In this annual forecast blog covering our network security and SASE/SD-WAN services, we explore a pressing question for 2024: Will 2024 be the year traditional firewalls and branch access routing die in favor of SASE? As we embark on a new year, it’s crucial to examine how these longstanding network security and connectivity pillars are expected to respond to the rapid advancements and growing adoption of SASE (which we see as the combination of SSE and SD-WAN). Let’s dissect how these adjacent markets are expected to behave in 2024 and influence each other to reveal a complex narrative of give and take.

Firewalls Won’t Die in 2024 but Will Continue to Take Some Body Blows

In 2024, the overall firewall market is set to experience a modest, low-single-digit growth, mirroring its performance in 2023. This steady yet subdued growth trajectory reflects the market’s resilience amidst evolving challenges and the shifting landscape of network security. For example, after weathering a significant 16% drop in 2023, the high-end firewall market is expected to rebound slightly with a single-digit increase in revenue. This recovery, although modest, signals a stabilizing trend under the influence of broader economic conditions and a restart of purchasing by service provider customers.

Conversely, the midrange firewall market anticipates a single-digit decline in 2024 after growing solidly in 2023. This downturn highlights a shift in the fortunes of a wider swath of the enterprise market, which is expected to return to earth after robust growth in the past couple of years. The low-end firewall segment, in contrast, is forecasted to see a marginal 1% growth. This limited increase points to the segment’s challenge in adapting to the growing preference for cloud-based alternatives and the evolving requirements of hybrid work environments.

On a brighter note, the virtual firewall market is poised for a significant surge, expecting a nearly 40% increase in revenue in 2024. With impressive growth, it will represent nearly 15% of the overall firewall market, underscoring the sector’s growing importance in a cloud-centric world and its adaptability to protect distributed, dynamic environments.

Despite the varied performance across these segments, the overall firewall market’s persistence in achieving low single-digit growth in 2024 suggests a continued relevance and necessity for firewalls in network security, albeit in an evolving role and form.

Access Routing Will Become a Shell of its Former Self in 2024 if Cisco Gets Their Way in the SD-WAN Market

Access routing, a mainstay in enterprise networks, is undergoing a dramatic transformation, largely influenced by Cisco’s strategic push towards SD-WAN. With the sunsetting of its successful ISR 4k access routers and the introduction of the Catalyst 8000 series, which are optimized for SD-WAN, Cisco is steering the market towards SD-WAN. This shift marks a significant pivot from traditional access routers to more agile, software-defined networking solutions.

The impact is stark: access router revenue is expected to drop by over 30% in 2024 to $1.4 billion. This seismic shift underscores the industry’s rapid adaptation to the changing needs of enterprise networks, favoring flexibility and cloud integration over traditional hardware-centric models. As SD-WAN gains prominence, it’s clear that access routing, as we know it, is on the brink of a fundamental change.

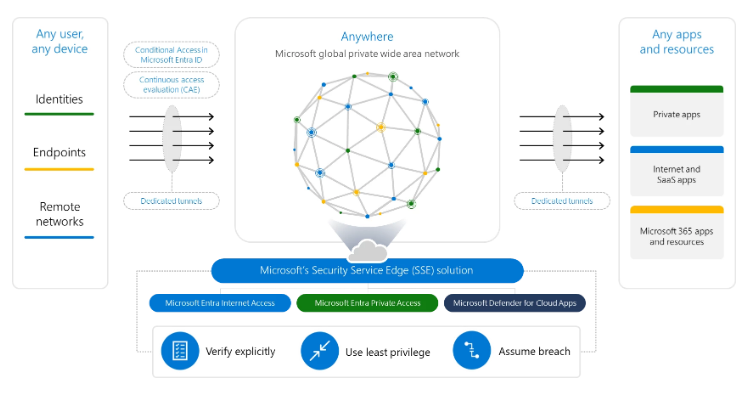

SASE Will Buck Market Uncertainty and Crack $10 B for the First Time

In 2024, the SASE market is expected to continue its upward trajectory, bucking broader market uncertainties and achieving a record-breaking milestone of $10 billion. This growth underscores the rising importance of SASE as a cornerstone in modern enterprise networking and security strategies. The surge in SASE’s popularity is driven by its ability to seamlessly combine SD-WAN networking with SSE security into an integrated service. This integration increasingly appeals to enterprises seeking efficient, streamlined, and secure network infrastructures, especially in an era of distributed workforces and cloud-centric IT models.

2024 will stand as a landmark year for SASE, not just in terms of technological adoption but also as a strategic response to the evolving needs of modern network environments. Reaching the $10 billion mark is a testament to its growing significance and the industry’s shift towards integrated, agile, and cloud-centric network solutions.

As we analyze the trajectories of firewalls, access routing, and SASE in 2024, it’s clear that we’re witnessing a period of significant transition in the enterprise network and security landscape. Traditional firewalls and access routing are being redefined and challenged by the rising tide of SASE, which offers a more integrated, flexible, and cloud-centric approach.

This evolution is not just about technological change; it reflects a deeper shift in how enterprises view and manage their networks in an increasingly cloud-dominated, hybrid work environment. While traditional solutions will not vanish overnight, their role and relevance are being reshaped in the face of these emerging paradigms.