The US broadband market has certainly become the most dynamic in the world. For decades, cable operators dominated net new subscriber growth, added millions of new homes passed annually, and compiled a dominant position in the market with a penetration rate of 65% or more. Even during the pandemic, cable operators saw their net subscriber additions per quarter accelerate, as they were able to poach dissatisfied DSL customers and attract first-time subscribers with the help of the FCC’s Affordable Connectivity Program.

But just as cable operators had reached their peak of subscriber growth, the rapid expansion of 5G-based fixed wireless access services put an end to cable’s quarterly gains. Now, the largest US cable operators are dealing with flat to modest net subscriber growth on a quarterly basis, with some quarters showing net subscriber declines. As a result, cable operator CEOs have started to change their tune slightly, moving away from calling fixed wireless an “inferior technology” to acknowledging its impact in creating a “high churn environment.”

But cable operator executives still continue to downplay the long-term impact that 5G FWA will have on their addressable share of broadband subscribers. They will claim that the pull-forward of broadband net subscriber additions during the pandemic combined with the general slowdown in new housing starts and moves—the typical drivers of subscriber growth—is the reason for the poor quarterly performance in new subscriber additions. They will continue to argue that 5G fixed wireless just doesn’t measure up to current DOCSIS service tiers—let alone any of the upgrades they are making through their mid- and high-split activities.

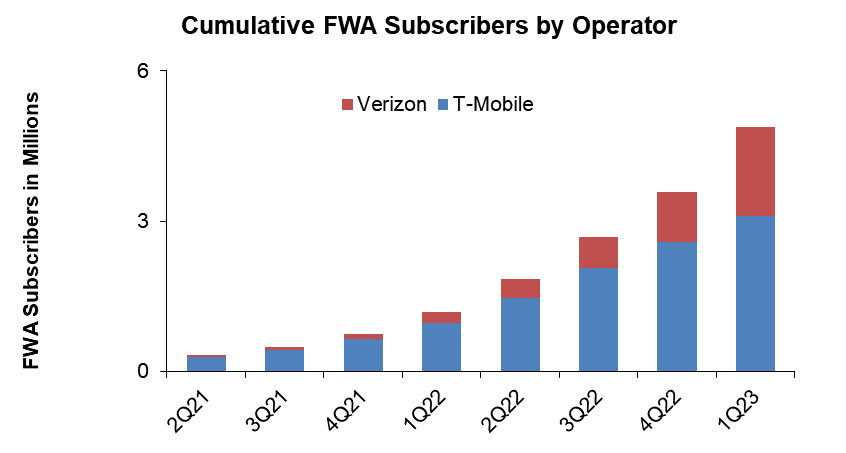

And yet both T-Mobile and Verizon continue to add FWA subscribers (both residential and small business) at a furious clip, with T-Mobile emphasizing that 51% of its fixed wireless customers come from cable operators. Verizon just announced the net addition of 384K FWA subscribers in 2Q23, pushing the company’s total subscriber base to 2.26M. Consumer FWA additions were 251K, while business additions were 133K. T-Mobile is expected to post even stronger subscriber gains in the second quarter, even as its FWA subscriber base in 1Q23 reached 3.2M through a net increase of 523K subscribers.

T-Mobile has a stated goal of serving 7-8 million subscribers by the end of 2025, while Verizon has a goal of serving between 4-5 million subscribers by the end of 2025. Collectively, that’s a potential subscriber base of anywhere from 11-13M subscribers. Those numbers don’t include the entry of AT&T in the 5G FWA market via its Internet Air service, which could net anywhere from 1.5-2M subscribers by the end of 2025, according to our estimates. Unlike T-Mobile and Verizon, which are offering their FWA services nationwide, AT&T’s service is aimed at retaining current DSL customers who are located in areas that will not be offered a fiber alternative as part of the company’s 30M-location fiber buildout. According to our estimates, that leaves an addressable market of approximately 13-15M locations. Though our take rate estimates are relatively low for the service, it is possible that AT&T could expand the reach of Internet Air if the service shows early signs of success at securing new subscribers and keeping churn rates low.

In total by 2025, the three major mobile operators could have a combined FWA subscriber base of nearly 15M, with a good percentage of those having shifted over from cable. And this only represents the potential subscriber drain caused by FWA. By 2025, fiber overbuilders will have dramatically increased their footprint with a product that is certainly going to have better take rates than any flavor of DSL offered over the last two decades. Suddenly, that 65% share of broadband subscribers in the US looks like it is poised to potentially drop well below 60% by 2025.

Cable operators will point to capacity issues as a major impediment to further FWA growth beyond the stated subscriber goals. But with the operators ready to unleash more C-band spectrum and likely to use that spectrum to harvest additional FWA subscribers, the short-term pain for cable operators doesn’t look like it is going to disappear.

And let’s not forget that if capacity does become an issue in certain markets, then both AT&T and Verizon can offer fiber as an alternative to ensure they don’t lose subscribers. From this perspective, T-Mobile is a bit of a wildcard. However, we believe T-Mobile will advance a strategy of partnering with open-access fiber network providers to offer a residential fiber service in markets where FWA capacity might be constrained.

Weathering the Storm

Cable operators aren’t standing still, of course. They are increasing the bandwidth and mix of service tiers through a combination of band splits and spectrum improvements in their access networks. They are improving the reliability and signal quality of their networks through DAA deployments. Compared with fiber overbuilds, these are relatively inexpensive upgrades that will pay dividends down the road.

But in the short term, the two most important tools cable operators have to combat subscriber churn are price-competitive fixed-mobile bundles and RDOF- and BEAD-subsidized rural and edge-out projects. The subsidized projects, which major cable operators like Charter have already used to expand their homes passed footprint and will continue to use through 2025, will be a major source of annual homes passed, especially in a market where new home construction through the first half of 2023 remains lower than in 2022. These subsidized buildouts are in markets that are expected to have very high penetration rates and a guaranteed return on investment. Additionally, while the number of passings for the subsidized buildouts is well-defined, there are likely to be thousands of what are known as “synergy passings,” where locations outside the subsidized census blocks can also be addressed and captured.

On the fixed-mobile bundle side, the large cable operators have consistently added a disproportionate share of new mobile subscribers over the last few quarters and are also seeing the penetration rates among their broadband subscriber base increase. This mobile growth certainly provides a counter to FWA growth. But all things being equal, the major cable operators would rather have those broadband subscribers back.

The push and pull of subscribers isn’t expected to slow down anytime soon. Certainly, with inflation continuing to put pressure on household budgets, consumers are going to be focused on keeping their communications costs low and looking for value wherever they can find it. That means we are returning to an environment where subscribers take advantage of introductory pricing on services only to switch providers to extend that introductory pricing once the initial offer expires. That shifting and its expected downward pressure on residential ARPU will likely be countered by increasing ARPUs at some providers as they move existing DSL customers to fiber or, in the case of cable operators, move customers to multi-gigabit tiers.

The US broadband market is definitely in for a wild ride over the next few years as the competitive landscape changes across many markets. The net result is certain to be shifts in market share and ebbs and flows in net subscriber additions depending on consumer sentiment. One thing that will remain constant is that value and reliability will remain key components of any subscription decision. The providers that deliver on that consistently will ultimately be the winners.