Cloud-Delivered Security to Grow 21 Percent CAGR and Hit $10 Billion by 2025

We just issued the latest edition of our 5-year forecast (2021-2025) for the Network and Security and Data Center Appliance (NSDCA) Market that spans Firewalls, Secure Web Gateways (SWGs), Email Security, Application Delivery Controllers (ADCs), and Web Application Firewalls (WAFs). Nearly 18 months since the COVID-19 pandemic began, the worst of the market turbulence appears behind us. Increased vaccination rates–albeit not fast enough for some countries and regions–have led to an unwinding of lockdown mandates and boosted economic activity. In addition, economic stimuli from central governments have provided additional market tailwinds.

After an anemic 2020, where revenue growth was just 3% year-over-year (Y/Y), we forecast a return to low double-digit growth in 2021 and 2022, and then high single-digit after that through the end of our forecast window (2025). This revenue growth slightly exceeds the historical revenue growth rate, averaging 8% Y/Y, due to the pent-up demand created during 2020, the recent economic stimuli, and the continued high priority placed on security, creating favorable market conditions.

On a form factor basis, we believe that products sold in a cloud-delivered SaaS (Software-as-a-Service) form factor will grow at a 21% compound annual growth rate (CAGR), reaching nearly $10 B in 2025. In contrast, the roughly $12 B physical appliance market is anticipated to grow nearly 3% CAGR by 2025.

We attribute the expected strong performance in the SaaS form factor due to the following factors:

- Elasticity: The elasticity of SaaS solutions–namely, the ease, swiftness, and scaling of deployments–is impossible to match with physical appliances.

- Cloud-indigenous: As enterprises pivot to embrace cloud architectures and the Internet becomes an extension of the corporate network, SaaS-based solutions are better suited.

- Nexus of Innovation: The elasticity and cloud-indigenousness of SaaS-based solutions have afforded vendors the ability to innovate and offer new services to their customers rapidly. Examples include zero-trust network architectures and, more recently, the marriage of security and networking services as SASE solutions. (We have published an Advanced Research Report on SASE in which we analyzed the intersections of SWGs, Firewalls, and SD-WAN. Please contact us, if interested in procuring a copy).

- Economic: Many enterprises are choosing to move away from the traditional capital expenditure (CAPEX) and depreciation model associated with physical appliances toward the operational expenditure (OPEX) subscription model strongly related to SaaS-based solutions.

Our report describes market dynamics by individual segment–including Firewalls, SWG, Email Security, ADC, and WAFs–and shows how each is expected to contribute to the overall SaaS-based revenue picture. There will be clear winners and others that lag.

About the ReportThe Dell’Oro Group Network Security & Data Center Appliance market 5-Year Forecast Report offers a complete overview of the industry with tables covering manufacturers’ revenue, units shipped and average selling prices for Application Delivery Controller, WAN Optimization Appliances, and Network Security Appliances. Each of these markets is further segmented by Physical and Virtual technologies. The Network Security Appliance market is also segmented by: Content Security, Firewall, IDS and IPS, and VPN and SSL. To purchase this report, please contact us by email at dgsales@delloro.com. |

|

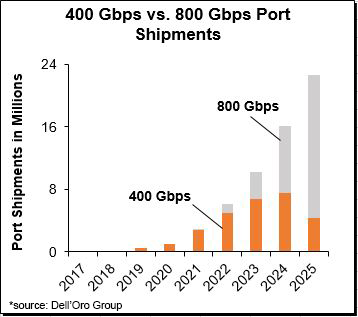

We predict that 800 Gbps adoption will be quick, surpassing 400 Gbps ports in 2024 (Figure). 800 Gbps deployments will be propelled by the availability of 100 Gbps SerDes and will not require 800 GE MAC. As a reminder, our forecast reflects port-switch capacity, regardless of how the port is configured. We expect early 800 Gbps ports to be used in breakout mode either as 8×100 Gbps or as 2×400 Gbps. (Breakout applications support many use cases, such as aggregation, shuffle, better fault tolerance, and bigger Radix.) The anticipated rapid adoption of 800 Gbps will be propelled by: 1) availability of 800 Gbps optics with a significantly lower cost per bit than two discrete 400 Gbps optics; and 2) lower cost per bit at a system level, as 800 Gbps will allow consuming 25.6 Tbps chips in a 1U form factor with 32 ports of 800 Gbps. These systems will have a better cost per bit than their equivalent 400 Gbps (which requires 2 U chassis to fit 64 ports). Since economics drive adoption, we believe that 800 Gbps will be more rapidly adopted than 400 Gbps.

We predict that 800 Gbps adoption will be quick, surpassing 400 Gbps ports in 2024 (Figure). 800 Gbps deployments will be propelled by the availability of 100 Gbps SerDes and will not require 800 GE MAC. As a reminder, our forecast reflects port-switch capacity, regardless of how the port is configured. We expect early 800 Gbps ports to be used in breakout mode either as 8×100 Gbps or as 2×400 Gbps. (Breakout applications support many use cases, such as aggregation, shuffle, better fault tolerance, and bigger Radix.) The anticipated rapid adoption of 800 Gbps will be propelled by: 1) availability of 800 Gbps optics with a significantly lower cost per bit than two discrete 400 Gbps optics; and 2) lower cost per bit at a system level, as 800 Gbps will allow consuming 25.6 Tbps chips in a 1U form factor with 32 ports of 800 Gbps. These systems will have a better cost per bit than their equivalent 400 Gbps (which requires 2 U chassis to fit 64 ports). Since economics drive adoption, we believe that 800 Gbps will be more rapidly adopted than 400 Gbps.