Scoring 2021 Predictions and Looking to 2022

Happy New Year! It’s an excellent opportunity to reflect on our 2021 predictions and share what we believe 2022 has in store. First, though, we need to temper our enthusiasm for projection by the fact the Covid pandemic continues to throw unexpected curveballs. Let us hope that the latest omicron variant is one of the last, if not the last. Nonetheless, let’s take stock and grade our predictions from a year ago first.

A year ago, we made three predictions for 2021:

- Enterprises will embrace the Work Anywhere securely mentality and make cloud-native SASE solutions mainstream

- Cloud-centric security will continue to grow faster than the overall market

- Firewall revenue will rebound after a meager 2020

On our first prediction, we can definitively say that enterprises embraced Work Anywhere based on the pandemic still forcing remote work in 2021. But beyond being forced remote workforce, we continued to hear how enterprises codified officially the role hybrid work will play long-term. Full-time remote work may not the new normal, but a blend between some days on-site and some remote will be. Hybrid work is no longer an employee perk but an expectation.

However, we did get wrong that SASE solutions would go mainstream in 2021. While SASE as a mandate did gain in importance, only a minority of enterprises deployed SASE fully. Moreover, a larger than expected swath of enterprises chose to stay with a traditional Firewall architecture.

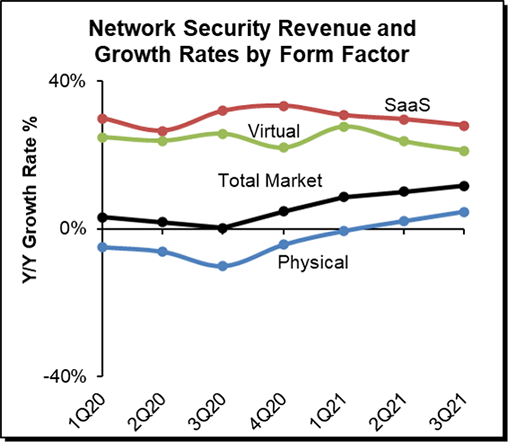

Our second prediction of cloud-centric security revenue growing faster than the overall market has been spot on. We predicted revenue growth to be north of 20%, which has been for most of 2021 for the Software-as-a-Service (SaaS) and virtual appliance form factors that we categorize as cloud-centric security. While 4Q21 numbers are not in, we don’t expect any significant shift in their growth trajectory. As enterprises shift towards being entirely digital, multi-cloud, and mobile-friendly, they have been voting with their wallets and favoring SaaS and virtual solutions.

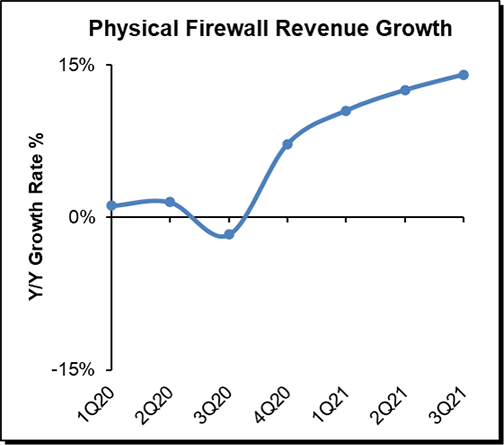

Our third prediction proved correct, with the physical firewall appliance market rebounding in 2021 from a tepid 2020. Enterprises that halted upgrades in 2020 are back in full swing doing refreshes to get greater capacity and the latest features.

Looking into 2022, we make the following three predictions:

1 – Only a minority of enterprises will fully deploy SASE in 2022, but all will force SASE of their vendors

If there’s any maxim in enterprise IT, change comes slowly for most enterprise IT teams. With SASE being a new architectural approach and causing a significant shift in networking and security operations, most enterprises are taking a methodical approach to SASE. Sure, there are a minority of enterprises capable and willing to give their entire WAN networking and security budget to a single pure-play SASE vendor to do full-blown SASE in one fell swoop. Still, the emerging reality is that in 2022 most enterprises will do things piece-meal by focusing on either the networking or security aspect of SASE first or using multiple vendors in their SASE deployment.

However, this doesn’t let vendors off the hook from SASE since most enterprises want their vendors to prove they know SASE and will help them in the journey. No enterprise wants to undertake either network or security transformation only to find out that their vendors can’t take them all the way.

Our 2022 SASE prediction is based on tracking the SASE market in two ways. The first is by what we call the SASE-related technology market, which is the total sum of all networking and security technologies that conceivably could be deployed in a SASE configuration. The second is by what we call the SASE technology market, which is the subset of the SASE-related market deployed in a SASE configuration. For full-year 2021, we expect the SASE-related technology market to nearly reach $4 B with year-over-year (Y/Y) growth topping 30%, while the SASE market may hit $500 M, representing highly robust growth of over 100% Y/Y.

2 – The physical Firewall market rebound will modulate, while cloud-centric security will continue to grow faster

Although we predicted a rebound in the physical Firewall market a year ago, its strength has surprised us. However, we expect the growth in the firewall market to level off. We believe the future of network security isn’t with the physical Firewall market, as it once was, but with those cloud-centric network security solutions that favor SaaS and virtual appliances as preferred embodiments.

3 – Firewall-as-a-Service will begin to cannibalize carrier-class Firewall physical appliances

In the last couple of years, Firewall-as-a-Service (FWaaS), or Cloud Firewalls, have started to pop up as an upsell feature of SaaS-based security solutions, notably in SaaS-based SWG and SASE solutions. The FWaaS in those solutions was primarily aimed at per-user or per-application type firewalling in remote user deployments. It wasn’t meant to replace the super-heavy iron of carrier-class physical firewalls that are still good hygiene in any large enterprise or carrier network. However, we have started to see both pre-IPO and public companies making motions and looking to use the power of the cloud to dethrone one of the last bastions where physical security appliances rule.

We predict that in 2022 at least several of the Fortune 100 will ditch their classic carrier-class Firewall hardware and go all-in on cloud-powered Firewalls.

A year from now, we’ll circle back and see what came true. We hope to repeat our good performance.