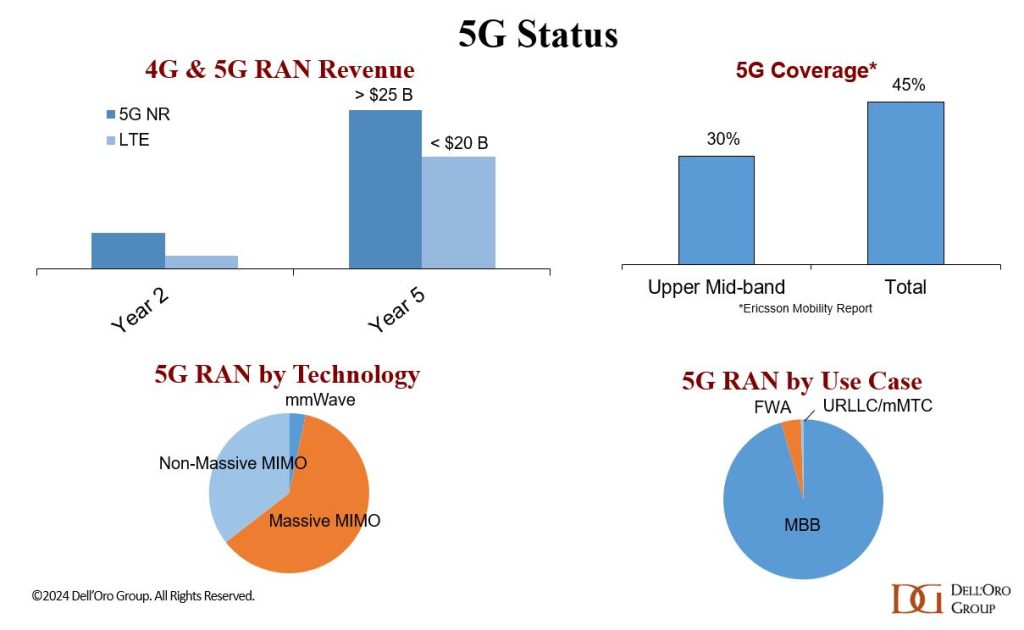

5G has come a long way since the Korean operators launched mobile 5G in early 2019. In the first five years, operators have invested around $0.4 T globally in 5G-related capex, deploying 20 M+ macro and small cell radios. Even so, the results are mixed. From a RAN investment and coverage perspective, 5G has accelerated at a much faster pace than previous mobile technologies. Preliminary findings suggest that 5G already covers around 45% of the global population, according to Ericsson’s Mobility Report. To put things into perspective, LTE reached the same milestone in early 2016. In addition to the reduced gap between the advanced and less advanced markets, the capacity boost realized with the upper mid-band taken together with the proliferation of Massive MIMO is providing a step function reduction in data delivery costs. The SK Telecom 5G/6G white paper focusing on 5G lessons points to a 70% reduction in cost-per-bit relative to LTE. At the same time, 5G has so far been mostly about improving the economics and increasing the data buckets for the existing use cases. However, 5G has so far had limited success in expanding the use cases and reversing the carrier revenue trajectory.

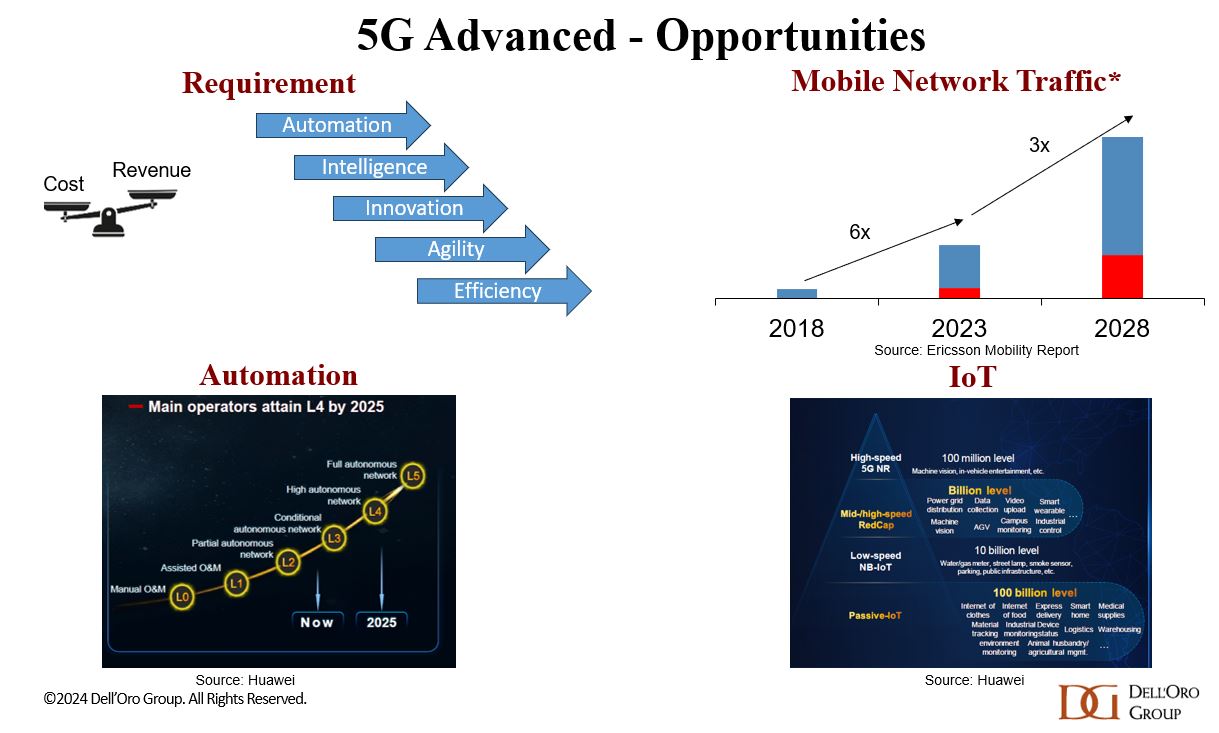

As we look to the next phase of this 5G journey, any incremental technology advancements that can improve spectral efficiencies will be valuable in a world where spectrum is limited and both humans and machines consume increasingly greater amounts of data. Additionally, any enhancements that can promote the growth prospects for Enterprise/Private 5G and Cellular IoT (cIoT)—ultimately helping to realize more aspects of the broader 5G vision—will also play an important role in this next phase. The objective of this blog is to provide updates on the 5G Advanced blogs we previously posted and to review the technologies, opportunities, and RAN implications with 5G-Advanced/5.5G.

What is 5G-Advanced?

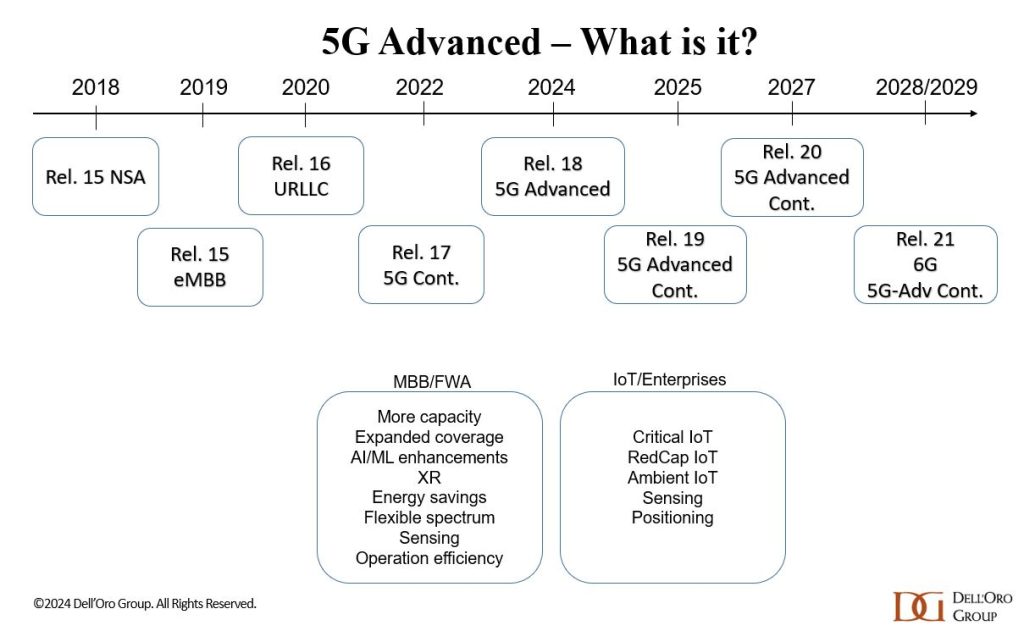

The 3GPP roadmap is continuously evolving to fulfill the larger 5G vision. In this initial 5G wave that began in 2018, 3GPP has already completed three major releases (new releases every 1.5 to 2 years): 15, 16, and 17.

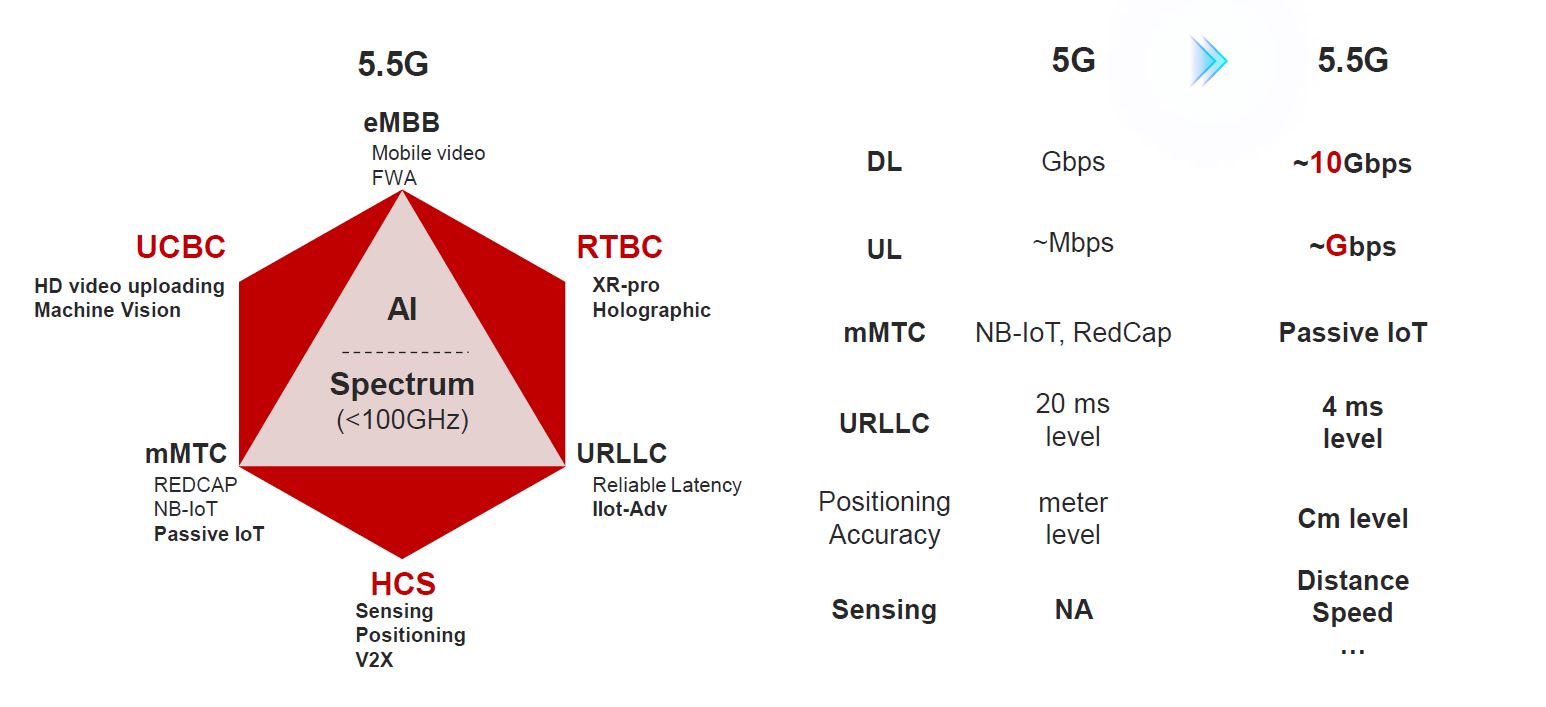

These initial releases have been key to the success of both MBB and FWA. But there are still shortcomings that need to be addressed, in order to fulfill the broader 5G vision. Current plans for Release 18 and beyond (often referred to as 5G-Advanced or 5.5G) involve gradual technology improvements aimed at elevating 5G to the next level, creating a foundation for more demanding applications and a broader set of use cases. In addition to performance improvements and support for new applications, sustainability and intelligent network automation are also important building blocks in the broader 5G-Advanced vision (Ericsson).

Source: Huawei

Current priorities with 5G-Advanced include:

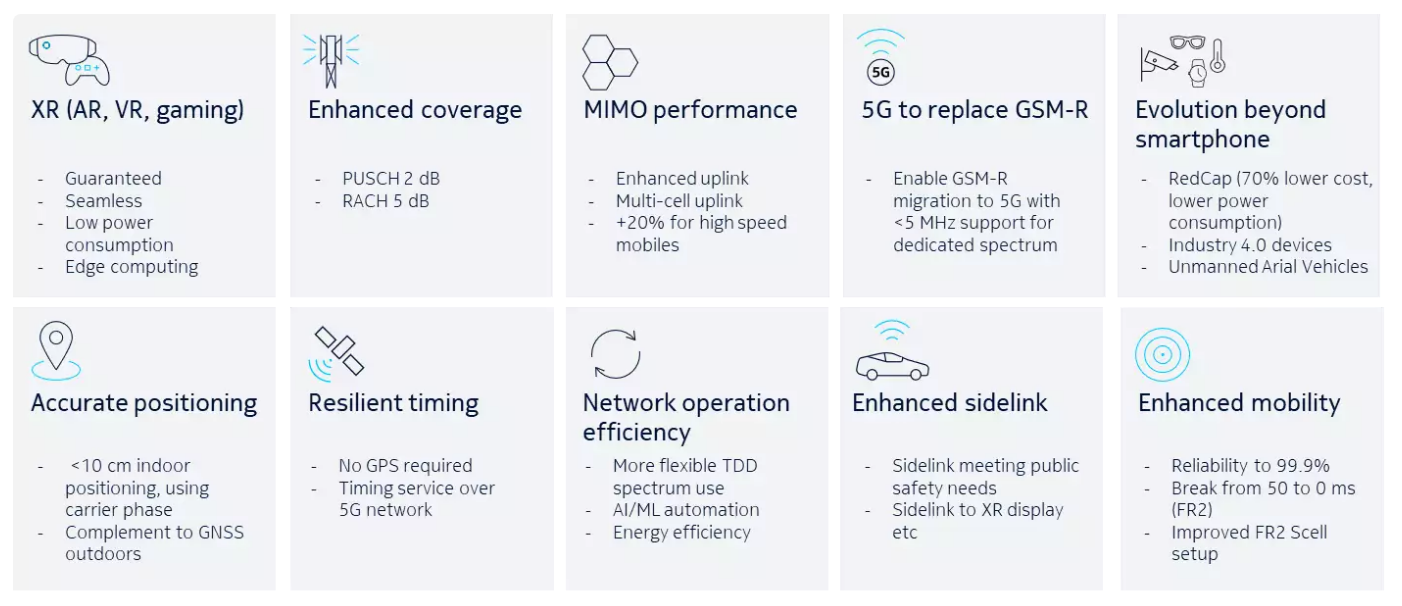

- More capacity and better performance. Some estimates suggest that MIMO enhancements, better beam management, and full duplex technologies taken together with other advancements, including multi-band serving cell (MB-SC) and Extremely Large Antenna Array (ELAA) will deliver another 20% of efficiency improvements relative to today’s 5G. Enhanced uplink (UL) and multi-cell UL improvements could pave the way for greater data rate and latency improvements in the UL. For reference, Huawei defines 5G-Advanced as a site that can support at least 10 Gbps of cell capacity. ZTE is also targeting 10 Gbps+ with 5G-Advanced.

- Expanded coverage. In addition to MIMO and IAB coverage enhancements, 5G-Advanced includes Non-Terrestrial Network (NTN) connectivity improvements, building on the NR/LTE-based NTN support that was introduced with Release 17.

- More intelligence. Releases 15-17 already include some AI/ML features. 5G-Advanced will offer AI/ML enhancements in the RAN (including the air interface) and the management layers. In addition, Intelligent RAN and AI-powered analytics will help operators to improve the performance and proactively address network issues before they become a problem.

- Energy savings. Release 18 includes a confluence of static and dynamic power-saving enhancements for the radios and the overall RAN. Also, the specification is targeting to define a base station energy consumption model with various KPIs to better evaluate transmission and reception consumption/savings.

- Flexible spectrum (FD, DSS, CA). NR is currently based on TDD or FDD spectrum. Full duplex (FD), a 5G-Advanced contender, improves spectrum utilization by allowing UL and DL to share the same spectrum (FD should improve capacity and latency, especially in the UL). Release 18 also includes DSS capacity enhancements (increasing PDCCH capacity by allowing NR PDCCH to be transmitted in symbols overlapping with LTE CRS). Other spectrum-related upgrades with 5G-Advanced include multi-carrier enhancements and NR support for dedicated spectrum bandwidths below 5 MHz.

- Critical IoT. 5G-Advanced includes multiple industrial and IoT related advancements. Release 17 included support for Time Sensitive Networking (TSN), which will be expanded in 5G-Advanced to support Deterministic Networking (DetNet).

- RedCap IoT. NR-Light or Reduced Capability (RedCap) was introduced with 3GPP NR Release 17. 5G-Advanced will introduce lower-tier RedCap devices, seeking to find a better set of tradeoffs between cost, performance, and power consumption.

- Ambient IoT. Passive IoT, sometimes referred to as Ambient IoT, will allow devices/objects to connect without a power source.

- Sensing. Harmonized communication and sensing (HCS) is a Release 19 study item.

- Positioning. Positioning is already supported in Release 16/17, though 5G-Advanced is expected to improve positioning accuracy and power consumption (Nokia has said sub-10 cm positioning is doable). In addition, Release 18 will include support for RedCap devices.

Source: Nokia

Where are the opportunities?

Looking ahead, operators will continue to invest in new RAN technologies and architectures that will allow them to better navigate stable carrier revenue trends and increased network complexities. 5G-Advanced is not the only toolkit. But it will play an important part as the operators incorporate more virtualization, intelligence, and automation into their RAN roadmaps. AI and ML already play a role in current 5G, and they are expected to penetrate further across the RAN stack.

It might not be the most exciting revenue growth opportunity for carriers, but one fundamental aspect of 5G-Advanced will be to support more demanding consumer MBB applications. The days of exponential data traffic growth are clearly in the past; however, global mobile data traffic is still projected to increase threefold over the next five years, reaching 0.5 ZB/month by 2028 (mobile plus FWA). While operators are currently in a fairly good position from a capacity perspective, especially those not aggressively pursuing FWA, some of the technology improvements with 5G-Advanced can help to address capacity limitations in hotspot areas.

Since the base case is built on the assumption that AR/VR will comprise only a small part of total mobile data traffic throughout the forecast period, the successful introduction of a new AR device for the masses could significantly alter the data traffic growth trajectory and corresponding RAN requirements.

With 5G RAN growth now slowing and carrier revenues staying flat, both operators and enterprises appear cautiously optimistic about the industrial focus promised by 5G-Advanced. Private LTE/5G is trending in the right direction, but the market remains small. The slower start is not impacting the long-term growth thesis: proliferating cellular connectivity into enterprises and industrial settings where WiFi or public cellular connectivity is poor remains a massive growth opportunity. Although LTE and 5G NR Releases 15-17 are sufficient to address the majority of existing use cases, 5G-Advanced will provide important IoT and industry-focused enhancements.

Fueled by the vision that 5G has a growing role to play in the Factory of the Future, expectations for 5G and 5G-Advanced in manufacturing are rising. While WiFi and LTE still dominate the smart manufacturing connectivity market, our assessment indicates that 5G RAN revenues to support the manufacturing vertical are on the rise. In fact, manufacturing already accounts for a double-digit share of Huawei’s, Nokia’s, and Ericsson’s ongoing private wireless projects. Huawei recently reported that manufacturing constitutes approximately 40% of its enterprise ToB revenues, and its enterprise 5G RAN revenues experienced rapid growth in 2023

Nonetheless, it is still early days outside of China, and the majority of enterprises are in the exploratory phase when it comes to using 5G-based AGVs, Digital Twin, AR/VR, and quality inspections. The improved reliability, latencies, device costs, positioning accuracy, and UL throughput should all contribute to improving the industrial 5G business case, but as with most enterprise verticals, it will take time.

Another area gaining attention is RedCap, a 5G NR-based cellular IoT technology introduced in Release 17 and further improved in Release 18. RedCap offers “slimmed down” 5G capabilities, targeting mid-tier IoT use cases that require reasonable bandwidth and robust battery life, albeit not the most stringent latency requirements (though still suitable for many applications). Bearing in mind that the industry has been discussing Cellular IoT for decades now, expectations are more tempered this time around

Passive IoT, sometimes referred to as ambient IoT, is also contributing to the renewed interest in Cellular IoT. In addition to the improved economics compared to RFID-based sensors, Passive 5G-Advanced IoT solutions are expected to be advantageous from a power consumption perspective. According to Huawei, some passive IoT devices (C tags) should potentially consume 100 times less power than NB-IoT devices.

What does this mean for the RAN forecast?

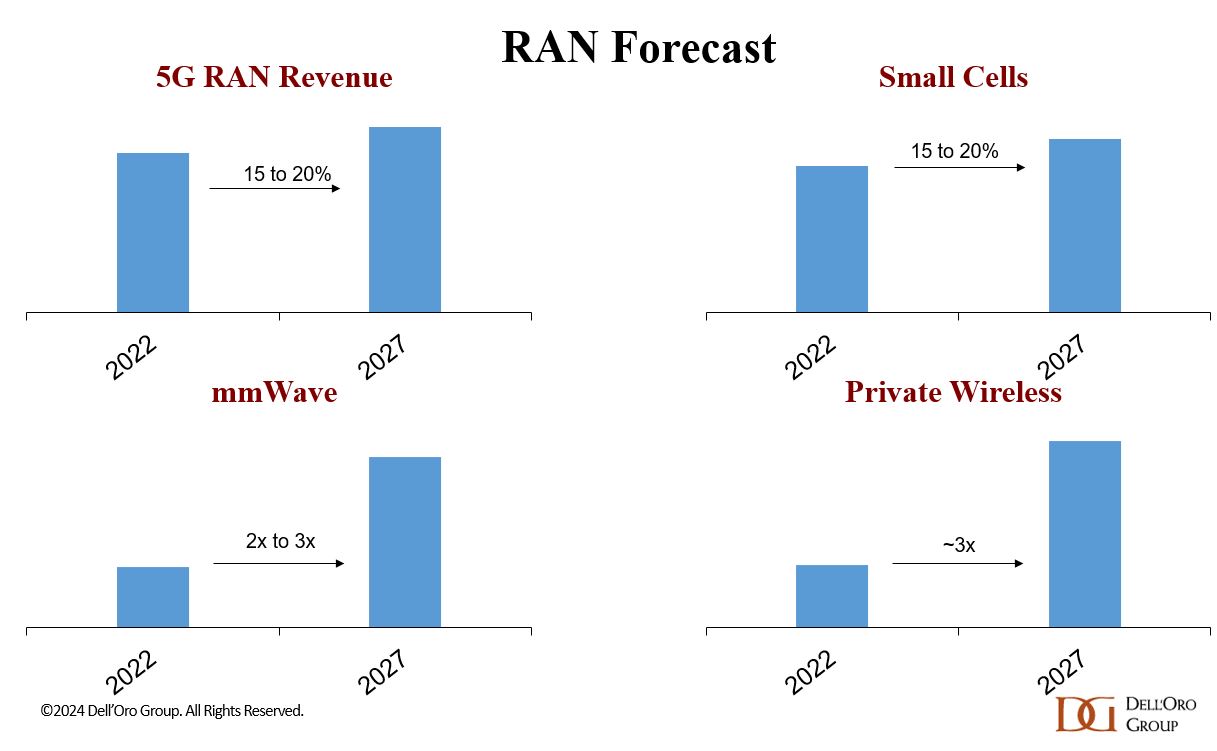

After a couple of years of exponential growth, 5G RAN investments are now slowing. Yet, it is still early in the broader 5G cycle, and total 5G NR plus 5G-Advanced RAN revenues are poised for further gains. Although the base case assumes that 5G-Advanced will not trigger another capex cycle, Release 18 and future releases are expected to play pivotal roles in this next chapter of 5G.

Predicated on the assumption that ongoing trials are successful, the ecosystem is in good standing, and the first part of the 5G-Advanced standard will be frozen in early 2024, the first wave of commercial deployments could become a reality by the second half of 2024 and into 2025.

5G-Advanced encompasses a broad array of technology enhancements. Some operators are already planning to upgrade their networks to support 10 Gbps (China Mobile recently announced the completion of 1K 5G-Advanced gNBs using 260 MHz of BW), while others might focus more on the IoT aspect. The majority of 5G base stations deployed in the latter part of the forecast period will incorporate some 3GPP Release 18+ features.

In short, 5G-Advanced is soon ready for prime time, with initial commercial deployments commencing in 2024. There is nothing wrong with a little bit of optimism and thinking big. At the same time, following the mixed results in the first 5G wave and the resulting rise in skepticism about the broader 5G business case, the industry now has an opportunity to recalibrate expectations.