and homologation required of any new technology. Considerable effort has already gone into defining the physical layer parameters, latency requirements, and Forward Error Correction (FEC), among other elements.

Already, a number of operators have either conducted early lab trials of prototype equipment or have endorsed the technology as their next choice, including China Mobile, China Telecom, China Unicom, Globe Telecom, Orange, Saudi Telecom, Swisscom, Telefonica Spain, Telekom Malaysia, and Turkcell. Other operators are keeping an eye on the standardization process but are also largely focused on their current rollouts of XGS-PON to make any formal commitment beyond that.

Additionally, a component ecosystem is emerging quickly, driven largely by system vendors who want to get products to market quickly, as operators want to be absolutely certain that the power budget requirements and dispersion penalty, along with the use of digital signal processors (DSPs) does not force any change in the existing ODN.

Recent Steps Forward

A number of major steps forward for 50G PON were announced in September 2022, during the ITU-T Study Group 15’s Plenary Meeting. The most significant announcement was the agreement on details for the simultaneous coexistence of all three ITU PON technologies (50G PON, XGS-PON, GPON) on a single ODN. Previously, simultaneous coexistence with GPON and XGS-PON had not been defined, meaning that operators would have to upgrade their GPON networks to XGS-PON prior to beginning their 50G PON deployment.

With the addition of a third upstream wavelength band (1284-1288nm) to the G.9804.1 standard’s existing 1260-1280 and 1290-1310 bands, 50G PON, XGS-PON, and GPON can now live together on a shared ODN. Additionally, combo PON implementations can now be supported using 50G + XGS-PON, 50G + GPON, as well as all three modes (50G + XGS-PON + GPON).

The support of both simultaneous coexistence as well as combo PON implementations is critical addition as operators have said time and again that they do not want to disrupt their ODNs when moving to a new technology. Additionally, operators are expected to make their transition to 50G PON through the use of combo PON, which takes advantage of the existing space in the central office, requires no modifications to the ODN, and does not require the use of a WDM multiplexing device, which can result in optical power loss.

Challenges Remain

50G PON represents a significant improvement in bandwidth availability and latency over today’s 10Gbps technologies. However, these benefits don’t come without their challenges. The biggest technical challenges are in the PHY layer. Specifically, the optical power budget required, dispersion penalty, and intersymbol interference (ISI) are all potential hazards in 50G PON systems. As bandwidth increases, overall performance typically declines, especially when the existing ODN defines a 32dB power budget. The use of DSP technology can reduce or eliminate these PHY layer issues. However, previous PON technologies did not use DSPs, so operators will want to test this thoroughly and ensure that point-to-multipoint communications between the OLT port and ONTs are occurring as expected and without error. The DSPs specifically help to reduce the dispersion and bandwidth limitation penalty, as well ensuring that lower-bandwidth GPON and XGS-PON ONTs are supported more efficiently.

At this point, current 50G prototypes are asymmetric, delivering 50G downstream and either 25G or 12.5G upstream. Though system vendors are working through the best options for delivering consistent, symmetric speeds and have already delivered some prototypes using semiconductor optical amplifiers (SOA) and FPGA-based DSPs, the ITU-T SG15 agreed back in September 2022 to further study the options for delivering symmetric speeds. Clearly, operators would prefer a symmetric option as early as possible. But the dramatic increase in downstream bandwidth and billboard speeds should more than suffice until the upstream technologies and components have been standardized and implemented in OLTs and ONTs.

Opportunities Continue to Grow

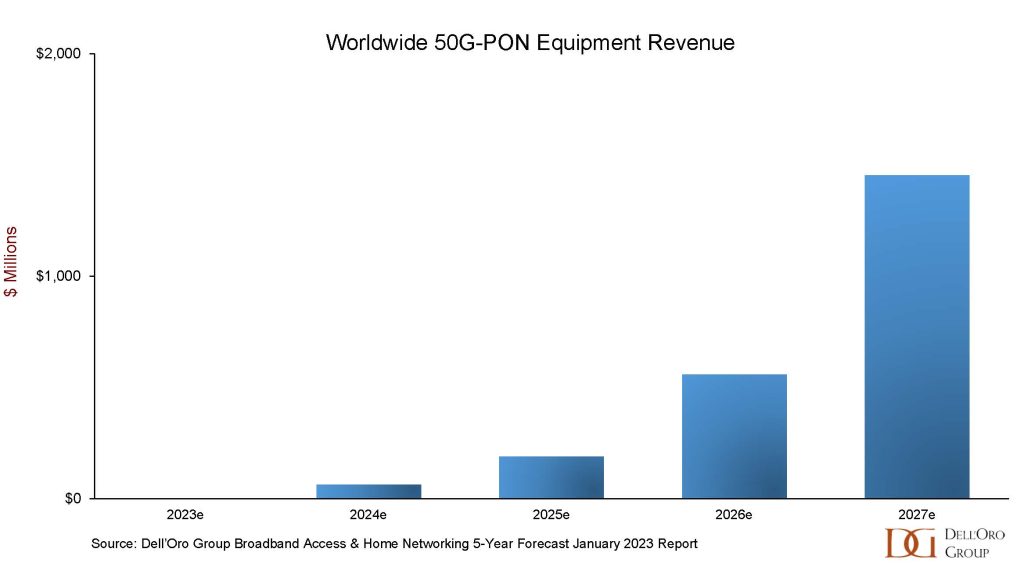

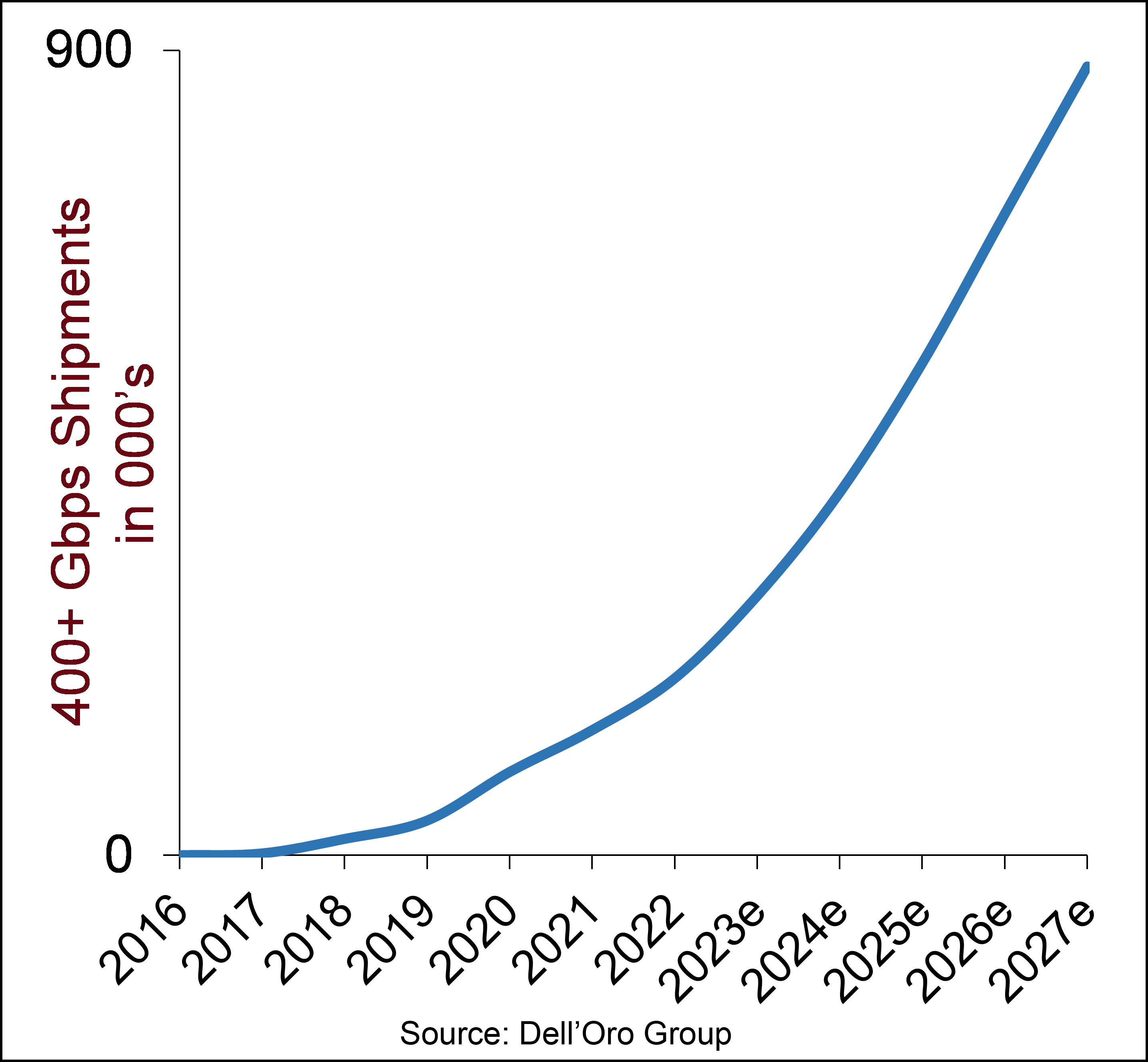

Though early, Dell’Oro Group believes total 50G-PON equipment revenue will increase from less than $3M in 2023 to $1.5B in 2027. Much more significant growth is expected after 2027, as operators begin to evolve their 10Gbps PON networks to next-generation technologies (Figure 2).

Beyond being able to anticipate future bandwidth growth coming from consumer applications such as VR, AR, online gaming, videoconferencing, and 8k video, 50G PON positions operators to address business services. Specifically, 50G PON allows a provider to offer four 10G Ethernet connections, split among multiple businesses. Additionally, 50G PON is ideal for POL (Passive Optical LAN) deployments, where fiber can be run to the desktop and deliver connectivity with less power, rack space, and less cooling than traditional point-to-point Ethernet architectures.

Figure 2: Worldwide 50Gbps PON Equipment Revenue

Similarly, 50G PON has applications in the backhaul of public Wi-Fi hotspots as well as private wireless LANs, both of which will see significant bandwidth growth with the availability and deployment of Wi-Fi 6E and Wi-Fi 7. Wi-Fi 6E allows individual subscribers to burst to 9.6Gbps while Wi-Fi 7 quadruples that throughput to nearly 40Gbps. Additionally, the Wi-Fi 7 standard defines extremely low levels of latency and jitter, which the evolving 50G PON standard is also incorporating.

Finally, as operators continue to converge their residential, business, and wholesale fiber networks onto a single ODN, 50G PON is envisioned as the universal technology to deliver services across those networks. Mobile midhaul and fronthaul applications, expanding IoT devices and services, wholesale fiber access to macrocells, backhaul of fixed wireless access (FWA) nodes—all of these can in theory be delivered using 50G PON. Other applications and use cases are certain to emerge as operators continue to reap the benefits of converting their disparate networks onto a shared ODN, with throughput and services delivered via 50G PON.

There were a number of announcements by service providers confirming that 1.2 Tbps-capable devices are ready, and that they themselves were looking forward to these new high-performance transponders. Three of those announcements were as follows:

There were a number of announcements by service providers confirming that 1.2 Tbps-capable devices are ready, and that they themselves were looking forward to these new high-performance transponders. Three of those announcements were as follows: