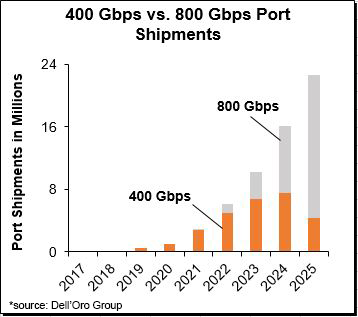

800 Gbps adoption rate expected to be faster than 400 Gbps, composing more than 25% of data center switch ports by 2025

Since the onset of COVID-19, we have predicted that the data center switch market will be for the most part resilient to the effects of the pandemic and that it will quickly recover from its low, single-digit revenue decline in 2020. We continue to believe that the Ethernet switch data center market will return to growth in 2021 and be able to exceed its 2019 pre-pandemic revenue level.

Following are key takeaways from the July 2021 Five-Year Ethernet Switch Data Center forecast:

-

- Our interviews with end-users and system and component vendors suggest that the pandemic has amplified the importance of the network and accelerated multi-year digital transformation projects. These trends are expected to bring major changes to data center networks and potentially generate additional market revenue.

- Despite our optimism, our interviews with major vendors revealed that a number of them are already operating at full manufacturing capacity and that supply challenges will continue through the remainder of the year with a potentially more pronounced impact on market performance and the pricing environment. If this is true, our forecast may prove to be too high, as it doesn’t currently take into consideration the impact of these various supply issues.

- Through our latest interviews with the large Cloud service providers (SPs), we have learned of a number of changes that may impact network architectures when they migrate to next-generation speeds. These changes will be driven by a limited power budget and new AI/ML applications, which may require different network topologies. These hyperscalers will make different choices in terms of network chips, switch radix, number of network tiers, and –ultimately – network speeds. We expect this diversity to increase when Cloud SPs build next-generation networks, as some will focus more on latency improvements while others will focus on power. Ultimately, however, all SPs will focus on cost reduction. Additional discussion about these possible changes and their associated effects may be found in our forecast report.

- Optics have always played an important role in enabling speed migration on data center switches. With the transition to 400 Gbps and beyond, however, the role played by optics will become even more crucial for a number of reasons. First, because of their increased price, optics for 400 Gbps speeds and higher are expected to compose about 60% to 70% of network spending (compared with less than 50% for speeds lower than 400 Gbps). For this reason, some switch vendors are planning to use the optics opportunity to capture a higher portion of network spending. Second, optics may displace some dense wavelength division multiplexing (DWDM) transport systems for certain Data Center Interconnect (DCI) use cases. Last, but not least, while pluggable (as opposed to embedded) optics are currently the form factor of choice, they may potentially exhibit some thermal and density issues as we approach speeds of 1.6 Tbps and higher. All of these possible changes in optics and their corresponding impact on the data center switch market are addressed in greater detail in our report.

-

We predict that 800 Gbps adoption will be quick, surpassing 400 Gbps ports in 2024 (Figure). 800 Gbps deployments will be propelled by the availability of 100 Gbps SerDes and will not require 800 GE MAC. As a reminder, our forecast reflects port-switch capacity, regardless of how the port is configured. We expect early 800 Gbps ports to be used in breakout mode either as 8×100 Gbps or as 2×400 Gbps. (Breakout applications support many use cases, such as aggregation, shuffle, better fault tolerance, and bigger Radix.) The anticipated rapid adoption of 800 Gbps will be propelled by: 1) availability of 800 Gbps optics with a significantly lower cost per bit than two discrete 400 Gbps optics; and 2) lower cost per bit at a system level, as 800 Gbps will allow consuming 25.6 Tbps chips in a 1U form factor with 32 ports of 800 Gbps. These systems will have a better cost per bit than their equivalent 400 Gbps (which requires 2 U chassis to fit 64 ports). Since economics drive adoption, we believe that 800 Gbps will be more rapidly adopted than 400 Gbps.

We predict that 800 Gbps adoption will be quick, surpassing 400 Gbps ports in 2024 (Figure). 800 Gbps deployments will be propelled by the availability of 100 Gbps SerDes and will not require 800 GE MAC. As a reminder, our forecast reflects port-switch capacity, regardless of how the port is configured. We expect early 800 Gbps ports to be used in breakout mode either as 8×100 Gbps or as 2×400 Gbps. (Breakout applications support many use cases, such as aggregation, shuffle, better fault tolerance, and bigger Radix.) The anticipated rapid adoption of 800 Gbps will be propelled by: 1) availability of 800 Gbps optics with a significantly lower cost per bit than two discrete 400 Gbps optics; and 2) lower cost per bit at a system level, as 800 Gbps will allow consuming 25.6 Tbps chips in a 1U form factor with 32 ports of 800 Gbps. These systems will have a better cost per bit than their equivalent 400 Gbps (which requires 2 U chassis to fit 64 ports). Since economics drive adoption, we believe that 800 Gbps will be more rapidly adopted than 400 Gbps.

To access the full report for details about revenue, units, pricing, speeds, regions, market segments, etc., please contact us at dgsales@delloro.com

About the ReportThe Dell’Oro Group Ethernet Switch – Data Center Five Year Forecast Report provides a comprehensive overview of market trends, including tables covering manufacturers’ revenue, port shipments, and average-selling prices for modular, fixed, and managed and unmanaged by port speed. We report on 1000 Mbps and the following Gbps port speeds: 10, 25, 40, 50, 100, 200, 400, and 800. We also provide forecasts by region and market segment, including Top-4 U.S. Cloud SPs, Top-3 Chinese Cloud SPs, Telco SPs, Rest of Cloud, Large Enterprises, and Rest of Enterprises. |

|