We are in the midst of an AI revolution. Enterprises recognize the need to harness this technology to propel their businesses forward. However, amidst what seems like unlimited potential, IT leaders can be at a loss as to what concrete steps to take next.

AI training and inference has been a major influence on data center investments over the past few quarters. Orders for Data Center Physical Infrastructure, accelerator server components, and high-capacity switch ports have grown along with hyperscaler cloud expansion; in some cases, this growth has offset declines caused by pandemic-related supply problems.

Meanwhile, enterprise investments in AI infrastructure are only just beginning. The unfolding trends, described in more detail below, point to the need to invest not just in data centers, but also in campus networking.

Local Area Networks Trends

- The need for a higher-capacity, high-performance LAN is growing. By 2027, the percentage of APs shipped to enterprises with multi-gig ports will rise to over 60% of the total APs shipped, almost double the rate of 2022. The combined shipments of 2.5, 5 and 10 Gbps campus switch ports will grow by over 150% between 2022 and 2027, fueled by increasing traffic on the LAN and higher-capacity Access Points (AP).

- Spending on software licenses delivering AI Operations (AIOps) enhancements for WLAN management is forecasted to grow to 20% of WLAN spending in 2027, increasing faster than the overall WLAN market. Vendors embracing AIOps are expected to elevate the frequency of feature updates, such that enterprises will have access to new features on a monthly or even weekly basis.

Enterprise Data Center Trends

- Over the next five years, enterprises will increase adoption of Hybrid Cloud infrastructures. Mission-critical AI workloads will drive investments in accelerated computing for private data centers. Enterprises will also benefit from a consumption-oriented cost structure of the Public Cloud for AI workloads. Cloud service providers will offer a variety of AI-enabled applications to enterprises to increase efficiencies and shorten product development cycles.

- Enterprises will invest in Edge Computing deployments for business to business and business to consumer applications such as virtual and augmented reality, smart manufacturing, and smart retail.

- Dell’Oro Group predicts that in 2027, over a quarter of data center switch ports shipped to large enterprises will be 400 Gbps or higher, compared to 9% in 2022. The adoption of higher speed interfaces will be driven by AI and High-Performance Compute (HPC) applications.

The trends indicate that whether an enterprise will use predictive, generative, or conversational AI—IT architectures must adapt. Where should leaders start investing, given that it is still early days? What overarching principles should guide the enterprise’s IT transformation?

Analysis of some recent network transformation projects and discussions with industry leaders have shown that certain common themes have been guiding investments. Two of these themes, discussed below, are helping enterprises prioritize investments to meet their IT needs today, while allowing them to prepare their networks and computing infrastructure for the future.

1. Focus on Experience

The best way for an enterprise to align IT investments to its core business strategy is to center requirements on its customers’, its employees’, or its users’ experiences. As the use of AI applications intensifies in enterprises, network performance is becoming critical in the pursuit of excellent user experience. IT organizations are adopting various strategies to ensure that their IT infrastructure is meeting users’ needs.

Many organizations are implementing a Wi-Fi First approach, deploying high-quality wireless connectivity across the entire footprint of an office space, even extending to outdoor spaces. This is particularly important for companies that have embraced a hybrid work model.

IT departments are able to prepare for the future by deploying software defined radios (SDR) on Wi-Fi APs. On the latest generations of Wi-Fi 6E and Wi-Fi 7 APs, SDRs can be reconfigured from operating in the 5 GHz band to operating in the new 6 GHz band. The decision to open a radio in the 6 GHz band can be made once there is a sufficient number of clients supporting the new frequency, resulting in increased throughput and reduced interference. SDRs are especially useful in countries that have regulations regarding use of the 6 GHz band that are expected to change in the future.

Because of the proliferation of Wi-Fi and IoT, enterprises must expand their campus backbone and switching capabilities. Dell’Oro Group predicts that in 2024, over 40% of WLAN APs will be shipped with a multi-gig port. The plethora of IoT devices has driven up the number of connections and increased demand for switch ports supporting Power over Ethernet (PoE). Higher grade, even optical, cables will all be necessary as network users rely more and more on quality network connectivity and data-rich applications.

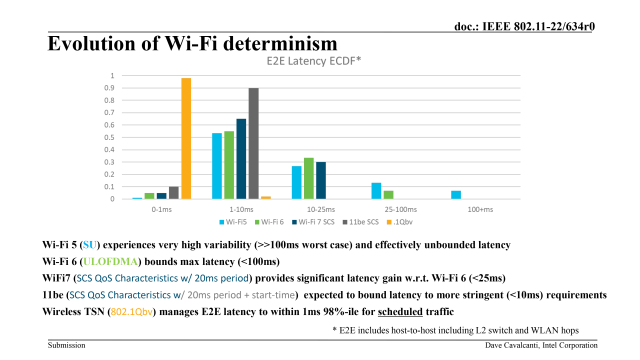

With cutting-edge network and data center technologies available, enterprises can consider the ways in which latency improvements may enhance their operations. For example, in its September 2023 paper “Get Ready for Wi-Fi 7”, the Wireless Broadband Alliance (WBA) identified industrial uses cases for which more deterministic latency could be beneficial. Autonomous Mobile Robots and wireless industrial safety controls may become possible with the implementation of Stream Classification Service (SCS) in Wi-Fi 7. An IEEE task group has also demonstrated that Wi-Fi 7 using SCS QoS characteristics provides significant latency gains over previous technologies (Figure 1).

Figure 1 – Wi-Fi 7 SCS shows higher determinism for end to-end latency between 1-10 ms

Latency can be further reduced with the deployment of computing infrastructure in close proximity to the users of latency-sensitive applications. For geographically distributed enterprises, the management of multiple data centers can be complex. In this case, data center orchestration and unified management applications become critical for deploying and configuring services and workflows across multiple data centers, without risking security or reliability.

At the same time, As IT experts design their infrastructure, they have an additional lever on which they can pull to enhance user experience: the deployment of application-aware systems. Traditionally, networking has followed the OSI model of communications, with each layer of the model being unaware of the communications occurring at the layer above. Application aware systems can make connection-level decisions based on information provided by the application operating at a higher level in the stack.

Videoconferencing is an application that can greatly benefit from application-aware networking. IT departments can collect data from end-user devices, videoconference applications, and network operations platforms. They can use Machine Learning (ML) to identify the source of network problems and propose resolution suggestions. Networking equipment schedulers can be enhanced to optimize video streams or improve performance for certain groups of users, for specific applications, or for special events. Enhancements to support the high bandwidth of today’s video applications will lay the groundwork for the next generation of applications using very high resolution and volumetric video.

As data from different domains – data center, network, and application – come together, the management of IT infrastructure becomes more powerful. The power of unification becomes evident with the application of uniform security policy, faster resolution of problems and a broader high-performance connectivity. These three factors are the underlying pillars of an exceptional user experience.

2. Automate to Increase Efficiency

Enterprises are only just beginning to develop strategic plans that include the benefits of AI applications. However, investments in AIOps can be made today, and will dramatically improve an organizations’ efficiency.

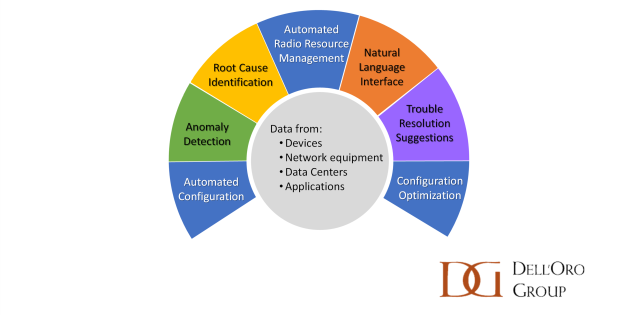

AIOps make use of advanced analytics and ML algorithms to support the complex tasks of network and data center operations, helping to increase data center storage efficiency, predict network performance issues, or even automatically suggest and apply fixes to problems.

The foundation of AIOps is accurate input data. Network mapping ensures that all IT resources are identified, understood, and visualized, and that the relationships between them are captured, even as configurations change. AI/ML algorithms applied to the combination of network mapping data and real-time usage metrics can automate a wide range of operations tasks –and may even lead the industry to the nirvana of network management: closed-loop, or fully automated, operations.

Figure 2 – Beneficial Features of AIOps and Advanced Management

Whereas full closed-loop automation remains a distant target for most organizations, AIOps applications are commercially available for both LAN and data center solutions. Enterprises using AI-based management are providing compelling insights into the benefits of AIOps. One company with which we spoke told us they have reduced their LAN trouble tickets by over 90%, and an AIOps application identified a configuration problem in the network that had been reducing user quality of experience for years.

Deploying advanced network management capabilities is critical because enterprises across the world are having trouble finding and keeping IT staff. Companies want to focus the employees that they do have on projects that are valuable to their core business objectives. Spending valuable hours just “keeping the lights on” can hamper the introduction of other innovative IT projects.

A journey of a thousand miles begins with just one step, and the path to an AI revolution begins with a high-performance network. Automation of network and data center management will be an early win for IT leaders—just one of the many revolutions that AI models are sure to bring.