The use of AI in the radio access network (RAN) is not new. In fact, 4G and 5G deployments already rely heavily on automation and intelligence to replace manual tasks and manage the increased complexity without raising the costs. AI is also used in both 4G and 5G to improve network performance and the user experience. What is new, however, is the proliferation of consumer and enterprise AI and the change in attitude toward this tool. As the conversation about the implications for society as a whole is now moving to center stage, the timing is right to review how AI is likely to impact the RAN market, both directly and indirectly. In this blog, we will focus on four specific areas: mobile data traffic, operator revenue, RAN economics, and RAN architectures.

Is the proliferation of consumer and enterprise AI fueling an increase in mobile data traffic?

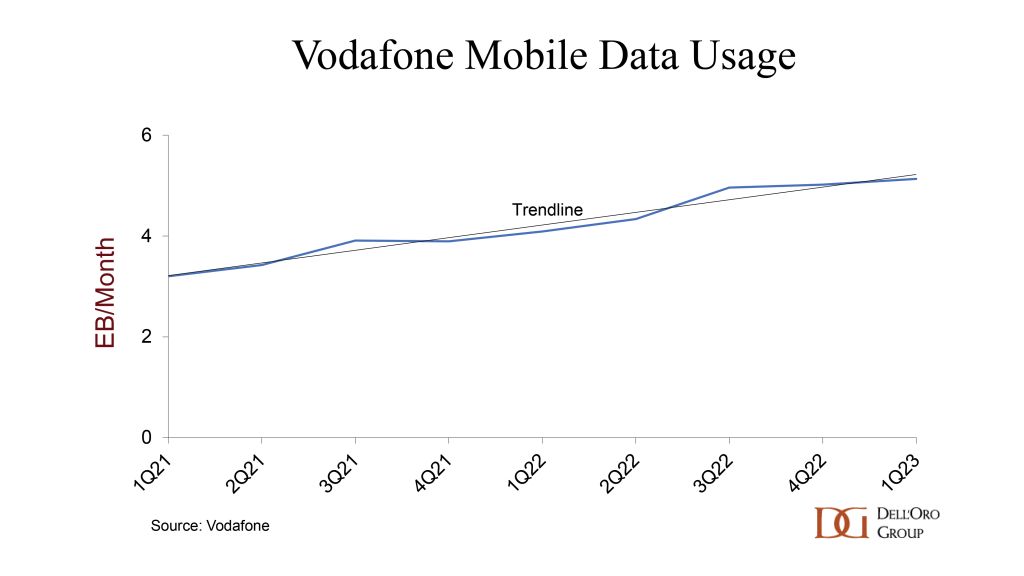

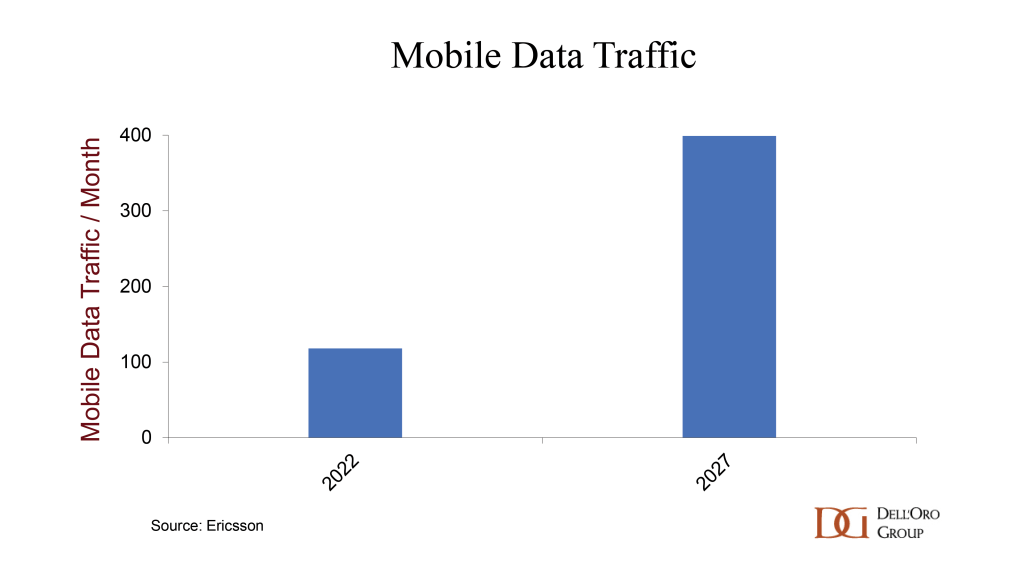

Preliminary findings suggest that AI tools such as ChatGPT and Google Bard are not at this time directly affecting mobile data usage. Data points are limited. Vodafone’s data usage in 1Q23 shows no discernable change in its overall consumption relative to the trend line. And per Ericsson’s latest Mobility report, mobile data traffic grew 36% in 1Q23, in line with the YoY growth trajectory over the past two to three years. While AI is changing computing, power, and cooling requirements inside the data center, the impact on the mobile network has so far been negligible. Over time of course this could change, either directly or indirectly, if for example AI triggers greater video usage or if the computing location changes. But for now, we don’t see a need to change mobile traffic projections to accommodate the rise of consumer AI. Per Ericsson’s Mobility Report, mobile data traffic is projected to grow at a CAGR of 25% to 30% between 2022 and 2027.

What does this mean for operator revenues?

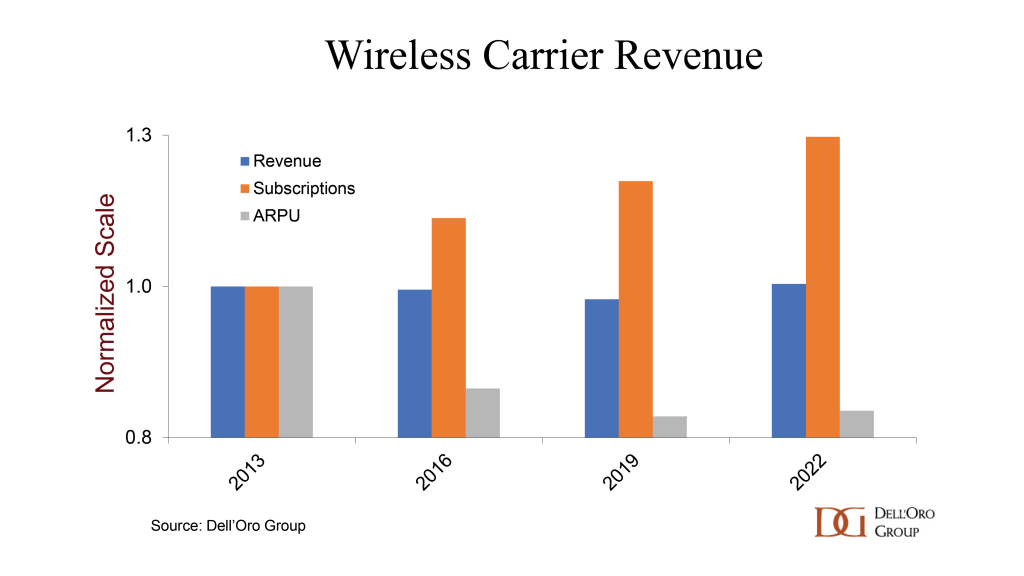

Global wireless carrier revenues advanced at a double-digit rate during the 1G-3G era, as mobile subscriptions exploded. But growth slowed with 4G and fresh data show that wireless revenues have stayed flat over the past ten years. The root cause is not the lack of subscription growth. Instead, we attribute the stable revenue trends to the slump in average revenue per user (ARPU), which has been down by roughly 20% over the past ten years. Even as AI is improving the optimism for potential revenue expansion, the downward pressure in ARPU in combination with slower subscription growth will continue to weigh on the prospects for growth in the area of consumer mobile broadband (MBB).

It is unlikely that AI will change these forces that now underpin the lion’s share of carrier wireless revenues. However, it is still crucial that operators invest in these tools so that they can extract more value from enterprises and verticals, improve the business case for fixed wireless access (FWA), and enhance their competitive position in all areas, including consumer MBB. In addition to improving performance and customer experience—which will indirectly improve revenues by minimizing churn—AI could assist with data monetization, especially in the enterprise, where this tool can help to optimize the user experience for 5G use cases and secure QoS levels that are key for premium services. In the future, AI might also play a role in terms of network slices.

How will AI and Intelligent RAN change RAN economics and performance?

As mobile data traffic continues to grow 25% to 30% annually while carrier revenue growth remains flat, operators have limited wiggle room to expand capex and opex to manage the increased complexity typically inherent with the technological and architectural advancements required to deliver the appropriate network performance while supporting more demanding and diverse end-user requirements. The impact on topline expansion will be limited but AI capabilities taken together with recent technology advances that allow suppliers to place intelligence inside the base station will be crucial for improving RAN economics and performance. Recent proliferation with generative AI is raising the expectations that continuation of this trend will:

-

-

- Improve performance and experience

- Maximize ROI on network investment

- Improve the vRAN business case

- Boost network quality

- Accelerate time to market

- Reduce complexity

- Reduce energy consumption

- Bring down CO2 emissions

-

The use of AI in the RAN is already delivering benefits in network deployment, optimization, and healing, ultimately contributing to an improvement of network performance and quality. These AI tools can be used to analyze end-user drivers and traffic patterns, while improving resource utilization. In addition, Intelligent RAN and AI-powered analytics will help operators to proactively address network issues before they become a major problem. Vodafone’s Zero Touch Operation Strategy, for example, aims to prevent 50% of the faults. A North American service provider was able to detect RAN issues 120x faster with Nokia’s AI/ML-powered SON.

According to Ericsson, operator opex could double over the next five years without more automation across deployment and management & operations, just to support the MBB-driven changes. AI will play an important role here simplifying complexity and curbing opex growth. Most of the greenfield networks are clearly moving toward new architectures that are more automation-conducive (Rakuten Mobile operates 300 K+ cells with an operational headcount of around 250 people). Change typically does not happen as quickly, however, with the brownfields. The average brownfield operator today falls somewhere between L2 (partial autonomous network) and L3 (conditional autonomous network), with some way to go before reaching L4 (high autonomous network) and L5 (full autonomous network). Still, China Mobile remains on track for L4 automation by 2025. Huawei remains optimistic that L4 Autonomous Driving Network (ADN) will be more prevalent by approximately 2025 (70% of its customer base plans to achieve L3 ADN by 2025). Rakuten Mobile previously said that its network could achieve L4 automation by the end of 2022. Vodafone has also set the target of achieving zero-touch intelligent networks by 2025, while Zain is targeting L4 automation by 2025.

Performance gains underpinned by Intelligent RAN will vary, depending on a variety of factors. Ericsson estimates that Intelligent RAN Automation solutions can improve the spectral efficiency by 15%, while Huawei has been able to demonstrate that its Intelligent RAN multi-band/multi-site 3D coordination feature can improve the user experience by up to 50% in some settings. ZTE and China Mobile have demonstrated a 3x rate of throughput improvement at the cell edge, in addition to a 50% reduction in handover delays.

With the RAN comprising around 1% to 2% of global electricity consumption (ITU), the intensification of climate change taken together with the current power site trajectory forms the basis for the increased focus on energy efficiency and CO2 reduction. Preliminary findings suggest that Intelligent RAN can play a pivotal role in curbing emissions, cutting energy consumption by 15% to 25%. As an example, Zain was able to realize 23% energy savings at a test site in Kuwait utilizing Huawei’s Intelligence-based energy saving solutions. Some operators are even more optimistic: Tele2 recently published a report demonstrating how smarter mobile networks can reduce energy consumption in the long term by as much as 30% to 40%.

The proliferation of AI now also offers the potential to improve vRAN economics. One of the main TCO challenges with vRAN/Cloud RAN is the difficulty of realizing efficiency gains from orchestrating several workloads. As a result, some are now exploring the possibility of improving the vRAN business case by realizing synergies in other ways (such as between 5G and AI). Softbank and Nvidia recently announced that they are looking at the utilization and financial benefits of deploying 5G vRAN on the same servers that run AI. While the TAM for centralized vDU implementations is limited, it will be interesting to follow Softbank’s progress here.

What does AI mean for future RAN architectures?

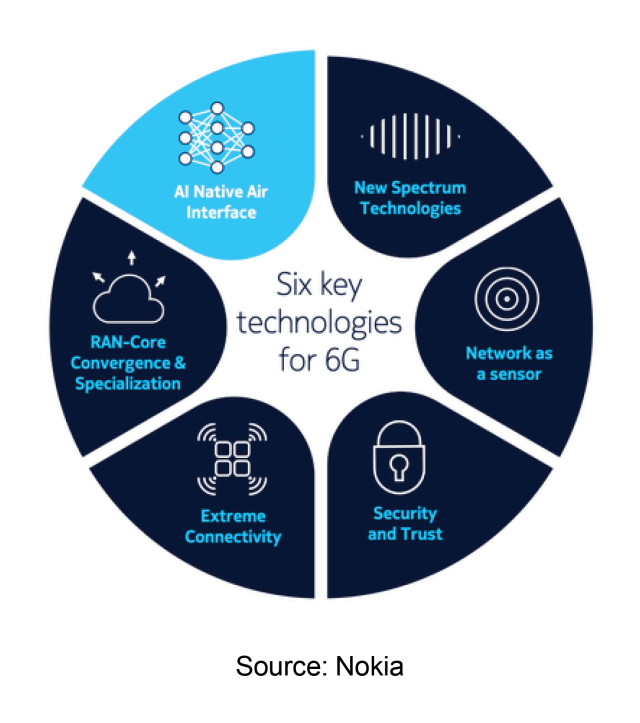

AI is already available in the RAN today to some degree, albeit to a limited extent. Going forward, however, the share of AI in the RAN will undoubtedly rise. In addition to increased use of AI with existing 5G networks, 5G-Advanced promises to introduce more AI and ML enhancements in the RAN, including in the air interface. And while we are still in the early days of 6G the current thinking is that AI native Air interfaces will be one of the fundamental technologies.

It would be premature at this early stage to attempt to paint a comprehensive picture as to how AI will transform society and the telecom networks. But compared to previously hyped technologies, one of the differences with AI is the broad-based acceptance that all roads lead to more of it. So even if this is not the magic answer for operators to grow consumer ARPU, there is no doubt that suppliers and operators will gradually increase the use of AI in and around the RAN.