It’s no secret that cable operators are facing growing competitive threats from both fiber ISPs and fixed wireless providers in markets where they previously only faced DSL competition. Certainly, these cable operators have many options at their disposal for evolving their existing HFC plant to increase bandwidth and stay ahead of competitors from both a billboard speed perspective as well as a network reliability perspective.

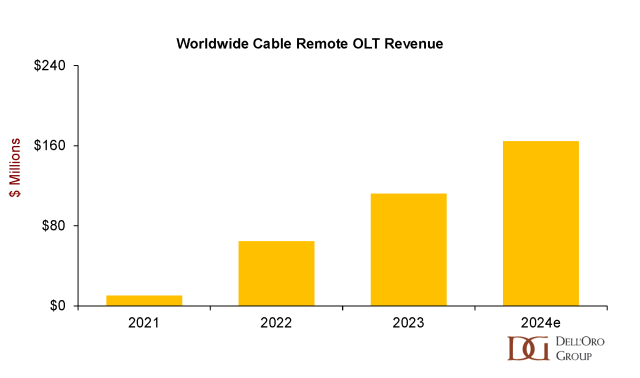

It’s also no secret that cable operators are building out greenfield networks using fiber and are doing so in edge-out projects using remote OLT platforms, which allow them to address new serving areas from either existing or new node locations. Charter Communications is a prime example of an operator expanding its fiber footprint using remote OLTs to support fiber delivery in rural and underserved markets. These and other deployments globally have resulted in a steadily growing market for remote OLT platforms, which are expected to see revenue growth from $112 M worldwide in 2023 to $164 M in 2024. Additionally, cable operators in North America are deploying more traditional OLT platforms in either their headends or hub sites to deliver either 10 Gbps EPON using DPoE (DOCSIS Provisioning over EPON) or XGS-PON. We estimate that North American cable operators have purchased around 30-35 K OLT ports on an annual basis to support their own FTTH buildouts. Those numbers are relatively small when compared with the deployments of telcos, utilities, and municipalities. However, they are growing as cable operators strike a balance between their current HFC upgrade strategies and out-of-market expansions using fiber.

Additionally, cable operators in North America are deploying more traditional OLT platforms in either their headends or hub sites to deliver either 10 Gbps EPON using DPoE (DOCSIS Provisioning over EPON) or XGS-PON. We estimate that North American cable operators have purchased around 30-35 K OLT ports on an annual basis to support their own FTTH buildouts. Those numbers are relatively small when compared with the deployments of telcos, utilities, and municipalities. However, they are growing as cable operators strike a balance between their current HFC upgrade strategies and out-of-market expansions using fiber.

Competition Drives 25GS-PON Upgrades

In a growing number of conversations we have had with North American cable operators—both large and small—the current and potential competitive threats they are seeing from fiber providers taking advantage of Federal and State Government subsidization to overbuild their own HFC and fiber networks are only going to accelerate. In these markets where cable operators once enjoyed market dominance, they now face encroaching competition from multiple fiber providers using GPON or XGS-PON to offer similar speeds and service tiers.

A growing group of these cable operators are either planning to upgrade or are currently upgrading the fiber portion of their networks to 25GS-PON so that they can deliver true 10 Gbps services to their business and, eventually, residential customers. In essence, their strategy is to use 25GS-PON as a deterrent for additional market entrants to encroach on their serving areas. The thinking is that, with the ability to offer symmetric 10 Gbps services across their fiber footprint, competitors will have less incentive to overbuild because of the speed disadvantage they would have not only initially, but presumably for multiple years. If subscriber acquisition opportunities are limited, thereby extending the time to revenue, then operators have less financial incentive to overbuild.

Service Electric Cablevision in Pennsylvania recently announced that it would be passing 200K new and existing homes with XGS-PON and 25GS-PON. We are expecting similar announcements from additional cable operators in North America throughout the year, as they look to balance their fiber expansion projects while also upgrading their existing DOCSIS footprint.

In many markets, cable operators have been the dominant video providers, either via their traditional QAM networks or via IP video. Holding video franchises for decades has often discouraged new market entrants. However, that advantage has been eroded over time, as subscribers have moved to streaming services or reduced their spending by taking smaller packages of local channels. With broadband now the anchor service for all cable operators, protecting their markets through the deployment of 25GS-PON, combined with more flexibility in the service tiers they offer their customers can provide similar market advantages they used to enjoy with broadcast video.

The market advantages extend to business customers, as well. Historically, cable operators have only been able to offer business-class DOCSIS services to these customers, with an upcharge for higher SLAs, static IP addresses, and other features. Cable operators have done extremely well over the last decade in stealing away small- and medium-business customers from telcos who had more inflexible pricing plans or relied on T1 or business-class DSL lines. But recently, telcos and other fiber ISPs have pushed hard to get these business customers back by pitching the higher reliability and technological advantage of fiber. Thus, the deployment of fiber and 25GS-PON gives cable operators a clear advantage as they can offer their business-class customers symmetric 10 Gbps services.

Related blogs:

- Growing Interest in 25GS-PON Drives Forecast Increases

- 25GS-PON Continuing to Gather Market Momentum