Reflecting on my recent attendance at the 2024 Tencent Global Industry Analyst Conference held on September 5th in Shenzhen, China, I’m struck by Tencent Cloud’s ambitious plans to expand beyond its home market. The conference provided a comprehensive look at Tencent’s technological advancements, its strategy for global expansion, and the challenges it faces in an increasingly complex geopolitical landscape. Using the “glass half full or half empty” metaphor, we’ll explore the promising aspects and the obstacles of Tencent Cloud’s global expansion efforts.

The Glass Half Full: Tencent Cloud’s Strengths and Opportunities

Tencent Cloud’s executives, led by SVP and CTO Wang Huixing, emphasized their focus on business continuity and next-generation infrastructure. This push for technological advancement extends to Tencent’s AI offerings, with the company claiming to have one of the best Chinese-language Large Language Models (LLMs).

However, what sets Tencent Cloud apart is not just its technology but its experience. As Poshu Yeung, SVP of Tencent Cloud International, emphasized, “We don’t just sell the products. We sell our experience.”

Tencent’s background in running successful apps like WeChat, which boasts over 1.3 billion monthly active users, gives it unique insights to share with clients. WeChat combines messaging, social media, mobile payments, e-commerce, and a vast mini-program ecosystem, making it a “super app” with few equals in the global digital landscape.

Tencent Cloud’s globalization efforts were a key theme throughout the conference. While the company has data centers on almost every continent, its natural expansion focuses on the Asia Pacific region, particularly countries like Indonesia, Malaysia, Thailand, and the Philippines. The Middle East and Africa, specifically Saudi Arabia, UAE, and South Africa were also mentioned as areas of interest.

A significant development in Tencent Cloud’s strategy is its focus on building a robust partner ecosystem. After having just a handful of partners three years ago, Yeung revealed that Tencent Cloud now boasts close to 1,000 active partners worldwide. These include Managed Service Providers (MSPs), Application Service Providers (ASPs), and Cloud Service Providers (CSPs). The contribution of these partners to Tencent Cloud’s revenue has grown from less than 10% to an expected 35% by the end of the year, with aims to cross 50% soon.

Tencent Cloud is positioning itself as more than just a technology provider. Yeung emphasized their approach of being a strategic partner to clients, helping them grow by leveraging Tencent’s experience in building and running successful digital products. This consultative approach, combined with their technical expertise, is how Tencent aims to differentiate itself in the market. In an interesting analogy, Yeung compared Tencent Cloud’s approach to the famous “Pepsi Challenge” from the Cola Wars, encouraging potential clients to try Tencent Cloud alongside other providers and judge for themselves.

The Glass Half Empty: Challenges and Hurdles

While the one-day Global Industry Analyst Summit didn’t focus on cybersecurity, I previously had been briefed late last year on Tencent Cloud’s security portfolio, which includes cloud and application security tooling. At first, I was disappointed that security wasn’t discussed during the industry summit, given its critical importance in cloud services. However, I later learned that security was given a dedicated session during the subsequent Tencent Digital Ecosystem Summit, a customer-focused event held the following day. Unfortunately, due to scheduling conflicts, I wasn’t able to attend the second day’s summit and hear about progress firsthand.

As Tencent Cloud continues its global expansion, security remains an important consideration for potential clients. Like all cloud providers, Tencent Cloud’s ability to meet various security needs and regulatory requirements will be a factor as companies evaluate their cloud options. The company’s experience in managing large-scale applications like WeChat could potentially offer unique insights in this area. However, as with any global technology provider, Tencent Cloud’s expansion efforts will need to navigate the complex landscape of international markets and varying regional requirements.

Indeed, the geopolitical landscape remains a significant factor in Tencent Cloud’s global ambitions. For many enterprises, particularly those in Western countries, Chinese cloud providers may be viewed cautiously due to data security concerns and regulatory pressures. This hesitancy extends beyond security features to encompass broader data governance and sovereignty issues. On the other hand, there are markets where Chinese technology might be actively preferred or seen as a viable alternative to US-dominated options, presenting both challenges and opportunities for Tencent’s expansion strategy.

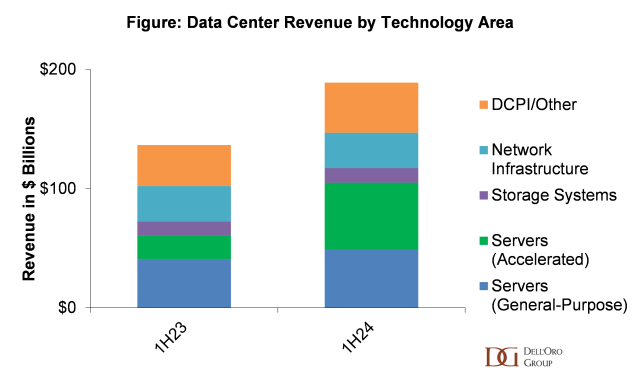

Tencent’s current global cloud market position also presents challenges. According to the Dell’Oro 1Q24 Data Center IT Capex Quarterly Report, Tencent’s share of worldwide cloud revenue stands at about 2% as of Q1 2024, significantly behind the top U.S. cloud providers who collectively hold over 80% of the market. These figures underscore the uphill competition Tencent faces in challenging the Western giants but also highlight the substantial room for growth in the global market.

Conclusion: A Promising Future with Challenges to Overcome

As the cloud computing landscape continues to evolve, it’s clear that Tencent is determined to be more than just a regional player. Whether you see Tencent Cloud’s glass as half full or half empty, one thing is certain — the competition in the cloud market is heating up, which could be good news for enterprises worldwide.

Tencent Cloud’s rise promises increased choice and potentially more tailored solutions, particularly for businesses in Asia and emerging markets. However, the path to global cloud dominance is far from straightforward. To succeed in this highly competitive landscape, Tencent will need to navigate complex international relationships, address security concerns head-on, and continue to innovate at a rapid pace.

Despite the challenges, Tencent Cloud’s unique experience, growing partner ecosystem, and focus on underserved regions provide a strong foundation for growth. By leveraging its strengths and addressing its weaknesses, Tencent Cloud has the potential to reshape the global cloud landscape and offer compelling alternatives to established players.

Ultimately, Tencent’s global expansion might be the “Pepsi Challenge” the cloud industry needs. Just as that famous marketing campaign encouraged consumers to look beyond brand names and judge based on taste, Tencent invites global enterprises to look past preconceptions and judge cloud providers on their merits. Whether Tencent can convince the world to take a sip of its cloud offerings remains to be seen, but one thing is clear: the cloud competition is far from over, and Tencent’s bid to shake up the market is a development worth watching closely in the coming years.

As Tencent Cloud steps onto the global stage, the team here at Dell’Oro will meticulously track every percentage point of market share gained or lost. So, will you take the Tencent Cloud challenge? Dell’Oro and the rest of us will eagerly watch to see who does.