400 Gbps and 800 Gbps adoption is expected to accelerate and drive nearly half of the revenue in the market by 2025

We just published the latest edition of our 5-year forecast for the data center switch market. Six months ago, when we published our July 5-Year forecast, we predicted that the data center switch market will be for the most part resilient to the pandemic. We also explained that most of the downward adjustment relative to our January 2020 Pre-pandemic forecast was driven by the non-Cloud segments, which include enterprises as well as Telco Service Providers (SPs). In the meantime, our July 2020 forecast for the Cloud segment showed only a slight downward revision relative to our pre-pandemic January forecast.

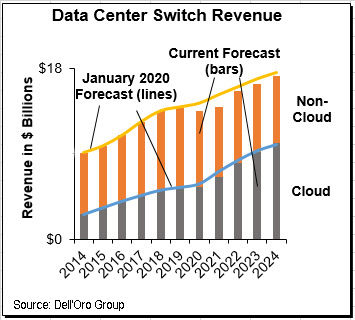

We are now pleased to announce that we hold to our prior view that the pandemic won’t significantly depress the growth in the data center switch market (Chart). We even had to raise our forecast slightly compared to our prior July report, as certain segments of the market, namely Tier 2/3 Cloud SPs and large enterprises, have been performing better than expected.

Our current forecast shows that the Ethernet switch data center market will decline only for one year (in 2020), at a low single-digit rate (-2%). We expect the market will return to growth in 2021 and will be able to exceed its 2019 pre-pandemic revenue level.

Other takeaways from the January 2021 5-Year Ethernet Switch Data Center Forecast Report include the following:

- The 200/400 Gbps adoption has been so far driven mostly by Google (starting 4Q18) and Amazon (starting 4Q19). We expect the 200 Gbps adoption by Facebook to accelerate in early 2021, and the 400 Gbps adoption by Microsoft to accelerate in the second half of 2021.

- We expect early 800 Gbps deployment to start in 2022, driven by the availability of 100 G SerDes. However, initial 800 Gbps deployments will not be based on native 800 G Ethernet MAC, but rather deployed as either 2×400 GE or 8×100 GE. In other words, 100 Gbps SerDes will allow building high-density, low-cost 400 Gbps or 100 Gbps systems. We expect early adoption to be propelled by Google and Amazon. We also expect Microsoft to adopt 800 Gbps (which will be deployed as 2×400 GE) by 2023.

- 200 G SerDes may be available in the market by 2024. However, the availability of 200 G Lambda may lag 200 G SerDes. Given that connecting 200 G SerDes to 100 G Lambda requires Gearboxes which add complexity, cost, and power consumption, we expect 100 G SerDes with 100 G Lambda to dominate over the next five years.

- Power is one of the major constraints for speeds beyond 400 Gbps. Future data center networks may require a combination of photonic innovation, such as co-packaged optics (CPO) and optimized network architectures.

- Our current revenue forecast does not reflect an increased portion of optics sold by switch system vendors (For example, Cisco selling more optics with their switches). We plan to reflect that in separate tables to avoid inflating the market size.

- We are assuming that CPO may start to ramp towards the end of our forecast period. However, the business model between chip suppliers and switch manufacturers is not yet clear to us (i.e who is going to carry the physical CPO inventory is not yet determined). Hence we elected to not reflect additional revenue associated with CPO in our current forecast until we have a better view of the business model.

If you need to access the full report to obtain revenue, units, pricing, relevant details including speeds, regions, market segments, etc., please contact us at dgsales@delloro.com.

|

About the Report

About the Report