Since 2020, a change in network usage patterns has imposed new requirements on IT infrastructure. Enterprises, educational institutions, and governments have experienced a seismic shift in the way they operate. Some organizations now have an entirely remote workforce. Other businesses have hybrid models, with a variety of work-from-home and work-in-the-office permutations. Even companies with exclusively on-site employees have enabled new video applications. Videoconferencing improves employee efficiency but also swamps the network with traffic, exposing network performance problems.

Defining the Future of Campus Networks

Amidst these profound changes in work patterns, enterprises are renewing their strategic IT plans. Companies must ensure that investments in their communications infrastructure support their current work patterns–but also that they are on a path to meet their future needs. Luckily, while enterprises are focusing on understanding today’s requirements, IEEE committees are playing a foundational role in developing IT standards for the future.

The IEEE 802 standards committee is responsible for the evolution of local, metropolitan, and other area networks. They tend to work with the two lower layers of the OSI reference model (the Data Link and Physical layers) and refer to the IETF’s work to define the upper layers.

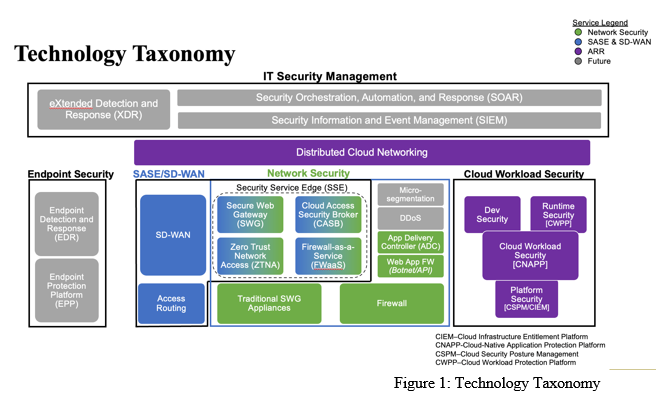

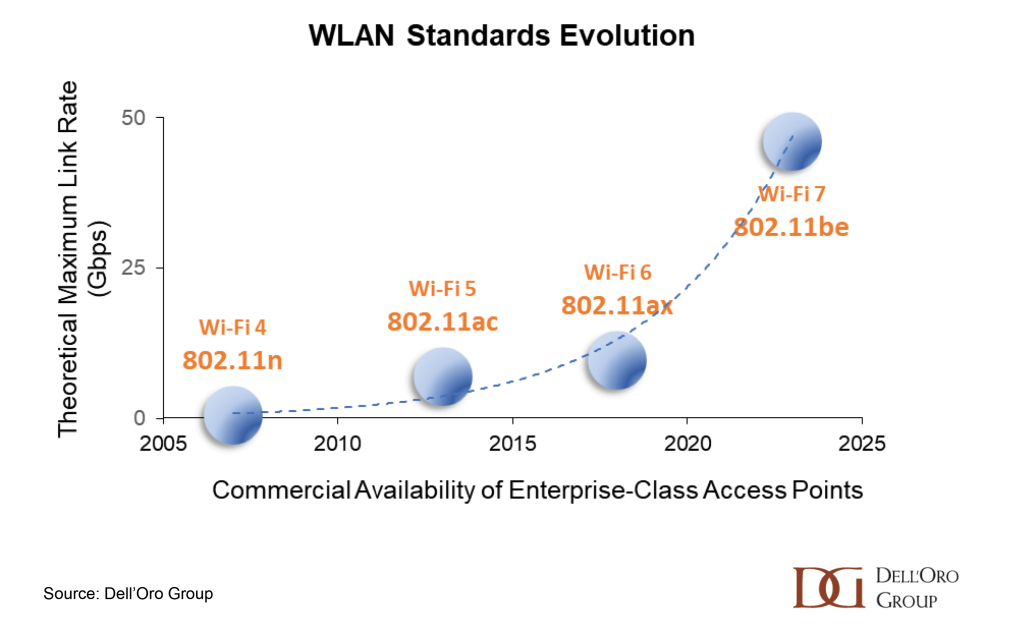

For example, the evolution of Wireless LAN protocols, as defined by the 802.11 WLAN working group, has been addressing organizations’ hunger for more wireless bandwidth in campus networks. With each successive 802.11 version, enhancements to modulation and coding schemes have increased spectral efficiency and lowered interference. Each WLAN standard has increased its maximum theoretical link rate, with Wi-Fi 7’s maximum rate over 75 times that of Wi-Fi 4, shown below.

However, the IEEE 802.11 organization focuses on more than increasing throughput. Made up of a multitude of discussion groups, study groups and more formal work groups, the IEEE is working to improve IoT (Internet of Things) functions, reliability, latency, power consumption and security of the LAN. All of these new capabilities should be considered by enterprises that are committed to transforming their networks.

Organizations Begin Their Network Transformations

To meet the dramatic shift in employee work behaviors, companies are rethinking the optimal use of office space. In its 2022 Occupancy Benchmarking Program, the CBRE (a global leader in commercial real estate services and investments), found that 87% of commercial real estate occupiers surveyed from across the world wanted to optimize their real estate portfolios. In the survey, real estate occupiers identified the need to invest in technology that integrated physical and virtual work experience.

Many different enterprise verticals are investing in IT infrastructure to meet new requirements. For instance:

- Multinational banks with high volumes of video conference traffic.

- Municipal Governments with wireless-first, smart city roadmaps.

- Real estate owners and operators providing high-end WLAN coverage to their tenants in dense urban environments.

- Universities transitioning to a Wi-Fi-only model for their students and staff and preparing for immersive learning by means of AR/VR applications.

- Manufacturers interested in integrating WLAN in their operations, requiring low-latency and deterministic connectivity.

- Retail operations revolutionizing processes such as self-checkout, inventory management and product labelling.

From our discussions with systems integrators, manufacturers, service providers and enterprises, we have identified five key trends that will reshape the enterprise LAN over the next three to five years.

1. A Wi-Fi First strategy

Prior to 2020, many IT departments worked with a standard metric of “number of Ethernet ports per desk”. For companies with employees working from home or in a hybrid model, this metric is no longer valid.

Wi-Fi first implies the deployment of low-density Access Points (APs) to provide connectivity in areas where there had previously been Ethernet ports, such as dorm rooms or low-density cubicles. Wi-Fi first can also involve covering common areas with high-density, high-performance APs to accommodate surges in traffic, such as in conference rooms or stadiums. Finally, a Wi-Fi first strategy often involves providing WLAN signals in new areas that had never had connectivity before; for example, urban centers, company patios, or school gymnasiums.

In addition to ensuring that the WLAN is delivering high bandwidth with low interference, an enterprise must ensure that the network backbone can support the traffic. Organizations’ strategic IT plans must include a provision for the growing bandwidth of WLAN uplink ports.

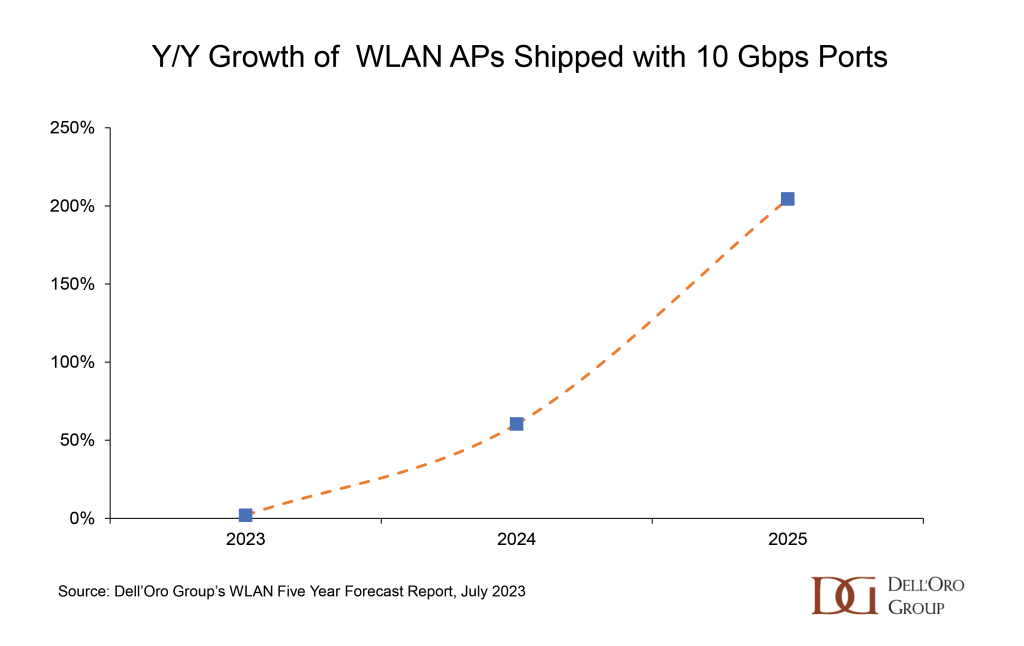

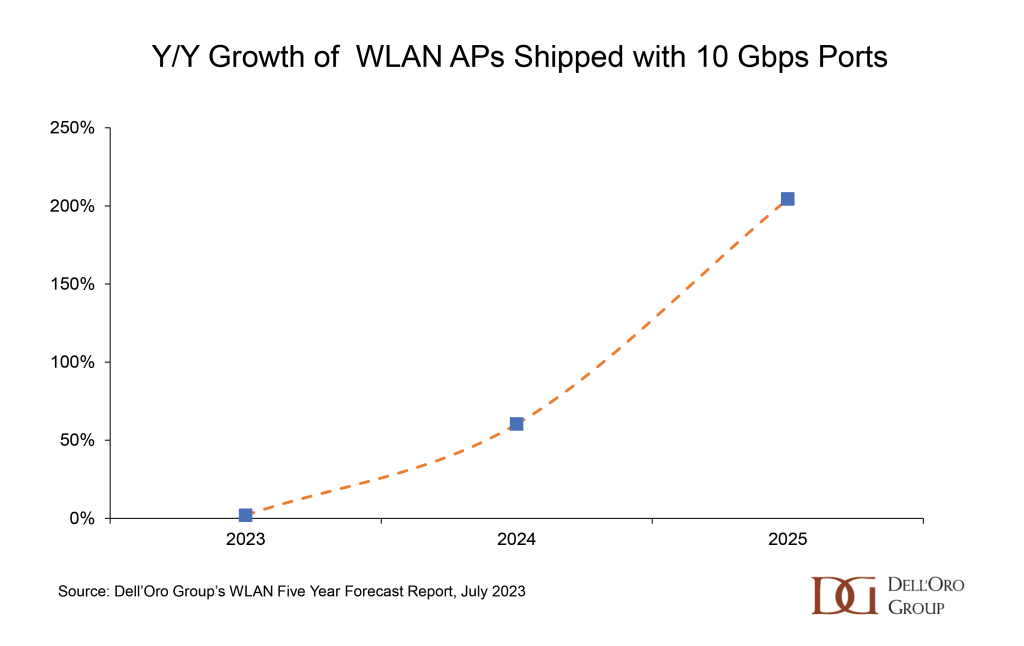

Most enterprise APs shipped today are equipped with a 1 Gbps port. However, APs supporting the latest standards are capable of higher data transfer rates; they can support 2.5 Gbps, 5 Gbps or even 10 Gbps interfaces. As Wi-Fi 7 is adopted in the market, we expect 10 Gbps ports to grow considerably, allowing higher bandwidth applications to operate in the LAN.

2. A Smarter Network Means Efficiency and Automation

With new demands on the network, organizations need a better understanding of how their facilities are being used. A wide range of applications and services are available to provide insights into meeting room occupancy, environmental readings, and the location of assets.

To enable these insights, enterprises are integrating more and more “things”, instead of just “people”, onto their LANs. The IoT can involve wired devices, such as security cameras and monitors for video conference rooms. The IoT can also rely on wireless devices, such as occupancy sensors, electronic labels, or environmental sensors.

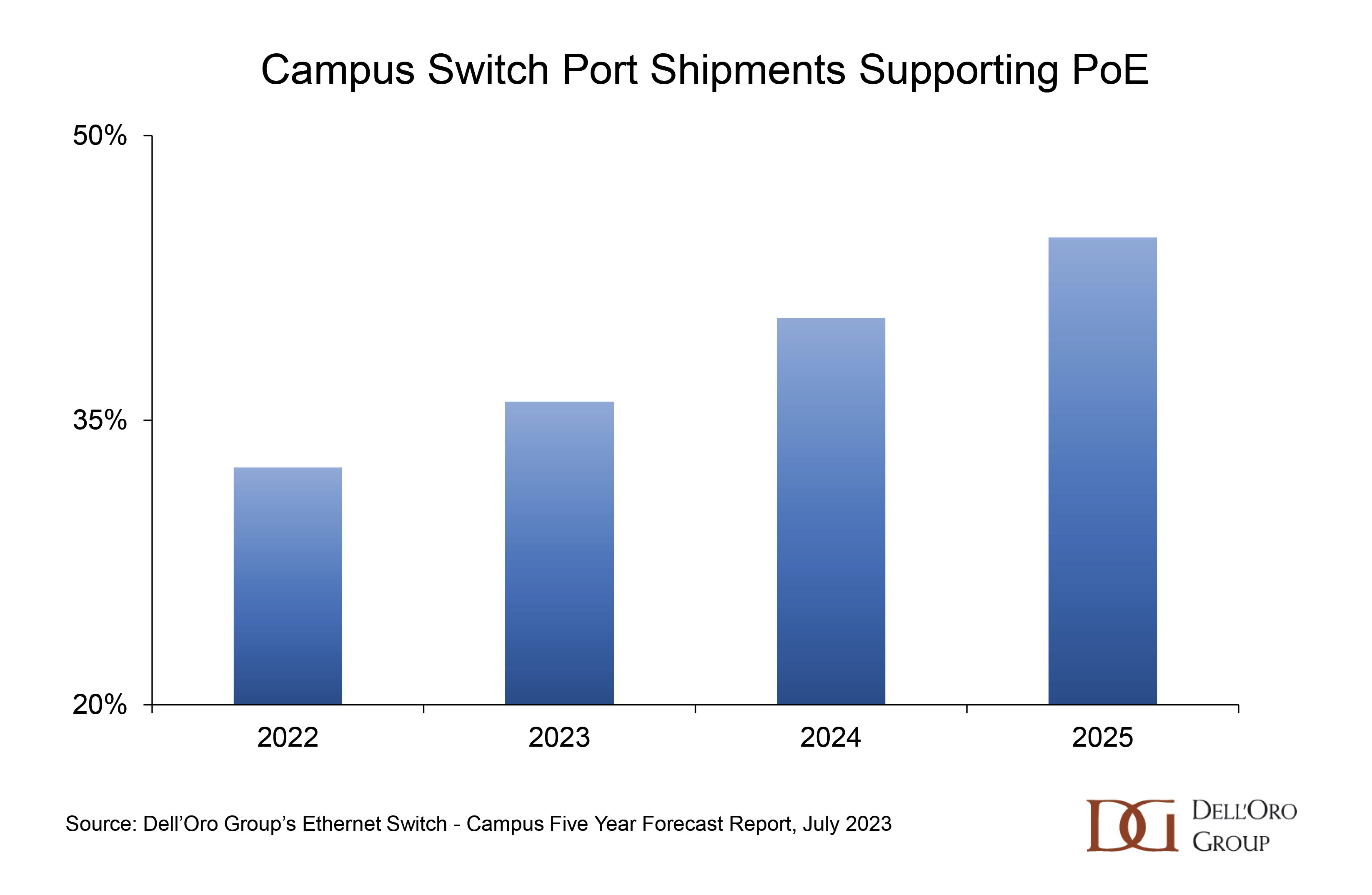

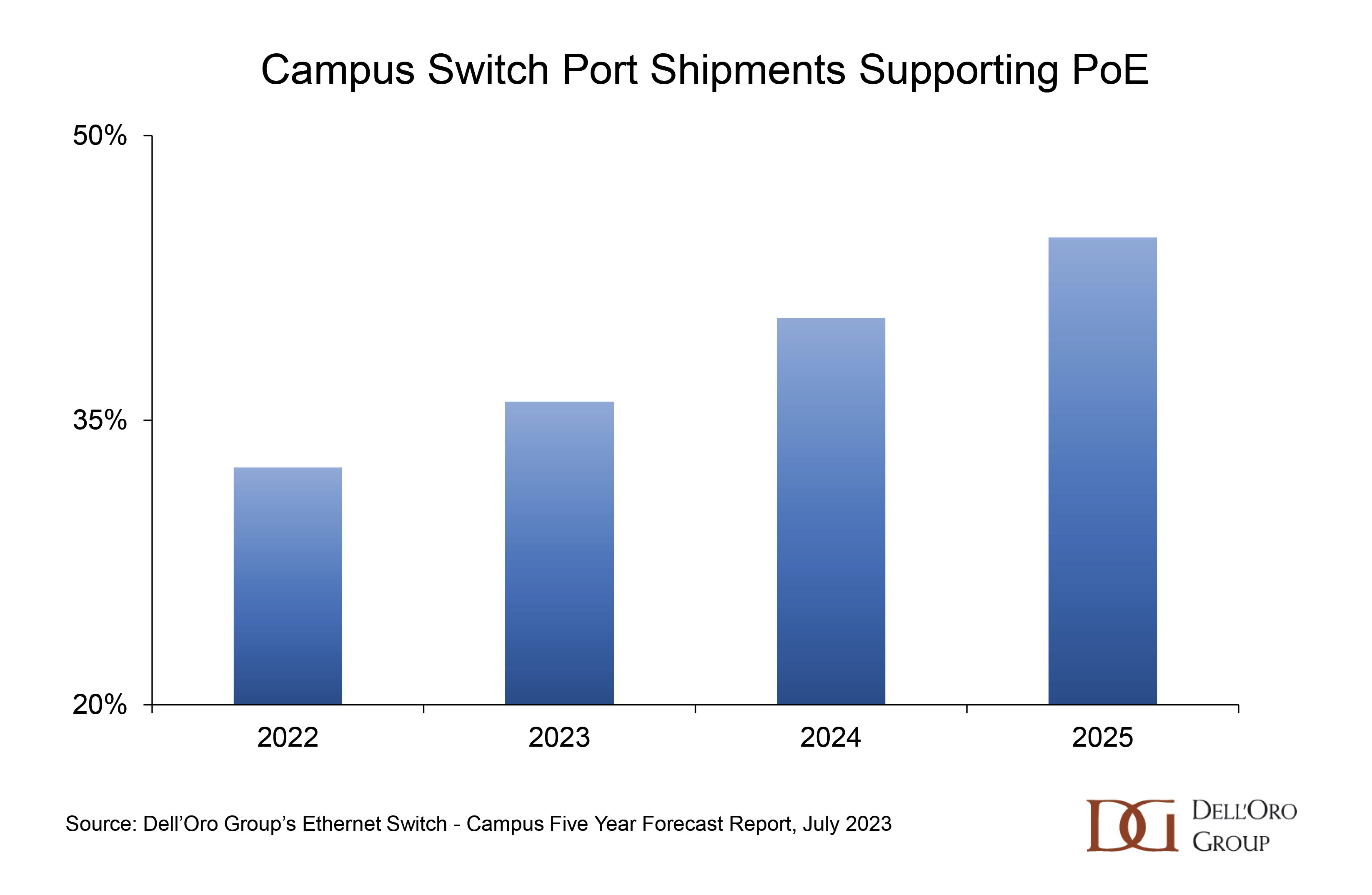

Some devices, such as video cameras or VR headsets, can increase LAN traffic considerably. However, organizations also need to consider the growing need for Power over Ethernet (PoE) ports on their campus switches. These ports are required to deliver more power to high performance APs, as well as to devices such as cameras. We expect that the percentage of switch ports that support PoE will continue to rise as the demand for high-end devices grows.

In addition to feeding applications with data to improve enterprise efficiency, the next generation of campus technology allows for the automation of network management. AI-Ops refers to features that use advanced analytics to simplify network operations, helping to filter alarms, predict network performance issues, or even automatically suggest and apply fixes to network problems.

The head of IT of one organization with which we spoke was amazed that activating AI-Ops features in the campus LAN uncovered existing network configuration problems that were previously undetected; these problems had been affecting quality of service for years. In addition to improving the user experience, AI-Ops reduced the number of trouble tickets by 95%.

3. Emphasis on Sustainability

Enterprises concerned with the environment are analyzing every step in their value chains to eliminate waste, decrease dependence on non-renewable resources, and reduce power consumption.

Initiatives that environmentally conscious enterprises are taking in their LANs include:

- Configuring Energy Efficient Ethernet (EEE) on switch ports, which moves ports to a low-power state when they are not carrying traffic.

- Replacing high-capacity copper cable with fiber. Fiber-optic Ethernet cables can support 10 Gbps and higher, and they can withstand longer distances with lower losses.

- Flattening the network hierarchy and reducing the number of switches in the network.

- Purchasing equipment made of recycled materials and packaged in a sustainable manner.

- Moving to commercial models (such as Campus Network as a Service) that incorporate the re-purposing of old IT equipment when it is replaced.

4. Low-Latency Communications

WLAN revenues generated from sales to manufacturing companies grew by more than $500 Million in 2022, an increase that exceeds the growth in any other vertical that we track. Industries that adopt wireless infrastructure for their industrial processes often need low-latency, deterministic communications.

In November 2018, the IEEE 802.11 Real Time Applications Topic Interest Group (RTA-TIG) published a report outlining the usage model and technical requirements of an array of real-time applications. The report cites a wide range of applications for industrial systems. Applications categorized as “Class B”̶ including AR/VR and remote Human-Machine Interaction ̶ had a latency bound requirement of between 10 and 1 ms, with “latency bound” defined as the worst-case one-way latency measured at the application layer.

Other verticals, apart from manufacturing, will also require low-latency capabilities. For instance, VR or AR applications relying on interactive video are relevant to logistics, education, and retail verticals.

As low-latency applications become more common, deploying Wi-Fi 7 will be an important initiative for enterprises. A study at Virginia Tech showed that Wi-Fi 7, with its inclusion of Multi Link Operations (MLO), lowers the latency of communications by allowing devices to operate in multiple bands simultaneously. Enterprises can also benefit from Wi-Fi 7’s ability to support a diversity of channel widths. By means of the judicious assignment of certain channels to latency-sensitive applications, enterprises will be able to lower the latency for the users who are most sensitive to this parameter.

In addition to upgrading to Wi-Fi 7, enterprises may further lower latency by investing in local computing infrastructure to avoid processing data from latency-sensitive applications in the cloud.

5. A Network That Prioritizes Experience

In its spring 2023 survey of office occupiers, CBRE determined that the average utilization rate of office space in Asia Pacific was 65% and, in North American and Europe, was below 60%. These low office utilization rates are the main reason that the quantity of video traffic on the LAN has exploded. Employees now take videoconferencing capabilities for granted, in their daily interactions with colleagues and with their customers.

The reliance on videoconference puts the spotlight on the network performance. A user of a popular videoconference application can require up to 3.3 Mbps of bandwidth for a meeting with 6 participants and content sharing. As the number of concurrent videoconferences grows, the bandwidth expands accordingly, and network congestion becomes apparent, impeding employees’ ability to communicate effectively. Now that doing business deals over videoconference is a regular occurrence, a dip in video quality can affect a company’s revenues.

To ensure that employees can rely on high-quality videoconferencing, enterprises are adding capacity to their networks, but they are also taking other approaches. IT departments are collecting data from end-user devices, videoconference applications, and the network operations platforms, and using Machine Learning to identify the source of network problems as well as for resolution suggestions. Networking equipment schedulers can also be enhanced to optimize video streams or to improve the performance for certain groups of users, for specific applications, or for special events. Enhancements to support the high bandwidth of today’s video applications will lay the groundwork for the next generation of applications using very high resolution and volumetric video.

Campus Networks Must be Ready to Support Future Applications

An organization’s strategic IT plan will cover the five themes discussed above to varying degrees, depending on the different use cases and priorities. The need to increase bandwidth will be a common element of all the plans.

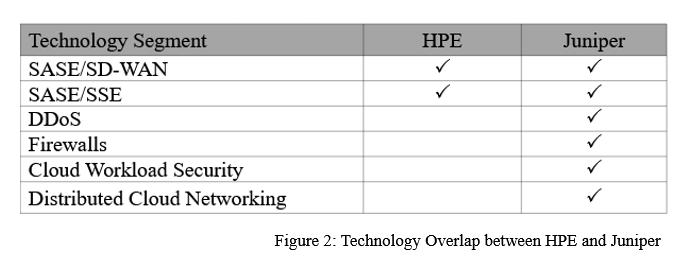

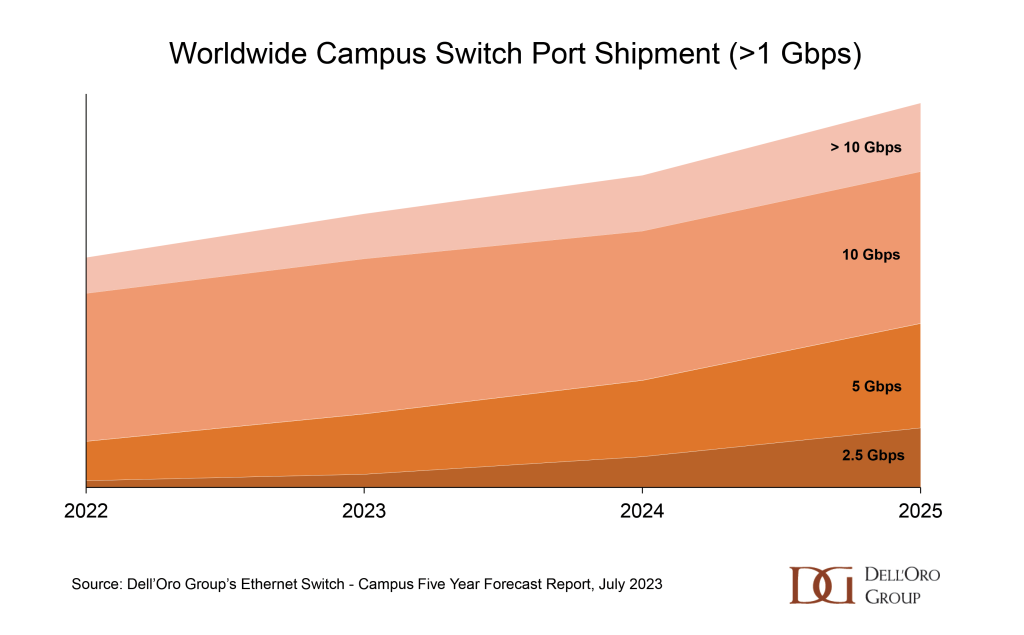

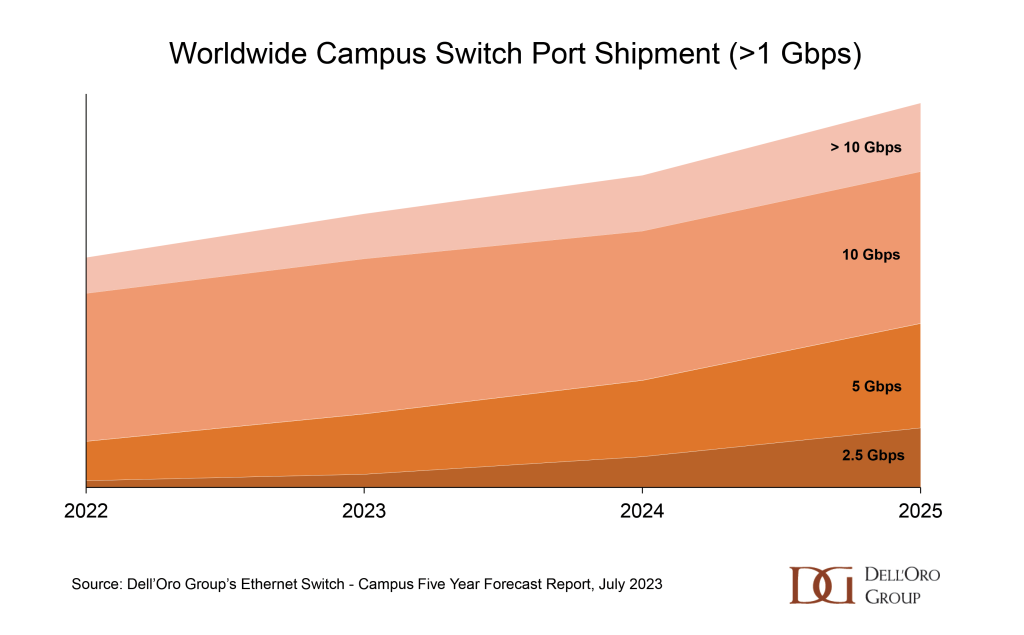

Although 1 Gbps ports will remain the speed of the majority of campus switch ports shipped over the next few years, we predict the growth of higher-speed ports in the LAN. This push to higher capacity links, shown below, will be driven by the need to connect branch offices at high speeds, by the elevated traffic generated by campus applications, and by the deployment of Wi-Fi 7 APs.

To build an IT strategic plan that will stand the test of time, enterprises must consider that their network traffic patterns will evolve along will their mode of work operations, whether it be mainly work-from-home, hybrid, or fully on-premises. The IEEE has laid a foundation of next generation campus IT functionality to meet the objectives of an organization’s IT plan, such as providing higher visibility into the usage of resources, improving the efficiency of workers, and increasing the sustainability of operations. Underlying all requirements is the need for greater bandwidth to the branch, in the LAN, and directly to end users. By moving to 10 Gbps in the campus, enterprises are taking an important step in readying their network for the future.

To build an IT strategic plan that will stand the test of time, enterprises must consider that their network traffic patterns will evolve along will their mode of work operations, whether it be mainly work-from-home, hybrid, or fully on-premises. The IEEE has laid a foundation of next generation campus IT functionality to meet the objectives of an organization’s IT plan, such as providing higher visibility into the usage of resources, improving the efficiency of workers, and increasing the sustainability of operations. Underlying all requirements is the need for greater bandwidth to the branch, in the LAN, and directly to end users. By moving to 10 Gbps in the campus, enterprises are taking an important step in readying their network for the future.