Recent shifts in U.S. trade policy, including the implementation and adjustment of tariffs, have introduced uncertainty into global markets. Temporary rollbacks and exceptions—such as reduced rates and product-specific carve-outs—have added to the complexity, particularly in response to market reactions.

As of now, the effective average tariff rate on U.S. imports is estimated at 27%, the highest level since the early 20th century, reflecting broader efforts to recalibrate trade dynamics. Accordingly, a key question from clients remains: how will changing tariff policies affect broadband deployments and the demand for related equipment?

Given the frequent adjustments to trade policy—including recent exemptions for smartphones, consumer electronics, and certain GPUs—it remains challenging to forecast the full extent of the impact on broadband infrastructure in the near term.

What follows are our best estimates as to the impact tariffs will have this year and beyond on the broadband market:

1. In the US, tariffs will have minimal impact on most fiber broadband equipment pricing and deployments.

Key fiber broadband equipment providers in the U.S. have already moved most of their assembly and manufacturing to the U.S. in order to adhere to the BABA (Build America, Buy America) waiver of the NTIA’s BEAD (Broadband Equity, Access, and Deployment) program. Though not all of the products being deployed in broadband access networks have been onshored, the most commonly deployed components—PON OLTs, ONTs, cabinets, and fiber-optic cable—have already been self-certified by the respective vendors and have already seen substantial increases in domestic manufacturing.

Beyond BABA, some major operators have multi-year purchase agreements in place for fiber-optic cabling and connectors that should protect them from any impact of tariffs on the import of silica and other raw materials used in the manufacture of fiber cables. For example, in 2024, AT&T signed a $1 billion multi-year agreement with Corning to ensure a stable supply of fiber cable and connectivity solutions. Originally intended to safeguard against supply shortages, this move now also serves to mitigate the risk of rising component costs.

2. Unlike FTTH, cable outside plant upgrades in support of DOCSIS 4.0 are likely to be impacted.

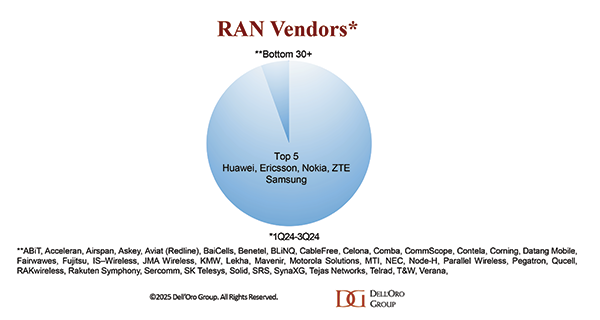

Commscope, which manufactures amplifiers and outer outside plant components in Mexico, and Teleste, which manufactures amplifiers in Finland, will both be impacted by tariffs at any level. We suspect that these manufacturers are either looking to relocate these facilities or manufacturing to the US or are seeking waivers in order to satisfy growing demand from Comcast, Charter, Cox, and others. The relocation of manufacturing is no trivial task and will introduce shipment delays beyond the inventory both already have in their warehouses. The time it takes to move manufacturing is a primary argument for the more gradual introduction of tariffs as opposed to introduction and implementation on the same day.

Additionally, Vecima Networks, which is delivering GAP (Generic Access Platform) nodes to U.S. operators, has already signaled that tariffs will also be materially significant at any level. The net result for cable operators pursuing DOCSIS 4.0 is additional deployment delays as well as increased equipment prices.

3. Residential Wi-Fi routers will feel an impact.

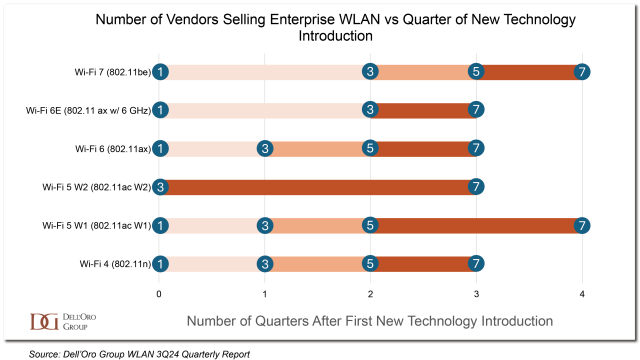

Just as Wi-Fi vendors are looking to ride the wave of Wi-Fi 7 penetration into more homes and businesses, tariffs at any level will easily increase the retail cost of even the most popular Wi-Fi brands by anywhere from 5 to 15%. China, Taiwan, and Vietnam are the manufacturing sources for the vast majority of these devices and, although these devices have been exempted from the tariffs as of Friday night, the likelihood of those full exemptions remaining is very slim, in our opinion.

4. Indirect impacts of tariffs and forecast adjustments.

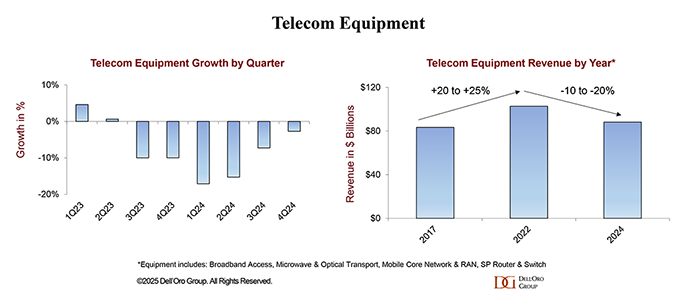

The challenge for all industries now is that they simply cannot unsee what has already happened. The state of economic recovery in many countries and industries was already fragile after dealing with the supply shock of the COVID-19 pandemic, which introduced accelerated levels of inflation that were only exacerbated by government policies designed to stimulate economies. Those macroeconomic challenges were felt acutely in telecom equipment purchasing as service providers overbought capacity in 2022 and early 2023 and then had to focus on drawing down those inventories, putting pressure on their equipment vendors to sustain themselves during the spending slowdown. Just as these businesses are set to rebound and return to more normalized and consistent purchasing levels, tariffs are introduced, making the road to recovery cloudier.

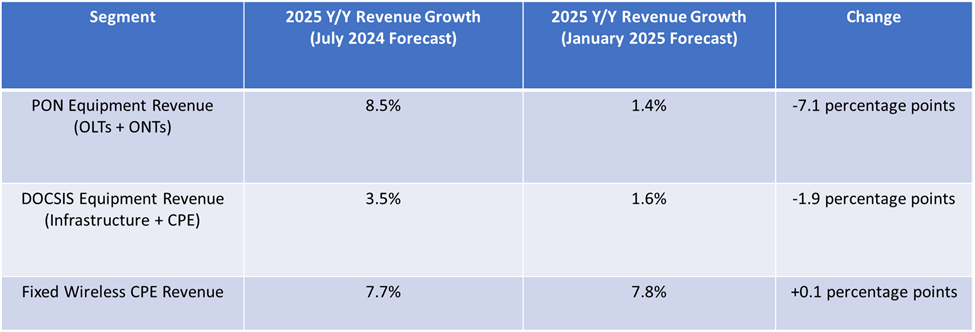

In our January 2025 forecast, we had already reduced our expectations for North American broadband equipment spending from our July 2024 forecasts. These adjustments accounted for moderate tariff increase of 15-30% for imported electronics, semiconductors, and other components from China. However, the broader scope of tariffs, which now includes countries like Vietnam and India, exceeds our initial expectations.

However, the tariffs and their resulting costs passed on to end customers actually play only a small role in the forecast changes. The expectation that the BEAD program would come under review and delay the initiation of select fiber projects also played a role in our forecast reductions. Though we were expecting a very limited amount of BEAD funds to actually flow through to broadband equipment providers in 2025, we did expect to see some in the fourth quarter. Now, we highly doubt any money will be spent on OLTs or ONTs this year, instead pushing the spend well into 2026.

The bigger concern we had going into 2025 was the uncertainty among consumers and businesses alike about what impact the new administration’s policies would have on overall spending and investment patterns. After two years of steady inflation and higher interest rates, US consumer confidence was already trending downward. Consumer debt levels were rising and stubbornly high mortgage rates limited the number of new homes being purchased, as well as overall refinancing. With consumer spending in the US typically 68% of GDP, any further decline in confidence could result in consumers pulling back from spending.

And that is where the maelstrom around tariffs this past week has left consumers very concerned about what the immediate future holds for them. That uncertainty is likely to result in consumers either maintaining their current spend on broadband services or downgrading those services to save some money each month. The combination of consumers managing their communications budgets more tightly, fewer new home purchases, and less moves all means it will be incredibly difficult for broadband providers to continue to grow residential ARPU.

Lack of ARPU growth could result in some delays in planned upgrades from GPON to XGS-PON or from DOCSIS 3.1 to DOCSIS 4.0, for example. But it won’t stop the continued buildout of fiber networks in both greenfield and overbuild scenarios, because those are long-term investments with decades-long returns. Even if the cost to pass and connect homes increases due to tariff-induced price increases, the fiber strategies of major operators including AT&T, Frontier, Lumen, and others aren’t going to change.

Broadband and mobile bundling will undoubtedly accelerate this year as telco and cable operators try to lock in subscribers early with aggressive pricing and incentives on mobile services. Those moves will eat into ARPU growth, as well. But service providers will forgo some margins in the short-term in order to expand their subscriber base when the market volatility subsides.