Announcement Roundup: CommScope, Cisco, Juniper, and Extreme are gearing up for growth in 2025

The past few months have seen a flurry of vendor announcements. Mobile World Congress (MWC) is looming, and while the conference has traditionally been centered on the telecommunications ecosystem, this year even enterprise networking vendors are under pressure to reveal the next generation products that will be showcased in MWC Barcelona.

After a Slow Start, Wi-Fi 7 hits mainstream and should have a “trickle-up” effect

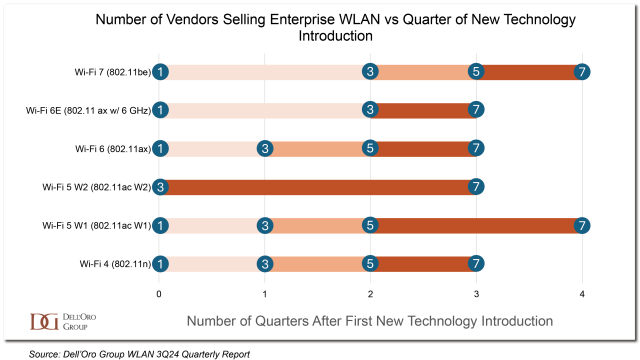

It feels like ages since the first enterprise class Wi-Fi 7 Access Point (AP) was commercialized in 2Q23. A quick analysis shows that indeed, enterprise Wi-Fi 7 AP introductions have been slightly slower than previous Wi-Fi technologies. It took a full year (4 quarters in the diagram below) for a critical mass of seven vendors to commercialize a Wi-Fi 7 AP for enterprises.

Unlike past versions of WLAN (Wireless Local Area Network), the early Wi-Fi 7 market has been dominated by vendors from China. H3C took an early lead in commercializing the first Wi-Fi 7 AP and in 2024, Huawei shipped the lion’s share of the new technology.

However, over the past few months, a larger portfolio of Wi-Fi 7 APs has become available worldwide. More Wi-Fi 7 APs are supporting the full 6 GHz frequency band, and these APs are power-hungry. As enterprises plan to upgrade their WLAN, they are looking carefully at the LAN infrastructure to determine whether it has the capacity and power available to drive a fully functional Wi-Fi 7 network. Recent vendor announcements aim to address the upcoming opportunities:

- On February 24th, CommScope announced the deepening of their collaboration with Nokia to deliver an optical LAN-driven Wi-Fi 7 network. This partnership involves the integration of Nokia’s OLT into CommScope’s RUCKUS One platform. CommScope commercialized the first RUCKUS Wi-Fi 7 AP back in December 2023, so this solution is ideal for organizations looking for the savings and performance of a fiber LAN coupled with the latest Wi-Fi technology.

- Cisco slipped the announcement of its 9172 and 9172H Wi-Fi 7 APs (the 2nd and 3rd in the Cisco portfolio) into the Cisco Live EMEA conference in February. Along with the APs, came the announcement of a new Meraki switch, the MS150. This is a cloud-managed multi gig switch, with 60W of PoE ++ to feed those hungry Wi-Fi 7 APs. Cisco is now delivering each Wi-Fi 7 AP in a single worldwide SKU, meaning that global organizations no longer have the complex task of managing inventory by country. The APs can be controlled and managed by a Catalyst controller or can be cloud-managed with the Meraki dashboard.

- Also in February, Juniper introduced a new Campus Switch: the fixed form factor EX4000. It is also designed for customers wishing to increase PoE to their LAN, with a PoE budget of 960W. Juniper indicates that the switch is quick to boot (under 2 minutes) and comes with an Intelligent Energy feature which can automatically adjust fan speed and de-activate PoE when ports are not in use.

Announcements start with A (and end with “I”)

Wi-Fi 7’s higher performance comes at the cost of higher management complexity. Fortunately, more

AI-driven network operations features are becoming available, offering an early opportunity for enterprises to use AI to benefit their bottom lines. Three recent vendor announcements target the AIOps opportunity for enterprises:

- CommScope’s February announcement highlights new AI features on RUCKUS One, the company’s network assurance platform. For instance, IntentAITM attaches network configurations to business outcomes, and EquiFlex TM promises to boost network capacity by reducing congestion in high-density environments.

- At Cisco Live EMEA in Amsterdam, Cisco announced new AIOps enhancements in Meraki (AI Assistant for trouble shooting) and an updated Wi-Fi 7 Radio Resource Management feature that uses an AI engine to more intelligently optimize radio configurations.

- With 3 million devices managed in Extreme’s cloud, there is a sizeable potential for the company to offer enterprises advanced AIOps features. In December, Extreme announced Platform ONE, which will deliver an automated experience throughout a customer’s lifecycle. This means that as well as supporting configuration and anomaly detection, it will deliver business functions such as asset management, contract analysis and personalized analytics. In February, Extreme announced the platform would be available for its Managed Service Provider partners. Platform ONE will support Extreme’s portfolio of campus and WAN networking equipment and will be generally available in the second half of 2025. Extreme’s Wi-Fi 7 APs have been shipping since June 2024 and Platform ONE promises that WLAN can be configured in one-click, simplifying impending upgrades.

We are on the doorstep of accelerated Wi-Fi 7 adoption, and arguably, this upgrade will have the biggest impact on the Local Area Network since Wi-Fi was first introduced to the enterprise. 2024 was a difficult year for enterprise networking vendors, with plummeting orders and contracting revenues. Now, the industry digestion period is coming to an end, and enterprises must upgrade their LAN equipment if they want to stay competitive. Things are looking up for the 2025 campus networking market.